Summary:

- Risk in banks is heightening, the Federal Reserve is tightening, and the market looks frightening.

- But amidst the gloomy headlines, these companies make gobs of cash and return it to shareholders – as they have done for decades.

- Let’s look at two top semiconductor companies that do it with substance, not flash.

Dilok Klaisataporn

The case for the Statement of Cash Flows

Many investors begin examining a company with the income statement. After all, this will tell us if the company is profitable. And that’s the most important thing, right?

Remember, cash is a fact; profit is an opinion. – Al Rappaport, economist known for his ideas on furthering shareholder value.

Net income contains several accounting measures, such as asset write-downs, amortization of intangible assets, a host of estimates and assumptions, and unrealized gains and losses, among others. And accounting standards are constantly evolving. This is why I always go to the statement of cash flows first – specifically cash flows from operating activities.

Nothing exists in a vacuum, of course. It is possible to have positive cash flow in a quarter due to timing and still be a failing business. But steadily increasing cash from operations over time is the greatest measure of a fantastic business – and a winning long-term stock. Rest assured, the cash-flow juggernauts below are profitable as well.

Cash-producing companies are also inclined to put a lot of that cash in your pocket through steadily increasing dividends and share buybacks.

This is the case with Texas Instruments (NASDAQ:TXN) and Analog Devices, Inc (NASDAQ:ADI).

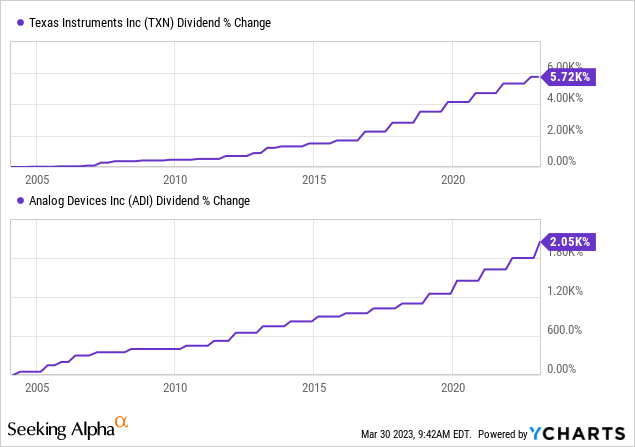

These companies have raised their dividends annually since 2004, as shown below, and there are more to come.

All substance, no flash

TI and ADI don’t call to a wide swath of retail investors. When was the last time we saw an article about them on the trending list? Even the product name “analog semiconductors” is snooze-inducing.

But long-time shareholders know this: money made the boring way spends just the same. Quality sleep is a valuable intangible asset. And going on vacation with “boring” money is just as enjoyable, am I right?

Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas. – Paul Samuelson, Economist, and Nobel Prize winner.

Analog semis are critical to technology.

Analog chips are enablers. They take real-world data (think temperature, speed, position, etc.) and translate the data for use by devices or high-tech digital semiconductors. They are in everything from thermostats to medical equipment to electric vehicles. We may not know when we are using them, but our lives would change drastically if they were to disappear suddenly.

The beauty of analog chipmakers is that they are essential and less dependent on (1) volatile markets, like NVIDIA (NVDA) and Intel (INTC), and (2) a small customer base, like Skyworks (SWKS).

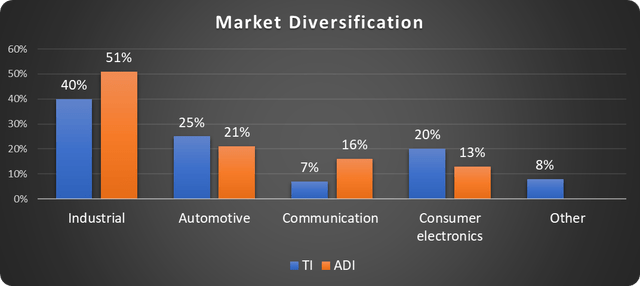

Consider that they are not only used in end products but also in the factory that makes the products. As shown below, ADI and TI get the vast majority of revenue from the industrial, automotive, and communications markets.

Data source: Analog Devices and Texas Instruments. Chart by author.

In addition, both companies have a customer base of over 100,000 and over 75,000 SKUs. This is critical to withstanding economic downturns – like recessions. Both TI and ADI raised dividends during the Great Recession fallout, albeit at a slower pace.

What are the best dividend stocks?

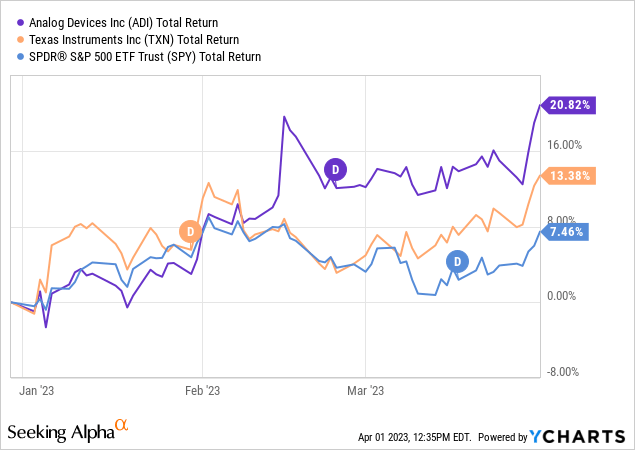

I’ve been on the bandwagons of these cash-flow kings for a while now and even included them as top 2023 long-term picks in articles that can be found here and here. So far, so good.

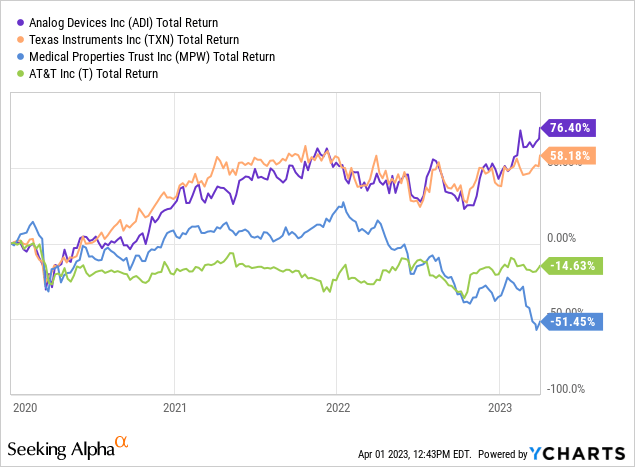

Many investors focus on dividend yield when dividend growth and cash-flow expansion are often better long-term indicators of total stock performance.

While many draw battle lines around high-yield favorites like AT&T (T) or risky plays like Medical Properties Trust (MPW), ADI and TI shareholders continue to see long-term outperformance, as shown below.

Is Texas Instruments a good dividend stock?

Texas Instruments has grown free cash flow per share by 11% CAGR since 2004. It has used this money to reduce the share count by 47% and increase the dividend by 25% CAGR during that time.

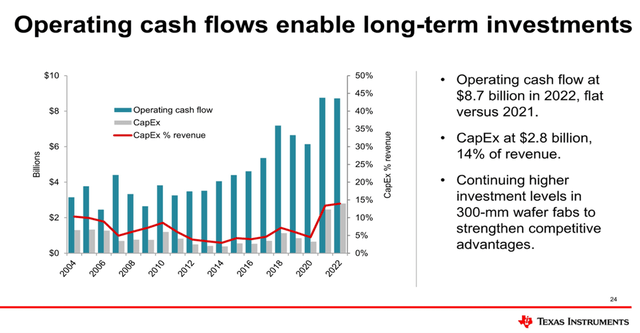

The company is investing in its future by expanding manufacturing capabilities, which has raised CapEx recently. But the company is doing so intelligently, using the post-pandemic boost in operating cash, as shown below.

Data source: Texas Instruments. Chart by author.

Even with the significant manufacturing investments, the free cash flow margin was near 30% in 2022, and the operating cash flow margin was fantastic at 44%.

Demand is strong, secular trends are positive, margins are exceptional, and Texas Instruments is a terrific dividend growth stock.

Is Analog Devices a good dividend stock?

Not to be outdone, ADI has pledged to return 100% of future free cash flow to shareholders through buybacks and dividends with a target of 10% CAGR dividend raises.

The economy is challenging, yet ADI’s Q1 fiscal 2023 results were encouraging. Sales rose 21% year over year, the operating cash flow margin was 43%, and the free cash flow margin was exceptional at 38%.

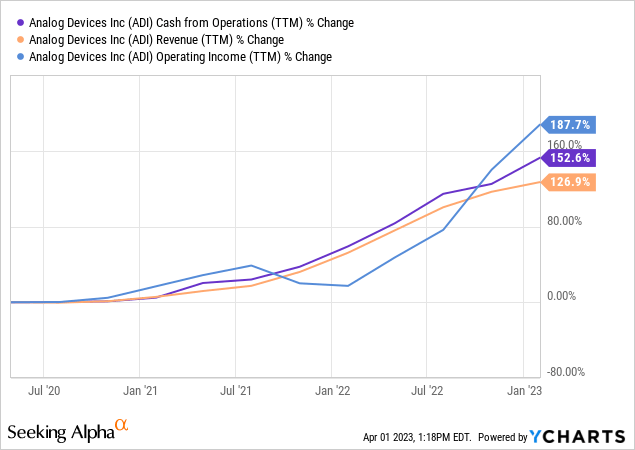

ADI is very well run. Cash and operating income are rising faster than revenue, showing outstanding efficiency.

Meanwhile, ADI is set to capitalize on trends such as cloud and edge computing, infrastructure investments, electric and autonomous vehicles, and digital healthcare.

Texas Instruments and Analog Devices have many things in common, including tremendous management, essential products, recession resistance, secular growth, and excellent margins. They also value their shareholders and are fantastic stocks for investors to earn income and long-term market-beating returns.

And there is nothing boring about that.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADI, TXN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors' goals, financial situations, timelines, and risk tolerances vary widely. The stocks mentioned may not be suitable for all. As such, the article is not meant to suggest action on the part of the reader. Each investor should consider their unique situation and perform their own due diligence.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.