Summary:

- Adobe’s stock rallied 15% after 2Q FY2024 earnings, but revenue outlook is below market consensus, showing weak growth rebound.

- Despite strong growth in RPO, company’s AI monetization plan has not significantly boosted top-line growth and billings, with guided 9.5% YoY revenue growth in 3Q FY2024.

- The company’s FCF growth has been disappointing, marked by a downward trend in FCF margins.

- Firefly can be customized by developers to create thousands of asset variations quickly, which could significantly accelerate AI monetization by boosting content creation efficiency.

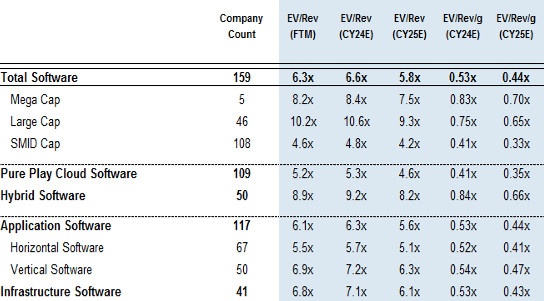

- The stock is trading at a premium valuation, with 1.04x of EV/Revenue/g FY2024E exceeding the averages across all software categories.

grinvalds/iStock via Getty Images

Investment Thesis

Adobe (NASDAQ:NASDAQ:ADBE)’s stock rallied more than 15% after its Q2 FY2024 earnings, driven by depressed market sentiment and better-than-expected earnings results. Despite an optimistic tone from the street regarding this quarter, my view is more muted for two reasons. First, the company’s revenue outlook is not only below market consensus but also does not indicate a strong growth rebound. Second, its top-line growth is expected to be 10.5% YoY in FY2024, which does not support its premium valuation as an AI-driven growth stock.

In my previous analysis, I initiated a buy rating and discussed ADBE’s primary focus on GenAI to boost its top-line growth and explore different monetization plans. Although the stock is up 10.5% since then, it has underperformed the S&P 500 index by almost 15%. Given the current growth trajectory, I think ADBE’s AI monetization might take longer than expected to feed into its growth outlook. Therefore, I downgraded the stock to hold from buy because I’m not impressed with the company’s revenue guidance.

2Q FY2024 Takeaway

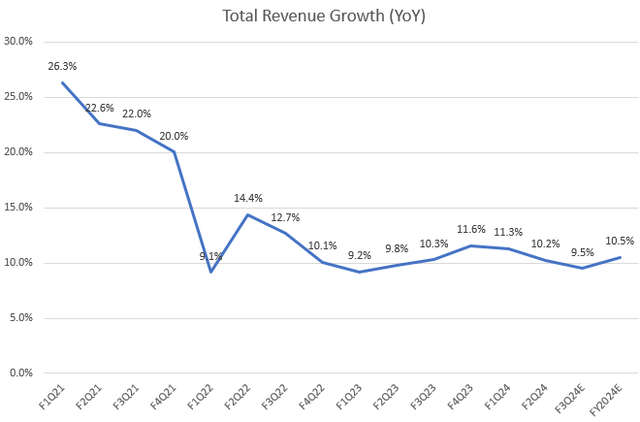

While ADBE topped both revenue and non-GAAP EPS in Q2 FY2024, the company provided conservative revenue guidance according to Seeking Alpha. Its Q3 FY2024 revenue guidance is below market consensus, and the FY2024 revenue outlook is in line with the consensus. As shown in the chart, the company’s top-line growth has significantly decelerated since FY2021 and remained flat year-over-year despite recent AI initiatives. This indicates that the company has not achieved a growth inflection in revenue yet. Specifically, the guided 9.5% YoY growth for Q3 FY2024 shows a slight deceleration from 9.8% YoY in Q3 FY2023. Meanwhile, the company is expected to grow 10.5% YoY in FY2024, nearly in line with 10.2% in FY2023. Therefore, I believe that the company’s AI monetization plan will not likely reaccelerate its top-line growth in the near term.

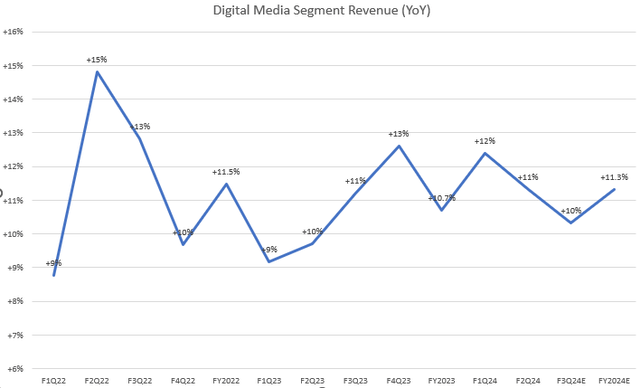

Let’s delve deeper into its revenue segments. The digital media revenue segment comprised 74% of total revenue in the last quarter. We can see that the company has forecasted a 10% YoY growth in the current quarter, which is lower than the 11% YoY growth seen in Q3 FY2023. Therefore, this segment has not yet established an upside growth momentum either, given that the guided 11.3% YoY growth for FY2024 still falls below the 11.5% YoY growth achieved in FY2022. Nevertheless, it’s still encouraging to see that the non-GAAP EPS outlook for Q3 FY2024 and FY2024 beats market consensus.

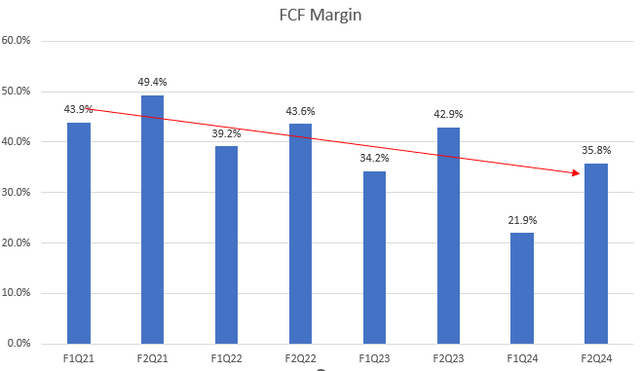

Regarding its FCF generation, ADBE has experienced negative year-over-year growth in FCF over the past three quarters. To remove seasonality, I have focused on 1Q and 2Q data for analysis in the chart. We can see that FCF margins in these quarters have also declined over the past three years. This trend might indicate weak year-over-year growth in billings, which represents the amount of cash inflow that ADBE actually receives from customers. However, I can already see early signs of success in its AI-driven growth narrative.

Firefly, A Growth Engine in GenAI Portfolio

As discussed in my previous article, one of Firefly’s standout features is its ability to efficiently generate copyright-free images for direct use in ongoing projects. By March 2023, Firefly had produced over 70 million images within its first month alone. During the 2Q FY2024 earnings call, management reported that Firefly had been utilized to generate over 9 billion images across Adobe’s creative tools in 15 months, marking a nearly 40% growth since 1Q FY2024. Furthermore, management indicated that more customers are upgrading to higher-tier plans driven by enhanced Firefly capabilities. They also announced that Firefly can be customizable by developers, enabling the creation of thousands of asset variations in minutes rather than months. This capability can accelerate AI monetization through increased content creation. However, with the growing demand for AI-powered tools, the critical question remains when these AI-driven demand will translate into the company’s top-line growth.

Demand Is Picking Up, But Timing on Revenue?

The company model

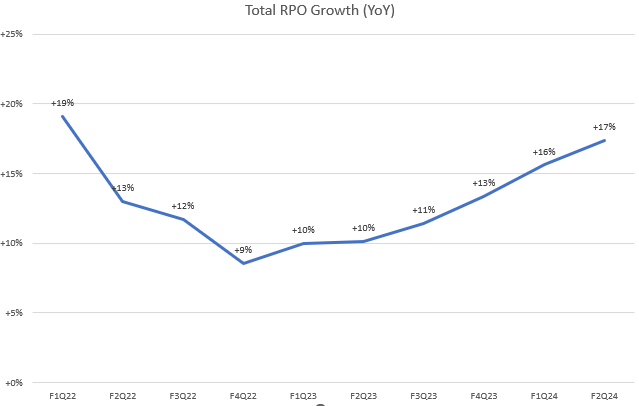

I believe ADBE is still on track for growth acceleration, as we are seeing early signs of a demand rebound under its AI growth initiatives. Looking at the chart, the company’s total Remaining Performance Obligations (RPO) have consistently accelerated over the past 5 quarters since 2Q FY2023. However, I’m waiting to see a robust backlog growth translate into sequential revenue growth, which I do not currently observe.

Some new readers may not understand the relationship between RPO and revenue. Essentially, RPO refers to the backlog of contracts that a company will fulfill in the future. These obligations can be converted into future billings, ultimately contributing to revenue generation. In other words, RPO is future revenue. When a customer signs a contract, the company records “bookings,” which equals the change in RPO balance plus revenue. However, the timing of revenue derived from total RPO remains uncertain. It’s possible that the company’s growth rebound story may not materialize in the near term.

Valuation

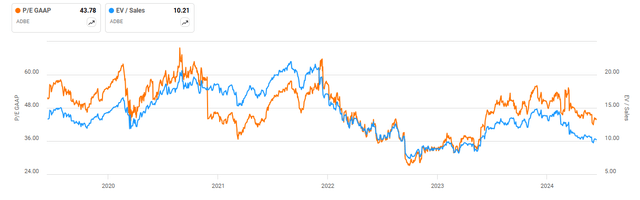

From a 5-year horizon, ADBE’s valuation multiples (GAAP) have been trading at premium levels, even though the numbers have come down from recent highs. When considering non-GAAP forward-looking basis, the stock is currently trading at 29x non-GAAP EPS FY2024E if we consider the midpoint of the EPS guidance from the last quarter. This number is slightly higher than the 28x non-GAAP EPS FY2023E reported in my previous coverage in June 2023.

JP Morgan

As mentioned earlier, ADBE is expected to achieve a 10.5% YoY revenue growth based on the guidance. We can see that its EV/Sales FY2024E currently sits at 10.9x. This implies an EV/Revenue growth ratio (EV/Rev/g) for FY2024 of 1.04x, which is higher than any category in the table above. Based on this valuation metrics, it appears that ADBE’s near-term growth outlook cannot fully justify its current valuation. However, considering the current strong demand trajectory based on its backlogs, I recommend that investors remain on the sidelines and watch for any signs of a rebound in revenue growth in the upcoming quarters.

Conclusion

In summary, ADBE has made significant progress with its AI plans. While the company has exceeded revenue and earnings expectations in the last quarter and shown strong backlog growth largely driven by robust demand for its AI-driven products, revenue growth has not yet started to pick up. The company’s FY2024 guidance suggests a flat growth trajectory compared to previous years, raising concerns about achieving a robust rebound in the near term. Valuation metrics such as EV/Sales and EV/Rev/g ratios indicate the stock is trading at a premium, potentially reflecting optimistic long-term growth expectations. However, given the uncertainties, I am downgrading the stock to hold to reflect these concerns. I would reconsider a more bullish view if the company successfully converts strong AI demand into actual revenue growth rebound in H2 FY2024.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.