Summary:

- Adobe stock was one of the best performers in the Technology sector year-to-date, with a 44% rally.

- The company demonstrated very strong financial performance in the last quarter and the upcoming quarter is also expected to be solid.

- My valuation analysis suggests the current stock price has already absorbed all the positive catalysts, and the upside potential is very narrow.

bennymarty

Investment thesis

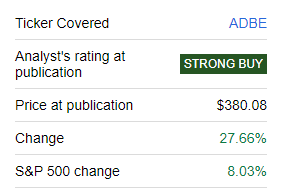

My first bullish call about Adobe (NASDAQ:ADBE), which I shared three months ago, aged really well. The stock substantially outperformed the broad market.

Seeking Alpha

Since the first coverage, many important events have happened, and today, I would like to update my investment thesis. The company delivered solid quarterly financials, but my updated valuation suggests little upside potential from the current stock price level. Moreover, the overall market correction is likely due to the remaining unfavorable factors in the broader environment. Therefore, I downgrade ADBE to “Hold”.

Recent developments

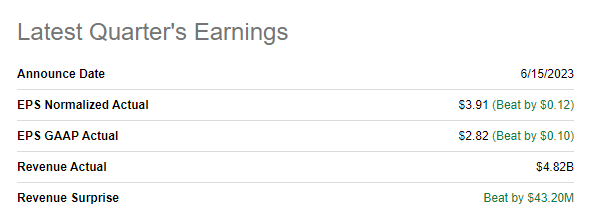

The company reported its latest fiscal quarter on June 15, delivering above-the-consensus earnings. Revenue demonstrated a solid 9.8% YoY revenue growth with adjusted EPS improvement from $3.35 to $3.91.

Seeking Alpha

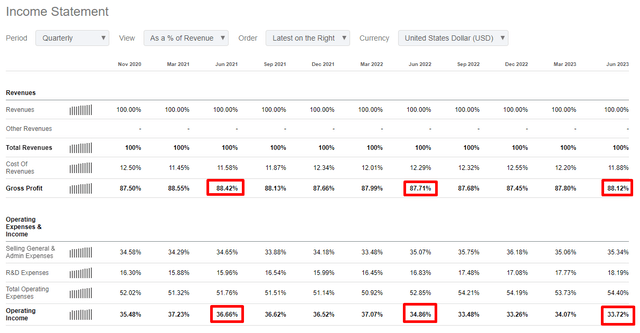

It is essential to mention that revenue growth could have been even more impressive, but unfavorable fluctuations in the foreign exchange rates shaved three percentage points from growth. Digital Media sales increased by 10%. This strength was partly fueled by a 9% growth in Creative Cloud revenue. The Digital Experience segment demonstrated an 11.6% sales increase to $1.22 billion. Profitability metrics are stellar, as usual. On the other hand, the operating margin deteriorated slightly YoY and deteriorated notably if we compare it to the June 2021 quarter.

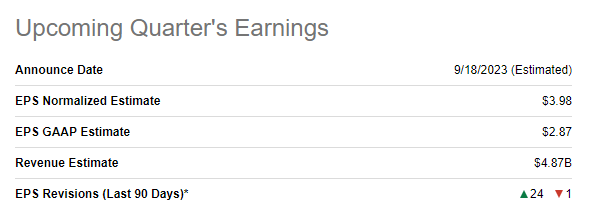

The upcoming earnings are also expected to be robust, with about 9% revenue growth YoY and the adjusted EPS expanding further from $3.40 to $3.98. Q3 of FY 2023 earnings are expected to be released on September 18.

Seeking Alpha

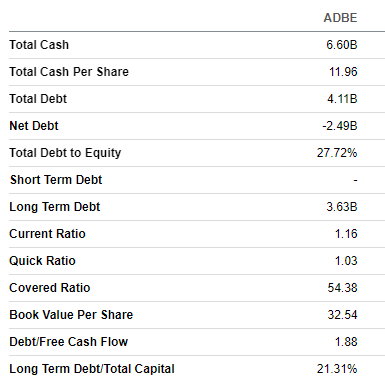

The company’s balance sheet is still very strong, with a substantial net cash position and sound liquidity metrics. With an operating profit margin above 30%, the covered ratio also looks very solid.

Seeking Alpha

Valuation update

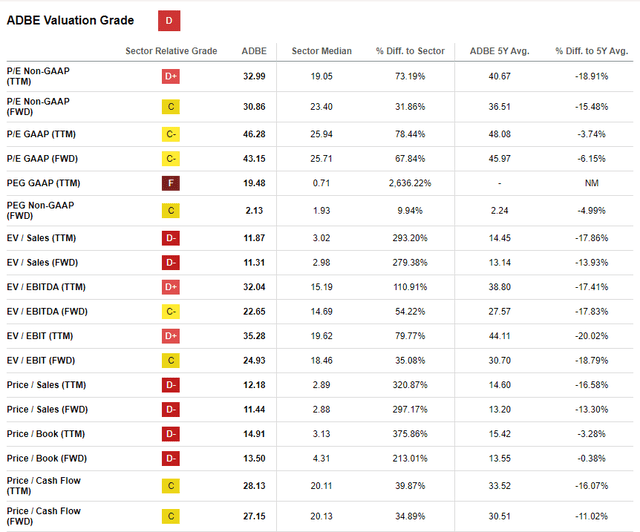

The stock delivered a massive 44% rally year-to-date, significantly outperforming the broad market. Seeking Alpha Quant assigns ADBE a very low “D” grade, meaning the stock is overvalued from the perspective of the valuation multiples. On the other hand, the premium compared to the sector median is fair, in my opinion. The company is an undisputed leader in its market segment, and its profitability is stellar. I believe these are strong reasons the stock is valued at a premium. I would also like to underline that current multiples are lower than 5-year averages across the board. For me, it indicates that the stock might be undervalued.

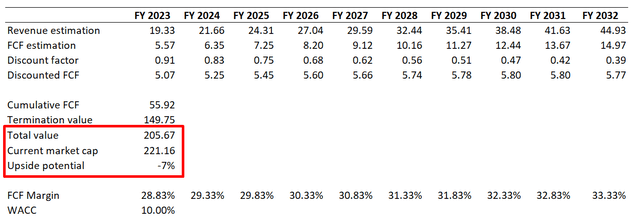

I want to simulate a discounted cash flow [DCF] model to cross-check the multiples analysis. I use a 10% WACC, which is softer than my previous estimates because the last time, there was a high level of uncertainty regarding how far the Fed will go with raising rates. But now we are highly likely close to the pivot in the monetary policy. Revenue consensus estimates were also updated, which I incorporated into my model. The revenue is expected to grow at a 9.8% CAGR over the next decade, which looks too conservative for me, but I will use this growth trajectory for my base case scenario. For the FCF margin, I use TTM, ex-SBC, which is at 28.83%, and I expect it to expand by 50 basis points yearly.

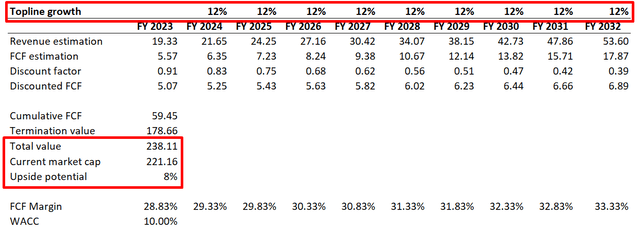

Based on the above assumptions, my DCF model suggests that the stock is slightly overvalued after the massive rally. Adobe bulls might argue that a 9.8% revenue CAGR is too conservative for a company like ADBE, so I will simulate the second scenario with a 12% annual revenue growth rate. Other assumptions remain unchanged.

As you can see, with a more aggressive revenue growth profile, the stock now looks undervalued. Organic growth might not be enough to achieve double-digit revenue growth over the long term, and the company might need strategic acquisitions to accelerate revenue growth. Therefore, I would better stick to the base case scenario and conclude that the stock has little upside potential over the near term. The company is in a net cash position, but I consider it insignificant compared to the market cap, so I do not include it in my valuation.

Risks update

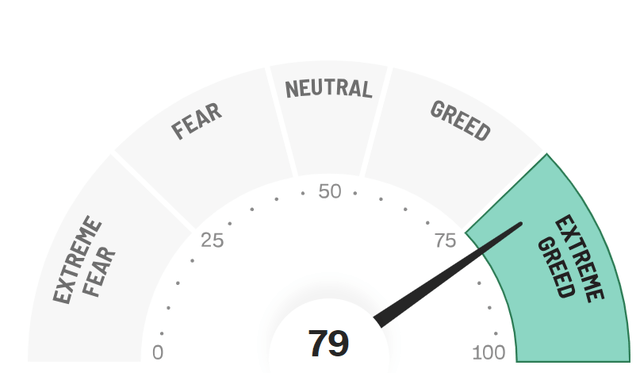

This year’s rally, especially in technological companies, is the most significant risk for further growth for stocks like ADBE. The market looks overbought, and CNN’s Fear and Greed Index suggests that we are in the “Extreme Greed” zone of the barometer.

At the same time, the macro environment is still harsh. Inflation is still substantially above the Fed’s targeted rates, and recently, Jerome Powell shared his opinion that more rate hikes are still possible to finish the fight against inflation. The eurozone, one of the world’s wealthiest markets, is already in a recession. The credit crunch risk seems to have eased after a massive consolidation in the banking sector, but I think that the probability of a credit crunch in the U.S. is still far above zero. Moreover, according to Reuters, U.S. Chapter 11 bankruptcy filings jumped 68% in the first half of 2023 from a year earlier. Therefore, I believe that the stock market is highly likely to start absorbing those risks in the nearest future, which is highly likely to lead to a new wave of selloffs in the market.

I also want to add that the company will likely face rigorous European antitrust scrutiny regarding the Figma acquisition. FT said the Figma deal could face a more detailed “phase 2” probe. The more challenging review is because of concerns that the deal will lead to less innovation and higher prices. I believe that the risk of the merger being blocked is low. Still, additional antitrust scrutiny will affect the schedule of the deal completion and further integration, which can adversely affect the company’s earnings over future quarters.

Bottom line

After a recent massive rally, the stock is a “Hold”. The company still demonstrates stellar financial performance and is a market leader. As we can see from my valuation analysis, the stock market has already absorbed all the recent good news about the company into the stock price. Therefore, I downgrade ADBE from “Strong Buy” to Hold.”

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.