Summary:

- Adobe’s growth deceleration and stagnating margins, coupled with AI uncertainty, make valuation the only path to beating the market.

- Despite exceeding revenue and EPS estimates, Adobe failed to impress the market lately, as growth has slowed to 10%-11%, justifying a lower multiple.

- Adobe’s unclear AI monetization path, and competition from companies like Canva and Meta challenge its ability to accelerate growth.

- I expect Q4 to be a more-of-the-same quarter, and view Adobe as a ‘Hold’.

JHVEPhoto

Adobe (NASDAQ:ADBE) is set to report its fourth-quarter results this upcoming Wednesday, December 11th, after market close.

Although shares have recovered from their May bottom, Adobe is closing in on a disappointing 2024.

Introduction To Adobe

Adobe is one of the largest pure-software companies in the world, on pace to surpass $21 billion in sales in 2024.

Of which, roughly 74% is coming from its Digital Media offerings, which are its known creative tools like Photoshop, Premiere, and Lightroom. The other 26% are generated primarily from its Digital Experience suite, which includes business software solutions for documents, marketing, commerce, and analytics.

I’ve been covering Adobe on Seeking Alpha since early 2023, with a generally bearish stance, culminating in a ‘Sell‘ rating prior to the last earnings release.

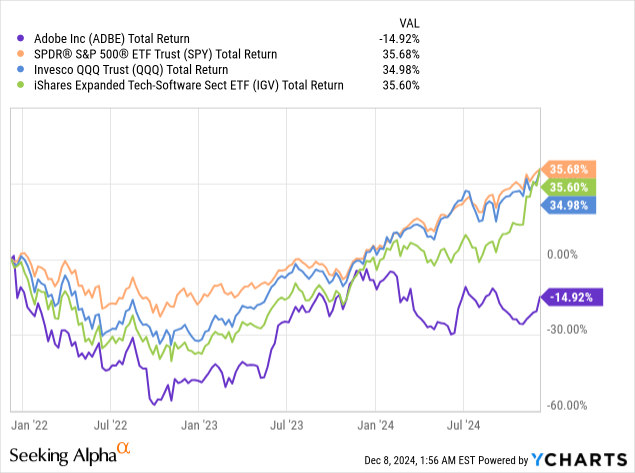

It’s been a rough stretch for Adobe shareholders, with shares significantly underperforming the S&P 500 (SPY) and the software sector (IGV).

The key reason in my view, is that Adobe still didn’t prove it’s an AI winner, rather than loser, with many critical use-cases, including digital marketing creative, web designing, and ecommerce solutions, being disrupted by the likes of Canva, Meta (META), Google (GOOG), Wix (WIX), and Shopify (SHOP).

With Adobe’s growth decelerating, margins declining or stabilizing, and the acceleration story still quite uncertain, Adobe lacked two of three ingredients for a successful investment.

The Recipe For A Market-Beating Investment In Software (And In General)

Sometimes, people over complicate the formula for a winning investment, but in reality, it’s quite simple. A company with accelerating revenue growth and expanding margins will almost always yield good stock performance, almost regardless of valuation.

Now, it doesn’t go to say we should ignore valuation, because it plays a key role in balancing risk and reward. By that, I mean that if you buy a company at an extremely high valuation, the moment revenue growth stops accelerating, or isn’t as high as expected, the stock could plummet. The same is true regarding margins.

On the contrary, if you buy a company at a fair or low valuation, even results that aren’t extraordinary can yield good results. Still, investors should always look for the trifecta, i.e., expanding margins, strong revenue growth, and reasonable valuation. Especially in a concentrated portfolio.

Adobe Is Missing Two Key Ingredients, Will Q4 Mark A Change?

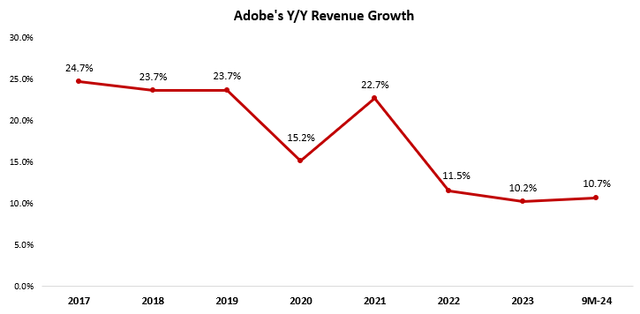

Although Adobe beat revenues and EPS seven quarters in a row, real market expectations (sometimes referred to as buy-side expectations) were higher. Until 2021, Adobe was a high-teens, and even a low-twenties growth story. Now, it’s in the 10%-11% range.

Created by the author using data from Adobe’s financial reports.

This “new” growth range puts Adobe in a different basket of companies, which inevitably get a lower multiple.

For 2025, consensus expects another year of low-double-digit growth, and if Adobe guides for something meaningfully higher than that, shares could surge. However, I don’t see that as likely, at least not this early. I believe they will guide somewhere in line with consensus.

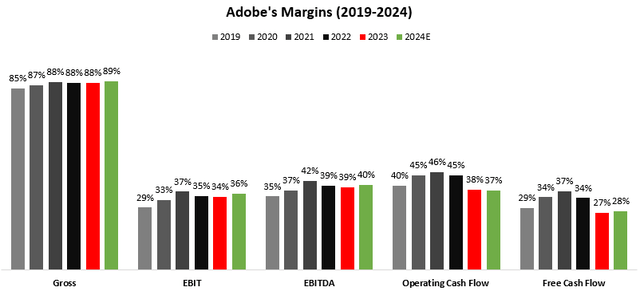

One way to offset lower revenue growth is with a strong margin expansion story, with Salesforce (CRM) being a prime example. Adobe has a rich man’s problem here, as its margins are already extraordinary high:

Created by the author using data from Adobe’s financial reports.

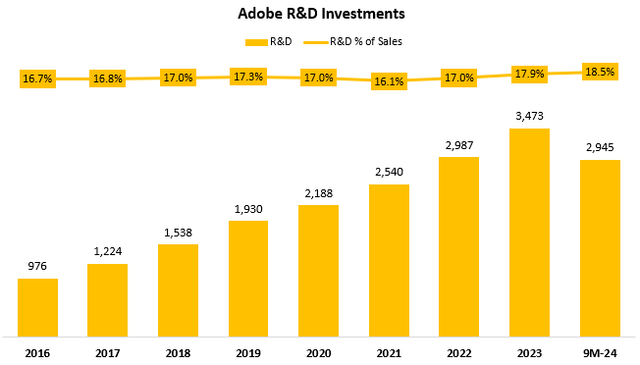

For the company to achieve better-than-expected growth, the path goes through AI and its Firefly initiative. That path involves higher investments, especially in R&D, which is on pace for a multiyear peak for Adobe, at 18.5% of sales.

Created by the author using data from Adobe’s financial reports.

In the upcoming quarter, it will be key to monitor this expense line, and the margin target underlying the EPS guide for next year. If it reflects stabilization in the 36% operating margin range (rather than expansion), along with a soft revenue guide, shares will probably decline.

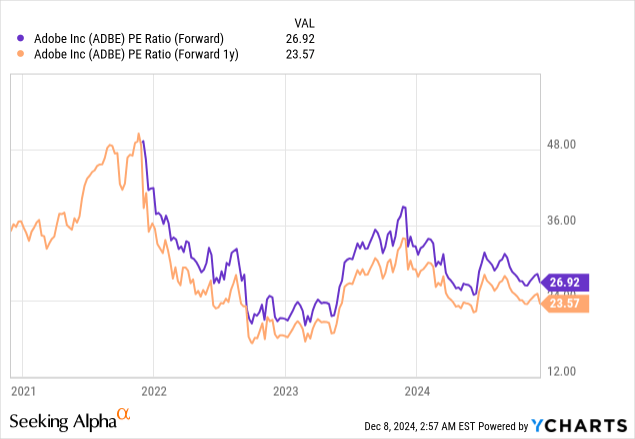

So, to sum up, for any other company, Adobe’s numbers would be exceptional. The problem is, Adobe is “competing” with itself. With no margin expansion, stable revenue growth, and AI uncertainty, the only ingredient that can provide a good setup for a market-beating investment is valuation.

Valuation

The first critical thing to be aware of is that Adobe reports both GAAP EPS and non-GAAP EPS, with the latter adjusting for one-offs (justified), amortization (less justified), and stock-based compensation (not justified).

Websites like Seeking Alpha, as well as most sell-side analysts, use the adjusted numbers “as-is”, which makes the valuation seem lower, but it’s incomparable to other companies.

If Adobe actually traded at 27 times ’25 earnings, I’d say it’s a bargain. In reality, it’s trading at around a 34x multiple if we exclude amortization, and at around 36x if we only exclude one-offs.

Now, with no margin expansion, the only driver for EPS growth above revenue, is buybacks. Therefore, we’re getting Adobe at around 3 times its EPS growth, or 3x PEG, which is too high considering the company’s trajectory.

With that said, after the sharp rise of the entire market, the recovery of the software sector, and Adobe’s underperformance since my previous article, I don’t consider it a ‘Sell’ anymore.

I would consider buying Adobe below the $500 threshold, and would consider it a ‘Sell’ above $580.

Conclusion

Adobe has yet to convince the market it has a viable AI story that will yield revenue acceleration and fend off competition.

With increasing competitive pressures and Adobe’s larger scale, the company seems bound in the 10%-11% revenue growth range. And, as Adobe needs to invest more to drive growth, margins will remain stable, at best.

These are the characteristics of a company that’s attractive at a 30x multiple or lower, rather than where it is today.

In the upcoming fourth quarter, I don’t see a path for big surprises, but any sign of improvements on the two ingredients we discussed should bode exceptionally well for the stock.

For now, I upgrade Adobe to a ‘Hold’.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.