Summary:

- Adobe has a strong business model and incorporated AI quickly, which I believe will be value-accretive over time.

- The company’s business model, focused on subscription-based products, generates consistent and sticky revenue.

- The recent selloff driven by OpenAI’s Sora model launch was FUD and will not impact Adobe in the short-run.

- Despite fundamental strength, Adobe looks overvalued and is trading well above my margin of safety.

tumsasedgars

Prelude

I’ve covered Adobe, Inc. (NASDAQ:ADBE) twice in the past. In both articles, I rated Adobe a buy (in January 2023 and March 2023) and I’m pleased with Adobe’s outperformance of the S&P to date. In January, I offered a price target of $315.58 and in March, I upgraded my target buy price to $350.88. Adobe was trading within these ranges at the time, and I was correct in my assessment that it was undervalued at the time.

In this article, I’d like to discuss the following: Adobe’s business model and AI applications, the FUD around OpenAI’s text-to-video generator Sora, recent legitimate headwinds, and a revamp of my now outdated valuation model alongside my rating downgrade from Buy to Hold.

Business Model and AI Applications

Adobe is the global leader in creative software applications. The breadth and quality of their product ecosystem is simply unmatched. While individual competitors may exist, Figma for example, there is no other company that offers the range and cross-compatability of creative software that Adobe offers. From video or image editing to drawing and 3D, and now to AI image generation or enhancement, Adobe offers the most extensive portfolio of software for creative professionals. Creative professionals (digital designers, video editors, movie producers, etc.) who need a range of tools have no sensible option other than Adobe.

This is how Adobe describes its value proposition in the recent 10-K: “Our products and services help unleash creativity, accelerate document productivity and power businesses in a digital world.”

The business has two major segments: digital experience and digital media. The digital experience segment is mostly focused on MarTech (Marketing Technology). It includes products like AEM (Adobe Experience Manager) to manage marketing campaigns, Adobe Analytics for campaign analysis, and Adobe Target for customer targeting. In essence, it’s a full-stack CRM platform. Digital media includes creative and document applications like Acrobat the PDF reader/editor, Firefly, Photoshop, and so on.

The key figure for both of these businesses is ARR (annual recurring revenue). Adobe products are subscription-based, providing predictable and sticky revenue. Global digitization and business transformation are natural tailwinds for Adobe. The more content that exists online, the more usage Adobe products will enjoy.

In March, I covered Adobe in the article Adobe Stock: Embracing AI In Digital Design, in which I made the case that Adobe’s quick embrace of AI will be a long-term tailwind for the company. Two days after that article was published, the company announced Firely, the proprietary AI text-to-image model that is a part of the AdobeSensei AI product suite. Adobe describes Firefly as:

A new family of creative generative AI models, first focused on the generation of images and text effects. Adobe Firefly will bring even more precision, power, speed and ease directly into Creative Cloud, Document Cloud, Experience Cloud and Adobe Express workflows where content is created and modified. Adobe Firefly will be part of a series of new Adobe Sensei generative AI services across Adobe’s clouds.

This came at a time of rhetoric that AI is a serious risk to Adobe. Adobe’s core customer base is digital content creators. Adobe is indelibly linked to human creativity, so as AI is increasingly capable of replicating this creativity, there could be serious issues. Even Adobe Firefly perpetuates this risk – the product is making graphic design significantly easier. Although you still need human intervention, do you need as much? Is Adobe shrinking its client base with this product?

In other words, AI tools will begin to automate the more time-intensive steps of graphic design and should increase productivity significantly. While this increase in productivity will likely leave fewer total jobs, those that remain will be more highly valued. Companies will have an incentive to continue AI spend over the years to drive further productivity gains. This will give Adobe pricing power well into the future. Incorporating AI early allows them to collect more data and train better models, leading to more productivity gains for users. Add this to Adobe’s existing flywheel effect and you see quite a rosy picture.

I believe Adobe will benefit from AI in the long run.

Firefly

An important figure to monitor for Firefly will be the total image generation volume. As with other AI models, the more training it has the better it will perform. Image generation will result in more user feedback and further model refinement. As of the Q3 earnings call, (six months post launch), Firefly generated 2 billion images.

Perhaps more important than Firefly itself is the availability of Firefly APIs, which allow businesses to build the Firefly text-to-image model natively into their workflows. This will drive a lot of enterprise value over time, and enhance Adobe’s enterprise pricing power.

Adobe’s value proposition presents a virtuous cycle for AI models: the better the models get, the more value they will present to customers. As customers derive more value, usage will increase. More usage means more feedback and a further refined model. As customer value increases, so too does pricing power.

As Adobe releases newer and better models, they will enjoy more pricing power which will be a secular tailwind for revenue and earnings growth and should be margin accretive over time.

Despite this, the recently launched text-to-video generator dubbed Sora caused a lot of FUD (fear, uncertainty, doubt).

Sora FUD

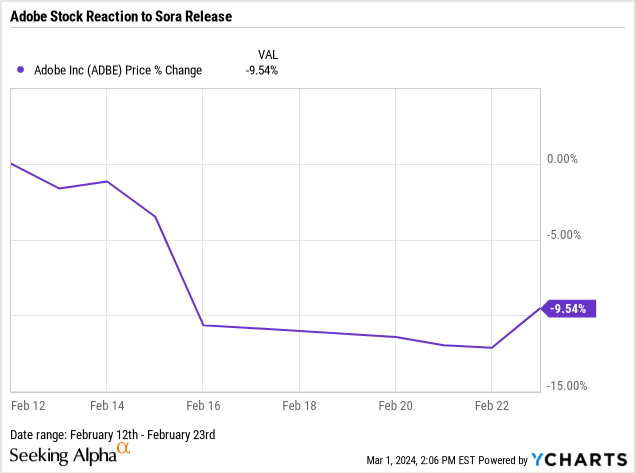

OpenAI, the creator of ChatGPT, launched Sora on February 15th. I won’t mince words here – the results are striking. The video quality is breathtaking and it’s truly an engineering marvel. Following the launch, the market did not treat Adobe well:

This was a market overreaction resulting from FUD (fear, uncertainty, and doubt).

Two of Adobe’s flagship products are a photo and a video editor. Many market participants have speculated that diffusion models (the models underlying text-to-image and text-to-video generators) will materially harm Adobe’s competitive advantage. The logic is sound, if AI can do the lion’s share of the work, Adobe’s TAM will consistently shrink. Adobe’s TAM is, after all, the human pursuit of content creation. On face value, diffusion models do present a very serious threat to Adobe.

This risk is legitimate long term but will not impact Adobe in the short run. Therefore, I’m classifying the response to Sora as FUD. Diffusion models are an extension of neural networks, which are beholden to something known in industry as the scaling law. In effect, scaling laws state that neural network performance is a function not only of its engineering but also of the underlying compute capacity. As computers become more powerful, AI models will perform better without any change to the underlying engineering.

Operating Sora at Adobe’s scale is entirely impossible with current compute infrastructure. Nvidia (NVDA) is trying its best to meet demand for accelerated infrastructure, but Jensen still believes demand will far outweigh supply. Nvidia’s next-gen AI accelerator, the B100, will presumably provide a step-function increase in compute performance but the infrastructure buildout is a matter of years, not months. For Sora to disrupt Adobe’s business, OpenAI would need to run Sora inference at a massive scale and the required infrastructure buildout for this will take years. We are far, far away from Sora being a serious competitor to Adobe, especially at scale.

While I believe Sora is just FUD, there are some legitimate short-term headwinds to Adobe’s investment case. Let’s discuss.

Recent Legitimate Headwinds

While I’m bullish on Adobe’s pricing power and the value-add of Firefly over time, the company did announce a pending FTC investigation into their subscription practices. Management said this could involve “significant monetary impacts”. In the worst-case scenario, Adobe will have to absorb a significant one-time fine that will reduce earnings in future reports and could materially harm pricing power. The business itself will remain uniquely strong and well-positioned to continue its historical growth trend, but this has the potential to disrupt earnings growth.

Another major headline is the recent termination of the Figma acquisition. While Figma is gobbling some market share in the digital design space, it’s unclear whether the acquisition was going to be of value to shareholders. Adobe was going to take a $10B cash hit and dilute current owners by an additional $10B in equity for this acquisition. As part of the termination, Adobe will pay $1B to Figma. Not a bad deal for Figma.

Current owners won’t be diluted as severely and will continue enjoying the EPS growth stimulated by Adobe’s current share buyback program. However, this could impair future growth expectations and will likely require Adobe to make an effort to build a competitive product against Figma. In all, it’s difficult to say whether this is a net negative for the company. Only time will tell, so it’s something that I’ll continue to monitor and report on.

Valuation and Downgrade

Adobe is a very cash-generative business, so I used FCF in my valuation model. I believe FCF is a better gauge of Adobe’s valuation because this contributes significantly to Adobe’s ongoing capacity to offset dilution with share buybacks and potentially pay a dividend in the future.

I estimated quite a conservative 10-year CAGR of 5% for Adobe’s FCF because of the $1b hit for Figma and pending FTC investigation. I used a 5% discount rate. Barring any significant equity dilution from acquisitions or major increases in stock-based comp, I believe Adobe’s fair value is currently within a range of $510-$530. My margin of safety would then be 10-20% lower than the $510 price point, so I am not considering adding to my Adobe position unless we see the $450 price range.

The current trading price of ~$570 does not present a sufficient margin of safety to add to my Adobe position. This makes sense looking at a pure valuation perspective as well – Adobe’s Non-GAAP FWD P/E of 31 is quite expensive for a company with a 16.5% 5-year revenue CAGR and 15.9% 5-year earnings CAGR.

I’ll be waiting on the sidelines until a correction brings Adobe closer to my margin of safety. My current equity position is +57.20% at a cost basis of $363.37/share.

I do not intend to trim or sell this position because I still believe Adobe’s long-term bull case is firmly intact and the valuation is not so egregious that it would be wise to take profits.

Overall, Adobe presents a very strong software business with predictable growth and a durable competitive advantage despite some headwinds and long-term risks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADBE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.