Summary:

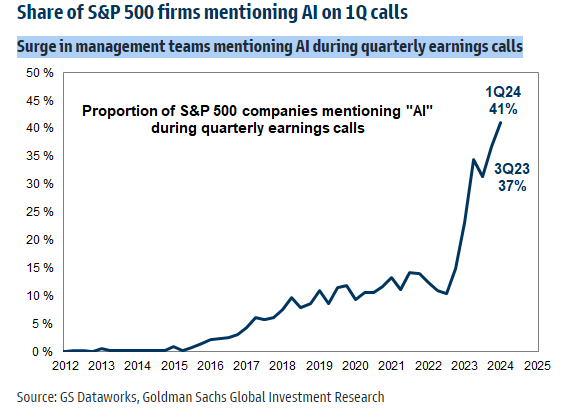

- 41% of S&P 500 firms mentioned AI on quarterly calls, but some tech firms claiming to be focused on AI are losing their luster.

- Adobe’s Q1 results were disappointing due to slower adoption of AI, but analysts expect strong growth in the next 12 months, leaving its valuation attractive today.

- Adobe’s technical chart shows warning signs with a bearish double top pattern and weakening momentum, making the stock risky ahead of earnings.

- Ahead of earnings next month, I highlight key price levels to watch.

hapabapa

With the Q1 reporting season just about wrapped up on Wall Street, the artificial intelligence (AI) narrative is louder than ever. Goldman Sachs reports that 41% of S&P 500 firms mentioned AI on quarterly calls. But the luster has been lost on some tech firms claiming to be focused on what AI can deliver.

I reiterate a hold rating on Adobe (NASDAQ:ADBE). Following a plunge earlier this year, shares are about flat from when I last reviewed the firm in June 2023. While I like its valuation better today, the momentum situation is precarious – I will detail key levels on the chart to monitor with the company’s Q2 report due out in less than a month.

AI mentions

According to Bank of America Global Research, Adobe is a diversified software company that offers electronic document technology and graphic content authoring applications to creative professionals, designers, knowledge workers, high-end consumers, developers, and enterprises. Flagship products from Adobe include Creative Suite, Photoshop, Acrobat, Premiere, Dreamweaver, Illustrator, InDesign, and LiveCycle. PDF and Flash technologies from the company have become industry standards and act as a platform for other Adobe products.

Back in March, Adobe reported a disappointing set of Q1 results. While quarterly non-GAAP EPS of $4.48 topped the Wall Street consensus estimate by a dime and revenue of $5.18 billion, up 11% from year-ago levels, was a modest beat, slower adoption of AI was seen affecting overall performance.

That weakness was also incorporated into a soft Q2 outlook from Adobe’s management team. Despite announcing a healthy $25 billion share repurchase program, traders slammed the stock – shares fell 13.7% in the session after the release. Looking ahead, data from Option Research & Technology Services (ORATS) show a 6.6% implied move after the June 13 Q2 earnings event. It will be key to watch what management says about monetizing its Firefly AI platform and its annual recurring revenue expectations.

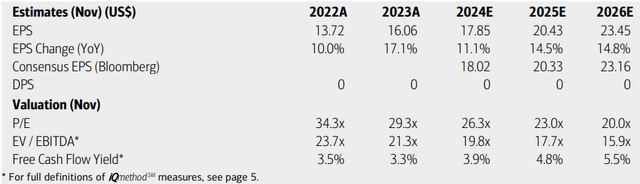

On valuation, analysts at BofA see earnings rising at a strong pace over the next 12 months. Per-share operating profits are expected to top $20 in the out year with continued increases through 2026. The Seeking Alpha consensus numbers show comparable EPS trends and there have been a slew of earnings upgrades in the past 90 days ahead of Adobe’s Q2 report due out in less than a month.

A fast-growing company despite its size, there is no dividend payout, but free cash flow is very healthy, and the firm’s forward EV/EBITDA ratio is back under 20x, significantly below its 5-year average.

Adobe: Earnings, Valuation, Free Cash Flow Forecasts

If we assume $19 of non-GAAP EPS over the year ahead and apply the stock’s 5-year average operating P/E multiple of 36, then shares should trade near $684. But if we take a PEG ratio approach, and assume an earnings growth rate of 13% over the long-term with a PEG multiple of 1.9, below its high long-term average, then the P/E should be more like 25, putting the valuation at $475. A 2.3 PEG, its historical norm, would put the intrinsic value closer to $570.

That’s a wide range, but with a significantly discounted EV/EBITDA ratio, even a moderate reversion to the long-term average would yield some upside from here. A fair value in the low to mid-$500s appears appropriate in my view.

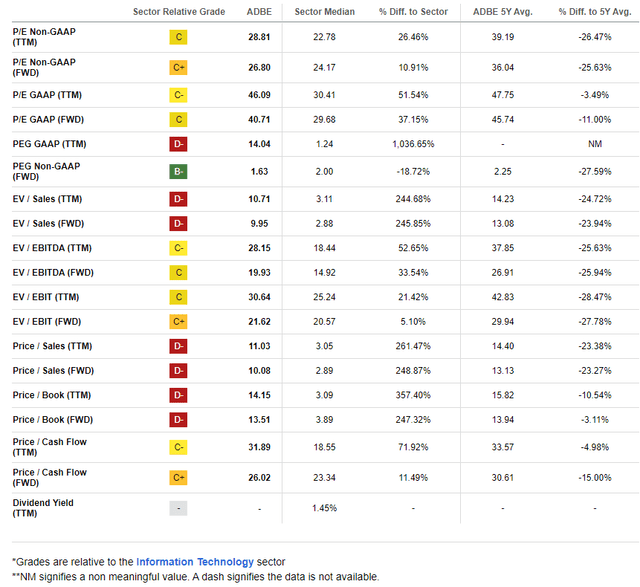

ADBE: Trades Significantly Below Its Long-Term Average P/E

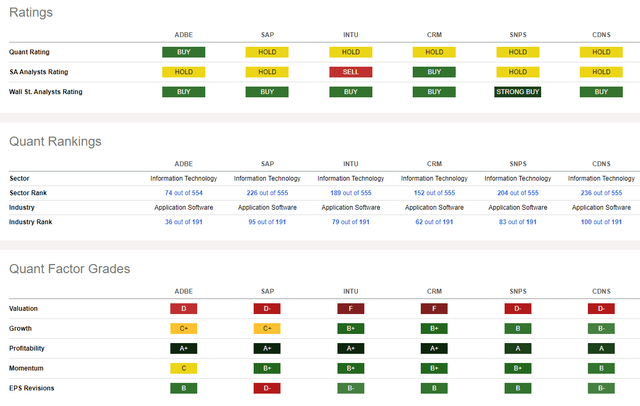

Compared to its peers, Adobe features a soft valuation rating, but many of its Application Software industry competitors trade at lofty valuations. And while the historical growth trajectory is unimpressive, the forward-looking earnings story is sanguine.

Adobe sports impressive profitability metrics, earning it a valuation premium, in my view, while share-price momentum has waned from earlier this year when the stock reached $638.

Competitor Analysis

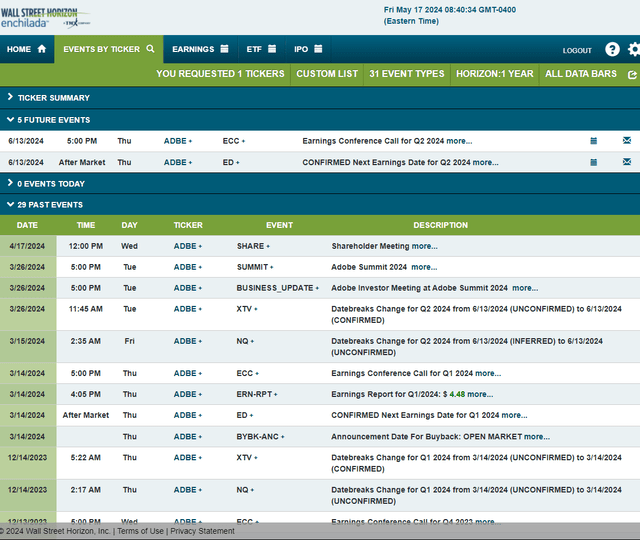

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q2 2024 earnings date of Thursday, June 13 AMC with a conference call later that evening. You can listen live here. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

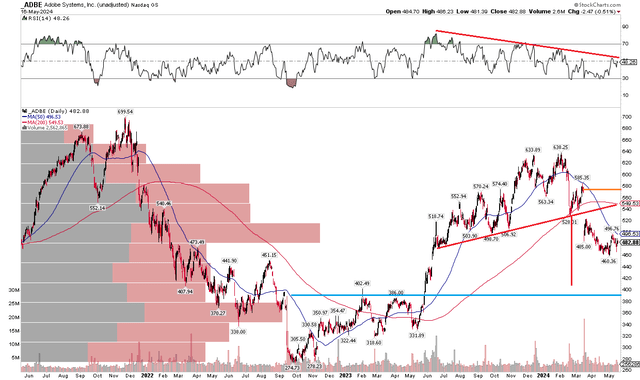

The Technical Take

With significant upside seen in Adobe’s earnings profile and a decent valuation ahead of Q2 results next month, the tech stock’s technical chart flashes warning signs. Notice in the graph below that shares put in a bearish double top pattern above $630 back in February. Shares then plunged around a disappointing earnings report, gapping lower in March, eventually hitting $460, a nearly 30% pullback from the early-year peak. The move lower violated an uptrend support line, which had the hallmarks of a bearish head and shoulders topping pattern. If we assume that pattern unfolds, then a downside measured move price objective to near $400 would be in play based on the height of the head and shoulders pattern.

Also take a look at key support near the $400 mark – that was a point of polarity in late 2022 and during the first half of last year. Moreover, the RSI momentum oscillator at the top of the chart shows a protracted period of weakening momentum. I would like to see the RSI gauge break the downtrend before getting excited about ADBE’s share price.

Overall, ADBE would be an absolute buy near $400, but I see risk with how it trades today technically.

ADBE: Bearish RSI Trends, Reverse Head and Shoulders Pattern In Play

The Bottom Line

I reiterate a hold rating on ADBE. I see the stock has a better value today versus my analysis in June last year, but the technical situation is risky ahead of earnings next month.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.