Summary:

- Adobe Inc. maintains strong revenue growth and profitability through its leading position in content creation software.

- Additional growth opportunities lie in artificial intelligence.

- Adobe faces challenges including regulatory concerns, data privacy issues, and high valuation pressures, but maintains strong fundamentals and financial stability.

- This article focuses on the fundamentals and whether Adobe is currently worth investing in.

JHVEPhoto

Adobe Inc. (NASDAQ:ADBE) has maintained strong revenue growth and profitability by maintaining a strong position as the leader in digital experience software. Strong suites of digital experience software support a strong portfolio that makes it difficult for new entrants to challenge the current market share. Aside from its product portfolio dominance, Adobe continues expanding globally, creating new revenue streams and growth.

Finally, a strong area of future growth for Adobe remains artificial intelligence. While there is large competition in this industry, the potential TAM (Total Addressable Market) is sizable enough to create growth for even a small market share. I think Adobe has a strong opportunity to continue to grow through artificial intelligence and has the market position to challenge other key players like Microsoft and Google. These are some reasons why Adobe maintains a strong financial portfolio and potential stock growth.

Some challenges that Adobe faces relate to regulatory concerns about their early termination clauses, making it difficult for clients to stop using the software. This could impact the stock price in the short term if Adobe is found guilty. Aside from direct lawsuits, Adobe also faces challenges in data privacy and security that many businesses are facing as laws relating to these areas change in the United States. A further concern for stock growth is the high valuation of the company, which places significant pressure on Adobe to win in a challenging artificial intelligence industry. While these challenges pose risk to any investors, Adobe continues to maintain a strong brand within the current market.

When considering these current stories about Adobe, we need to determine which news topics will have a long-term and ongoing effect on the company and its share price. Overall, Adobe maintains strong financial performance, especially with its growth in its digital media segment. The company continues to have strong innovation with its incorporation of AI in its products and the development of new products in a growing industry. The company does have risks related to regulatory concerns and large competition in the artificial intelligence space. Adobe will have to win to meet its high valuation targets and provide returns to investors.

While current news stories, good or bad, can sway our opinion about investing in a company, it’s good to analyze the fundamentals of the company and to see where it’s been in the past and in which direction it’s heading.

This article will focus on the long-term fundamentals of the company, which tend to give us a better picture of the company as a viable investment. I also analyze the value of the company versus the price and help you to determine if Adobe is currently trading at a bargain price. I provide various situations which help estimate the company’s future returns. In closing, I will tell you my opinion about whether I’m interested in taking a position in this company and why.

Snapshot of the Company

A fast way for me to get an overall understanding of the condition of the business is to use the BTMA Stock Analyzer’s company rating score. Adobe shows a rating score of 71.125 out of 100. This is a decent score, but it shows some weakness in its fundamentals.

Before jumping to conclusions, we’ll have to look closer into individual categories to see what’s going on.

Fundamentals

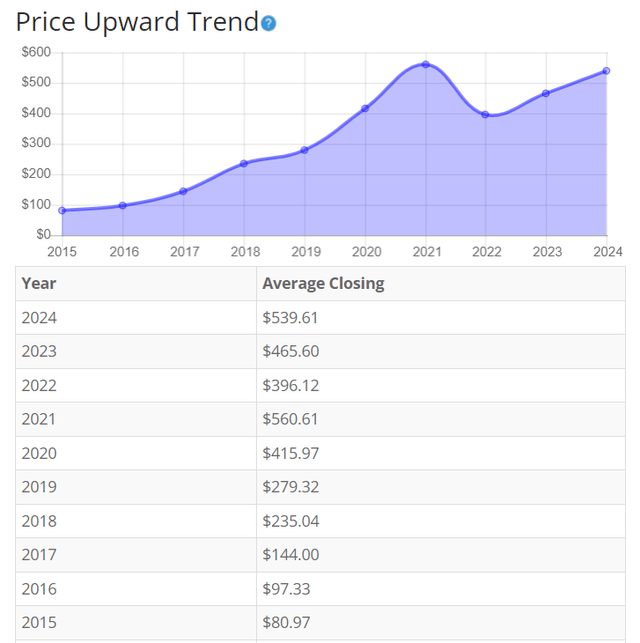

Adobe’s share price has grown significantly before a dip and recovery recently. Strong revenue and bottom-line growth have helped to increase this stock’s share price. Further AI potential leaves an opportunity for the recent upward momentum of the share price to continue over the long term. Overall, the share price average has grown by about 566.432% over the past 10 years, or a Compound Annual Growth Rate of 23.46%. This is an outstanding return!

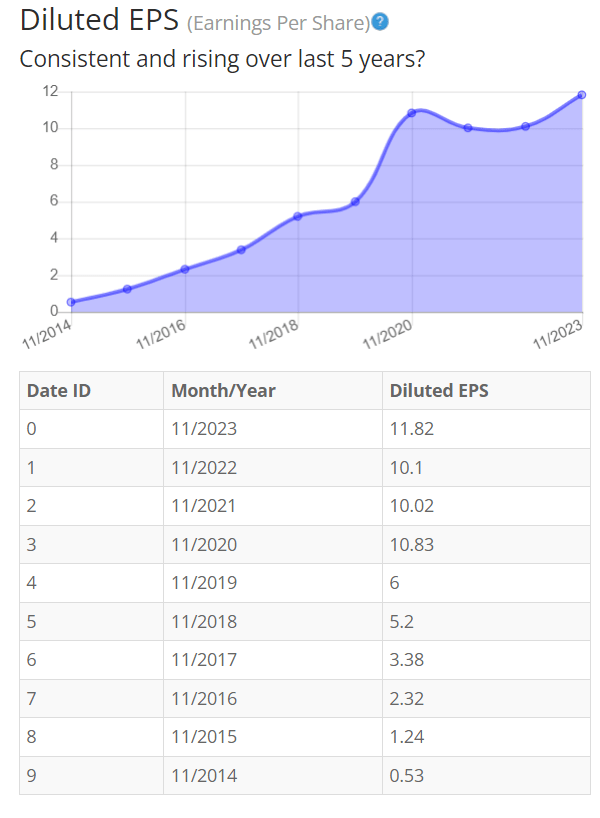

Earnings

Adobe’s earnings have risen consistently, even with a minor dip during Covid-19. Adobes high margins and consistent revenue through its subscription model help to drive its earnings higher. A strong business model and continued excellence in growth help to make Adobe grow its earnings year over year. Even with its recent Q2 earnings showing robust growth, I expect this trend of EPS increasing to continue.

BTMA Stock Analyzer

Since earnings and price per share do not always give the whole picture, it’s good to look at other factors like the gross margins, return on equity, and return on invested capital.

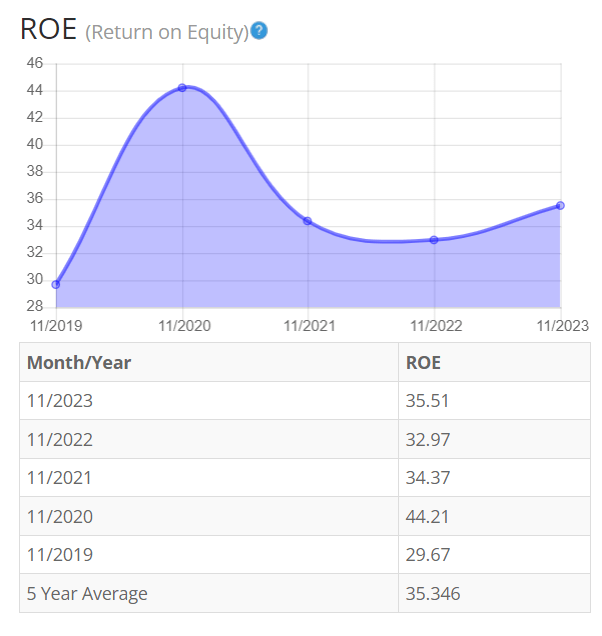

Return on Equity

The return on equity fell recently after its previous high during Covid. Adobe’s continued investment in its product portfolio has diminished some of its Return on Equity for investors. There have also been large infrastructure and scaling costs for the expansion of Adobe’s cloud-based services that have eaten away at some of its investors’ returns. Aside from these two direct factors, the macroeconomic conditions have not been favorable for many tech business’s return on equity, including Adobe. For return on equity (ROE), I look for a 5-year average of 16% or more. So, Adobe easily meets this requirement.

BTMA Stock Analyzer

Let’s compare the ROE of this company to its industry. The average ROE of 351 software (system and application) companies is 24.44%.

Therefore, Adobe’s 5-year average of 35.346% is well above its peers.

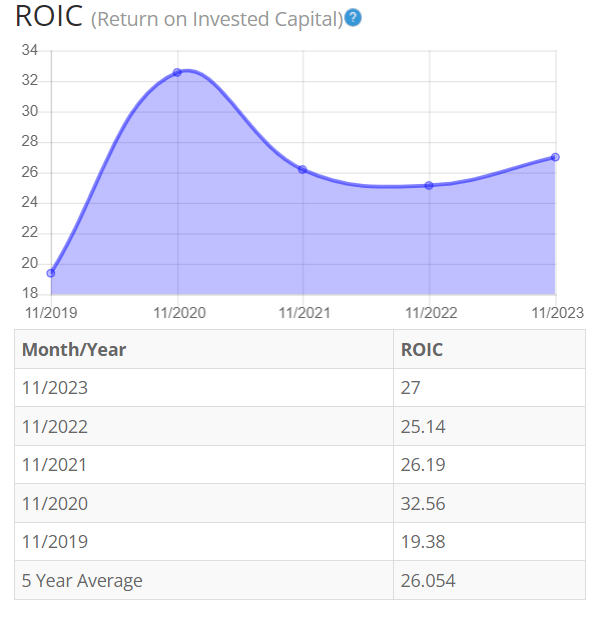

Return on Invested Capital

The return on invested capital shows a recent decline, like the return on equity. The company’s capital expenditure has fluctuated year over year for the past few years. With the investments in scaling its cloud digital services being a focus of the company, it is not surprising to see a small dip in its ROIC compared to a potential long-term growth in its cloud offerings. Besides its cloud services, Adobe is also competing in the AI space, which continues to require much research & development to maintain a competitive edge. If Adobe can win in the artificial intelligence industry, the ROIC will see rapid growth in the long term. For return on invested capital (ROIC), I also look for a 5-year average of 16% or more. So, Adobe exceeds this amount.

BTMA Stock Analyzer

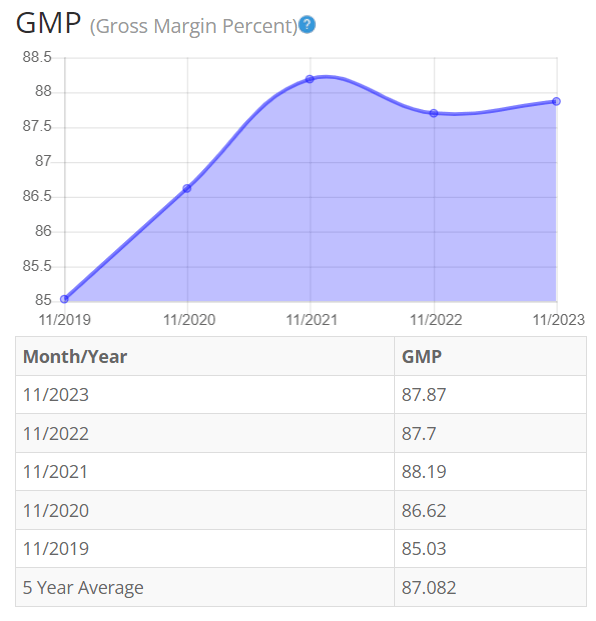

Gross Margin Percent

The gross margin percentage (GMP) has remained stable, with a slight increase over the last 5 years. Adobe has impressively strong gross margins as its product is software with a subscription fee for revenue. Most of Adobe’s costs come from development costs and marketing to continue its brand strength in the market. I expect this strong gross margin to continue unless Adobe makes some drastic changes to its business plan. I typically search for companies with gross margin percent consistently above 30%. So, Adobe is above this criterion.

BTMA Stock Analyzer

Financial Stability

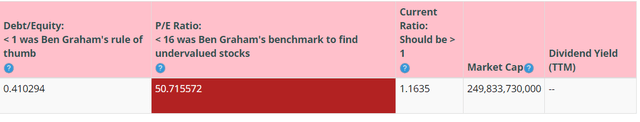

Looking at other fundamentals involving the balance sheet, we can see that the debt-to-equity is less than one. Adobe shows a strong balance sheet with the ability to pay off its obligations.

Adobe’s Current Ratio of 1.16 indicates it can pay off its short-term debt.

Ideally, we’d want to see a Current Ratio of more than 1, so Adobe exceeds this amount.

Adobe does not carry a large debt load relative to its assets. If Adobe needs to fund continued expansion in the artificial intelligence space or its global expansion efforts, it can raise additional capital due to its low debt load.

Adobe does not pay a regular dividend.

This analysis wouldn’t be complete without considering the value of the company vs. share price.

Value Vs. Price

The company’s Price-Earnings Ratio of 50.71 indicates that Adobe is very overpriced when comparing Adobe’s PE Ratio to a long-term market average PE Ratio of 15.

However, the 10-year and 5-year average PE Ratio of ADBE has typically been 50 and 48, respectively. This indicates that ADBE could be currently trading at a slightly high price when comparing to its average historical PE Ratio range.

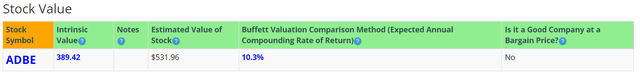

The Estimated Value of the Stock is $531.96, versus the current stock price of $563.41. This indicates that Adobe is currently selling above its value.

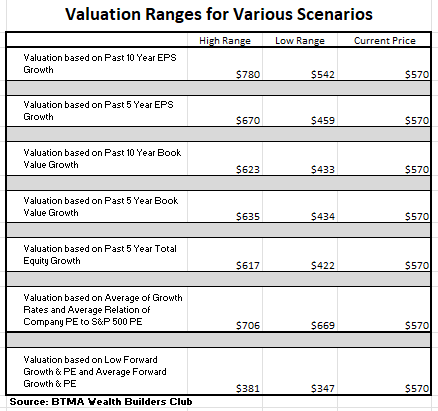

For more detailed valuation purposes, I will be using a conservative diluted EPS of 11.82. I’ve used various past averages of growth rates and PE Ratios to calculate different scenarios of valuation ranges from low to average values. The valuations compare growth rates of EPS, Book Value, and Total Equity.

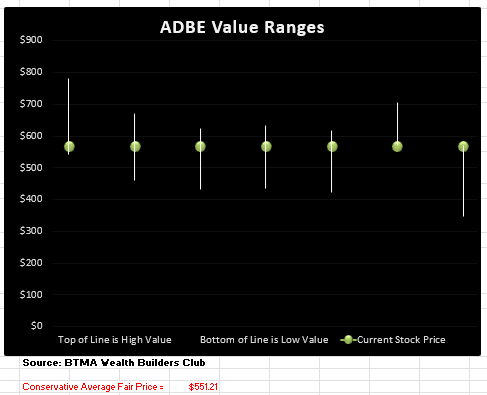

In the table below, you can see the different scenarios, and in the chart, you will see vertical valuation lines that correspond to the table valuation ranges. The dots on the lines represent the current stock price. If the dot is towards the bottom of the valuation range, this would indicate that the stock is undervalued. If the dot is near the top of the valuation line, this would show an overvalued stock.

BTMA Wealth Builders Club

BTMA Wealth Builders Club

This analysis shows an average valuation of around $551 per share versus its current price of about $570, this would indicate that Adobe is overpriced.

Summarizing the Fundamentals

After analyzing Adobe’s fundamentals, I believe the company shows exceptional levels of ROE, ROIC, and Gross Margins. The 10-year EPS has also been mostly consistently improving. Note that ROE and ROIC have dipped recently from Adobe’s continued investments in AI and its cloud services, which I expect to pay dividends and drive growth in the future. Finally, Adobe’s gross margin remains strong due to its current business model and most of its costs coming from marketing or research and development. While research and development will always be needed to maintain its competitive advantage, marketing expenses can always have improved efficiency to increase the fundamentals of the company’s financials. Overall, the company showcases strong fundamentals with potential for growth as the artificial intelligence industry continues to grow over the next 5 years.

In terms of valuation, my analysis indicates that the stock is overpriced.

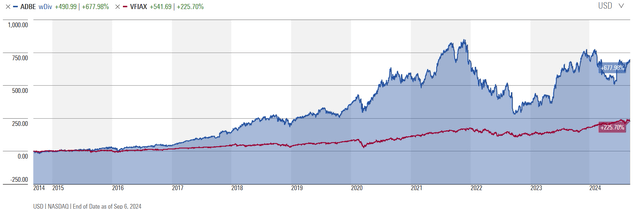

Adobe Vs. The S&P 500

Now, let’s see how Adobe compares versus the US stock market benchmark S&P 500 (SP500) over the past 10 years. From the chart below, Adobe outperforms the stock market on a consistent basis. Notice that Adobe does show more volatility than the benchmark. Therefore, ADBE provides more opportunities to buy during pullbacks and to capitalize on larger gains thereafter.

I think the stock is also in a prime position to continue to outperform the market in the long term with the potential growth of the AI industry and Adobe’s persistence in global expansion.

Forward-Looking Conclusion

Over the next five years, the analysts who follow this company are expecting it to grow earnings at an average annual rate of 13.81%.

In addition, the average one-year price target for this stock is $616.88 which is about an 9.4% increase in a year.

The Expected Annual Compounding Rate of Return is 10.3%.

If you invest today, with analysts’ forecasts, you might expect about 9% (low growth) to almost 14% (average growth) per year.

Here is an alternative scenario based on ADBE’s past earnings growth. During the past 5-year period, the average EPS growth rate was about 14.5%.

But when considering cash flow growth over the past 5 years, the average growth has been about 14%. Therefore, when considering all of these return possibilities, our average annual return could likely be around 12.4%.

If considering actual past results of ADBE, the story is a bit different. Here are the actual 10 and 5-year return results.

______________

10 Year Return Results if Invested in ADBE:

Initial Investment Date: 9/10/2014

End Date: 9/10/2024

Cost per Share: $72.33

End Date Price: $567.50

Total Return: 684.60%

Compound Annualized Growth Rate: 23%.

_______________

5 Year Return Results if Invested in ADBE:

Initial Investment Date: 9/10/2019

End Date: 9/10/2024

Cost per Share: $276.14

End Date Price: $567.50

Total Return: 105.51%

Compound Annualized Growth Rate: 16%.

_________________

From these scenarios, we have produced results from 16% to 23%. I feel that if you’re a long-term patient investor and believer in ADBE, and its existing products (content creation software), you could expect ADBE to provide you with around at least 10-16% annual return over the long haul. But for the short-term swing trader or impatient investor, the near future of ADBE, might show some volatility as the overpriced technology sector and market may encounter short-term corrections.

As a comparison, the S&P 500’s average return from 1928 to 2014 is about 10%. So, in a typical scenario with ADBE, you could expect to earn as much or a higher long-term return as compared with an S&P 500 index fund. The individual Adobe stock obviously doesn’t offer the diversification that the index fund does, but Adobe has proven that it is a consistent performer over the long run.

Does Adobe Pass My Checklist?

- Company Rating 70+ out of 100? Yes (71.12)

- Share Price Compound Annual Growth Rate > 12%? Yes (23.46%)

- Earnings history mostly increasing? Yes

- ROE (5-year average 16% or greater)? Yes (35.34%)

- ROIC (5-year average 16% or greater)? Yes (26.05%)

- Gross Margin % (5-year average > 30%)? Yes (87.08%)

- Debt-to-Equity (less than 1)? Yes

- Current Ratio (greater than 1)? Yes

- Outperformed S&P 500 during most of the past 10 years? Yes

- Do I think this company will continue to successfully sell the same main product/service for the next 10 years? Yes

Adobe scored 10/10 or 100%. Therefore, Adobe could be a great potential investment.

Is Adobe currently selling at a bargain price?

- Price Earnings less than Adobe’s average historical PE Ratio Range of 48-50? No (50.71)

- Detailed Valuation greater than the Current Stock Price? No (Value $551<$570 Stock Price).

Adobe continues to showcase its strength with strong earnings and continued investment in expanding its suite of products. The integration of AI represents a large opportunity for additional stock growth in the long term if Adobe can capture some market share. Even with an established brand, Adobe continues to attract new customers to its content creation products. The company has strong fundamentals and a low risk of a large stock decline even in a tough macroeconomic environment because of the stability of its subscription-based products.

I am interested in Adobe as a potential investment, but not at its current price. I feel that there is a good possibility that the technology sector as a whole could experience price corrections moving forward.

Therefore, I’ll add Adobe to my watch list and consider adding some to my portfolio when it experiences a dip, so I can buy this solid company at a bargain price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want to find good companies at bargain prices that will provide you with long-term returns and dividends in any investing climate, then my Seeking Alpha Marketplace service (Good Stocks@Bargain Prices) is a good match for you.