Summary:

- Adobe has a strong foothold in the creative content and customer experience management markets, which are likely to grow at double-digit rates in the coming years.

- High profitability allows the company to navigate inflationary headwinds with relative ease, and Adobe’s market-leading position largely shields it from a potential recession.

- Huge free cash flow allows Adobe to gobble up potential competitors and actively buy back shares.

- However, it seems that the high quality of the company is already noted by the market. We recommend waiting for a more attractive buying opportunity.

Sundry Photography

Investment Thesis

Adobe (NASDAQ:ADBE) has an extensive product portfolio and leads in the digital content and customer experience management markets, which are expected to grow rapidly in the coming years. Adobe has no direct competitors with a comparable market share, and its huge cash flow allows it to buy potential competitors long before they begin to pose any threat to the company.

High profitability allows the company to navigate inflationary headwinds with relative ease, and Adobe’s market-leading position largely shields it from a potential recession. In addition, Adobe is actively buying back shares and is likely to continue to do so as the company has a low capital intensity and a strong balance sheet.

However, the company’s high quality and prospects seem to be more than reflected in the price. According to our valuation, Adobe is trading at a slight discount to its fair value, which does not provide a sufficient margin of safety. We recommend waiting for a more attractive buying opportunity.

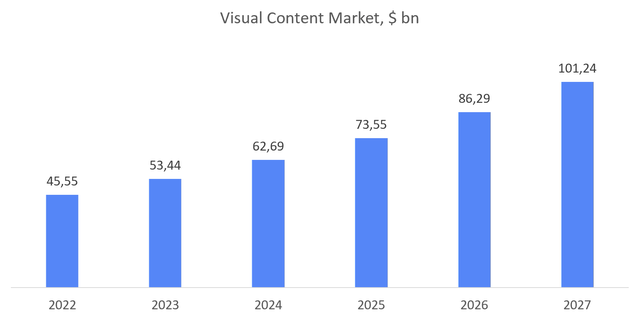

Potential of Target Markets

The daily time spent by Internet users on social media has risen by 63% over the past ten years and reached 147 minutes in 2022. The number of smartphone users increased from 3.67 billion in 2016 to 6.26 billion in 2021. The figure is expected to reach 7.69 billion by 2027. The transformation of media consumption and the rapid growth of social media has forced brands to adapt and change their distribution model. This has become a growth driver for the visual content industry. The visual content market is expected to grow at a compound annual rate of 17.32% and reach $101 billion in 2027.

Today, the Digital Media segment, which provides creators with the tools to create and monetize their digital content, generates $12.84 billion, or 72.9% of total revenue. While maintaining its current market share, Digital Media’s revenue could reach $28.54 billion in 2027.

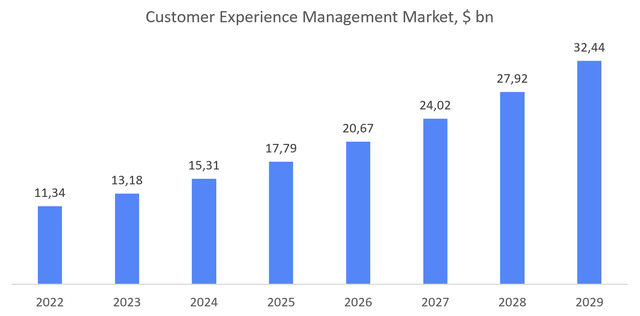

Second in importance is the Digital Experience segment, which offers analysts, sales managers, and other professionals customer experience solutions to create, manage, monetize, and optimize customer experiences. This segment generates $4.42 billion in revenue, which corresponds to 25.1% of total revenues. According to Fortune Business Insights, the global customer experience management market is valued at $11.34 billion and is expected to reach $32.53 billion by 2029, representing a compound annual growth rate of 16.2%.

Adobe’s competitive position in the creative content market is unshakable, making it reasonable to assume that the Digital Media segment is able to grow as a market on average, even with a high calculation base. As part of the Digital Experience, the company faces fiercer competition. However, Adobe has a strong position here too: the company was named the market leader in more than 40 analytical reports in categories such as digital experience platforms, customer analytics, content management systems, B2B marketing automation platforms, enterprise marketing suites, and digital commerce. However, since Adobe solutions account for the lion’s share of the markets, the potential for organic growth is limited and depends on the overall dynamics of industries.

Deep Competitive Moat

Microsoft (MSFT), Amazon (AMZN), Apple (AAPL), Meta (META), and Alphabet (GOOG) (GOOGL) dominate many areas of our lives today. You are probably reading this on a smartphone with an Apple or Alphabet operating system, or in front of you is a PC with Windows. Most likely, when this page was loading, it was connected to one of the Amazon data centers. And if you decide to share this research (we hope so), you will probably use the social network or messenger from Meta.

These companies secured their dominance using a similar scheme. Having become leaders in their original business, they began to buy up promising companies to prevent potential competitors from even a mile closer to their positions. Of course, this attracts the attention of politicians.

Adobe has an important advantage – its target markets do not attract the attention of legislators. Probably, since the company specializes in servicing businesses and the self-employed, it stores and operates the data of professionals. At the same time, Adobe has all the main features of the above giants:

- Adobe has an extensive portfolio of products that are leaders in their respective segments. Over the past year, more than 400 billion PDF files have been opened in Adobe products. Adobe Scan is the leading scanning app for iOS and Android. And one of the company’s flagship products, Adobe Photoshop, has become a household name used by over 90% of the world’s creative professionals.

- Adobe has no direct competitors with comparable market share, and its huge cash flow allows it to buy potential competitors long before they pose any threat to the company.

Adobe widens the competitive moat with every new M&A deal. Over the past five years, Adobe has made ten acquisitions. In mid-September, a deal was announced to acquire Figma, a cloud-based design software, for $20 billion, half in shares. After the announcement, the stock fell 29%.

The market felt that Adobe had overpaid. However, from a qualitative point of view, the company eliminated a competitor that many professionals rated as the best in the industry. On the quantitative side, Adobe bought the company with an expected annual recurring revenue of over $400 million on 100% revenue growth and 90% gross margin, with a net retention rate of 150%.

When evaluating the present value of the cash flow that Figma will generate in the coming years, it is necessary to take into account the losses that Adobe could suffer if it lost its competitiveness. In other words, the value is high, but we do not believe that this deal burns shareholder value.

Financial Performance and Capital Allocation

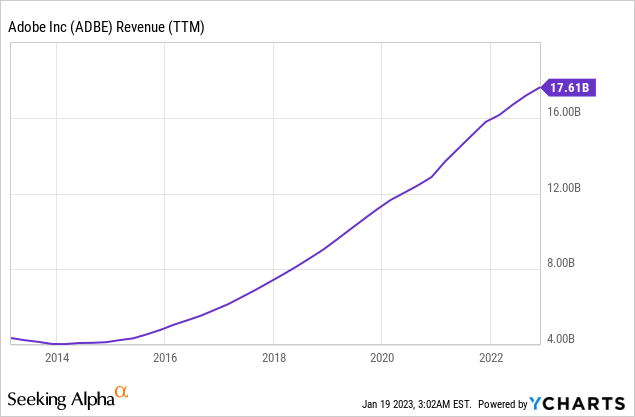

In the mid-2010s, the company’s management made a fateful decision – to switch to the Software-as-a-Service model. While Adobe used to make money from license sales, now revenue comes from subscriptions. The SaaS model not only breathed new life into the company’s finances but also made sales recurring and predictable. Over the past five years, revenue grew by an average of 20.66%, and in 2022, total sales increased by 11.54% year-over-year to $17.61 billion.

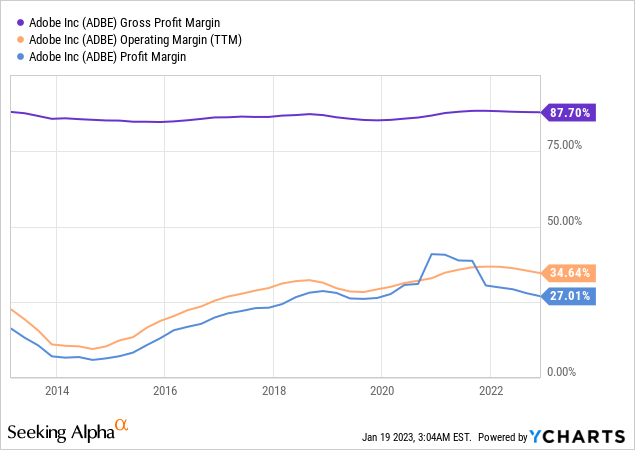

While numbers have declined in 2022, Adobe is still showing impressive margins. At the end of the reporting period, the gross margin was 87.70%, the operating margin was 34.64%, and the net margin was 27.01%. High profitability allows the company to navigate inflationary headwinds with relative ease, and its market-leading position largely shields Adobe from a potential recession in my opinion.

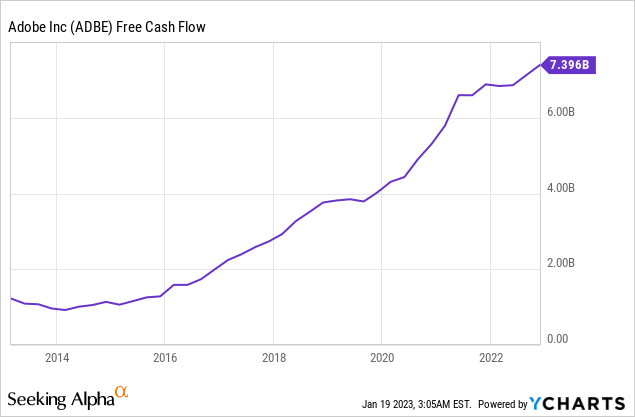

The key tool for creating shareholder value is the firm’s huge free cash flow. At the end of the year, FCFF exceeded $7 billion. With a relatively low debt load of $4.13 billion, Adobe is actively buying back shares.

Thus, over the past year, the Treasury stock balance has grown by 37% and reached $23.84 billion. Given the company’s strong balance sheet and low need for additional capital, we see no reason to reduce buybacks. It is worth noting that the company currently has $6.55 billion remaining of its $15 billion authorization which goes through 2024.

ADBE Stock Valuation

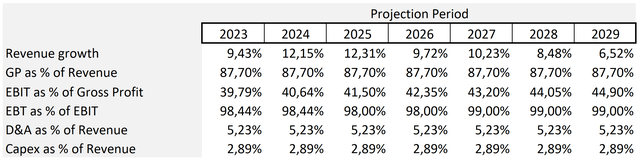

The DCF model is built on several assumptions. We expect revenue to grow in line with the Wall Street consensus. While the company’s gross margin has grown as revenue has grown, we expect the figure to remain at 2022 levels of 87.7%.

Over the past five years, operating expenses as a percentage of revenue have declined by an average of 1 percentage point annually. We assume that such dynamics will continue during the forecast period.

We expect DD&A expenses as a percentage of revenue to be at 5.2%, in line with the average over the past five years. The capital expenditure forecast is also based on a five-year average of 2.9%.

Over the past five years, the number of outstanding common shares has declined by an average of 1.1% per year. Within the framework of the model, we assume that such dynamics will continue.

Our assumptions are presented below:

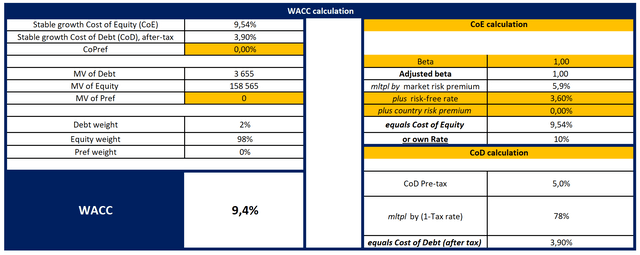

With the cost of equity equal to 9.54%, the Weighted Average Cost of Capital [WACC] is 9.4%.

With a Terminal EV/EBITDA of 18.40x, our model projects a fair market value of $168.1 billion, or $390 per share. The upside potential we see is about 12%.

You can see the model here.

Our sample for a comparable valuation includes both the closest peer of Autodesk (ADSK) and previously noted mastodons in the face of Apple, Microsoft, Alphabet, and Meta. Adobe is trading at a premium to the average.

| ADBE | ADSK | AAPL | MSFT | GOOG | META | |

| EV/Sales | 8.79x | 8.97x | 5.34x | 8.51x | 3.89x | 2.82x |

|

EV/EBITDA |

21.01x | 42.43x | 16.12x | 17.48x | 11.70x | 7.60x |

| P/Cash flow | 19.94x | 22.70x | 17.53x | 20.05x | 12.71x | 6.45x |

| P/E [TTM] | 33.79x | 70.11x | 22.13x | 25.39x | 18.07x | 12.65x |

| P/E [FWD] | 31.22x | 58.04x | 21.99x | 25.21x | 19.42x | 14.92x |

(Source: Seeking Alpha)

Conclusion

Adobe has a strong foothold in the creative content and customer experience management markets, which are likely to grow at double-digit rates in the coming years. The company shows solid revenue growth and impressive margins, while its huge free cash flow allows Adobe to gobble up potential competitors and actively buy back shares. However, it seems that the high quality of the company is already noted by the market. In our opinion, the current price does not provide a sufficient margin of safety. We would recommend buying the stock at a lower price.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.