Summary:

- We’re maintaining our buy rating on Adobe Inc.

- We think Adobe is better positioned to reaccelerate organic growth in its creative cloud engine and with its Firefly product.

- Additionally, we think the weaker global IT spending environment has been priced into the stock.

- The stock is up 58% since our buy rating in November, outperforming the S&P 500 by 48%.

- We expect Adobe to continue to outperform the peer group in 2H23 and 2024 as it leverages A.I. to improve its average revenue per user.

ersinkisacik/E+ via Getty Images

We remain buy-rated on Adobe Inc. (NASDAQ:ADBE). We think the company is in the early innings of monetizing the A.I. growth opportunity into an operational and financial tailwind. We see the stock outperforming the peer group and consensus expectations in 2H23 and 2024. We were previously constructive on Adobe’s Firefly generative models but were cautious about monetization, as we’ve seen software companies race to integrate A.I. into their product portfolios since Microsoft (MSFT) and OpenAI launched ChatGPT late last year without enough focus on monetization.

We now think Adobe is better positioned to leverage the gen A.I. growth as management does two things simultaneously: the first is to launch its Firefly gen A.I. models in its Creative Cloud, Adobe Express, and Adobe Experience Cloud and the second is to put a pricing plan, including its generative credits. We see greater clarity in Adobe’s A.I. monetization roadmap and expect Adobe to reaccelerate the creative cloud organic growth engine in spite of the uncertain macro environment.

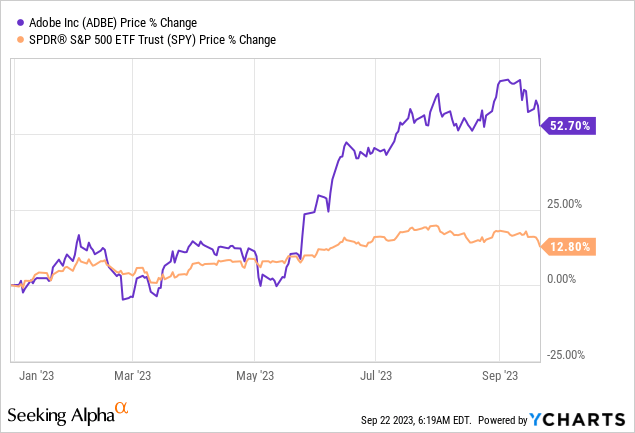

While we understand investor concern over the weaker global IT spending environment weighing on top-line growth in 2H23, we think the macro headwinds have been priced into the stock for the most part. The stock is up 58% since our buy rating in November, outperforming the S&P 500 (SP500) by 48%. Adobe is up 53% YTD, outperforming the S&P 500 by 40%, but outperformance has been moderating over the past month. Adobe is down 1% over the past month, relatively in line with the S&P 500. The stock is down 4% during the past day, alone. We now believe our concerns regarding the softer spending environment raised late last year have played out, and we see a clearer growth path for the stock into 2024.

The following outlines Adobe’s stock performance against the S&P 500.

YCharts

Early innings of A.I. monetization

We expect Adobe to continue to accelerate revenue growth both Y/Y and sequentially as it enters the early innings of monetizing A.I. to improve its revenue per user. This quarter, 3Q23, the company reported revenue of $4.89B, up 10.4%, marking a turning point for revenue growth as a percentage entering the double-digit range; we’re constructive Adobe edging Y/Y revenue growth higher from 9.8% last quarter and 9.4% in 1Q23. The digital media segment grew 14% this quarter, accounting for roughly 75% of total revenue, and includes Creative Cloud with 50% weight and Document Cloud. Creative Cloud is what most know Adobe for, encompassing Photoshop, Premiere, Illustrator, InDesign, After Effects, Fireworks, XD, and Dreamweaver, among others. We got a good read on the company’s growth runway and customer appetite after Adobe’s subscription annual revenue reached $464M, well above the guidance of $410M set last quarter. We expect spending on the platform to expand further after management announced integrating Firefly into products and adding the generative credits feature; we think the latter will be a game changer, putting Adobe ahead of the competition in the race to monetize A.I.

Adobe announced plans to charge for Firefly; the interesting (or rather creative) part is how. The company is going to use generative credits to measure user interaction with AI-related models; every time a user pushes the “generate” click to create a Firefly image, one credit is consumed. Under different subscription plans, users get a different amount of generative credits; for example, Creative Cloud All Apps gets 1,000 credits, Adobe Express Premium gets 250, Free users with Adobe ID get 25, and so on. The credit limits will be put into place starting in November; hence, we expect the company’s A.I. strategy to yield results in the mid-to-long term. Subscribers will have an allocated number of image generations depending on their plan and will have to pay about 5 cents per creation for more images without delay.

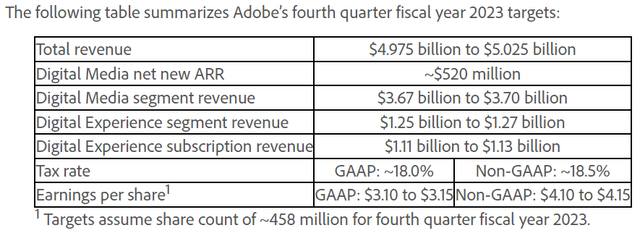

Guidance for Q4 2023

Management guides for $4.975-$5.025B for next quarter versus $5B with Digital Media net new ARR ~$520M. We see a strong economic moat for the company heading into 2024; management is guiding for Digital Media revenue of $3.67-$3.70B, up from $3.59B this quarter. We see the new Firefly product driving new user adoption and the opportunity to continue to grow the existing book of business.

The following table outlines Adobe Q4 2023 guidance.

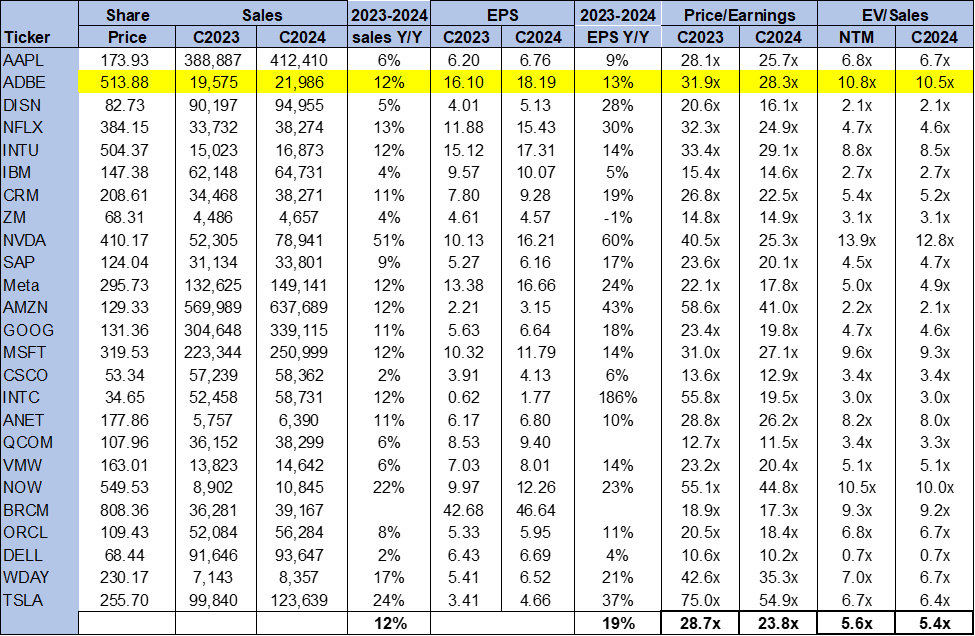

Valuation

Adobe is trading well above the peer group average, but we think the higher multiple is justified against the company’s growth rate. On a P/E basis, the stock is trading at 28.3x C2024 EPS $18.19 compared to the peer group average of 23.8x. The stock is trading at 10.5x EV/C2024 sales versus the peer group average of 5.4x. We understand investor hesitance about the higher valuation, but we continue to see valuations inflated in 2H23 due to A.I. growth exposure; considering Adobe as a growth stock, we see attractive entry points at current levels.

The following chart outlines Adobe’s valuation against the peer group average.

TSP

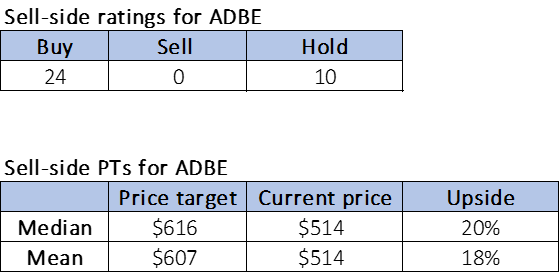

Word on Wall Street

Wall Street shares our bullish sentiment on the stock; it’s rare that we see eye-to-eye with the sell-side analysts. Of the 34 analysts covering the stock, 24 are buy-rated, and the remaining are hold-rated. The stock is currently priced at $514 per share. The median sell-side price target is $616, while the mean is $607, with a potential 18-20% upside.

The following charts outline Adobe’s sell-side ratings and price targets.

TSP

What to do with the stock

We remain buy-rated on Adobe. We’ve been less than optimistic about software/hardware and semi-stocks’ A.I. growth promises in the near term, as the broader industry has yet to figure out how to monetize the A.I. opportunity. Our bullish sentiment on Adobe is based on our belief that the company will be among the first to successfully turn A.I. into higher revenue growth per user, driving top-line growth. We continue to see softer global IT spend due to macro uncertainty, but we think Adobe is uniquely positioned to outperform due to the recent price increases coupled with the new A.I.-focused solutions.

We’re already seeing strong appetite from corporate customers this quarter, with Adobe winning deals with Amazon (AMZN), Take-Two Interactive (TTWO), and Paramount (PARA). We expect the cross-over of A.I. features and generative credits to serve as a tailwind for financial outperformance. Additionally, we think the weakness has been priced in. We recommend investors explore entry points into the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Appreciate your interest in our tech coverage. If you want first-hand access to our analysis of software/hardware and semiconductor spaces, best ideas within the current macro backdrop, and our coveted research process, we hope you’ll take a 2-week free trial of Tech Contrarians, our Investing Group service. The first wave of subscribers gets a significant lifetime discount on annual subscriptions after the 2-week free trial, so we hope to see you in our group soon.