Summary:

- Adobe’s revenue and earnings outlook shows AI is causing problems.

- The Adobe Summit presentation was visually appealing but lacked substance in my opinion.

- Adobe’s financial performance is lackluster, with a decline in stock price and a disappointing outlook for future growth.

- Let me know when Adobe hits $250.

hapabapa

Adobe may be one of the most misunderstood companies on the market. It seems like everyone thinks they are a beneficiary of the AI trend. But they are not. I’ve read through all of Adobe’s filings and transcripts and one thing is clear – they have, at best, a weak AI monetization strategy.

I believe I was the first Seeking Alpha analyst to make this point when I first wrote about how AI was disrupting Adobe back in December. My thesis was that AI was going to disrupt them – and many other SaaS companies. The rise of AI to assist programmers will increase the competition for SaaS companies. And the rise of Generative AI will specifically harm Adobe and its Creative Cloud offerings.

Since then, the stock has fallen from $604 to $491 – a 19% decline. And the story has only gotten worse since then. First, we’re going to talk about their recent Adobe Summit – their premier conference of the year – and how it lacked substance. Then we’ll move onto their financial performance and valuation.

Shoulda Called it the ‘Adobe Plateau’…

Because their business growth has peaked.

The Summit conference looked good if you just look at their new AI releases. They sounded impressive. But most of us aren’t creative types here. We are investors. We care about how Adobe plans to monetize these AI features. And I don’t think their management knows how they’re going to do this.

The only concrete AI monetization plan I can see was released in January. They have a credits plan where users can get 500 credits for $20 a month or an unlimited plan (which they severely throttle after using 1,000 credits) for $60 a month. From what I’ve heard from Adobe users, this is annoying. They either lose functionality when they run out of credits or they have to wait longer for the AI to do its work. Not a user-friendly experience.

Plus, most people find that Midjourney and OpenAI’s DALL-E 3 produce higher quality images than Adobe’s Firefly. And just to go off on a small tangent – Adobe’s advantage because their model wasn’t trained on copyrighted images is minuscule. First, Bloomberg just reported that about 5% of the images used for training Adobe’s ‘ethical’ Firefly model were from competing AI image generation services.

Second, some large companies may care about this, but they already use Adobe products. A small upstart or an individual doesn’t care. There isn’t any imminent legal threat. Artists have filed a suit against Midjourney and StabilityAI, but the judge’s initial rulings did not go in their favor. And no suits have been filed against any business or person for using AI-generated art. If anyone knows of any lawsuits, please paste some links in the comments below.

Adobe has to pin all their growth hopes on enterprise – which is their strongest segment. So it’s not all bad. But they will lose the incremental small users to AI. And they need these users to pay up to meet their expectations.

Here are some quotes from the Adobe Summit about their monetization strategy.

“We are on the cusp of monetizing the power of AI.”

“The monetization opportunity extends across the spectrum of customers.”

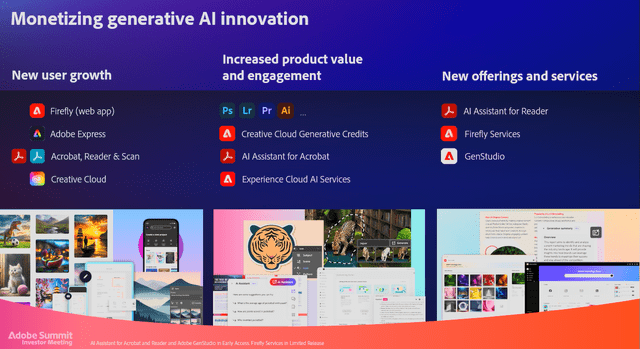

These tell us nothing. And then even when they try to get more specific, they start talking about slides like this:

Weak AI Monetization Specifics (Adobe Investor Presentation)

Let me list the problems with this slide.

- They see user growth in primarily free services.

- They talk about increased product value, which doesn’t directly lead to more revenue.

- New services such as AI Assistant for Reader.

AI Assistant is their chance to “monetize PDF consumption.” This offering allows its generative AI model to read your documents, and then you can ask questions. Not many people are going to pay for this.

First off, there are hundreds of free sources that do this. And the enterprise customer which is most likely to adopt this should be hesitant. In 2023, Adobe’s terms of service said it many analyze content to improve products and services. To be fair, they did, they came out and said they’ve never used any of that for training their AI models. But anyone serious about protecting their data will only use a locally run AI model to analyze their documents. They won’t use this Assistant.

I could go on, but at this point I feel like I’m beating a dead horse. It’s clear their AI monetization is lacking.

And then management had to go and say this:

We’re up over 300% year-on-year with users sharing PDF links. Free-to-paid conversions continues to perform well, and it’s driving revenue growth.

Statement like these that drive me crazy. Management put a hard number when the data is good (300% growth on shared PDF links) and then vague when the numbers don’t suit them (free-to-paid conversions performing well).

As analysts, we care nothing about shared PDF links. It means nothing for revenue generation. We care about the free-to-paid conversions, and we have no idea how those are actually doing.

I harped on this in my earlier writing on Adobe as well. I don’t like when a management team shares selective data like this. We know free-to-paid conversions aren’t going that well because of the financials.

In my opinion, the main reason for the monetization struggle is that all these “new” features will quickly become mandatory. AI features will become table stakes for these kinds of programs. It’s likely Adobe won’t be able to upcharge as much as they think… And then they have compute heavy AI applications which are expensive to run start to drag on margins.

And we haven’t even gotten to the competitive pressures they’re beginning to face. They will have to drastically improve their AI capabilities to maintain their strong industry standing. For a more comprehensive market overview, check out Matteo Sada’s thorough overview here.

Now let’s get onto the financial performance.

Adobe’s Lackluster Forecast

First, let’s start by saying Adobe’s first quarter was fine. They eeked out a slight beat on revenue and earnings. Plus, they announced a $25 billion buyback, which should help support the price of the stock.

The problem is their outlook. They had to guide down their Q2 outlook numbers. You never want to see a growth company miss forward estimates. Lower than expected forward growth forces analysts to revisit growth assumptions in their models and revalue the company.

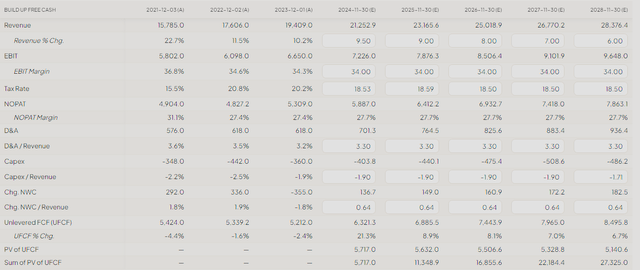

They predict their revenue will be approximately $5.3 billion this quarter. That’s only 10% growth. And I don’t see their unlevered free cash flow growing any faster than that. Here’s a model I put together using The Complete AI Powered Stock Research Platform’s modeling tab.

DCF model (Finchat.io & Authors estimates)

And then by using the above model and putting a generous 18x EV/FCF exit multiple for the terminal value, I get a present value of $114 billion. That translates to an implied fair value of $254 a share. That’s my new price target for Adobe, which represents a 48% decline in share price.

Now even if we use above consensus revenue growth of 12% a year for Adobe, increase its EBIT margin 300 basis points, and up the exit multiple to 24x, the stock is still overvalued. That gives us an implied share price of $403. That’s a decline of 17% from the time of writing.

Risks To My Thesis

It’s always worth pointing out the risks to any thesis. Even though I have a high conviction in my short thesis, let me tell you the main risks and what to look out for.

Adobe could continue to see an expansion in growth from its enterprise customers. This is the biggest risk to my thesis. Their enterprise growth is strong and could continue to expand despite their lack of AI leadership. This will be an important number when Adobe next reports.

Enterprise customers, in general, are less price-sensitive than individuals. They’ll pay to make their employees more efficient or happy. In Adobe’s investor day presentation, they reported their top 1000 customers have a net dollar retention rate of 117%. Meaning, its large clients increased spend by 17% year-over-year. I would like to know what this number is for the entire company, but I couldn’t find it…

The other risk would be that Adobe can actually monetize these AI additions. If that’s the case, we will see a top-line beat and that could propel the stock higher. If this happens, we will hear all about in the next earnings call.

Conclusion

Adobe’s creative suite changed the world for all creative types. And its breadth of capabilities is why it is used across most large organizations in the world. This led to quite a run for the stock. But now it’s safe to say, the price has gotten ahead of Adobe.

The company faces many challenges due to the rise of generative AI and from new competitors utilizing this technology. Adobe’s competitive moat is narrower than it’s ever been. Management has a lot of work to do to navigate these new challenges. And until they show they can, I will remain bearish on the company.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in ADBE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.