Summary:

- Acuity Brands’ revenue continues to decline, but bottom line metrics like net income and EBITDA show improvement, driven by a strong net cash position.

- Despite better-than-expected earnings, the stock is down 2.3% while the S&P 500 is up 9.3%, and the firm offers limited upside potential at current valuations.

- The company is rewarding shareholders through dividends and significant stock buybacks, enhancing shareholder value.

- I maintain a ‘hold’ rating, but could upgrade if shares get cheaper or management provides strong guidance for the 2025 fiscal year.

Thomas Barwick

In early April of this year, I reported on the management team at Acuity Brands (NYSE:AYI) announcing financial results covering the second quarter of the company’s 2024 fiscal year. In that article, I acknowledged that earnings came in better than anticipated. Unfortunately, this was offset by revenue figures that came in lower than what analysts had hoped they would. Ultimately, shares of the company barely budged in response. Since then, we have had additional data come out covering the third quarter of 2024. And while revenue continues to contract, most of the company’s bottom line results are encouraging.

In that article, I rated the business a ‘hold’. Even though I was happy about the bottom line performance, the price at which shares were trading made me believe that further upside relative to the broader market was unlikely. Sure enough, since then, the stock is down 2.3% at a time when the S&P 500 is up 9.3%. The firm continues to deliver on the bottom line, and this year will likely result in higher profits and cash flows than next year. But that’s not enough to offset its valuation.

Obviously, this picture could always change. The fact of the matter is that, before the market opens on October 1st, the management team at Acuity Brands is expected to announce financial results covering the final quarter of the company’s 2024 fiscal year. If results come in stronger than anticipated and/or if management reveals robust guidance for the 2025 fiscal year, my mindset could change. After all, shares are getting closer to the undervalued range. So it wouldn’t take much from where they are now for me to make that leap.

Continued mixed results and expectations

For those not familiar with Acuity Brands, the company specializes in lighting and light control products for its customers, with light solutions dedicated to commercial, architectural, and specialty customers. It also provides products and services like building management systems and location aware applications, all for creating what it calls ‘intelligent spaces’. I don’t know about you, but I consider this to be an interesting place for any company to play in. However, recent financial performance has unfortunately been mixed.

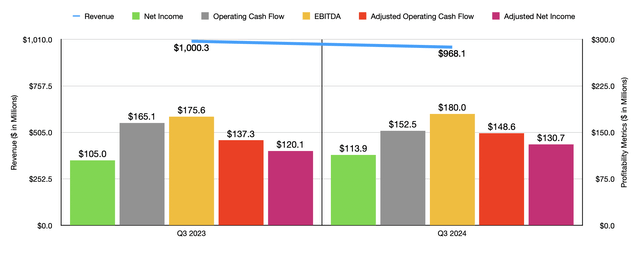

Take, as an example, the third quarter of the 2024 fiscal year. During that time, revenue for the company came in at $968.1 million. That’s a decrease of 3.2% compared to the $1 billion reported one year earlier. This decrease in sales was in spite of the fact that the company’s Intelligent Spaces Group reported a sales increase of 15% from $65.8 million to $75.7 million. This rise was mostly because of higher sales of Distech products and because of higher revenue thanks to its acquisition of KE2 Therm. The weakness for the company, then, came from its Acuity Brands Lighting and Lighting Controls segment. Revenue there dropped 4.5% year over year, declining from $940.7 million to $898.5 million. That decline was because of weakness across all sales channels, with the exception of corporate accounts.

Even though revenue has disappointed, the bottom line for the company did improve. Unlike in the third quarter of 2023 when the company had net interest expense of $3.9 million, it booked net interest income this year of $1.8 million. This is because the firm has a net cash position as of this writing of $203 million. This allowed net income to grow from $105 million last year to $113.9 million this year. Other profitability metrics largely followed suit. The one exception was operating cash flow. It declined from $165.1 million last year to $152.5 million this year. But once we adjust for changes in working capital, we get an increase from $137.3 million to $148.6 million. Meanwhile, EBITDA for the company managed to rise from $175.6 million to $180 million. Management does also keep track of what it calls adjusted net income. This grew nicely from $120.1 million in the third quarter of 2023 to $130.7 million the same time this year.

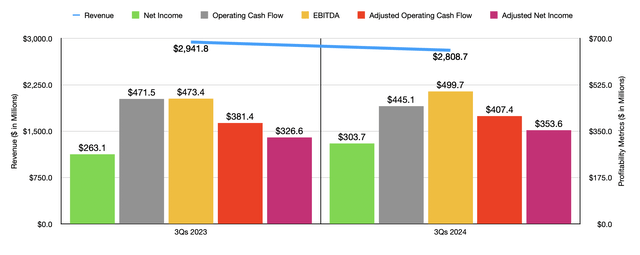

In the chart above, you can see financial results covering the first nine months of 2024 compared to the first nine months of 2023. As was the case with the third quarter on its own, the company saw revenue drop year over year. However, net profits, adjusted net profits, adjusted operating cash flow, and EBITDA all increased on a year-over-year basis. Only operating cash flow took a hit, declining from $471.5 million to $445.1 million. There were two primary drivers of this year-over-year improvement on the bottom line. In the first nine months of last year, the company saw special charges of $6.9 million. No similar charge was incurred this year. Furthermore, last year, the company booked $16.2 million in net interest expense. This year, because of higher interest rates and a change to a net cash position, the company saw net interest income of $1 million.

Management is making sure to allocate this capital toward rewarding shareholders directly. During the first nine months of this year, the company paid $13.4 million to shareholders in the form of dividends. That’s up from the $12.7 million reported the same time last year. But more importantly, the company has also been buying back stock. In the first nine months of this year, the business repurchased 0.5 million shares in exchange for $88.3 million. And for the first nine months of this year as a whole, it repurchased 1.3 million shares for $218.8 million.

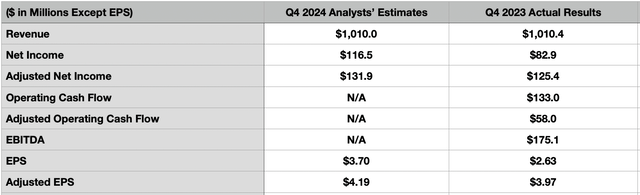

When it comes to the final quarter of this year, analysts believe that revenue will come in at about $1.01 billion. This would actually match with the company achieved in the final quarter of 2023. Earnings per share, meanwhile, are forecasted to be at about $3.70. That would be drastically above the $2.63 reported the same time last year. This would bring net profits up from $82.9 million last year to $116.5 million this year. There are also estimates when it comes to adjusted earnings per share. Those are anticipated to be around $4.19, which would translate to net profits on an adjusted basis of $131.9 million. For context, last year, adjusted earnings per share totaled $3.97. That works out to roughly $125.4 million in adjusted net income.

Unfortunately, analysts have not provided guidance when it comes to other profitability metrics. Having said that, if earnings are going to come in higher than what they did last year, it is highly likely that other profitability metrics for the company will also improve year over year. In the table above, you can see what the important ones were for the final quarter of 2023. I dare not guess what those numbers will ultimately come out to be. But I am cautiously optimistic about the picture.

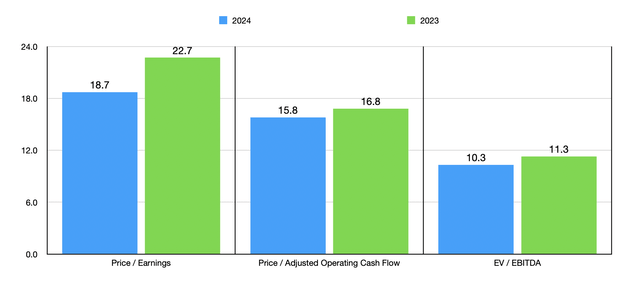

For 2024 as a whole, if we take analysts’ estimates for earnings per share, then we should get net profits of about $420.2 million. Simply annualizing the results that we have seen for the first nine months of the year, we would then get adjusted operating cash flow of $497.1 million and EBITDA of $712.3 million. Using these estimates, as well as historical results for the 2023 fiscal year, we can see in the chart above how shares are currently priced. On a forward basis, they are definitely inching closer to being attractive. However, I would still say that they are not attractive enough. As part of my analysis, I then, in the table below, compared Acuity Brands to five similar firms. And using each of the three valuation metrics, I found that two of the five companies ended up being cheaper than our target. This further impresses upon me that the stock is probably closer to fair value than it is being undervalued.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Acuity Brands | 18.7 | 15.8 | 10.3 |

| Generac Holdings (GNRC) | 36.0 | 13.3 | 16.4 |

| Emerson Electric (EMR) | 34.2 | 36.5 | 18.0 |

| Nextracker (NXT) | 10.6 | 17.2 | 7.2 |

| Regal Rexnord (RRX) | 38.4 | 16.4 | 15.0 |

| Atkore (ATKR) | 6.1 | 5.4 | 4.2 |

Takeaway

Fundamentally speaking, I understand that the picture for Acuity Brands is mixed at this time. But all things considered, I must say that I am a fan. I’m not a big enough fan to upgrade it from a ‘hold’ to a ‘buy’. But I do think that the company is moving in the right direction. I love its net cash position and I especially enjoy the improvements the company has seen from a profit and cash flow perspective. If shares continue to get cheaper and/or management comes out with robust expectations for the 2025 fiscal year, that could be enough for me to change my mind. But for now, staying the course makes the most sense.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!