Summary:

- Adobe reported a strong start to FY24 paired with a modest forecast that drove the share price down -14%.

- The company’s topline growth is expected to moderate despite the firm rolling out GenAI features across their product suite, resulting in single-digit growth in the coming years.

- Adobe’s GenAI features may not have the same growth potential as other AI platforms.

Justin Sullivan

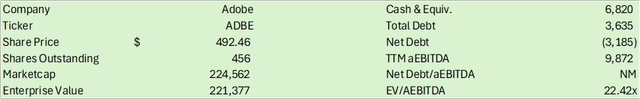

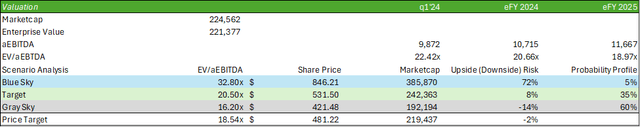

Adobe (NASDAQ:ADBE) made quite the splash with their q1’24 earnings results followed by an intense selloff by the market. With a -14% pullback in the share price, I do not anticipate the selling to be over as the firm’s topline growth moderates. Though I expect margins to strengthen as more customers turn to their subscription-based model, I do anticipate single-digit topline growth to persist over the coming years as I do not believe the firm will experience the same upswing in growth as a result of the AI wave. I provide ADBE shares a SELL recommendation with a near-term price target of $481.22/share priced at 18.54x eFY25 EV/aEBITDA and a long-term target of $421.48/share at 16.20x eFY25 eV/aEBITDA.

Operations

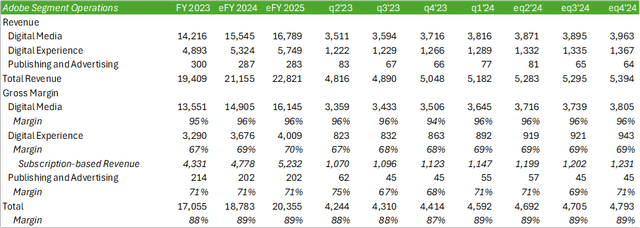

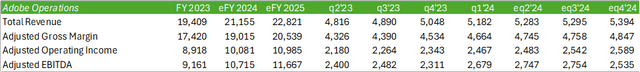

Adobe (ADBE) posted a strong q1’24 earnings result with revenue climbing 12%, GAAP-EPS up 18%, and RPO growth up 16% y/y. The firm broadly grew their ARR with net new Digital Media ARR up 13% and Document Cloud ARR up 23%. Given the company’s operating strength in the quarter, analysts and investors remain skeptical on eq2’24 guidance coming in below expectations, which resulted in a -14% dive in the share price. Despite the skepticism in analyst questioning during the q1’24 earnings call, management remained optimistic about the trajectory and the ability for the firm to cross-sell enterprise platform features as Adobe integrates GenAI into their products.

One point that came up was whether video and photo generation using GenAI would result in the replacement of Adobe Premiere Pro, which I believe is a viable question as AI-generated photos and videos become more sophisticated and lifelike. Management doesn’t appear concerned with Premiere being replaced by these AI features, but rather, used in tandem to create a vast amount of iterations before touching up using their editing platform. Though there may be some cannibalistic effects as GenAI becomes more sophisticated, I do believe that the features will not be a complete replacement of Adobe’s photo and video editing tools and will likely be used in tandem to generate ideas and edit how the user sees fit.

In terms of value add with Adobe GenAI, I believe that the firm will see certain upside across the creative industries; however, I do believe other firms will better cater to operational optimization as Adobe’s features may be more limiting in the broader reach of data aggregation. Though I do not believe this is necessarily a negative aspect, I do believe that Adobe’s share valuation might be impacted by this limiting factor and may not experience the same growth as other companies that are developing GenAI and CoPilot features on their platforms. For example, CrowdStrike (CRWD) brought forth a CoPilot feature that allows security ops engineers to more easily analyze anomalies and detect cyber risks faster. Palantir (PLTR) is leveraging GenAI to help customers optimize their operations by aggregating vast swarths of data for AI/ML models. Snowflake (SNOW) is developing the cloud-based data lake for a broader aggregation of data for data analysts to sparse through and develop their models. I believe that Adobe’s features will be significantly more specialized to the creative industries which arguably have a significant amount of competition from OpenAI & Microsoft (MSFT) CoPilot, Google (GOOG) (GOOGL) AI Studio, and other designer GenAI tools. One of the selling points that management mentioned in their q1’24 earnings call was that AI Assistant is governed by secure data protocols, which I believe can be a major selling point for an industry that caters to one that’s centric on creative intellectual property. This can be hugely beneficial, especially when tying in their music and artistic design capabilities.

Corporate Reports

Looking to operational performance, I do anticipate Adobe to bring stronger margins in the coming quarters as more customers continue to turn to subscription-based consumption. In terms of sales growth, I do believe the firm will be moving to single-digit growth in aggregate throughout the next two years. Outside of enterprise customers, I do anticipate softening from retail customers as creative GenAI platforms become more sophisticated. This may pose some challenge to generating higher growth going forward; however, I do anticipate enterprise customers to more than offset this risk.

Corporate Reports

Management is targeting between $5.25-5.30b in revenue for eq2’24, which I believe is a relatively modest growth trajectory of ~10% y/y.

Valuation & Shareholder Value

Corporate Reports

Adobe announced a massive $25b share repurchase program in q1’24 as the firm retires the remainder of the previous program. I believe that this benefit may be a signal from management to entice shareholders as the firm faces some growth headwinds. Rather than issuing a dividend, the repurchase program offers the firm the flexibility to allocate excess cash flows how they see fit, which in turn allows the firm to make appropriate investments without the risk of balancing between returns and investments.

Valuing ADBE, I believe investors will be weighing the downside risk over any upside seen from subscription-based growth and ARR improvements. I believe that slower revenue growth will weigh in on share valuation and that ADBE may not experience the same AI-related growth other firms are experiencing. For these reasons, I weigh the gray-sky scenario more heavily in my valuation analysis in the chart below. Though I do not anticipate any operational challenges for Adobe other than slower growth, I do believe that investors will have a keen eye on the firm’s growth trajectory as Adobe adds their GenAI features across their product suites. I provide ADBE shares a SELL recommendation with a near-term price target of $481.22/share and a long-term price target of $421.45/share based on 18.54x & 16.20x, respective, at eFY25 EV/aEBITDA.

Corporate Reports

Looking at ADBE from a tactical perspective, shares may retrace up to ~$501-520/share before continuing down to my target price of $481.22/share. This may be an opportune time for an investor that has a position to reduce their holdings or exit the position completely. Given how far shares have been sold off, the rebound may not be robust enough to retrace to the 0.618 before the continuation of the path down. I recommend caution if undergoing this trading route given how deeply shares were sold off post-earnings. Though I do not anticipate the move to my price target to be overnight, volatility in the market may drive a stronger sell-off than I anticipate.

TradingView

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.