Summary:

- Adobe dominates the creative industries with its industry-standard software and wide customer base, making it difficult for competitors to enter the market.

- Adobe’s unmatched innovation, including the integration of AI into its applications, allows for efficient content generation and customization, attracting new customers and strengthening relationships with existing ones.

- Adobe has shown financial strength and consistent growth, with a strong subscription-based revenue model and profitability metrics, making it an attractive long-term investment opportunity.

hapabapa

Thesis

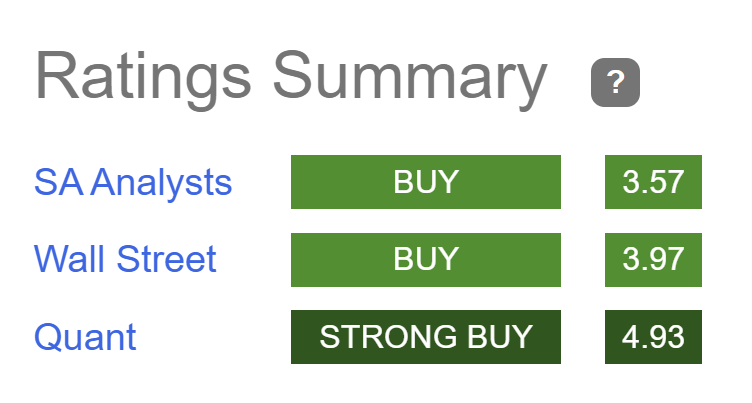

Adobe Inc. (NASDAQGS: ADBE) is a software development company headquartered in San Jose, California. It supplies creative software to individuals and organizations in almost every creative industry. Its industry-standard applications are widely used by companies in industries like marketing, social media, graphic design, photography, film, and education. By embracing cloud-based software, Adobe is able to bring in a majority of its revenue through subscription-based licensing. The stock has a strong history of performing well with a YTD increase of 57.97%. Though this might make some investors cautious to enter, I believe this is a company that can continue growth far beyond its current level. Like many other companies, Adobe is taking advantage of the possibilities AI brings to the table and has been implementing innovative developments to its existing applications. Competitors will always be operating in the shadow of Adobe’s massive market share. I give this stock a buy rating and find it to be trading under its fair value of around $562. Other analysts from wall street and Seeking Alpha give this stock an average rating of 4.93 which sits between a “buy” and a “strong buy” rating.

Seeking Alpha

Adobe Dominates Creative Industries

One of Adobe’s key advantages in the software market is the massive presence and brand recognition it has in almost every creative industry. Adobe is reported to have a 61.33% market share within the Application Development sector with its Creative Cloud subscription program having its own 3.42% market share. Adobe’s large portfolio of products allows the company to leverage multiple industries as a source of revenue. This gives Adobe a base for consistent revenues that they can rely on since they have such a wide variety of customers. On top of this, Adobe’s customer loyalty is top tier. When companies think of industry standard software, they think of Adobe products. This makes it extremely difficult for other companies to enter their market and steal customers from Adobe. Their multi-software subscription service further increases the barrier to competitors by providing companies and individuals access to multiple applications through one easy subscription based on their needs. I think this is the main thing keeping Adobe so far ahead of the competition and I see it as a competitive edge that the company will hold for years to come.

Adobe’s Unmatched Innovation

One significant catalyst that is going to prove valuable for Adobe is their announcement of Adobe Firefly and Express to enterprises. This announcement came on June 8 and was announced during Adobe’s bi-annual summit. Adobe plans to make this available to enterprises at some point in the second half of 2023. One of the main reasons Adobe is in the spotlight currently is because of its involvement in Generative AI. It has already begun to integrate it as a beta version into some of its applications such as Photoshop. This new technology allows users to alter and create images, designs, and text effects via simple text inputs. So what does this mean for businesses? Adobe is making it the easiest it has ever been to use AI to generate commercially viable, branded content for companies. One of the rumors Adobe has been throwing around is that companies will be able to custom-train Adobe Firefly models with their own branded assets allowing the AI to generate content in line with each company’s unique style and brand. This is huge for driving efficiencies, cutting costs, and streamlining the content supply chain. Adobe has already revealed some of the companies that it is working to customize AI solutions with. Among these companies are massive names like IBM, Dentsu, and Mattel. This not only will strengthen the connection Adobe has with current customers but will also generate client interest in new companies.

Financials

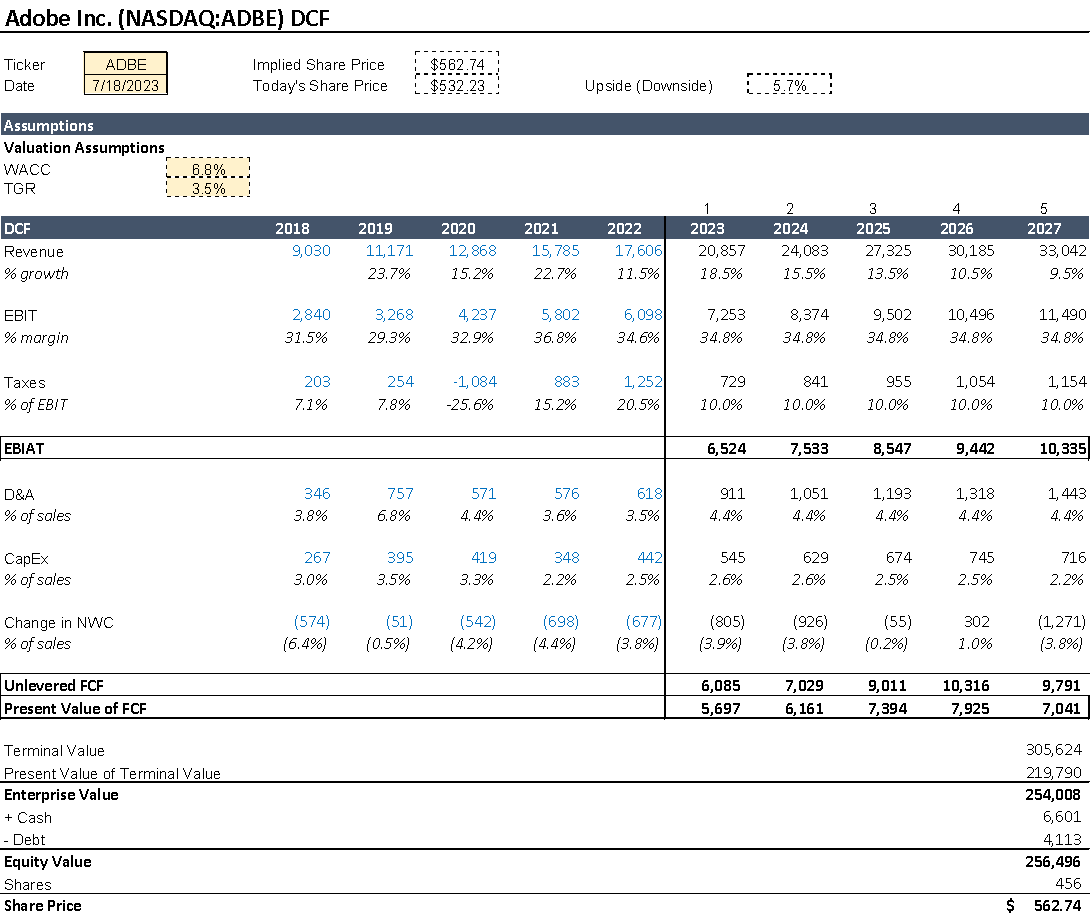

Adobe Inc. is a company that has shown financial strength even through some of the toughest economic drawbacks. The stock price dropped briefly by about 24.8% when the COVID-19 pandemic struck the US but quickly recovered and continued its growth well beyond that point. As of Q2 in 2023, Adobe reported earnings at $4.82 billion, which beats estimates by $43.67 million. This represents a 10% YoY growth from Q2 in 2022, and it reflects the financial success of the company. This comes as no surprise due to Adobe’s growth strategies that have allowed it to stay on top of the software game. Revenues over the past five years have shown consistent double-digit growth rates with an average growth rate of 19.36% per year. As shown in my DCF, I expect the growth to taper down to the single digits by the time 2027 comes around. I believe Adobe’s recent integration of AI into its software will be one of the causes of the growth. However, once the new consumers that Adobe attracts with this have entered the market, the revenue growth rates will naturally drop again.

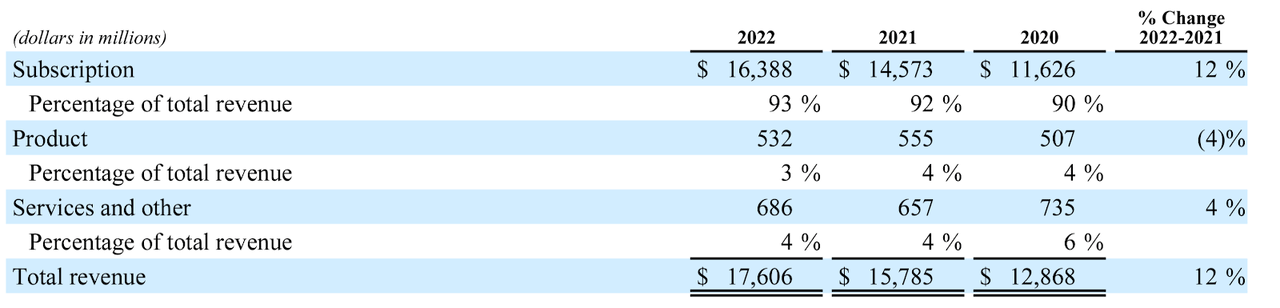

Adobe Inc. 2022 10-K Report

Adobe reported its revenues to be segmented into three categories: Subscriptions, Products, and Services & Other. Of these three categories, Subscriptions have accounted for at least 90% of Adobe’s revenue since 2020. That number has since increased to 93% in 2022 due to the increasing popularity of Adobe’s Creative Cloud subscription package. Being primarily a software development company that generates most of its revenue through licensing subscriptions, Adobe boasts great profitability metrics. The company has a trailing twelve month (TTM) gross profit margin of 87.77% and an EBITDA margin of 37.03%. From my perspective, I believe any significant growth beyond this point will largely depend on Adobe’s ability to continuously integrate new AI and tech developments into its applications. Given Adobe’s strong financial, and innovative history, I am optimistic that the company will be able to hold its market share while attracting new consumers to its products. Current third-quarter EPS expectations are between $3.95 and $4.00 per share. I believe this upcoming quarter will bring even more growth than that for Adobe. I expect earnings to be roughly 7-10% higher than current estimates due to how efficient Adobe’s margins are. Having low-products and a strong customer base that keeps growing is a great recipe for growth.

DCF Valuation

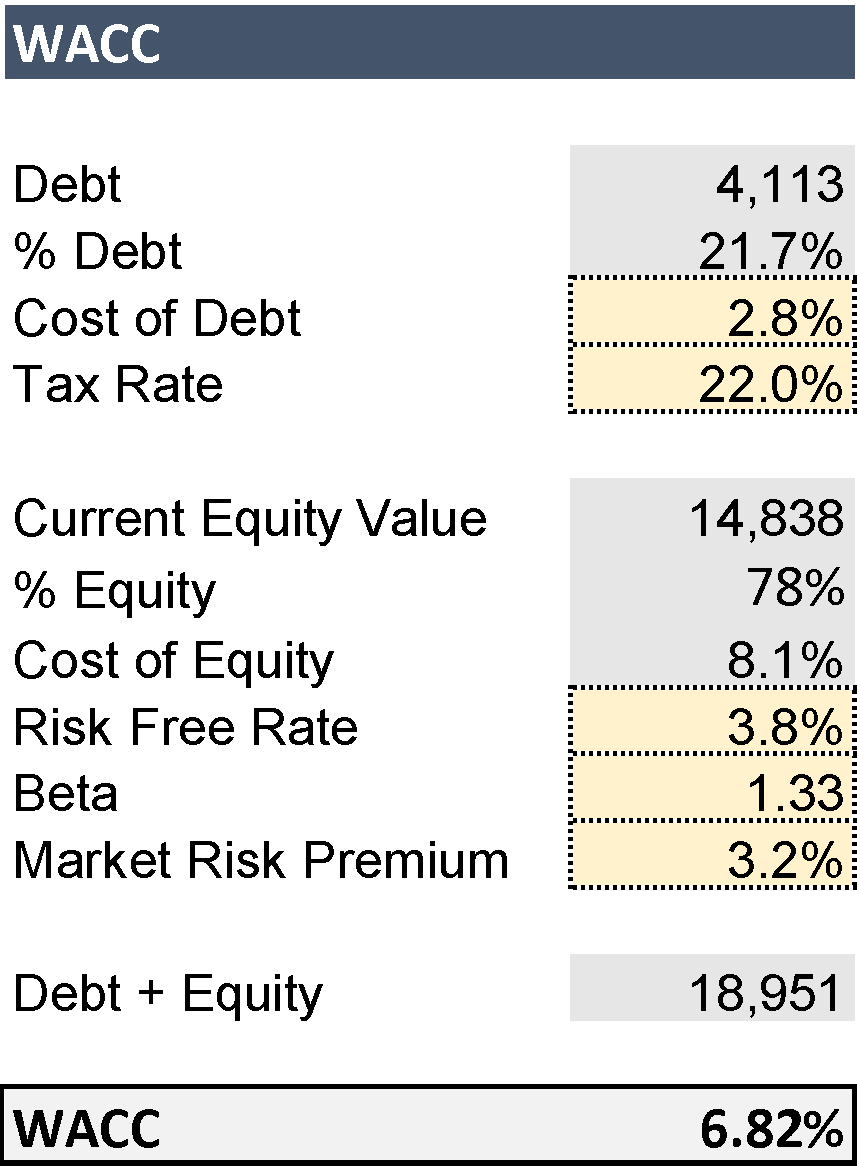

I believe Adobe will continue the steady growth trajectory that it has set for itself. Adobe is good at efficiently marketing itself to a variety of different target markets. This gets their foot in the door but on top of that, Adobe also knows how to retain customers. Creating returning customers is one of the most important ways to secure stable revenues. My calculation of Adobe’s weighted average cost of capital (WACC) and discounted cashflow (DCF) valuation yielded positive results supporting my thesis. I used a beta of 1.33 and a risk-free rate of 3.80 based on the US treasury rate to calculate the WACC. The rate of return I used to calculate market risk premium is 7.04%. This led me to a discount rate of 6.8% for Adobe Inc.

Double digit revenue growth is unsustainable and naturally slows down so looking ahead from 2022’s revenues, I tapered the growth down to single digits by the end of the projection period. I assumed a terminal growth rate (TGR) of 3.5% which is a little higher than what I would use for other companies, but Adobe has proven to be a high-growth company, so I believe this number is adequate. Forward EBIT margins and expenses are forecasted based on recent historical averages since there are no significant outliers to offset my projections. The result we get is an implied value of $562.74 per share, a $30.51 difference from its current share price. Adobe has many opportunities to turn its artificial intelligence innovations into significant growth. I believe in the long-term, the stock can perform at an even higher level than I projected. Some of its top customer markets are areas where we are seeing massive growth in. As long as Adobe can maintain its industry-standard rating, there is no reason the company shouldn’t keep growing.

Author’s Material

Author’s Material

Risks

While Adobe has proven to be a historically strong company and has a great outlook, there are still risks that every investor must consider. One of the most notable risks is something that many software companies struggle with preventing to this day: Piracy. Their move from boxed software to cloud-based software was an effort to make pirating software harder but it still did not eliminate the issue completely. The usage and sale of pirated Adobe software among consumers impacts the company’s revenues and costs them money to try and counter. Additionally, high costs may be limiting Adobe’s market penetration in the more price-sensitive areas such as small businesses and individual consumers. For individuals, the typical Adobe Creative Cloud subscription will cost $84.99/mo., while access to a single application is typically around $35.99/mo. For many people interested in creative products, this simply isn’t in the budget causing potential customers to turn to competitors or pirated software.

Conclusion

Bottom line, Adobe has proven itself to be a strong company and it is one of the giants when it comes to software companies. On top of that, Adobe holds a significant market share of a very active market. Its subscription-based licensing system almost guarantees recurring revenues from the same customers, making stability one of its strong points. I don’t see Adobe as a company that will be decreasing in value anytime in the foreseeable future. I believe this stock is an attractive investment for anyone looking to take advantage of a long-term growth opportunity. Adobe continues to be at the forefront of the software market facilitating workflow and accessibility for all its customers.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.