Summary:

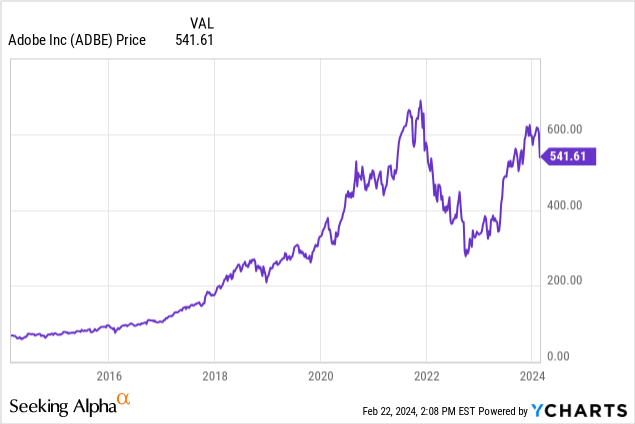

- Adobe Inc. stock has underperformed the broader market by around 20% since my last report.

- The planned acquisition of Figma has been abandoned, relieving investors of a potentially expensive deal.

- But investors might not be asking the right questions, namely, why did Adobe want to pay such a high valuation for Figma?

- Investors may be underestimating the long-term threats from generative AI and Figma.

Frazao Studio Latino/E+ via Getty Images

Adobe Inc. (NASDAQ:ADBE) was a big winner in 2023, as the company benefited from both a broader tech recovery as well as the rise of generative artificial intelligence, or AI. The company has sustained exceedingly resilient revenue growth and delivered typically impressive profit margins. With the company’s planned acquisition of Figma now off the table, many investors may be relieved to see a potentially expensive deal sidelined.

However, investors should instead be asking why ADBE wanted to acquire Figma in the first place, and why they were willing to pay nosebleed valuations to do it. Generative AI may have helped boost ADBE’s business in the near term, but I continue to see it representing the company’s greatest long-term threat, as it may accelerate the technological disruption from competitors like Figma. Despite the more attractive valuation, I reiterate my view that investors should avoid this stock.

ADBE Stock Price

Many investors might know ADBE as a long-term growth winner. Due to its strong profit margins and history of rewarding shareholders with share repurchases, I have seen it often viewed by traditional value investors as one of the few growth stocks that they could stomach.

I last covered ADBE in December, where I explained why the stock price was far too rich and was not offering an attractive risk-reward. After underperforming the broader markets by around 20% since then, that risk-reward proposition has indeed improved, with ADBE trading near the high end of my fair value range, but I continue to recommend caution given the aggressiveness of consensus estimates.

ADBE Stock Key Metrics

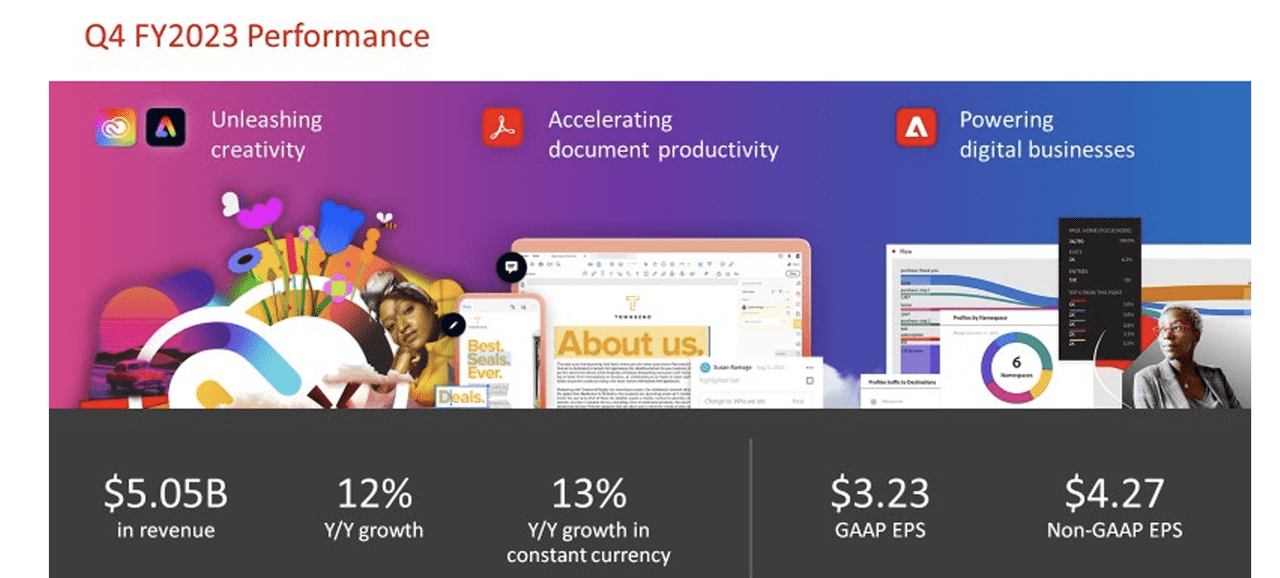

In its most recent quarter, ADBE generated 12% YoY revenue growth to $5.05 billion, surpassing guidance of between $4.975 billion and $5.025 billion. Non-GAAP EPS of $4.27 exceeded guidance of between $4.10 and $4.15.

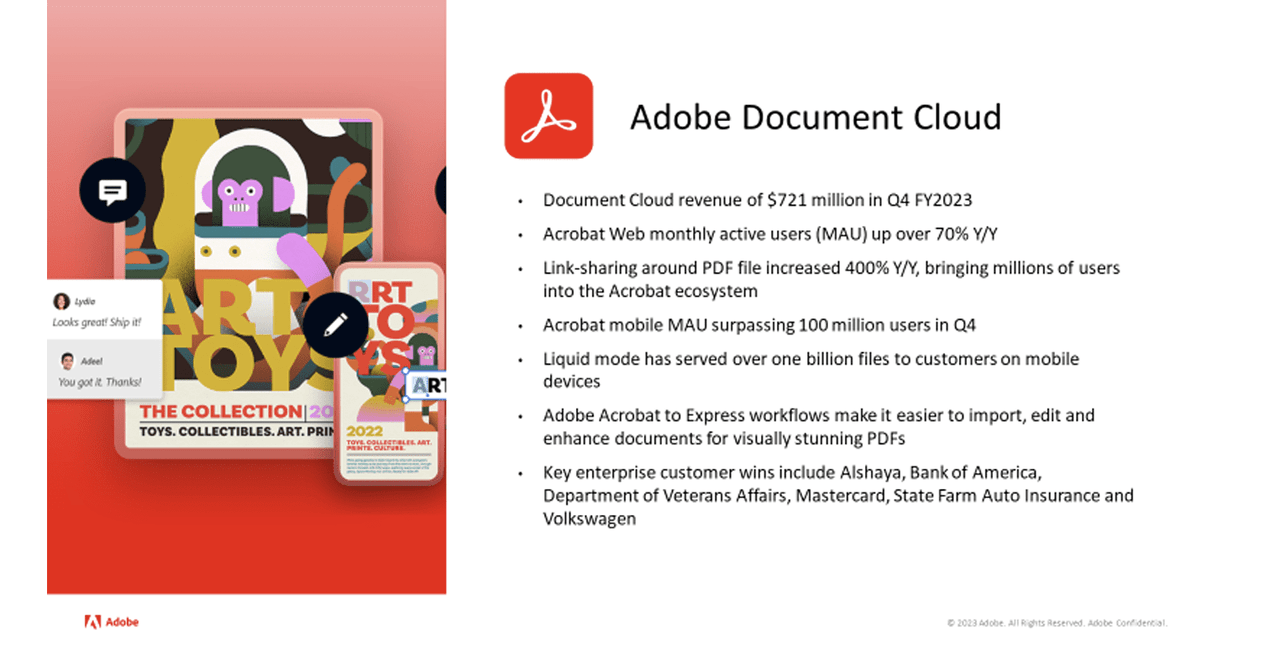

The company’s well-known Photoshop and Illustrator products continue to be cash-generation engines, while the company’s Document Cloud division showed the strongest segment growth with 17% YoY revenue growth.

Management noted that the company has exited 2023 with $17.22 billion in remaining performance obligations (“RPOs”), representing 13.4% YoY growth and nearly 10% QoQ growth. The company ended the quarter with $7.84 billion of cash versus $3.6 billion of debt, representing a strong net cash balance sheet.

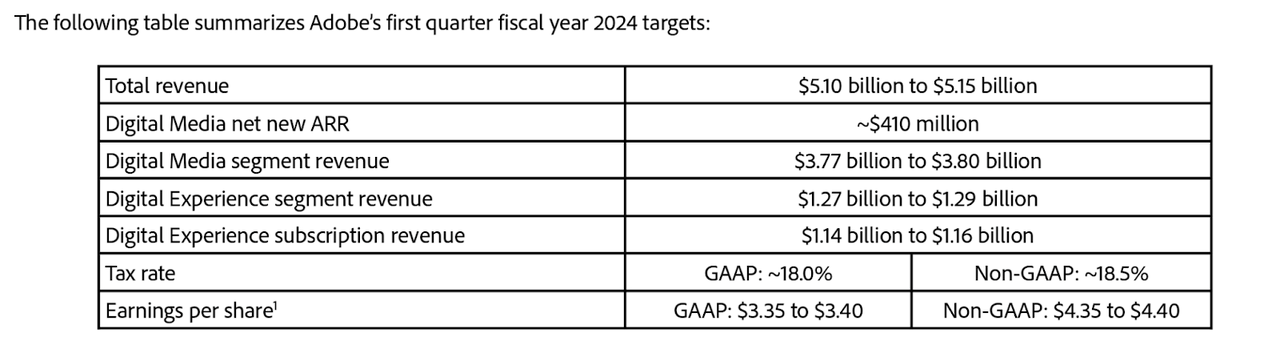

Looking ahead, management has guided for the first quarter to see 10.5% YoY revenue growth to $5.15 billion. Consensus estimates call for the company to generate $5.14 billion in revenue and $4.38 in non-GAAP EPS. Given the company’s history of outperforming guidance, I wouldn’t be surprised if the company comfortably beats on both fronts.

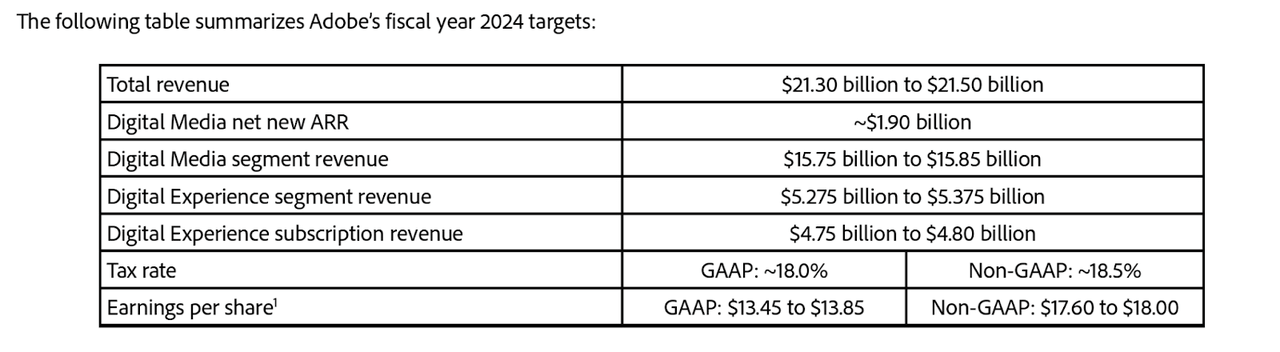

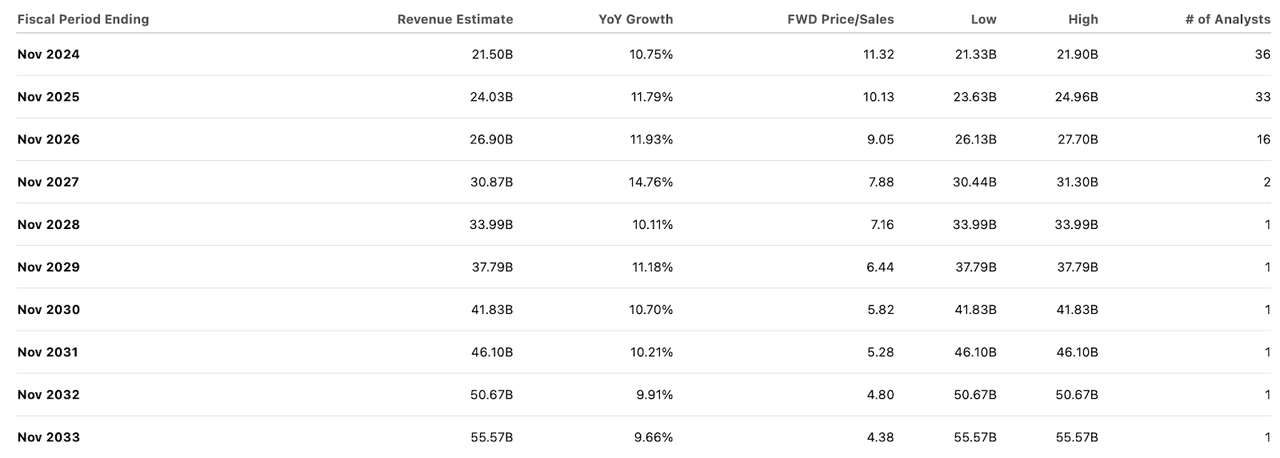

For the full year, management is guiding for up to 10.8% YoY revenue growth to $21.5 billion and 12% YoY non-GAAP earnings growth to $18.00 per share. Consensus estimates call for the company to generate $21.5 billion in revenue and $17.92 in non-GAAP EPS. Similarly, given that this is just the first quarter, I expect the company to surpass both full-year guidance and estimates.

On the conference call, management noted that their generative AI offering Firefly has led to “over 4.5 billion generations since launch in March.” However, with the macro environment appearing to improve across the board for enterprise tech companies, analysts appeared confused by the apparently conservative revenue growth guidance. One would think that between tailwinds from an improving economy, generative AI interest, and generative AI price increases, that their revenue forecast might be at least slightly higher. Management only stated that they “take our guidance at this point of the year very seriously.” It bears remembering that ADBE is, after all, a mature tech company with over $20 billion in annual revenue generation.

Is ADBE Stock A Buy, Sell, or Hold?

Since last quarter, ADBE and Figma, as mentioned, have agreed to terminate their merger due to regulatory obstacles. The deal would have implied a roughly 50x revenue multiple and investors initially appeared pessimistic. Thus, if the deal has fallen through, that’s good news, right? Not so fast.

Yes, ADBE will no longer pay such a high multiple for Figma. But investors should instead be asking why management was willing to pay 50x revenues in the first place. ADBE appears widely regarded across Wall Street as having dominant positioning across its product suites like Illustrator and Photoshop. But in reality, ADBE is arguably being disrupted by competitors like Figma. Figma has the top market share in collaborative UX design with Adobe XD being far behind. Historically, Figma offered a “good enough” product, but UX designers might have to make edits in Illustrator or Photoshop for more advanced requirements and import those files back into Figma for cross-collaboration.

But with the rise of generative AI, competing products like Figma may have been able to address that hole, and we are now seeing a realistic possibility that UX designers may be able to use a product like Figma in its entirety, without having to rely on outside editors much at all. Ray Wang of Constellation Research said in an interview with Tech Crunch that the failure of this deal means that ADBE needs to invest heavily in its collaborative software capabilities.

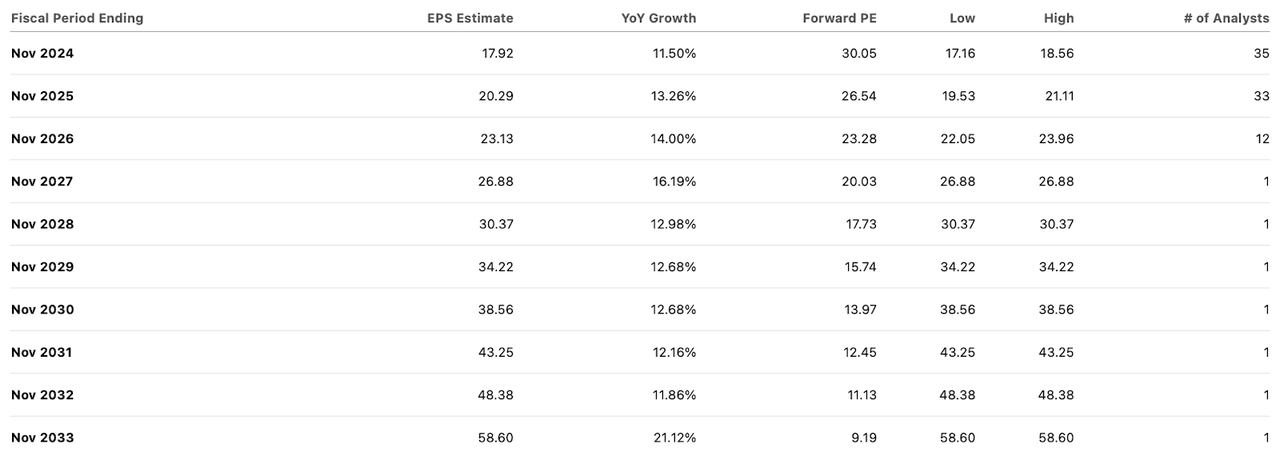

With that in mind, we can now address valuation. As of recent prices, ADBE was trading at around 30x this year’s earnings.

Consensus estimates call for the company to sustain double-digit revenue growth over the next decade.

Given that companies typically experience decelerating growth due to the law of large numbers, these revenue consensus estimates look awfully aggressive. Earnings estimates are not much better, with analysts expecting a 48% net margin by 2033.

Perhaps one believes that ADBE can sustain a 30x earnings multiple over the long term due to a quality thesis like Microsoft Corporation (MSFT) or Apple Inc. (AAPL). That would imply a stock price of $1,758 per share in 2033, or a compounded annual return potential of 13% over the next 9.5 years (or roughly 15% to 16% inclusive of the earnings yield).

However, given the long-term threats from competitors like Figma, ADBE might end up trading more around 20x earnings. We should remember that not all tech stocks trade at crazy multiples, there are also names like Oracle Corporation (ORCL) that trade at 20x earnings or less. That would imply a stock price of around $1,172 per share in 2033, or 8.5% annual return potential over the next 9.5 years (around 11% to 12% inclusive of the earnings yield).

Given the aggressiveness of the consensus estimates for Adobe Inc., I am of the view that these projected returns are insufficient and offer too low of a margin of safety. The company’s strong GAAP profitability and top-line growth rate help to offset some risks. Perhaps the best takeaway is that investors should be cautious in extrapolating ADBE’s strong 2023 financial performance, as generative AI may eventually become more of a foe than a friend.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!