Summary:

- AYI recently announced its Q2 FY23 results with increased revenues and net income.

- They have a diversified portfolio of products and a strong sales network.

- Their revenue growth rate is poor, and the technical chart looks weak.

- I assign a hold rating on AYI.

Dilok Klaisataporn

Acuity Brands (NYSE:AYI) offers building management and lighting solutions globally. It operates through two segments, ABL and ISG. In the ABL segment, they offer commercial and specialty lighting solutions and components for indoor and outdoor applications. In the ISG segment, they provide a building management platform. AYI recently posted its Q2 FY23 results. I will analyze its financial performance and technical chart in the report. I believe there is no significant reason to buy AYI. Hence I assign a hold rating on AYI.

Financial Analysis

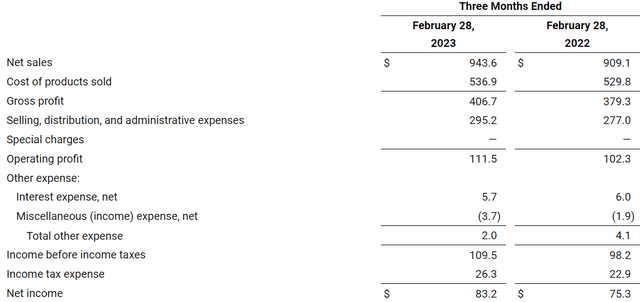

AFI recently announced its Q2 FY23 results. The net sales for Q2 FY23 were $943.6 million, a rise of 3.8% compared to Q2 FY22. I believe the main reason behind the surge was an increase in revenues in the Acuity Brands Lighting (ABL) and Intelligent Spaces Group (ISG) segments. The revenues from the ABL segment rose by 3.2% in Q2 FY23 compared to Q2 FY22. I think the independent, direct sales network and retail channel’s increased sales were the primary drivers of the ABL segment’s revenue growth. In addition, the operating profit from the ABL segment rose by 6% in Q2 FY23 compared to Q2 FY22. I think that management’s better cost control and better pricing policy increased operating profit in the ABL segment.

The revenue from the ISG segment rose by 16% in Q2 FY23 compared to Q2 FY22. I believe the main reason behind the rise was strong growth in their distech solutions and Atrius brand. The net income for Q2 FY23 was $83.2 million, a rise of 10.5% compared to Q2 FY22. I believe the main reason behind the rise was increased operating profit in the ABL and ISG segments. The increase in revenues and net income in Q2 FY23 is a positive sign, and despite the challenging market environment seeing growth is an optimistic sign. In my view, the financial performance of AYI was decent, but whether they will be able to continue the growth is an important question, and I will discuss it later in the report.

Technical Analysis

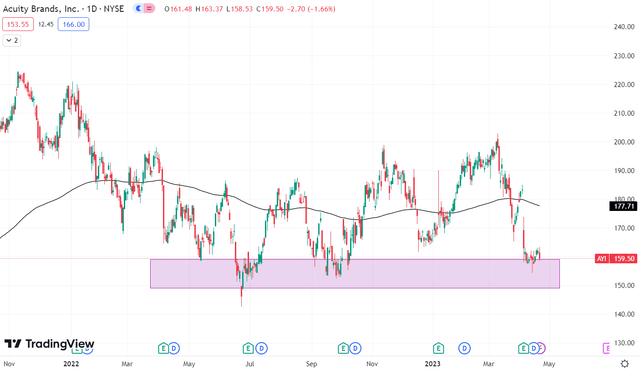

AYI is trading at the level of $159.5. Currently, it is revolving around its 200 ema, and the stock is directionless. It is near the support zone of $150-$159; in the last 14 months, it has touched the support zone six times, which is not a good sign because when a stock touches a support or resistance zone multiple times, that means the support or resistance zone is becoming weak, and there is a high chance that the stock might not sustain the level. The same is happening in AYI stock; if it breaks the support zone, it might fall to $140. So, in my opinion, there is no buying opportunity in AYI.

Should One Invest In AYI?

I believe the company’s increasing product vitality and its services give them an edge over most of its competitors. They introduced several new products in their recent annual sales conference NEXT 23. I want to mention two of them which I think might boost its revenue growth. The first is the nLight AIR System which is an indoor controller device that reduces the need for complex wiring solutions and reduces installation costs for the customers, and the second product is the AIR rPOD Micro which is a battery-powered wall switch. The diversified product portfolio of AYI is its strength, and I believe it is one of the major reasons behind its financial success. I believe the new products might be a hit among customers due to the value they provide, and another reason I think is the strong sales network of the company. They have around 4000 local sales and support people throughout North America. In addition, they have one of the best independent sales agents, which is one of the major reasons behind the success of their products in the past. So I believe they have a perfect combination of strong product vitality and a sales network.

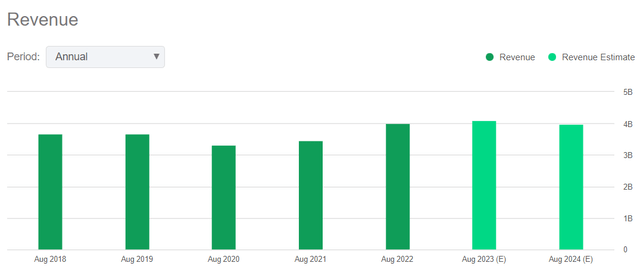

Their revenue estimate for FY23 is around $4.09 billion, and I believe they might achieve the revenue targets. But I have a concern; the three-year revenue (CAGR) of AYI is around 5% which is a poor growth rate. The revenue estimate for FY23 is just 2% higher than FY22. Therefore, even if they succeed in achieving their targets, it won’t be appealing enough for us to invest in. In 2018 the stock was trading at$160, and five years later, in 2023, the stock is trading at the same level, which means it has not provided any returns in the last five years, and I believe stagnant revenue growth might be one of the major reason behind it. So even though they posted decent quarterly results and the management has provided optimistic revenue guidance, I believe it is not enough to invest in AYI. Hence I would advise holding the stock for now after looking at their growth potential.

Now looking at the company’s valuation. I will use PEG and P/E ratios to judge its valuation. The PEG ratio of a firm is calculated by dividing the P/E ratio by the annual EPS growth rate. AYI has a PEG (FWD) ratio of 0.92x compared to the sector ratio of 1.56x. AYI has a P/E (FWD) ratio of 11.40x compared to the sector ratio of 16.65x. After looking at both ratios, I believe they are undervalued.

Risk

The foundation of their competitive strategy is the ongoing introduction of new goods and solutions, services, and technology, improving current products and services, and efficient customer servicing. The timely and successful development of new products, their quality, market acceptance, and the capacity to manage the launch of new products and solutions are just some factors that affect how successful new product and solution introductions are. Risks related to product life cycles include increased inventory obsolescence risk as life cycles shorten, new products and production capabilities, efficient handling of purchase duties and inventory levels to support anticipated product manufacturing and demand, availability of products in sufficient quantities and at reasonable prices to meet anticipated demand and risk that new products may have quality or other defects. As a result, it is difficult to accurately forecast how new product introductions will ultimately affect a company’s operations. Furthermore, new goods and solutions might not turn a profit at the same rate as anticipated or in comparison to their prior iterations. Other market participants, such as renowned rivals, may create alternative platforms for commercializing goods, services, and solutions that cause a paradigm change in the sector, particularly concerning emerging and new technologies.

Bottom Line

Even though they posted decent quarterly results, I believe there is no buying opportunity in AYI. They have a poor revenue growth rate, and the management has provided optimistic revenue guidance for FY23, which is just 2% higher than FY22 revenues. So I believe they might not be able to provide returns to its shareholders in the near future. In addition, its technical chart looks weak. Hence I assign a hold rating on AYI.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.