Summary:

- Adobe’s outlook led to a 9% sell-off, with bulls seeing value and bears questioning growth, making it a battleground stock.

- Adobe’s AI enhancements improve productivity, but rising competition in AI-driven tools threatens its dominance and growth prospects.

- Despite guiding for 11% y/y revenue growth, Adobe’s growth is slowing, and its valuation at 25x next year’s EPS isn’t enticing.

- Adobe’s stock buybacks raise questions about capital allocation, with limited upside due to a fully optimized cost structure and modest revenue growth.

bennymarty

Investment Thesis

Adobe (NASDAQ:ADBE) delivered a mediocre outlook with its fiscal Q3 2024 results, which led to a 9% sell-off.

Even though its outlook wasn’t too far off analysts’ own expectations, this has been a battleground stock for a long time.

Bulls call Adobe a value stock, while bears question whether this business is flying high on narrative and low on growth rates.

For my part, I’m very much on the fence with Adobe, and believe that there are amply better opportunities elsewhere.

Rapid Recap

Back in June, I wrote a piece titled, Picture Perfect Priced in, where I stated,

I make the case that paying 26x next year’s non-GAAP EPS leaves me with no room for error. Accordingly, I know I can find better stocks elsewhere, so I will stick to neutral here.

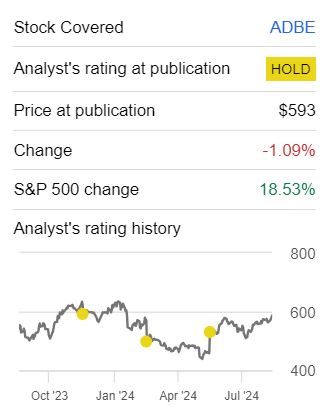

Author’s work on ADBE

As you can see above, I’ve been cautious about Adobe for a long time. And today’s results vindicate my trepidation in recommending this stock. Here’s why.

Adobe’s Near-Term Prospects

Adobe provides creative, digital, and document solutions through its three main product segments: Creative Cloud, Document Cloud, and Experience Cloud.

Creative Cloud offers tools for content creation like Photoshop, empowering users to produce visually compelling designs, videos, and graphics.

Document Cloud focuses on document management, including editing, sharing, and signing PDFs through Acrobat. Experience Cloud helps businesses manage customer experiences with data-driven marketing tools.

Adobe’s strength lies in integrating these platforms, allowing seamless collaboration, content creation, and workflow management for both individual users and enterprises.

In the near term, Adobe’s recent AI enhancements in products like Photoshop, Acrobat, and Premiere Pro are improving user productivity and boosting customer retention.

Adobe has also seen significant adoption of its Firefly AI models, which power creative features across its platforms. With continued integration of AI across its product suite, Adobe is well-positioned to further monetize AI-driven features, which could fuel future growth.

Now, the main contention for investors, is AI technology a benefit or a headwind for Adobe?

The rapid development of AI has lowered barriers to entry in the creative space, allowing competitors to develop similar tools quickly and sometimes cheaply.

As AI simplifies content creation, many smaller, more agile companies can offer competitive alternatives at lower prices. The growing competition in AI-driven creativity tools threatens to erode Adobe’s dominance, as customers seek cheaper alternatives without needing the comprehensive features Adobe provides.

Given this balanced background, let’s now delve into its fundamentals.

Revenue Growth Rates Moderate

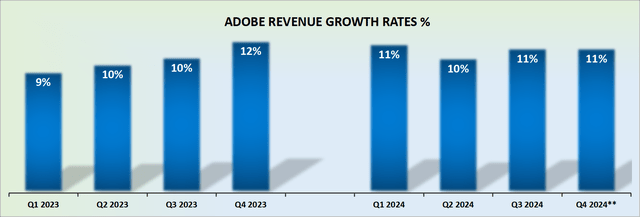

ADBE revenue growth rates — author’s work

Adobe’s recent guidance didn’t impress investors, despite guiding for 11% y/y revenue growth rates.

This wasn’t a big surprise, as the previous year’s fiscal Q4 set a high bar. However, the Street had become overly optimistic, expecting Adobe to keep accelerating its growth into Q4 2024.

Now, even if we assume that Adobe beats the high end of their own guidance, it is still unlikely to deliver more than 11% topline growth.

As a result, despite all the talk about being well-positioned for AI and adapting to the modern world, this 40-year-old company is struggling to live up to the saying, ‘adapt or die.’

With growth slowing down, investors are now looking beyond revenue to decide whether Adobe’s stock is undervalued or already priced fairly.

ADBE Stock Valuation — 25x Next Year’s Non-GAAP EPS

Adobe’s balance sheet carries a net cash position of approximately $1.4 billion. This is certainly enough, given that Adobe makes nearly $2 billion of free cash flow every 90 days and growing higher each quarter.

But at the same time, I know of plenty of companies that are priced below $20 billion market caps, that carry the same amount of net cash on their balance sheet. This is not a lot of cash, particularly given that Adobe has been so actively repurchasing its shares this quarter.

And this brings up the next big question. Is this management a good capital allocator? Because from what I see, management has spent all the free cash flow it produced in the quarter buying back stock, rather than investing in its future opportunities.

That is a short-term tactic that will work for a short while, but at some point, this tech business has to figure out some new growth avenues.

Presently, Adobe is on a path to deliver approximately $18.40 per share this fiscal year. Next, let’s assume that Adobe’s buybacks support its EPS growing by 15% y/y into fiscal 2025 (starting in December of this year).

This would see Adobe’s non-GAAP EPS reaching approximately $21.20 per share next fiscal year. Is this stock a bargain at 25x next year’s non-GAAP EPS?

What’s more, keep in mind that for my estimate of $21.20 in next year’s non-GAAP EPS, I have already baked in a very rosy outlook for Adobe.

Simply put, I don’t believe its valuation is that enticing. At this valuation, there are plenty of options outside of large-cap tech. At 25x forward EPS, I would minimally expect to see a path towards 15% topline growth, with opportunities for further cost-optimization. Not a business that has long ago fully optimized its cost structure and is now delivering low double-digit growth rates.

The Bottom Line

Paying 25x next year’s non-GAAP EPS for Adobe isn’t a compelling thesis because the company is delivering only modest revenue growth and has already fully optimized its cost structure, leaving little room for significant upside.

While Adobe’s AI-driven tools are promising, competition is rising quickly, and its growth is not strong enough to justify this premium valuation.

With numerous other opportunities in the market offering better growth potential, Adobe’s stock feels more like a creativity bottleneck than a clear path to innovation. In short, Adobe might need to “illustrate” a better story for investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.