Summary:

- Adobe reported a solid Q2 report this past June, including a significant guidance increase amid high demand for AI-related services.

- Shares rose big the following session, but I see the stock near fair value ahead of its Q3 report in September.

- Adobe faces risks from AI investment slowdown and global competition, but analysts expect continued growth.

- Along with an assessment of the options market, I highlight key price levels to monitor on the chart.

Santiaga

Some market strategists assert that the time has come for AI hype to turn into real profits from beyond just the picks and shovels companies. While semiconductor makers have undoubtedly thrived, the next stage of the cycle should come from other infrastructure plays and AI beneficiaries downstream.

And it’s not just sellside research pundits voicing that opinion. We can see it in price action, too. Shares of the S&P 500 Equal Weight Index have outperformed the traditional cap-weighted index since early July, with the RSP ETF notching new all-time highs this week. But one firm has, at least for now, stood out, evidenced by a solid Q2 report in June and a bullish guidance raise.

Still, I reiterate a hold rating on Adobe (NASDAQ:ADBE). I continue to like the valuation, but I also remain cautious about the technicals, resulting in the hold call. Shares are up 17% from my springtime analysis, largely due to the big jump after its most recent quarterly report, outperforming the S&P 500.

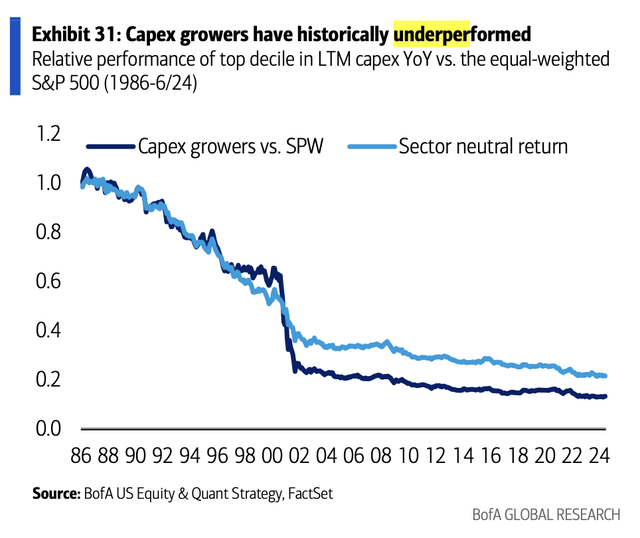

Adobe must be careful, however, not to invest too heavily into the AI theme. BofA points out that capex growers have historically underperformed the S&P 500 Equal Weight Index. The point is, that while themes can have powerful momentum, they often act as a siren song, leading to malinvestment from management teams in affected industries. It’s a key risk to watch as EPS estimates for AI-related companies have retreated.

Risk: Capex Growers Tend to Underperform

Back in June, Adobe reported a very strong set of quarterly results. Q2 non-GAAP EPS of $4.48 topped the Wall Street consensus estimate of $4.39 while revenue of $5.3 billion, up 10% from the same period a year earlier, was a modest $20 million beat. The top-line increase was 11% on a constant-currency basis. The firm registered a healthy $1.94 billion cash flow from operations and the company bought back 4.6 million shares during the quarter.

What really drove shares higher post-earnings was the guide in the out year. For the near term, Adobe’s management team now sees total revenue of $5.33 to $5.38 billion in the quarter just ending versus the consensus of $5.4 billion. Its FY 2024 outlook was also not far from what analysts had been expecting. For FY 2025, the company increased sales guidance just slightly by $50 million, but its operating EPS forecast was hiked by nearly two percentage points of growth to 12.6%.

With solid and consistent revenue growth, robust margins, and apparent earnings momentum now more evident, there are some fundamental tailwinds. Its Digital Media and Digital Experience segments posted double-digit operating income figures despite a slowdown in hiring (though that likely helped its margins). What’s more, Adobe may have second-half momentum care of growth in its Creative Cloud Net New Annual Recurring Revenue amid new product catalysts and AI enhancements.

Shares surged by 14.5% in the session that followed – the biggest post-earnings gain in at least three years, according to data from Option Research & Technology Services (ORATS). As for the upcoming profit report, the options market prices in a 6.5% earnings-related stock price swing when analyzing the at-the-money straddle expiring soonest after the September 12 report, slightly above the long-term average of a 6.1% change. The company has topped bottom-line estimates in each quarter going back to at least August 2019. Seeking Alpha data shows a consensus EPS estimate of $4.54 on revenue of $5.37 billion.

Key risks include a slowdown in AI investment and weaker-than-expected gains from AI efficiency. Increasing global competition could hurt its currently high profitability metrics while higher labor costs across segments could lead to larger expenses. Also, Adobe faces potential challenges from a recent FTC lawsuit, so that could pose reputational risks.

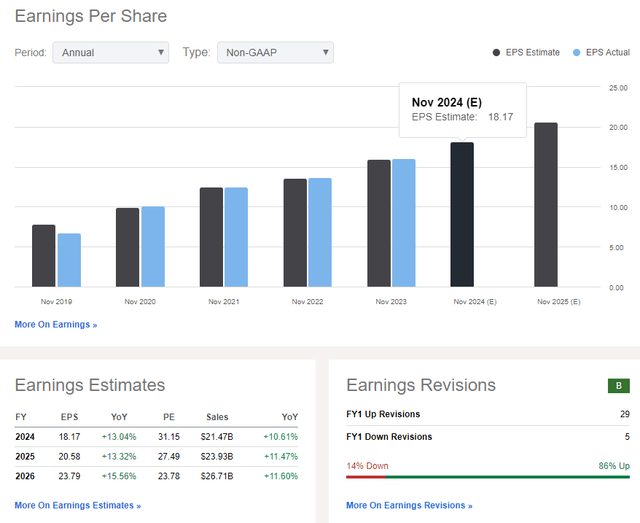

On the earnings outlook following the very encouraging quarter, analysts expect more than $18 of operating EPS in the current year, rising 13% from 2023. A comparable bottom-line growth pace is seen in the out year with even higher non-GAAP EPS advancement by 2026. It’s a more sanguine outlook compared with my previous analysis. Additionally, Adobe has posted $14.05 of free cash flow per share in the last 12 months, resulting in a FCF yield of 2.5% – not overly high, but FCF is expected to rise going forward.

Adobe: Earnings Estimates & Revision Trends

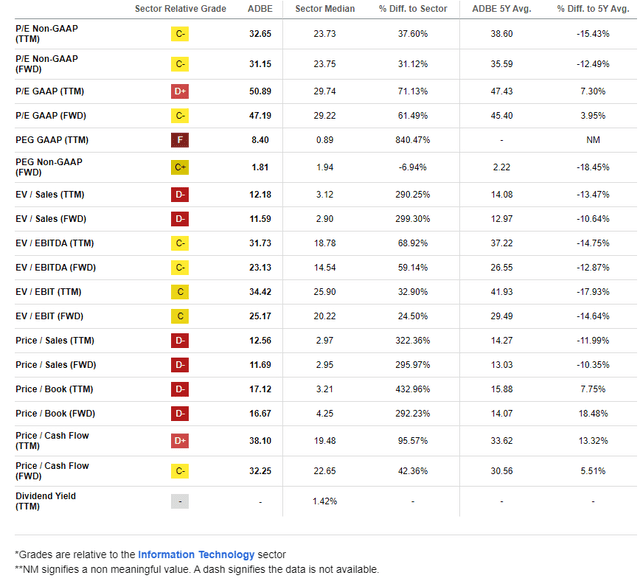

On valuation, taking a PEG ratio approach using a 14% EPS growth rate, above my previous 13% assumption following robust Q2 earnings and favorable guidance, and the same PEG multiple of 1.9, then a P/E of 27 is appropriate. Assuming non-GAAP EPS of $20 over the next 12 months, then the fair value estimate is near $532.

A 2.22x PEG would put the stock at 31x multiple and an intrinsic value of $620. Taking a midpoint between those two figures yields a stock price that should be near $575, about where shares are today. Lastly, the stock is mildly expensive on its price-to-sales ratio, but growth from AI likely warrants that level of a premium

Adobe: Mixed Valuation Metrics, Low PEG vs History

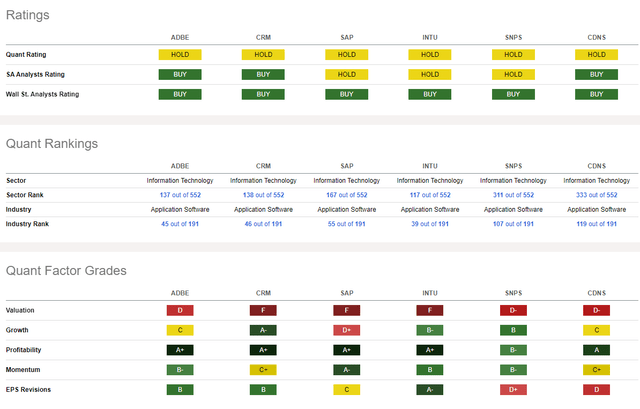

Compared to its peers, Adobe features a valuation grade that is on par with its competitors while its growth trajectory has been lackluster. More consistent profitability trends ahead should result in a positive EPS path, however.

With stellar profitability trends as it stands and improved share-price momentum, there are reasons to be bullish. Moreover, the sellside has come out very positive on the stock in the last 90 days with 29 EPS upgrades compared with just 5 downgrades.

Competitor Analysis

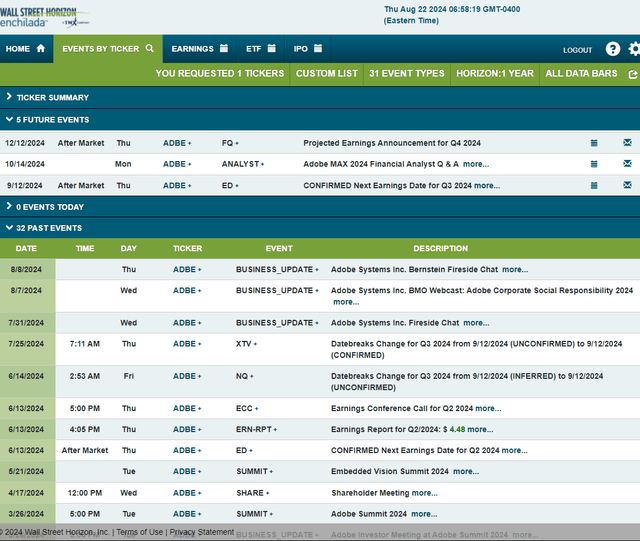

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q3 2024 earnings date of Thursday, September 12 AMC. A month later, the management team will present and field questions at the Adobe MAX 2024 Financial Analyst Q&A Event.

Corporate Event Risk Calendar

The Technical Take

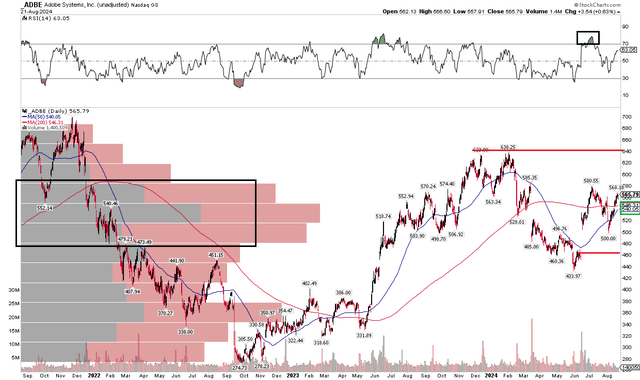

With shares about near fair value following the big Q2 and ahead of the Q3 report next month, ADBE’s technicals are mixed. Notice in the chart below that shares may be in a trading range between $434 on the downside and $638 on the upside. Buttressing that assertion is that ADBE’s long-term 200-day moving average is flat in its slow, though the short-term 50dma is on the rise, about to surpass the 200dma which would be a bullish golden cross pattern.

I also like that the stock dipped into a price gap from the Q2 report reaction earlier this month during the Tokyo crash, but didn’t fill the gap. That tells me that the bulls have some control over near-term trends. But with a high amount of volume by price up to about $600, there’s still work to do to get shares closer to multi-year highs.

Overall, technicals are mixed with $500 as support and $638 as resistance.

ADBE: Shares Rangebound, Flat 200dma

The Bottom Line

I have a hold rating on Adobe. The stock surged after its last earnings report and there are fundamental tailwinds while the technical situation is neutral.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.