Summary:

- ADBE’s strategic shift from one-time perpetual license to a subscription-based business model in 2011 has contributed to its double-digit growth over the past decade.

- With a global market share of over 80%, it is unsurprising that certain platforms are almost synonymous to the company, including Adobe Photoshop and Adobe Acrobat Pro – PDF.

- Despite the softer FQ2’24 earning guidance, ADBE’s core consumers remain highly sticky, as observed in the growing multi-year backlog and Annualized Recurring Revenues.

- The recent market over-reaction has triggered an opportunistic entry point for investors looking to add for long-term capital appreciation.

We Are

The ADBE Investment Thesis Is Even More Attractive After The Recent Pullback

Adobe (NASDAQ:NASDAQ:ADBE) along with Autodesk (ADSK) are two stocks that does not require an introduction indeed, given that I am a licensed architect with nearly two decades of cumulative education and experience.

With ADBE offering a well diversified SaaS offerings across photo, design, and video applications commonly used in the enterprise and commercial markets, it is unsurprising that certain platforms are almost synonymous to the company, including Adobe Photoshop and Adobe Acrobat Pro – PDF.

As a fun fact, Paramount’s Top Gun: Maverick (PARA) and Disney’s Avatar: The Way Of Water (DIS) were entirely edited on Adobe Premiere Pro, further highlighting its globally successful SaaS platform.

ADBE’s shift from one-time perpetual license business model to the monthly/ annual subscription business model since 2011/ 2012 was highly strategic as well, since it had contributed to its double digit growth over the past decade.

This has also explained the SaaS company’s double beat FQ1’24 earnings call, with revenues of $5.18B (+2.7% QoQ/ +11.3% YoY) and adj EPS of $4.48 (+4.9% QoQ/ +17.8% YoY).

The high-margin SaaS business model is also observed in the company’s growing operating margins of 36.8% (+2.3 points QoQ/ +2.7 YoY) and adj Free Cash Flow margins of 41.1% (+10.4 points QoQ/ +6.9 YoY), after accounting for the $1B termination charge related to the abandoned Figma acquisition.

Much of ADBE’s robust Free Cash Flow generation has been put to great use indeed, as observed in the 3.2M or the equivalent -0.6% of its float retired over the last twelve months, and 35.3M/ -7.1% since FY2019.

This is further demonstrated by the outsized $25B share repurchase program through 2028, implying the management’s confidence of consistently generating robust cash flows ahead.

At the same time, the SaaS company reported a healthier balance sheet, with a net cash situation of $4.12B (+17.3% QoQ/ +103.9% YoY) by the latest quarter, further underscoring why the abandoned Figma acquisition has been a blessing in disguise, attributed to the overly hefty price tag of $20B.

As a SaaS company, we believe that ADBE is one that is highly profitable, with a healthy balance sheet and excellent shareholder returns thus far.

ADBE’s AI Monetization Is On The Right Path – Slow & Steady Wins The Race

While ADBE has met its share of generative AI delays through the supposedly ethical Firefly platform as its competitors forge on, readers may want to note that it is not the only company facing this issue.

For context, the market appears to be overly critical about ADBE’s AI monetization path, with much of the generative AI capabilities being incremental improvements in the consumer engagement and value-add services.

The management has also opted to introduce a credit pricing plan for Firefly, instead of a standalone subscription platform, while integrating the AI capability across its existing enterprise offerings.

On the one hand, we can understand why the market may have been disappointed with ADBE’s slower monetization path, especially when compared to the double digit growths reported by other generative AI SaaS providers, such as Palantir (PLTR), Microsoft Azure (MSFT), and CrowdStrike (CRWD).

On the other hand, given the breadth of ADBE’s enterprise offerings along with the potential intellectual property headwinds, we believe that the management’s prudence through the ethical Firefly platform is highly strategic to the longevity of its business indeed.

This is especially since up to 59% of its customer base employs over 5K employees and up to 64% generates over $1B in annual revenue, where copyright infringement is not an option.

While we may be wrong, in which ADBE’s Firefly may fail to gain traction as well as how its start up peers have, including Stable Diffusion, Midjourney, and OpenAI’s DALL-E 3, we maintain our belief that it is more important that the former to safeguard its core enterprise customers’ interests.

With Alphabet’s Gemini (GOOG) and Microsoft-backed OpenAI’s GPT-4 (MSFT) still reporting hallucination issues thus far, we believe that the path toward a truly sustainable AI monetization remains bumpy and likely to be fraught with legal challenges.

For now, ADBE may have offered a supposedly softer FQ2’24 guidance, with revenues of $5.275B (+1.8% QoQ/ +9.6% YoY) and adj EPS of $4.375 (-2.3% QoQ/ +11.8% YoY) missing the consensus estimates of $5.31B (+2.5% QoQ/ +10.3% YoY) and $4.38 (-2.2% QoQ/ +12% YoY), respectively.

However, we are not overly concerned indeed, given the robust moat attributed to the growing demand for its SaaS offerings and the inherent stickiness of its consumer base. This has been demonstrated by the growing multi-year Remaining Performance Obligations of $17.58B (+2% QoQ/ +15.5% YoY) by FQ1’24.

This is on top of the robust growth reported in ADBE’s Digital Media Annualized Recurring Revenue [ARR] to $15.76B (+3.8% QoQ/ +15.2% YoY), Creative ARR to $12.78B (+3.3% QoQ/ +13.2% YoY), and Document Cloud ARR to $2.98B (+6% QoQ/ +24.6% YoY) in the latest quarter.

These numbers demonstrate that its core consumers are unfazed by the generative AI headwinds, notably attributed to the SaaS company’s robust moat across the photo, design, and video applications, with it commanding the market leading share of 80.1% in the global business process management (graphics) software vendors as of February 2024.

Moving forward, readers may want to monitor ADBE’s AI strategy, since the slower monetization has directly triggered the management’s softer forward guidance and the market’s discounting of its FWD valuations, triggering risks to its long-term investment thesis in the fast pace generative AI race.

However, with the generative AI beta services still in the ramping stage through Q2’24, we believe that it may be more prudent to wait for good news in H2’24 instead, based on the CFO’s recent commentary in the FQ1’24 earnings call:

We’re ramping Firefly Services and Express and Enterprise. As we talked about, we saw a very good beginning of that rollout at the — toward the end of Q1. We also expect to see the second half ramping with Express Mobile and AI Assistant coming through. So we have a lot of the back-end capabilities set up so that we can start monetizing these new features which are still largely in beta starting in Q3 and beyond…

As we have now introduced the new pricing for CC with Firefly, and overall, the roll-off of the prior pricing is more significant than the new pricing that we’ve introduced. (Seeking Alpha)

So, Is ADBE Stock A Buy, Sell, or Hold?

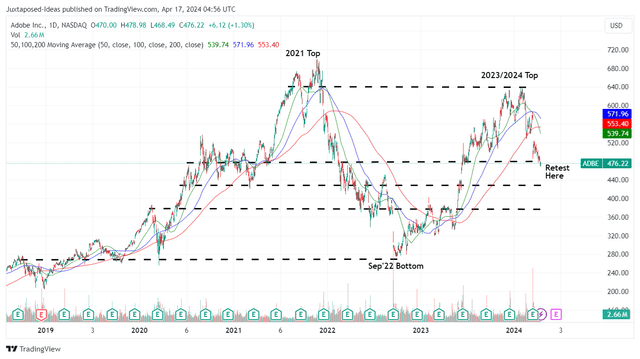

ADBE 5Y Stock Price

For now, ADBE has retraced dramatically from its 2024 top, while trading way below its 50/ 100/ 200 day moving averages as it appears to retest the previous support levels of $470s.

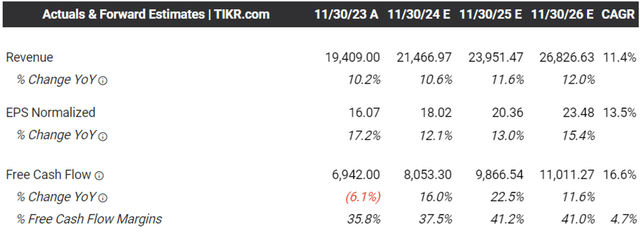

The Consensus Forward Estimates

As a result of the management’s softer FQ2’24 earnings guidance, we can also understand why the consensus have temporarily downgraded their forward estimates, with ADBE expected to generate a decelerating top/ bottom line expansion at a CAGR of +11.4%/ +13.5% through FY2026.

This is compared to the previous estimates of +12.9%/ +14.1% and the historical growth of +18.7%/ +27% between FY2016 and FY2023, respectively.

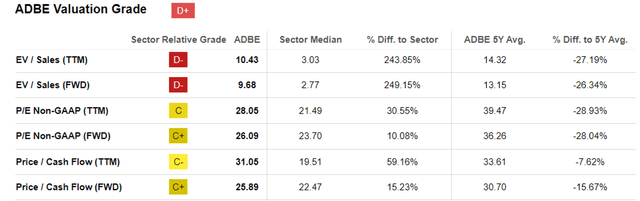

ADBE Valuations

As a result, we can understand why the market has moderately discounted ADBE’s FWD P/E valuations to 26.09x and Price/ Cash Flow valuations to 25.89x, compared to its 1Y mean of 30.33x/ 28.50x and 3Y pre-pandemic mean of 32.68x/ 28.51x, respectively.

However, as the SaaS business matures from high double digit growths during the pre-pandemic to low double digits growths during the hyper-pandemic, we believe that ADBE’s valuation normalization is to be expected.

Even when compared to its other enterprise SaaS peers, such as Microsoft (MSFT) at 35.35x/ 27.96x, Oracle (ORCL) at 21.46x/ 17.46x, ADSK at 28.43x/ 33.23x, we believe that ADBE appears to be fairly valued here.

This is especially after comparing ADBE’s forward estimates to MSFT’s projected top/ bottom line growth at a CAGR of +14.7%/ +16.9%, ORCL at +8.4%/ +11.7%, and ADSK at +10.4%/ +11.2% through 2026, respectively.

For now, based on the LTM adj EPS of $16.76 and the discounted FWD P/E valuations of 26.09x, ADBE appears to be trading above our fair value estimates of $437.20, with a notable premium of +8.9% at current levels.

Despite so, based on the consensus FY2026 adj EPS estimates of $23.48, there seems to be an excellent upside potential of +28.6% to our long-term price target of $612.50, thanks to the SaaS company’s double digit EPS growth through FY2026.

As a result of the relatively attractive risk/ reward ratio after the recent pullback, we are cautiously rating ADBE as a Buy, though with no specific entry point since it depends on individual investor’s dollar cost average and portfolio allocation, given the wide differential between the fair value and long-term price target.

Given the market’s over-reaction to the supposedly softer FQ2’24 guidance, it may be more prudent to observe the stock’s movement for a little longer, before adding once a floor has materialized, likely between the previous trading ranges of between $420s and $450s for an improved margin of safety.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.