Summary:

- Adobe Inc.’s relentless innovation in Creative Cloud and Digital Media, especially with AI tools like Firefly, has driven its impressive stock performance and long-term growth potential.

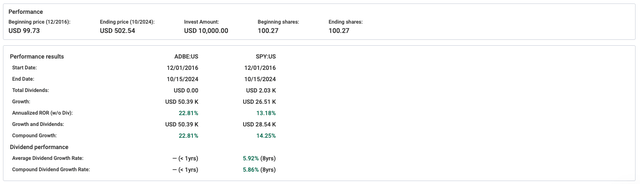

- Since CEO Shantanu Narayen’s shift to a cloud-based subscription model, Adobe’s stock has seen a spectacular annual return of 22.81% from 2016 to 2024.

- Strong Q3 financials with $5.41 billion in revenue, driven by AI-enhanced tools and freemium models, underscore Adobe’s robust growth and market leadership.

- Despite AI development costs and competitive pressures, Adobe’s balanced innovation and profitability strategy, supported by solid fundamentals, make it a “Buy” for growth-focused investors.

Sundry Photography

Thesis

This analysis highlights how Adobe Inc. (NASDAQ:ADBE) has driven its success, especially in stock performance and its move into AI-powered creative tools like Firefly, through nonstop innovation in its Creative Cloud and Digital Media segments.

All of this, of course, is thanks to Adobe’s relentless tinkering and toying in its Creative Cloud and Digital Media segments. But, there have been a few potholes—like the cost of AI development and the inevitable slow-downs in growth in some spots. Despite these hiccups, Adobe’s clever strategy of weaving AI into its products and attracting more users seems to have them nicely set up for a good, long run.

Creative Cloud and Leadership

The software industry giant Adobe Inc. began operations in 1982 when computers were a fairly new subject for the masses. Over the years, Adobe quietly but steadily grew by snapping up companies like Macromedia, which gave the world tools like Flash and Dreamweaver—names that would soon become part of the digital landscape. This proved to be a smart move, helping Adobe assemble an impressive, all-in-one suite of software solutions. Later on, Adobe eventually dove into digital marketing with its Adobe Experience Cloud, managing to add even more to its already overflowing portfolio.

These days, Adobe is practically synonymous with its Creative Cloud suite, the go-to toolbox for just about anyone in the world of design or multimedia with heavy hitters like Photoshop, Illustrator, Premiere Pro, and After Effects.

This dominance in the creative space didn’t happen accidentally, of course. Much of it comes down to some smart leadership choices. Since CEO Shantanu Narayen took the helm in 2007, Adobe has made a bold move to shift everything to a cloud-based subscription model—a decision that’s paid off handsomely. This shift’s been a big factor in why Adobe’s stock has been on such a winning streak recently.

Between December 2016 and October 2024, ADBE pulled off a stock market performance that could only be described as spectacular, with an annual return of 22.81%. To put that in perspective, the broader market, represented by the SPDR (SPY), posted a still respectable but comparatively modest 13.18% annual return over the same stretch.

In real terms, if you had the foresight to drop $10,000 into Adobe back in 2016, you’d be sitting on $50,390 today. By comparison, the same investment in the SPY would’ve grown to $26,510, which is nice, but it’s not Adobe nice.

Adobe MAX 2024 and Firefly

Adobe’s stock performance has been largely fueled by the company’s unstoppable drive for innovation, especially these days in the world of artificial intelligence. Nowhere was this clearer than at Adobe MAX 2024, where the company rolled out its vision for the future of creative tools.

Front and center was Adobe’s Firefly platform, a generative AI system that’s seamlessly woven into its apps, allowing users to create images, edit visuals, apply effects, and generate multimedia content just by typing in a few words. The whole thing is designed to supercharge workflows for creatives, and so far, it’s been a massive hit. In fact, users have already churned out more than 12 billion Firefly-powered creations using AI-enhanced tools like Photoshop, Illustrator, and Premiere Pro.

Another perfect, corporate, real-world example of Adobe’s innovative muscle comes from Red Hat (an IBM company), which saw a tenfold boost in time savings after introducing Adobe Express into its global marketing operations.

Strong Q3 Financials

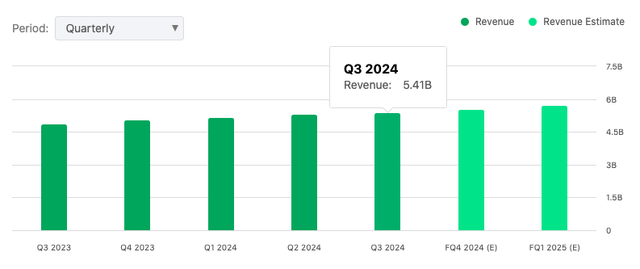

This burst of innovation was mirrored quite nicely in Adobe’s fiscal Q3 earnings, where the company reported a tidy $5.41 billion in revenue, up 11% from the previous year. The Digital Media segment led the way, bringing in $4 billion, with Creative Cloud and Document Cloud driving the growth.

But the real star was Document Cloud, posting an 18% increase and hitting $807 million. Demand for PDF and Acrobat solutions is only growing stronger. Both have been supercharged by AI tools like Firefly, proving that even the humble PDF can benefit from a little futuristic magic.

Freemium Models and Growth

This impressive performance wasn’t limited to Document Cloud, as Adobe’s Creative Cloud remains strong, pulling in $3.19 billion in revenue with an 11% year-over-year growth. A big driver behind this is the company’s focus on AI innovations and seamless integration across its cloud platforms. They’re also seeing growth thanks to their push for new user acquisition. They’ve cleverly introduced freemium models—think Firefly—which make it wonderfully easy to reel in fresh faces and turn them into loyal customers.

E-Commerce and Mobile Insights

Beyond the innovation — Adobe’s been taking a big leap into e-commerce, and Adobe Analytics and Experience Cloud are contributing to this. For instance, they expect $240.8 billion in online sales in the US for the holiday season 2024 — this is just one of the ways their analytics pick up the pulse of the market.

But it’s not only about predicting big numbers; it’s also about how Adobe leverages those insights for business. With Adobe Analytics, companies get a direct feed of what’s happening with their customers, what’s failing, and how to change that moment-to-moment.

This results in more relevant marketing, personalized shopping, and higher conversion rates. That’s directly linked to sales growth for Adobe’s customers and is an indication of how entrenched Adobe is in the online marketplace. Experience Cloud takes it even further by making all of these insights accessible in one unified system, so companies can optimize everything from recommendations to mobile engagement.

Such efficiency is critical to firms wanting to remain in the game. Adobe is, then, more than providing tools; it’s delivering results that help improve both the performance of clients and its profitability.

Risks & Headwinds

Firefly’s fast growth, showcased at Adobe MAX and in the Q3 earnings, underscores Adobe’s leadership in AI-driven creativity. But with that growth come some hurdles, especially around handling AI-related costs.

API (Application Programming Interface) calls have tripled quarter-over-quarter, showing just how critical Firefly has become in expanding Adobe’s creative platform. At the same time, the earnings report pointed out concerns over the rising costs tied to AI development. As investments in AI training ramp up, there’s a risk those expenses could squeeze profit margins if revenue growth doesn’t keep up.

Furthermore, the high cost of AI video production tools, for example, could put a damper on future profitability, especially with competitors in the AI space evolving fast. Adobe is still figuring out pricing models for AI tools like Firefly, and they’ll need to strike the right balance between making money and getting users on board.

And lastly, Adobe’s latest quarterly results revealed that Creative Cloud isn’t growing quite as fast as its sibling, Document Cloud. Now, this could be a sign that the creative tools market is maturing — at 11% growth, Creative Cloud seems to be inching toward middle age, possibly nudged along by the increasing swarm of competitors in the AI-driven creativity space. Broader economic issues and potential belt-tightening among big corporations could also stir up trouble, especially when a sizable chunk of Adobe’s income comes from heavy hitters like Amazon, Meta, and Disney.

Q4 Outlook, Valuation and Investment Rating

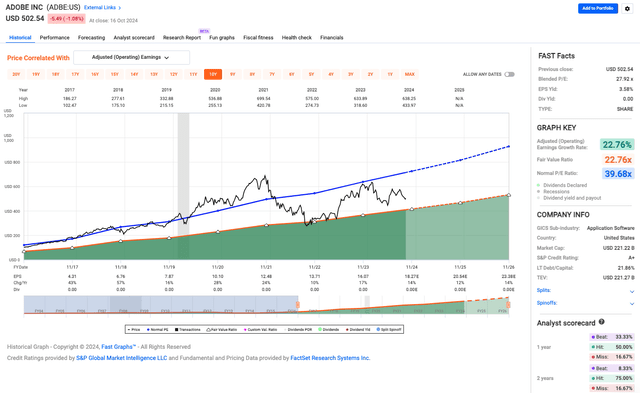

With these obstacles in mind, ADBE’s blended P/E ratio of 27.92x may seem high, but that’s quite typical in the tech sector. Additionally, ADBE’s 22.76% growth in adjusted operating earnings shows its ability to expand, driven by the products I just discussed.

This growth, in turn, supports its current valuation, especially when compared to the average P/E ratio of 39.68x, which actually suggests there may be more room for growth if performance remains strong. In short, the slight 5% dip in stock price over the past month doesn’t signal more concerning issues. With solid earnings growth and a manageable P/E ratio, Adobe seems appropriately priced for growth-focused investors.

Given these strong fundamentals and manageable valuation, the focus now shifts to how Adobe will continue driving performance. As the company heads into Q4 with revenue projected between $5.50 billion and $5.55 billion, the real question is how well they can keep balancing innovation with profitability.

Their leadership in AI-powered creative tools, like Firefly, is undeniable, and they’re killing it in the Digital Media and Document Cloud segments, further proving their innovation-first strategy. With double-digit revenue growth and AI integrations making people more productive, it looks like Adobe’s setting itself up for continued long-term success. Moreover, they’re buying back shares and generating solid cash flow, key signs of a company that’s got its act together. I’d call Adobe a “Buy.”

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADBE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.