Summary:

- Acuity Brands Q4 earnings included growth in revenue, net income, earning expectation wins, share repurchases, and a maintained dividend.

- Cash flow was $316 million, which is down $92 from last year.

- Updates to WACC and DCF assumptions show a fair value of $147, dropping a previously “Strong Buy” rating to a “Hold”.

Photography By Tonelson/iStock via Getty Images

Thesis

Though a relatively strong Q4 earnings performance, a lack of cash flow and new Weighted Average Cost of Capital (“WACC”) and Discounted Cash Flow (“DCF”) assumptions indicate a “Hold” for AYI, after I previously rated it a “Strong Buy”.

Summary

Acuity Brands, Inc (NYSE:AYI) announced Q4 earnings on October 4th and the results were mostly good. From a financial standpoint, they grew revenue, net income, beat earnings again, repurchased shares, and maintained their dividend. Cash flow generated was $316 million, which is down $92 from the prior year. We never want to see a decrease in cash flow; however, we are told AYI was using cash to invest in working capital to support inventory growth and CapEx. From my previous article, their growth platform surrounds their ISG product line of smart, safe, and green tech and AYI feels they have successfully repositioned between sustainability and technology. We also see they are industry leaders in return on capital. I don’t love the decrease in cash, but to see it allocated into high returning capital decisions, makes me feel a little better. They pride themselves on maintaining a dividend, and I would rather see cash allocated towards growth over a potentially unaffordable dividend for this specific company. After these earnings results, I have made some tweaks to my DCF (“Discounted Cash Flow”) analysis, and WACC (“Weighted Average Cost of Capital”) discount rate, ultimately changing my rating on the company to a “Hold” from a previous “Strong Buy”.

Further information on my DCF and WACC calculations are found in the included sheet: (Mitchell_s_Cheat_Sheet.pdf – Editor’s Note: automatically downloads on clicking)

WACC Updates

In my previous analysis, one of my assumptions was a 10% WACC discount rate. After AYI announced they had a reduction in cash flow, and changes in debt, I thought a good start would to be to review the WACC value.

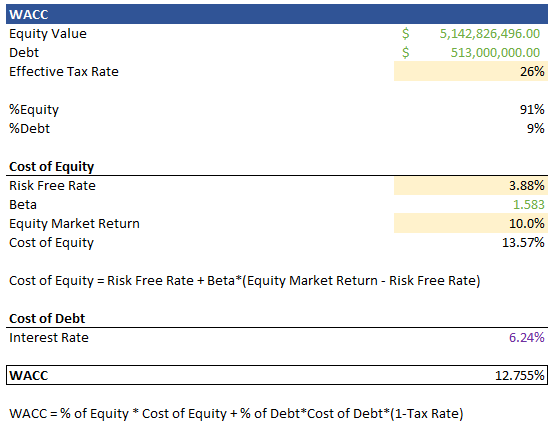

WACC Assumptions and Calculation (Author)

The new updated WACC discount value will be a high 12.8%. The assumptions are in the tan boxes with 26% effective tax rate, which is an average over the last ten years. The risk-free rate will be the current Ten-year Treasury Yield at 3.88% and the Equity Market Return will be 10%. This WACC value will be used in the updated DCF as a discount rate.

DCF Updates

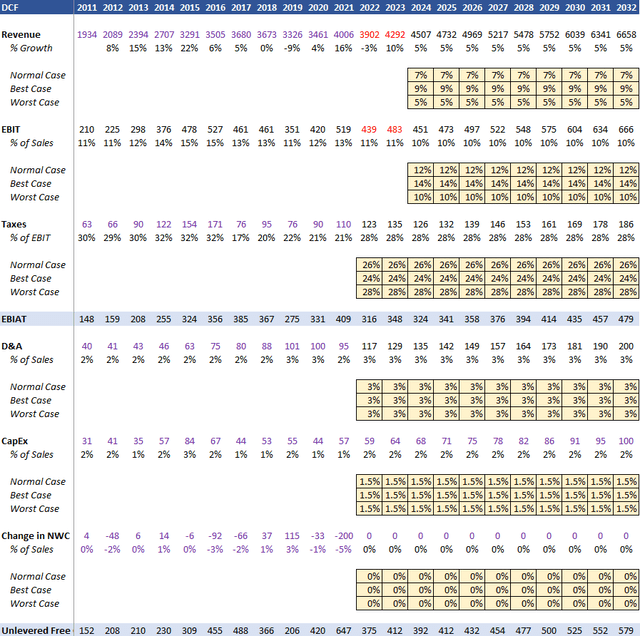

Updates to the DCF include a 1% increase to each revenue growth case from last quarter. I also have refined Taxes and Change in Net Working Capital (“NWC”) assumptions to better reflect their capital allocation strategy moving forward. Detailed assumption values are shown in tan boxes, and red font indicates averages from (13) analysts from Financial Modeling Prep.

DCF Assumptions (Author)

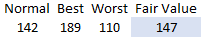

New Fair Value

After updating the WACC and DCF assumptions, I came to a new fair value of $147 ($171 last quarter), which is an average of the three case scenarios. Note that this value does not have a margin of safety applied either. Because this new calculated value is significantly lower than last year, and lower than the current share price, I have updated my rating to a “Hold”.

Fair Value (Author)

Conclusion

AYI is still a great company. Financially, they performed well on all fronts this quarter. They followed their capital allocation strategy plan well, but the cash flows weren’t as great as expected. This has affected assumptions in a new fair value and changed to a “Hold” rating for now. If they are as successful in the return on capital as their history states, then this invested cash flow will reward investors tremendously. But for now, I don’t see any reason to add more shares, and there is no reason to jump ship either.

Disclosure: I/we have a beneficial long position in the shares of AYI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.