Summary:

- Adobe has been seen as a generative AI winner.

- The company has been quick to integrate generative AI into its products including Photoshop.

- I expect generative AI to drive accelerating top-line growth over the next few quarters.

- Over the long term, however, generative AI is likely to be more of a foe than friend.

- At 30x earnings, we must re-evaluate our stance on Adobe stock.

gorodenkoff

Adobe (NASDAQ:ADBE) has joined in on the AI-hype machine, with its stock trading at 52-week highs. The company entered the year as a reliably profitable tech company trading at reasonable valuations. The company has taken advantage of growing hype for generative AI by quickly including it in their products. Wall Street appears optimistic that generative AI can give the company the boost it needed to re-accelerate revenue growth rates. While I can get on board with such sentiment, I am of the view that generative AI may pose long term secular risks due to leveling out the competitive playing field. With the stock trading at rich valuations, I must downgrade my rating to neutral as it is no longer clear that this stock can outperform the broader market.

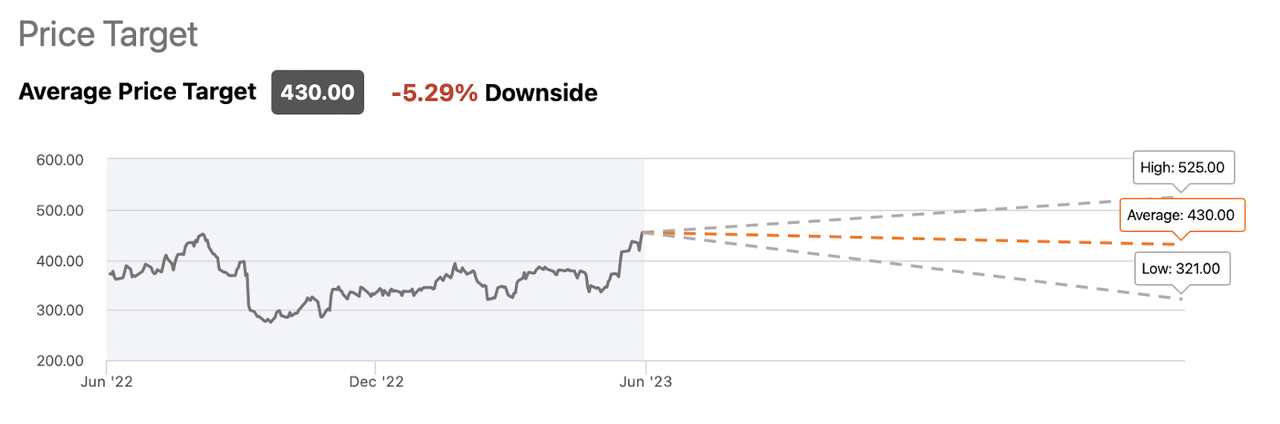

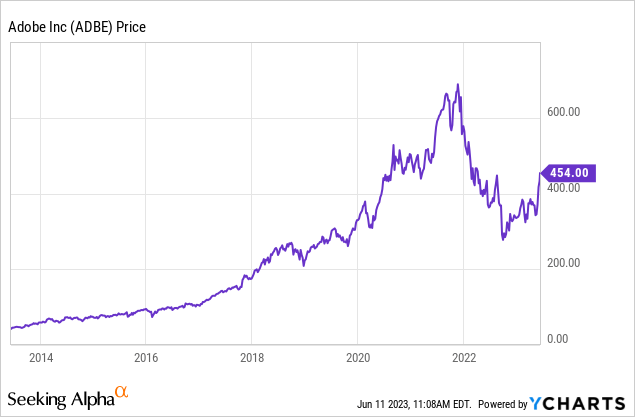

ADBE Stock Price

ADBE stock is still down substantially from all time highs, but in hindsight it is arguable that the stock was trading at bubbly valuations at that time.

The stock is up significantly this year, with its upward move so dramatic that it is now trading above consensus price targets even after accounting for the recent rise in estimates.

I last covered ADBE in March where I rated the stock a buy due to the reasonable valuation and ongoing share repurchase program. The stock is up 28% since then but I may be in the minority camp in concluding that the rally fueled by the rise of generative AI has been misguided.

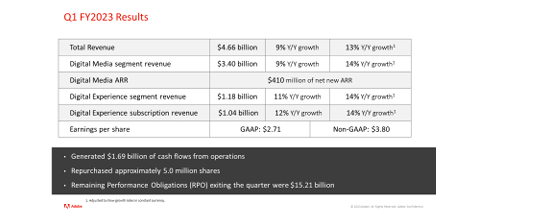

ADBE Stock Key Metrics

Just a quick recap; ADBE has sustained resilient fundamentals despite the tough macro environment. Revenue grew at a double-digit clip (constant currency) as the company benefited from having a complete product portfolio.

2023 Q1 Presentation

ADBE ended the quarter with a net cash position and continues to utilize the bulk of free cash flow to repurchase stock. Management has guided for the next quarter to see 9% revenue growth and 13.4% non-GAAP EPS growth, in-line with consensus estimates. I find it likely that ADBE meets its revenue growth guidance and is able to beat on its earnings guidance due to more aggressive share repurchases.

How Will Generative AI Boost Adobe Photoshop?

ADBE was not obviously cheap prior to this rally, nor has the company seen accelerating growth rates. Instead, its rally appears to be driven mainly by the potential of generative AI. ADBE has quickly developed its Firefly generative AI offering which is slated to be available for use in conjunction with Google Bard.

Adobe

At this point in time, it seems like anything and everything that has exposure to generative AI has been exploding higher. ADBE intends to extend its generative AI offering to assist in designing “flyers, TikToks, resumes, and Reels,” making it appear like a “picks and shovels” play for the generative AI boom.

Indeed, I can see the scenarios in which the company is able to show accelerating top-line growth due to offering generative AI in its products. These expectations appear to be driving strong stock price action at stocks like Microsoft (MSFT) and Palantir (PLTR). But I may be a lone skeptic. ADBE’s advantage over peers has long been its technological prowess and ability to offer developers and content creators an edge over the competition. Generative AI, by its very nature, aims to level the playing field. As competitive products integrate generative AI into their own product suites, I expect the overall proficiency of content creators to even out, which would heavily reduce justification for ADBE’s higher price tag. Yes, content creators will likely still need to edit any AI-created content for their own unique use cases, but they would be doing so from a very developed rough draft and would likely spend less time than before on such efforts. This might not occur for several years and, as discussed just above, ADBE is likely to show brilliant fundamental results until then, but generative AI has suddenly created serious risk to their business model.

Is ADBE Stock A Buy, Sell, or Hold?

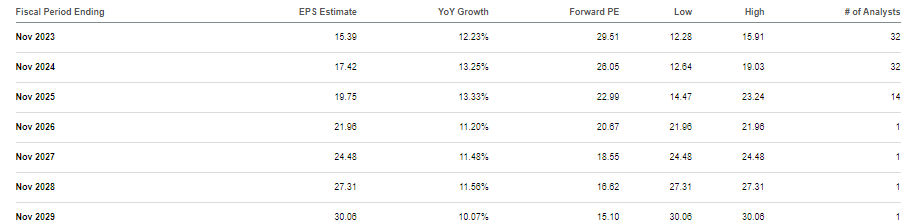

After the rally, ADBE is now trading at around 30x earnings, representing a 2.3x price to earnings growth ratio (‘PEG ratio’).

Seeking Alpha

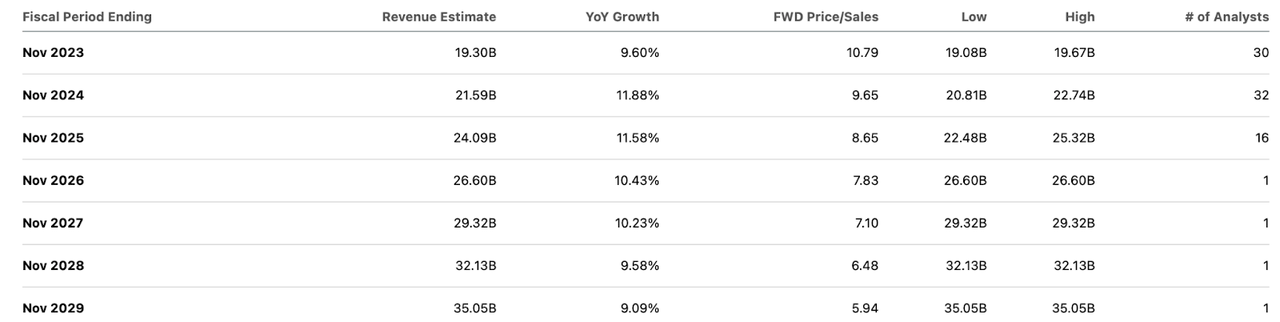

I typically try to buy stocks at a PEG ratio of less than 1.5x, signaling that shares may be overheated. Yes, operating leverage is still possible here, but consensus estimates are already incorporating material operating leverage as revenue is expected to grow at a slower pace.

What’s more, I am unconvinced that ADBE has as much low hanging fruit as other tech peers given that the company has historically operated at among the highest profit margins in the sector. If anything, margin compression is not such an unlikely outcome here. ADBE stock is trading as if it has the same impenetrable moat as names like Apple (AAPL) or Microsoft (MSFT). I do not share such sentiment. Perhaps prior to the rise of generative AI this year, I may have shared some of that belief, largely due to ADBE’s brand name. But generative AI may have ironically helped to increase the risk of the business model, despite what the stock price might otherwise indicate. There will be many cloud providers and technological consultants lining up to help the competition integrate generative AI into their products. One of the byproducts of our digitally transformed world is that digital transformation can occur at unprecedented speeds as compared to the past. ADBE should see some strong fundamental results over the next few quarters, but investors may be underestimating how quickly the competition can catch up. When that happens, I expect investors to question why the stock should be worth 30x earnings despite a rather lukewarm growth forecast. I wouldn’t rule out the stock falling down to a 1.5x PEG ratio or lower implying as much as 40% potential downside. The company’s earning power and share repurchase program should offer some downside protection, but only in the near term.

I must downgrade my rating to neutral as I am of the view that the upside from generative AI has been priced in – even if momentum is clearly in the upwards direction.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 10 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!