Summary:

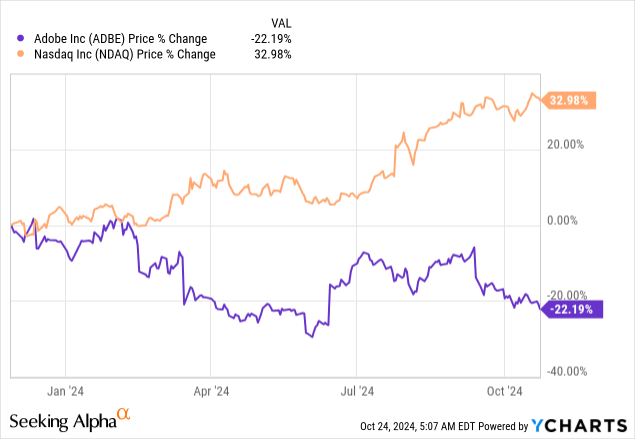

- Adobe’s stock has fallen by more than 20% over the past year, even as fundamentals improved, and there is a good reason for that.

- Contrary to popular opinion, the stock is not significantly undervalued, but that’s not needed to justify a buy rating.

- It appears that the current momentum in margin improvements could be sustained and this will provide a much-needed tailwind for the share price.

- I am changing my near-term outlook on the stock, but will be looking for more solid evidence for sustained margin improvements during the upcoming earnings release.

JHVEPhoto

About a year ago, in November 2023, I warned that Adobe Inc. (NASDAQ:ADBE) stock was at significant risk of reversal.

Back then, investors were excited about the recent returns as the stock was up roughly 85% over the prior 12-month period and the hype around the margin opportunity on the back of generative AI opportunities was on a high note.

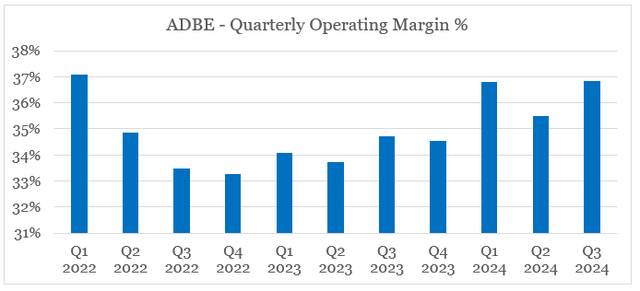

Operating margins have improved on a quarterly basis since then, and they now seem to be on track to recover to their previous highs of 37%.

prepared by the author, using data from Seeking Alpha

In that process, however, ADBE shareholders were severely punished, with the stock down by more than 22% since my November article while the Nasdaq Composite Index returned almost 33% over the same period.

On itself, that does not make ADBE an attractive buying opportunity, but as the valuation has normalized Adobe’s shareholders could take a breath of fresh air.

Don’t Let Recent History Fool You

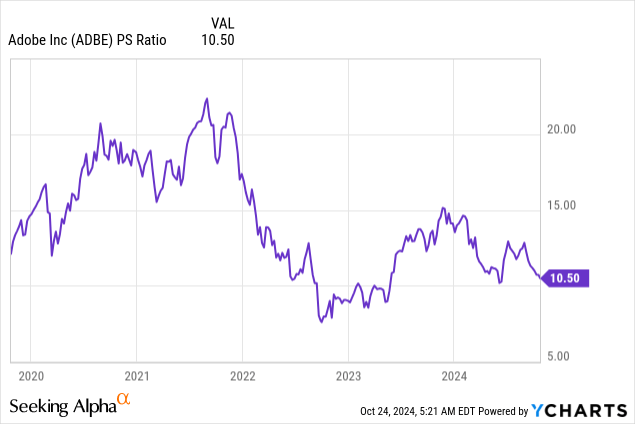

ADBE’s sales multiple has cooled off significantly over the past year and the stock now trades close to levels last seen in late 2022 and early 2023.

Although this looks like a good time to buy, reviewing valuation multiples in isolation and in such short time intervals could easily lead to the wrong conclusions.

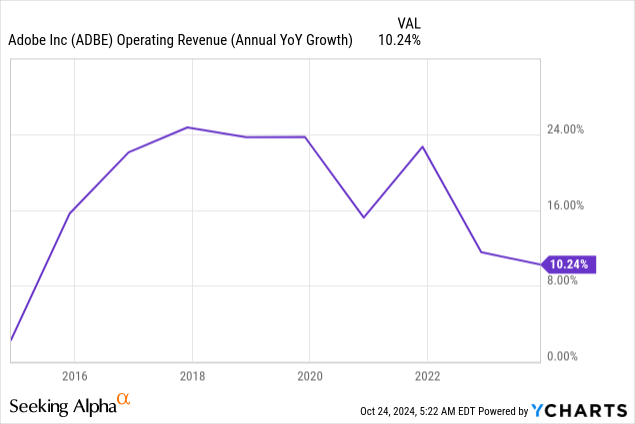

As a starting point, ADBE’s topline growth has slowed down significantly, after a period of a notable increase in digital content creation and digitalization across the globe. This ongoing trend was put on steroids following the pandemic and ADBE was among the main beneficiaries.

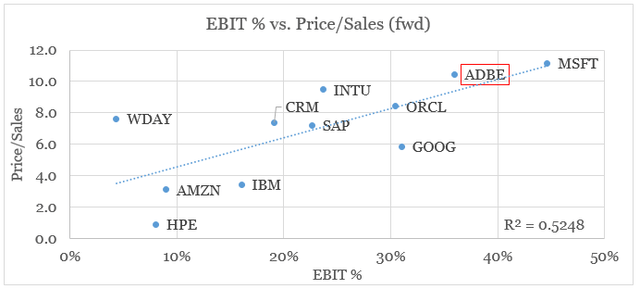

Another reason why current multiples might seem low on a historical basis is because as bond yields and interest rates more broadly are now normalizing, valuation premiums for high-growth stocks have also come down. That is why, if we compare ADBE against its broader peer group on an EBIT margin vs. Price/Sales multiple basis, the stock appears to be fairly priced currently (it lies on or close to the trend line).

prepared by the author, using data from Seeking Alpha

That is why, even though significant progress is being made on the profitability side of the business, I still don’t see ADBE as a $600 stock anytime soon. Having said that, however, ADBE is no longer significantly overpriced, and further margin improvements in conjunction with sustained business momentum could justify a buy rating.

Margin Improvements

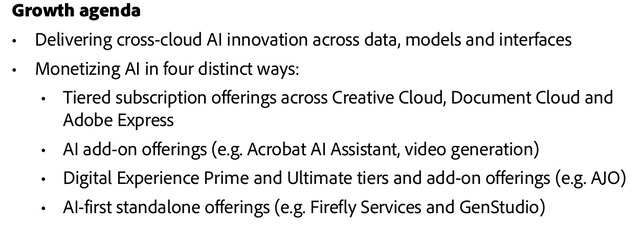

One of the main pillars of ADBE’s bullish thesis is that the company is now fully capitalizing on generative AI opportunities. These should not only reinvigorate sales growth, but also have a positive impact on margins.

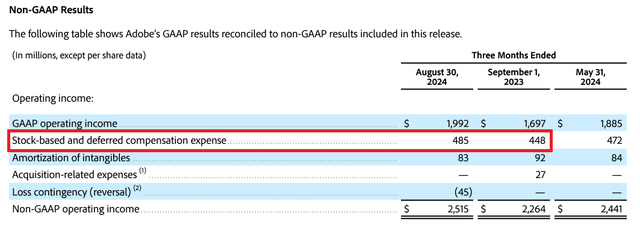

As margins continue to improve ADBE continues to rely heavily on stock-based compensation, which increased by more than 8% during the last quarter. This increased reliance on stock-based compensation has been one of my key areas of concern for quite some time now and should be on investors’ minds when ADBE reports its next quarterly results.

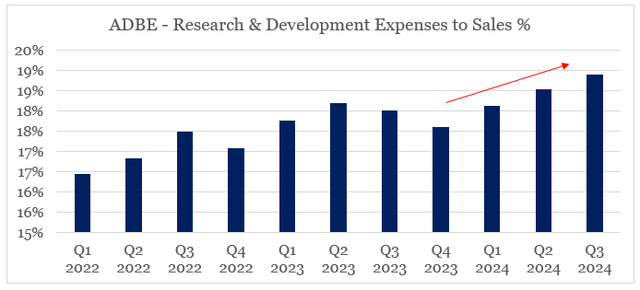

Last year, I also showed why ADBE will be faced with the need to invest more heavily in research and development for a prolonged period of time. In the quarters that followed this has materialized and the share of R&D expenses to revenue has increased significantly.

prepared by the author, using data from Seeking Alpha

Despite all that, gross margin improvements and realized economies of scale on selling, general and admin expenses have been more than enough to offset these headwinds and Adobe’s operating margin is now once again at record-high levels.

During the last reported quarter, the company’s EBIT margin reached almost 37%, which is at par with 2021 – a record-breaking year in profitability.

As we saw above, the market is already pricing in the current improvement in margins, and we will need to see further strength in profitability before the current multiple improves. Given the strong business momentum across the company’s cloud offerings, however, it seems highly likely that more economies of scale will be realized over the coming quarter. (Provided that a recession is avoided and there are no macroeconomic headwinds.)

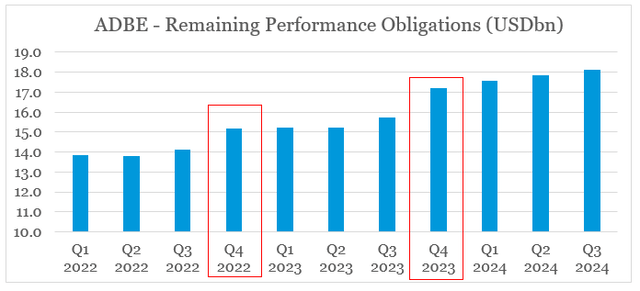

The total remaining performance obligations (RPO) at the end of Q3 2024 stood at $18.14 billion, which was a notable 15% increase from a year ago. While this was a major positive sign for the current sales momentum, the fourth quarter of each fiscal year is the most important one that sets up the tone for the rest of the year. With that in mind, the upcoming 3-month period will be of crucial importance for investors and expected share price returns.

prepared by the author, using data from quarterly earnings releases

Conclusion

After 2 and half years, I am finally seeing some light at the end of the tunnel for Adobe’s stock. Valuation has normalized in recent months and sustained business momentum could lead to satisfactory shareholder returns, at least in the short term. Although I am changing my rating on the stock, I remain cautiously optimistic. Long-term investors in the stocks should pay close attention to the level of stock-based compensation, remaining performance obligations, and gross margins during the upcoming earnings release as more solid evidence that business momentum will be sustained.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for similarly well-positioned high quality businesses in the technology space?

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.