Summary:

- Adobe is scheduled to report its first quarter earnings for 2024 later this week.

- The company is in a very good position to exceed analysts’ expectations, and this should provide a short-term tailwind for the share price.

- I will put more emphasis on the company’s gross margins and its ability to retain its pricing power going forward.

- A reinstatement of the dividend will be a major positive sign that management will be able to sustainably increase cash flow.

SeanShot

Adobe’s (NASDAQ:ADBE) upcoming earnings are in the spotlight this week as the company is gearing to be among the big beneficiaries of the generative AI trend.

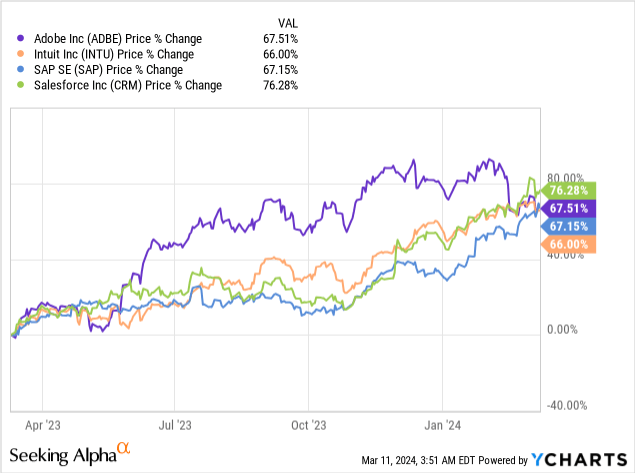

The company’s has just hit the $5bn mark on quarterly revenue during the last reported three-month period, and the expectations are high that it will continue to deliver on that momentum. On the share price front, ADBE returned nearly 70% over the past year, although this is largely in line with its indirect peers in the Application Software industry.

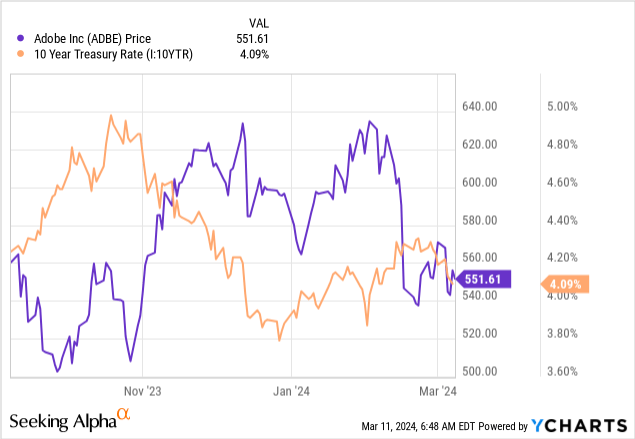

Returns in the whole sector benefited massively from the activity by the U.S. Treasury and the sharp drop in bond yields since Nov. 1. That’s why even though ADBE reported very strong quarterly results in mid-December of last year, the big jump in the share price to recent highs occurred following the Treasury Quarterly Refunding Announcement in November.

This sensitivity of ADBE’s share price to overall liquidity within the market should not be ignored even as we evaluate the upcoming quarterly results.

Having said that, I believe that the company is in a good position to defy even the currently optimistic expectations during the first quarter of its current fiscal year. It’s also a very important quarter for investors to evaluate the true potential of Adobe’s AI-driven strategy and its ability to influence pricing power.

Pricing Power Challenges

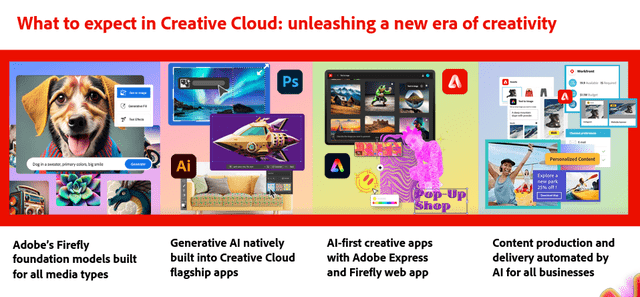

Over the past decade, Adobe has enjoyed an unmatched pricing power of its services, while also benefiting from significant economies of scale as it grew and expanded its ecosystem. But the advent of generative AI is likely to be a double-edged sword for the company, offering an opportunity to further differentiate its services while also bringing new competitors in the creative cloud space.

Thus, it’s very important to keep track on the company’s pricing power at it introduces the whole slate of AI-driven services. During the upcoming quarter, investors are likely to prioritize the total revenue growth figure as trial of these new services is bringing in lots of new paid subscribers.

While we started rolling out new Creative Cloud pricing in select geographies in November, the primary driver of growth continues to be new paid subscriptions across our routes-to-market.

Source: Adobe Q4 2023 Earnings Transcript

But as noted above, Adobe has recently started rolling price increases within its Creative Cloud and the first quarter of FY 2024 will be a big test for the company’s pricing power in this area. In my view, Adobe’s current leading position in this field would allow for meaningful price increases, without sacrificing subscription growth which will well-received by the market in the short term.

Adobe Investor Presentation

As we have seen recently with OpenAI’s Sora, however, competition in text to video models is brewing and the whole creative space is likely to be disrupted in the coming years.

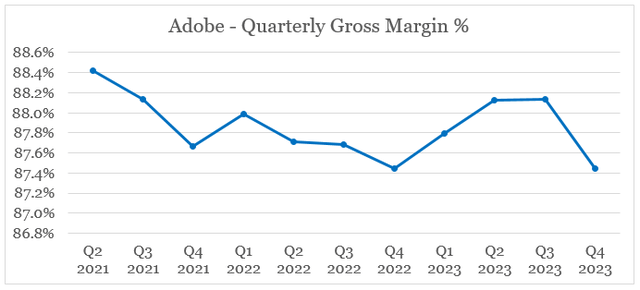

In the more immediate future, however, we should keep an eye on Adobe’s industry-leading gross margin figure as the closest proxy of its pricing power in the field. During the last reported quarter, gross margin has fallen sharply to one of its lowest levels in recent years and that’s something that I would expect to change as confirmation that the AI-driven strategy is working as expected.

prepared by the author, using data from Seeking Alpha

Beating On Revenue

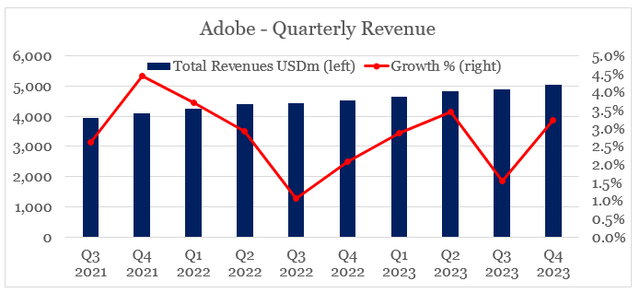

Adobe’s total revenue growth has been fairly consistent over the last 10 quarters, with an average rate of roughly 3% (see below).

prepared by the author, using data from Seeking Alpha

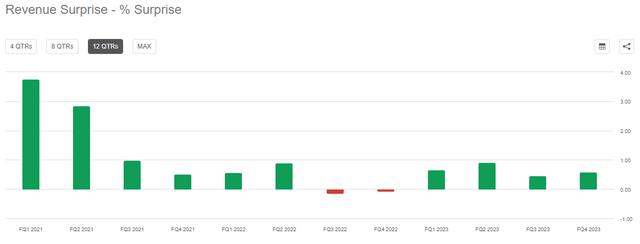

Thus, after the initial spike in demand following the pandemic, the quarterly reported figures have become more consistent with the expectations of the sell-side analysts, resulting in very low revenue surprise.

Seeking Alpha

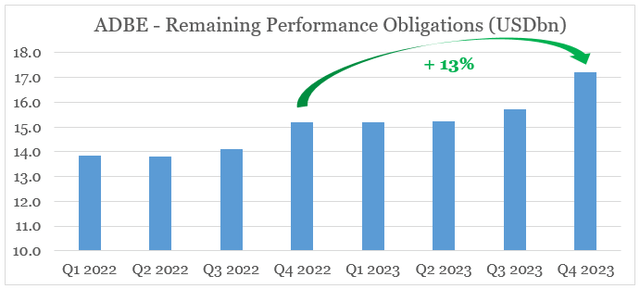

This is one of the reasons why Adobe’s share price has been trailing those of its indirect peers and has been largely influenced by broader market movements as opposed to business developments. During the last quarter, however, ADBE reported a very strong increase in its remaining performance obligations, which is a strong indicator of sustained strength in the company’s subscription revenue.

Adding approximately $1.5 billion RPO in the quarter, our highest sequential quarterly increase ever (…)

Source: Adobe Q4 2023 Earnings Transcript

The total remaining performance obligations (RPO) at the end of Q4 2023 stood at $17.22 billion, which was a notable 13% increase from a year ago.

prepared by the author, using data from quarterly earnings releases

This was accompanied by a record amount of new commercial subscribers in the Creative Cloud and a quarter of lapping price increases from a year ago.

(…) we delivered a record Creative Cloud new commercial subscriptions number in the year. (…)

You need to consider that FY ’22 had two pricing actions, that accrued to Creative Cloud that are much lower now in Q4 FY ’23. So, if you normalize for the impact of the pricing that rolled off and the pricing that came on, Creative Cloud net new ARR in Q4 grew on a constant currency basis.

Source: Adobe Q4 2023 Earnings Transcript

All that in combination with the buzz around AI-generated content puts Adobe in a very good position to surprise and exceed analysts’ estimates on the topline figure.

Cash Flow and Capital Allocation Considerations

The third area of focus is Adobe’s capital allocation, or more specifically any changes that will mark a departure from the company’s recent policy.

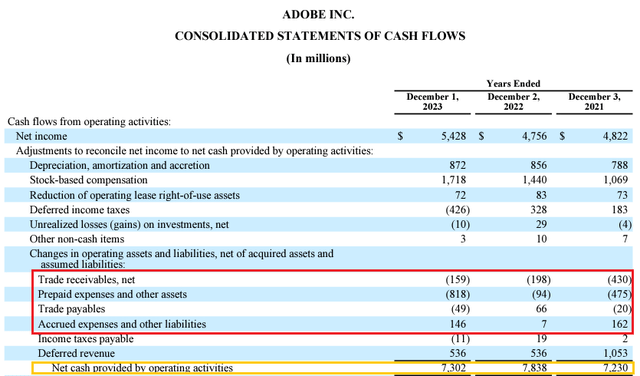

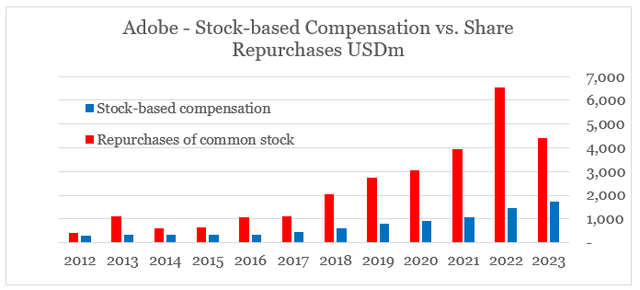

As a starting point, ADBE’s stock-based compensation has been steadily increasing in recent years, while the company’s cash flow from operations remained flat on the back of the company’s increased working capital requirements and slow progress on net income.

Adobe 10-K SEC Filing

As a matter of fact, the ratio of stock-based compensation expense to the company’s cash flow from operations has reached 24% in FY 2023 which, although is still lower than those of Salesforce (CRM) and Intuit (INTU) is reaching unsustainable levels.

At the same time, the amount of share repurchases has been significantly reduced from $6.6bn in FY 2022 to $4.4bn during the past 12 months.

prepared by the author, using data from SEC Filings

Provided there are no large acquisitions planed for FY 2024, I would expect Adobe’s management to either increase its share buyback program, which has roughly $2bn left from the $15bn authorization granted in December of 2020, or to reinstate a dividend payment.

The latter should be very well-received by shareholders and will follow on the recent steps of Salesforce, which announced its first-ever dividend last quarter.

Now I’m thrilled that we’re opening the door to another incredible part of our ongoing transformation today with the introduction of our first ever dividend.

Source: Salesforce Q4 2023 Earnings Transcript

A dividend yield of around 0.5% will be comparable to those of Salesforce and Intuit and would result in roughly $1.25bn annual outflow – a manageable amount given the current free cash flow of nearly $7bn and exceptionally high-interest coverage of Adobe.

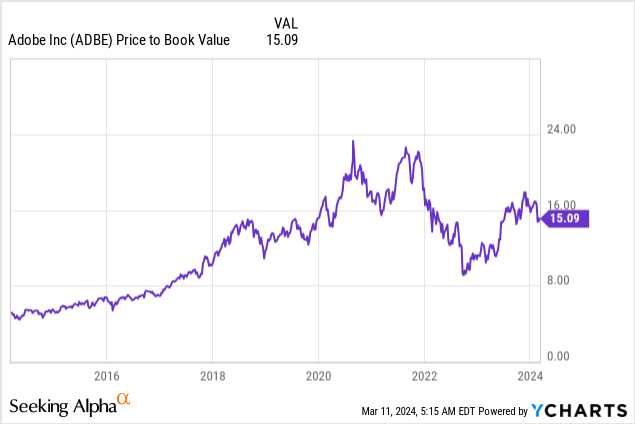

It also would send a strong message to shareholders that Adobe’s management believes it will be able to consistently grow its free cash flow. Last but not least, it will be preferred by shareholders as ADBE stock still trades at elevated multiples within the long-term context, which makes share buybacks less effective way to return capital to shareholders.

Conclusion

As we await Adobe’s first quarter results for FY 2024, the odds are increasingly stacked in the company’s favor. Strong revenue growth momentum in combination with improving margins could easily send the stock back to $600 levels. Although I do expect short-term tailwinds for ADBE’s share price, I retain the stock as a “Hold” as long-term potential remains limited at current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

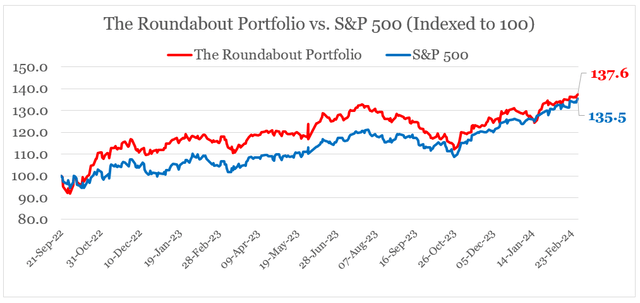

Looking for better positioned high quality businesses in the technology space?

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.