Summary:

- I upgraded Adobe to a “buy” with a $518 price target, driven by strong GenAI adoption and early signs of revenue acceleration.

- Despite Q4 guidance missing expectations, Adobe’s RPO growth indicates potential revenue acceleration which could improve investor sentiment in the coming quarters.

- Adobe’s Digital Media and Experience segments show robust growth, with significant contributions from Creative and Document Cloud, driven by AI integration.

- Competitive threats exist, but Adobe’s cohesive, AI-driven approach across its product suite differentiates it and supports future growth prospects.

JHVEPhoto

Introduction & Investment Thesis

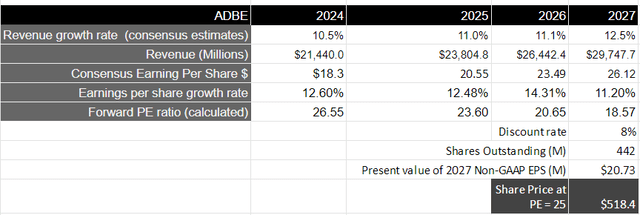

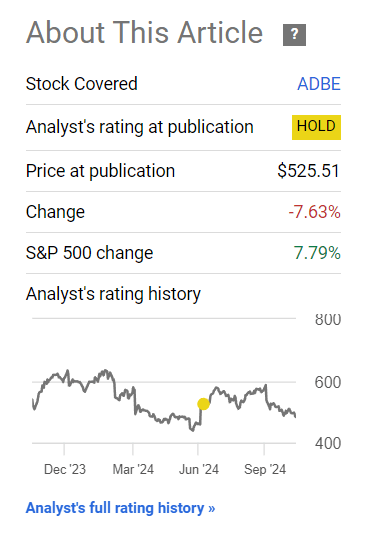

I had initiated a “hold” rating on Adobe Inc. (NASDAQ:ADBE) on June 17, where my thesis was predicated on my belief that its valuation was capped given its future growth estimates into FY27. Since then, the stock has underperformed the indices, as can be seen below.

SA: Stock Performance since “hold” rating

The company reported its Q3 FY24 earnings last month, where it saw its revenue and earnings grow 11% YoY on both fronts, beating estimates. During the quarter, Adobe demonstrated strong acquisition and retention trends across customers of all sizes, particularly enterprises, as usage of GenAI features and applications ramped up, given the company’s commitment to bring together content creation, production, workflow, collaboration, and campaign activation across its Document, Creative, and Experience Cloud with a customer-centric approach to AI with its Firefly models.

However, despite evidence of growing adoption and usage of GenAI features among its customer base, the stock has underperformed since then. The weakness is tied to its softer-than-expected Q4 revenue and earnings guidance. However, when looking more closely, we can see that RPO (remaining performance obligations) has been accelerating, while many of the deals that were supposed to close in Q4 closed earlier in Q3.

Given the early signs of revenue acceleration into next year, as monetization from GenAI ramps up with generative credits and AI-specific pricing plans, we should see investor sentiment improve with a growing likelihood of upward revisions to future revenue and earnings projections.

Therefore, assessing both the “good” and the “bad,” I have upgraded the stock to a “buy” with a price target of $518. While the upside of 7% may not look very attractive, I believe that it can get further extended as investor sentiment improves from growing evidence of GenAI monetization in the coming quarters.

The good: Strength in Digital Media and Digital Experience segments, as monetization for GenAI ramps up

Adobe reported its Q3 FY24 earnings call, where it saw its revenue grow 11% YoY to $5.41B, beating estimates, driven by strength across its Creative, Document, and Experience Cloud with strong acquisition and retention of users and enterprises given its customer-centric approach to AI, enabling customers of all sizes to adopt and realize the value of AI. At the same time, the company reported an operating income of $1.992B, which grew 17% YoY with a margin of 36.8%, driven by operating leverage and disciplined prioritization of their investments.

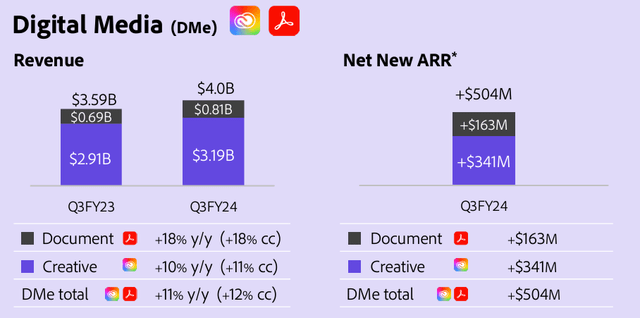

Out of the $5.41B in revenue, the company’s Digital Media Segment that houses Creative and Document Cloud grew 12% YoY to $4.00B, contributing 73% to Total Revenue, with Document Cloud growing 18% YoY, contributing 20% to the Digital Media Revenue segment, while Creative Cloud grew 11% YoY, contributing the remaining 8% to the Digital Media Revenue Segment.

Q3 FY24 Investor Datasheet: Performance in Digital Media Segment

Within Document Cloud, Adobe released AI Assistant across Adobe Acrobat and Reader with the ability to have conversations across multiple documents and support for different document formats, transforming the way users interact with the documents, resulting in efficiency gains and higher usage with 70% growth on a quarter-over-quarter basis. Simultaneously, the company has also integrated Adobe Firefly image generation into their Edit PDF workflows, thus allowing users to leverage GenAI for presentations, emails, and other communication in Adobe Acrobat with expanding use cases across verticals and industries. With key customer wins that include Amazon, Charles Schwab, Disney, Home Depot, and more, I believe that this is a testament to the company successfully monetizing its GenAI product roadmap, especially as they align their go-to-market activities around promoting subscription plans that include GenAI capabilities over legacy plans that do not.

When it comes to its Creative Cloud, Adobe is focused on integrating its Firefly innovations throughout their tools so that organizations can generate and assemble content at scale, as they released Firefly models for Imaging, Vector, and Design and previewed a new Firefly Video model, which will enable editors to realize their creative vision more productively in their video products, including Premiere Pro, leading to a tripling of API calls on a quarter-over-quarter basis. With Creative Cloud adding $341M in Net New ARR (Annual Recurring Revenue), Adobe saw subscription strength across single apps such as Illustrator, Lightroom, and Photoshop, along with growing demand for their AI-first Adobe Express offerings.

On the point of revenue drivers, I would like to bring back the topic of Generative Credits, which I had touched on in my previous post. The company describes Generative Credits as follows:

“Generative credits allow the use of generative AI features powered by Firefly in the applications to which you are entitled. The consumption of generative credits depends on the generated output’s computational cost and the value of the generative AI feature used.”

During the earnings call, the management noted that as they have deeply integrated GenAI into their tools, they are seeing accelerated consumption of generative credits, with better retention metrics. However, what is important to note is that Adobe has not instituted any caps on generative credits yet, as they are focused on proliferation and usage across their customer base. As time progresses, the management noted that they will be instituting caps or selling premium AI plans that will enable them to better capture the monetization opportunity.

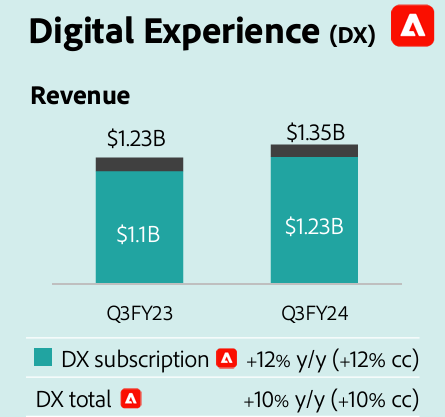

Shifting our focus to the Digital Experience Segment that houses Experience Cloud, Adobe saw revenue of $1.35B, with Subscription Revenue growing 12% YoY to $1.23B given strong enterprise demand for an integrated platform to deliver personalized experiences to acquire, engage, and retain customers while maximizing ROI (return on investment) on marketing investments.

Q3 FY24 Investor Datasheet: Performance in Digital Experience segment

With native integrations across Experience and Creative Cloud and general availability of Adobe Content Hub, Adobe Workfront Planning, and Adobe Journey Optimizer, Adobe is well positioned to help companies efficiently plan, create, deliver, and measure marketing content, with key customer wins during the quarter that includes Home Depot, Humana, IBM, and more.

The bad: Q4 estimates came softer than expected; Competitive threats remain.

However, despite a rock-solid quarter, with GenAI adoption ramping up, the company issued softer-than-expected guidance for Q4 that dampened investor sentiment. For Q4, it sees total revenue of $5.525B, with $4.1B in the Digital Media segment and $1.37B in the Digital Experience segment, which missed expectations by 1.3%. With the management setting a goal to reach $30B by FY27 in their investor presentation, it requires the company to grow at a compounded annual growth rate of approximately 12.6% between FY25 and FY27, and therefore softer guidance and downward revenue projections for the future years are concerning investors. However, when we look more closely at it, the weaker revenue guidance is related to deals that closed earlier in this quarter as opposed to closing in Q4, which was originally expected. Plus, its RPO also rose 15% YoY to $18.14B, which indicates a revenue acceleration ahead given the company’s success in acquiring and retaining customers across its solution suite. Meanwhile, its projections for earnings per share at $4.65 were also missed by a few pennies.

On the point of competition, there is increasing chatter about Adobe facing competition from Canva, OpenAI, Runway, and more. While the concern is valid to some extent, I would like to point out that Adobe is differentiating itself from its competitive landscape by becoming more cohesive and interoperable across its Creative, Document, and Experience Clouds with the help of GenAI, given its massive data to drive value across its broad suite of tools.

Revisiting my valuation: Cautiously “optimistic”

Looking forward, assuming that Adobe meets its Q4 and FY24 revenue guidance, followed by growth in the low teens region as per consensus estimates, it should reach close to its FY27 revenue target of $30B. I believe that the accelerating RPO is an optimistic sign, and as the company continues to innovate its GenAI product roadmap to drive customer acquisition and retention, with a specific focus on enterprise customers across its Digital Media and Digital Experience segments, along with implementing generative credits or AI-specific pricing plans, it should be able to accelerate its comps in the coming years.

From a profitability standpoint, taking the consensus estimates for non-GAAP EPS of $26.12 in FY27, we can see that it will be growing more or less at the same pace as revenue growth, which is reflective of management’s focus on its financial discipline. This will be equivalent to a present value of $20.73 in non-GAAP EPS when discounted at 8%.

Taking the S&P 500 as a proxy, where its companies grow their earnings on average by 8% over a 10-year period, with a price-to-earnings ratio of 15-18, I believe that Adobe should be trading at 1.4-1.5 times the multiple given the growth rate of its earnings during this period of time. This will translate to a PE ratio of 25 or a price target of $518, which is roughly 7% higher than where it is currently trading at.

My final verdict and conclusions

The way that I see it, the quarter was rock-solid. Until the previous quarter, GenAI adoption and usage was a key risk for the firm, but given its focus on a robust customer-centric approach to AI innovation, we are seeing the company attract and retain customers across industries and sizes as they ramp their usage of AI features across the solution suite.

I will admit that so far we are not seeing GenAI move the financial needle like it is for hyperscalers and semiconductor companies. But I believe that it will be possible as we see app monetization take place when the company places a cap on its generative credits, leading to a new revenue stream from generative credits, or implementing AI-specific pricing strategies.

Assessing both the “good” and the “bad,” I believe that if the company can steadily show progress in its usage and monetization for its GenAI roadmap, we will see investor sentiment improve with a higher likelihood of upward revenue and earnings revisions, boosting the stock price. Therefore, given where the stock is currently trading, I will upgrade the stock to a “buy” with a price target of $518.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ADBE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I am Amrita and I write primarily about growth software stocks.

I recently joined The REIT Forum and if you are looking for more investment ideas like this one, get them exclusively at The REIT Forum with access to our subscriber only portfolios.