Summary:

- Adobe is a software company operating in the IT sector with potential for dividend growth in the future.

- The company has experienced significant revenue and EPS growth over the past decade, partly due to its shift to a subscription-based business model.

- While Adobe does not currently pay dividends, its growing free cash flow and history of share buybacks suggest the potential for future capital returns to shareholders.

SeanShot

Introduction

As an investor focused on dividend growth stocks, I always seek new investment opportunities in income-producing assets. I often add to my existing positions when I find them attractive. I also use market volatility to my advantage by starting new positions to diversify my holdings and increase my dividend income for less capital. Sometimes I seek companies that have the potential to become dividend growth companies, and I cover them as well.

The information technology sector is attractive, including Adobe (NASDAQ:ADBE). IT companies have enjoyed a significant run during the first half of 2023, and while some of them may be overvalued by now, there are still several opportunities. As we see the interest rates reaching their peak, the lower level of uncertainty may be an opportunity even for more conservative investors who usually refrain from companies that do not pay dividends.

I will analyze Adobe using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

Adobe operates as a diversified software company worldwide. It operates through three segments: Digital Media, Digital Experience, and Publishing and Advertising. The Digital Media segment offers products, services, and solutions that enable individuals, teams, and enterprises to create, publish, and promote content. Its flagship product is Creative Cloud, a subscription service that allows members to access its creative products. The Digital Experience segment provides an integrated platform and set of applications and services that enable brands and businesses to create, manage, execute, measure, monetize, and optimize customer experiences from analytics to commerce. The Publishing and Advertising segment offers products and services like e-learning solutions, technical document publishing, web conferencing, document and forms platform, web application development, high-end printing, and Advertising Cloud offerings.

Fundamentals

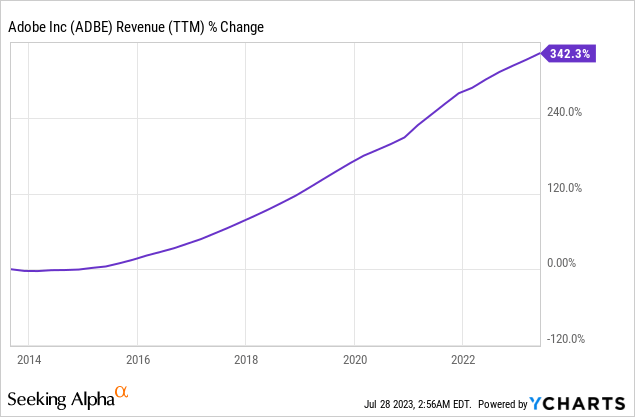

The revenues of Adobe have increased by more than 340% over the last decade. It means the company has more than quadrupled its sales as it changed its business model from product sales to subscriptions. The company also gained revenue increases from some of its acquisitions, though, besides the Figma acquisition, they were smaller niche players. In the future, as seen on Seeking Alpha, the analyst consensus expects Adobe to keep growing sales at an annual rate of ~11% in the medium term.

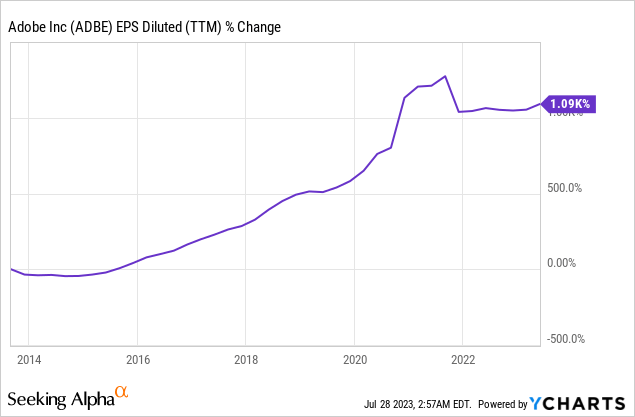

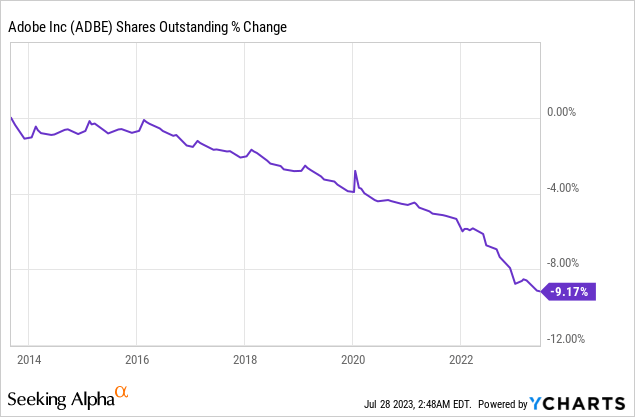

The company’s EPS (earnings per share) has grown by more than 1000%, meaning that the EPS is more than tenfold higher than it was a decade ago. Adobe achieved it by increasing sales, buying back stock, and improving margins as it shifted towards a cloud-based subscription, which allowed it to lower costs. In the future, as seen on Seeking Alpha, the analyst consensus expects Adobe to keep growing EPS at an annual rate of ~14% in the medium term.

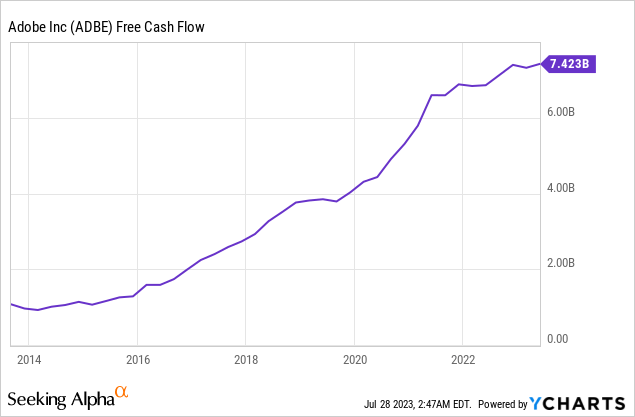

The company doesn’t pay a dividend to its shareholders. However, it may still be compelling to dividend growth investors who do not seek dividend income now. The key to paying a progressive dividend is having a growing FCF (free cash flow), and Adobe offers that. As the company still grows fast, investing the cash into the business makes sense. As growth slows down, it is a possibility that the company will start paying a dividend in addition to the buybacks. We have seen the same with companies like Apple (AAPL), Microsoft (MSFT), Cisco (CSCO), and more. As growth slows, sharing the wealth with the shareholders makes sense.

Adobe already shares some wealth with its shareholders via buybacks. Over the last decade, the company acquired almost 10% of its shares. Buybacks support EPS growth as they lower the number of shares outstanding. Moreover, we have seen with companies in the IT sector, such as Apple and Microsoft, that buybacks are the first stage before the dividend. Therefore, I am optimistic about the chances of us seeing more capital returned to shareholders through buybacks and dividends. Other companies already buying back shares are Meta (META) and Alphabet (GOOG)(GOOGL), and as growth slows down, they may become another future dividend growth prospect.

Valuation

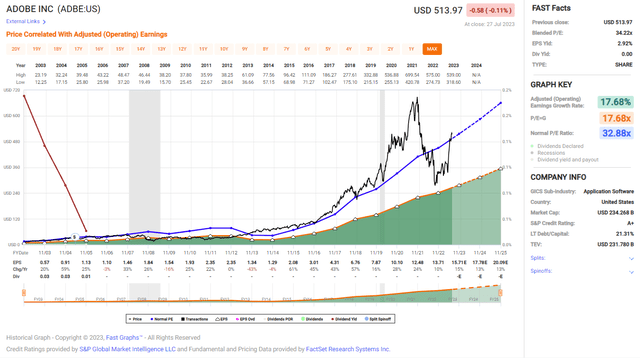

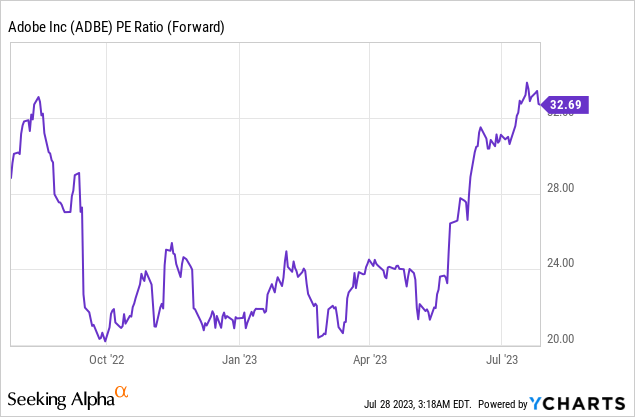

The P/E (price to earnings) ratio of Adobe stands at 32 when using the 2023 EPS estimates. The current valuation seems a bit high, even if not out of touch. The company does grow fast, with a 14% annual forecasted growth rate. Yet, with interest rates at 5.5%, the current valuation is challenging, especially when this is the highest valuation we have seen over the last twelve months.

The graph below from Fast Graphs shows that Adobe is slightly overvalued. The company’s average P/E ratio is 32.9, and the current is 32.7. However, in the past, the company was growing faster at an annual rate of 17.7% compared to the forecast of 14% in the coming years. Therefore, I believe the shares are slightly overvalued in that business environment where rates are higher than in the last two decades.

Opportunities

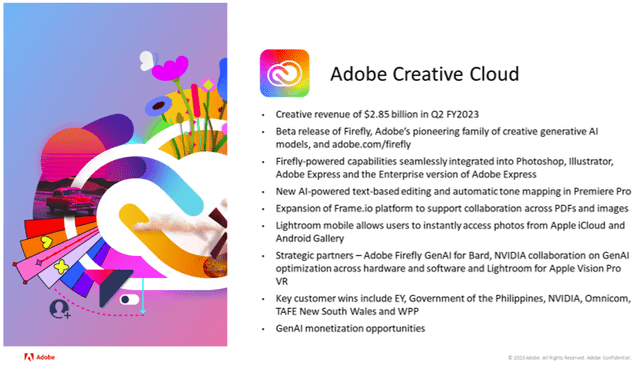

Adobe has a significant brand that is well-known by the mainstream population and is highly renowned among creative professionals. The company’s position is critical in a world where investment in sales and marketing is massive, and there is high competition as cloud technology lowers the barriers to entry into the software realm. Adobe can leverage its brand for its marketing and to win the competition.

Adobe

A solid shift to SaaS (software as a service) business model is another excellent opportunity. The company has shifted from selling products to selling subscriptions to services. These subscriptions allow the company to enjoy a steady stream of revenues and don’t have to sell its product repeatedly. The shift was successful, and in the last quarter alone, the company has increased the ARR (annual recurring revenue) by almost $1B, and it did it in all three of its business segments, proving that the transition is successful and beneficial. That transition will allow Adobe to keep increasing margins as every client adds only a marginal cost.

For FY23, we now expect Creative Cloud and Document Cloud to end the year ahead of our previously issued revenue and ARR targets and Digital Experience to be slightly below our previous annual target, given the current enterprise spend environment. As a result of our groundbreaking innovation and continued execution, we are pleased to raise total Adobe annual revenue and EPS targets.

(Shantanu Narayen – Chairman and CEO, Adobe’s Q2 results)

AI adoption is another excellent opportunity for Adobe. The company has released Firefly, its generative AI tool. The tool is embedded into its applications, allowing creators to create more sophisticated products easily. The company is standing at the front when it comes to generative AI for creators, and this is a long-term growth opportunity as it allows more people to express their creativity. These people are likely to become Adobe’s new future clients.

The introduction of the new Adobe Express and Firefly will go down as a seminal moment in our creative history. These innovative products and our generative AI co-pilot in our flagship applications will extend our leadership in core creative categories such as imaging, design, video, illustration, animation, and 3D and attract an increasingly expansive global audience.

(David Wadhwani – President, Digital Media, Adobe’s Q2 results)

Risks

The growth rate is slowing down when looking at both the revenues and the EPS. The EPS growth has slowed from 61% in 2015 to 10% in 2022. Sales growth has also slowed, from 16% in 2015 to 12% in 2022, after reaching 25% in 2017. Therefore, while the company is still growing at a healthy rate, it is far from the growth we have seen, while the valuation has remained the same.

To deal with the slower growth rate in its core business, Adobe acquired Figma for $20B, which scared investors as Adobe’s market cap dropped by $30B when the deal was announced. Therefore, as the company seeks more ways to grow, there is the risk of poor capital allocation. There is no doubt that Figma fits Adobe, but if the management doesn’t allocate well and pay decent prices, investors may find themselves with some value being destroyed.

The last risk is the lack of margin of safety. The company is trading for a higher valuation compared to its average valuation. Moreover, the company is not growing as fast as it did, and even the Figma acquisition cannot have enough impact on the growth rate. Even great companies such as Adobe should be acquired only for the right price and with enough margin of safety in case investors were wrong in their assumptions.

Conclusions

Adobe is not a dividend growth company, as it doesn’t pay dividends. It returns capital only in the form of buybacks. The company enjoys a growing free cash flow, which can be the basis for a future dividend. As the company’s growth is slowing down, using the free cash flow to reinvest in the business and pay shareholders will make sense. In the foreseeable future, investors shouldn’t rely on the dividend but on the continuous growth of the FCF.

Regarding the attractiveness of the investment, I believe that investors should be cautious when rates are so high, and the current valuation is higher than the average. Therefore, I think shares of Adobe are a HOLD and will become attractive when the P/E ratio is ~23-25. Some investors may prefer buying slowly into the company and buying more shares whenever the share price dips.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL. CSCO, MSFT, GOOG, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.