Summary:

- Following the massive drop in Adobe’s share price, more investors are looking favourably at the business.

- In my view, however, capital allocation decisions within the company raise some red flags that are hard to overlook.

- As a long-term shareholder, who focuses on quality business models, I still have a hard time rating Adobe as a buy.

Prykhodov

When analysing Adobe (NASDAQ:ADBE), it is very easy to get the impression that the stock represents a solid long-term investment opportunity, if you ignore the broader issue of capital allocation.

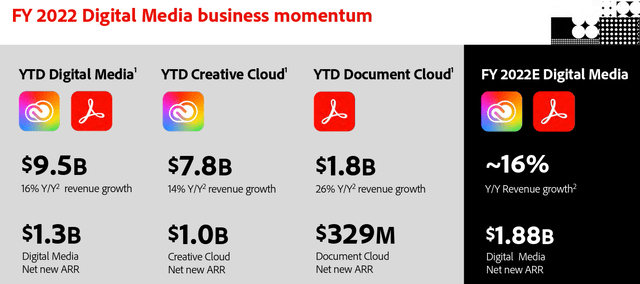

To begin with, the company is growing at double-digit rates and its Creative and Document clouds have significant TAMs (Total Addressable Markets).

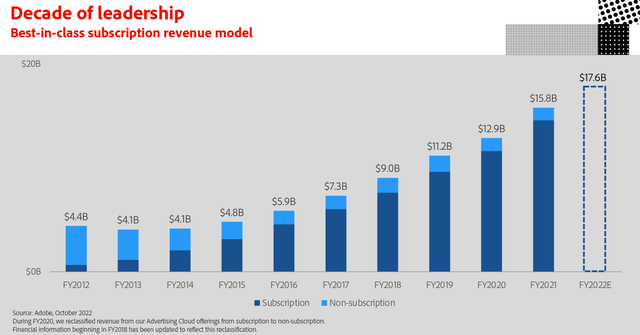

What’s even more attractive in Adobe’s business model is its subscription-based model, which results in very high share of recurring revenue.

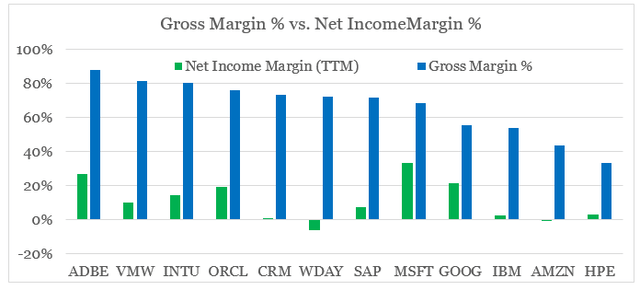

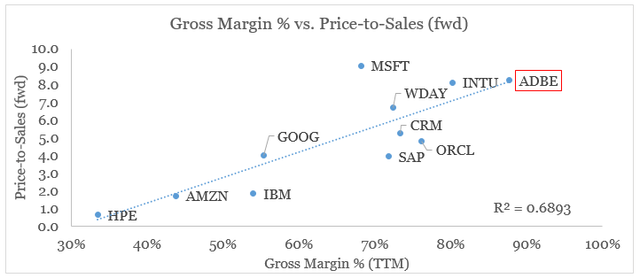

The business’ unique positioning that caters to many small content creators, free lancers and small to medium businesses also results in the highest gross margins within the broader peer group of large cap software and cloud players (see below). The large scale on the other hand, reduces the share of fixed costs and makes Adobe one of the highest net income margin businesses.

prepared by the author, using data from Seeking Alpha

Only Microsoft (MSFT), Alphabet (GOOG) and Oracle (ORCL) come anywhere close to Adobe when it comes to net income margins.

Although Adobe lost more than 20% of its value since I first warned of some major risks associated with the company and I later showed why Adobe is no-longer a $600 stock, the large drop in share price has now made ADBE fairly priced relative to its peers when we take into account stable gross profitability into account.

prepared by the author, using data from Seeking Alpha

Usually subscribers to my investing group would be the first to hear about such an attractive opportunity that also appears to be trading near fair value. After all, one does necessarily need to wait for a great business to trade at a discount in order to position him/herself for above-market future returns.

In this case, however, there is a big caveat. As we dig deeper into Adobe’s strategy and capital allocation, some major problems begin to surface.

Can Acquisitions Tell Us Something Important?

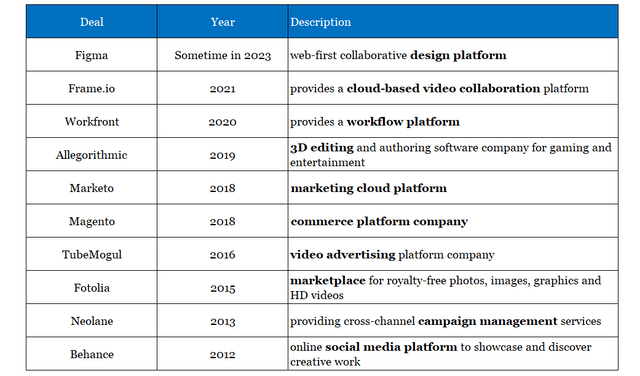

It is no secret to anyone that Adobe has been on an acquisition spree over the past decade or so. Strategic acquisitions are an integral part for a business the size of ADBE as they create synergies and cross-selling opportunities that are relatively easy to realize and they could also be used as a way to steer the business into strategically important areas.

As we see, Adobe has been following this strategy to support its sales growth by adding a number of platforms to its portfolio – from video collaboration to marketing, commerce and project management.

prepared by the author, using data from SEC Filings

It also clearly illustrates, however, that Adobe was late in its efforts to develop cloud-based collaboration platforms and had to play catch-up in many of its verticals.

For the most part, this was not a problem for the cash flow generating business of Adobe. Most deals were not very large in comparison to Adobe and it seemed that the strategy was working.

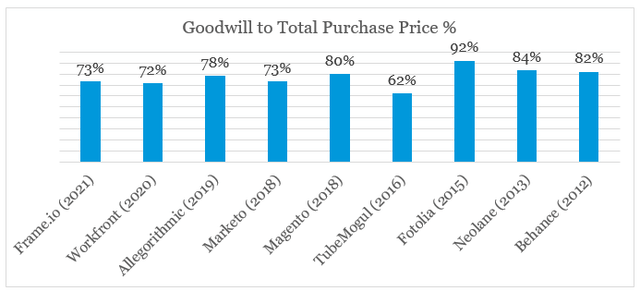

However, the share of goodwill within the total purchase price of each of these deals (see the graph below) clearly illustrates that the company was not paying for individual intangible assets, e.g. technology, customer lists, trademarks etc.

The vast majority of value from these deals was to be derived from synergies and potentially higher sales growth as part of Adobe’s strong portfolio.

prepared by the author, using data from SEC Filings

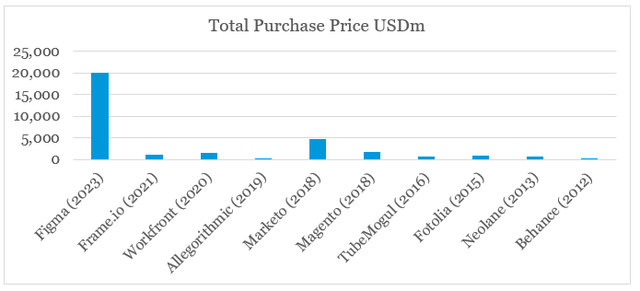

Again, not a major problem as long as Adobe is able to successfully integrate these businesses and quickly scale them up globally. The most recent deal for Figma, however, is orders of magnitude larger than Adobe’s previous deals.

prepared by the author, using data from SEC Filings

This significantly increases integration risk and the probability that Adobe could end-up overpaying for its $20bn target.

On the other hand, it could be a red flag that Adobe’s management is seeing a growth-slowdown ahead and is resorting to larger deals in order to support its topline. That is why, ADBE’s stock price reacted so negatively on the news that the U.S. Department of Justice could soon sue to block the proposed deal for Figma.

But even, if you are a firm believer that Adobe would be able to sustain its topline growth for a longer period of time, without the help of Figma, there is another red flag that you should consider.

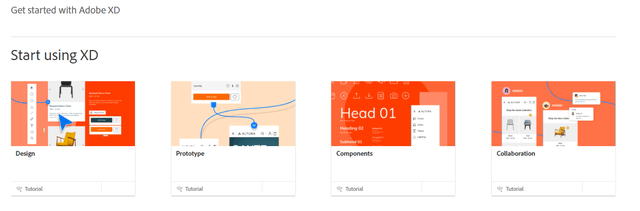

Among the company’s largest desktop apps, there is Adobe XD – a design platform that competes with Figma.

The reason why this is concerning to me is that through the deal Adobe admits that after years of developing its own platform, it cannot compete successfully and resorts to acquiring its competitors.

This is rarely a successful strategy and the fact that Adobe is having a hard time competing in an area that is so quintessential to its business model is troubling.

How Is Cash Being Used?

The problem I outlined above becomes even more pronounced when put in context to Adobe’s capital allocation policy in recent years.

As a starting point, Adobe is spending around 17% of its revenue on Research & Development, which is both in line with historical spend and also comparable to the amount spent by other cloud and software players, such as Salesforce (CRM), Oracle (ORCL), Intuit (INTU) and SAP (SAP).

This shows that Adobe is not experiencing any difficulties for cash in financing its growth internally.

The company pays no divided, which in my view is rather unusual for its size, and also has very low leverage. The latter could be seen as a major advantage as fears of rising interest rates are reflecting negatively on businesses with large debt loads. Having said that, being extremely conservative when using leverage could be equally bad for a company’s competitive positioning.

In the case of Adobe, as of the end of fiscal year 2022, the company has a total debt on its balance sheet of only $4.1bn and cash and cash equivalents of $4.2bn which results in a negative net debt figure. This low extremely low leverage suggest that the company lacks a pipeline of attractive internal projects to finance.

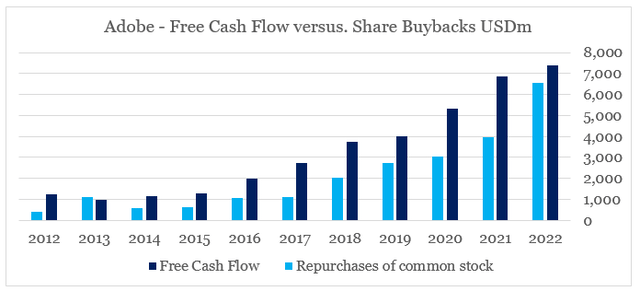

That is why, Adobe uses the almost entire amount of its free cash flow to repurchase its own shares.

prepared by the author, using data from SEC Filings

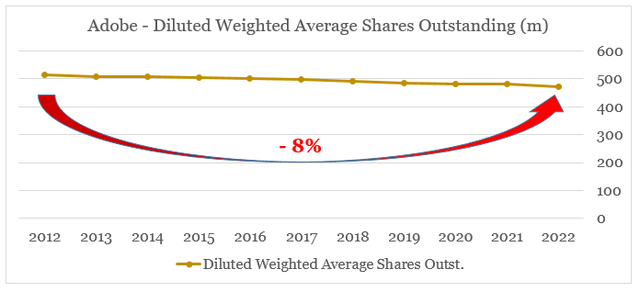

In and of itself, this is concerning to me, but we should also consider that this massive amount spent on share repurchases – more than $23bn since 2012, did little good to existing shareholders. As of the end of fiscal year 2022, Adobe’s total shares outstanding are just 8% lower than they were back in 2012.

prepared by the author, using data from SEC Filings

The reason for that is Adobe’s generous stock-based compensation, which makes roughly 18% of the company’s cash flow from operations. At the same time, the vast majority of insider transactions are selling orders which to me is yet another red flag.

Conclusion

On the surface, Adobe appears as a very attractive long-term opportunity – a highly profitable and sticky business model that also appears to be trading near fair value. As we dig deeper into the company’s strategy and its usage of cash, however, some major red flags begin to surface. That is why, I am still having a hard time rating ADBE as a buy, even as it trades nearly 20% lower since my initial coverage.

Disclosure: I/we have a beneficial long position in the shares of ORCL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author’s opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies’ SEC filings. Any opinions or estimates constitute the author’s best judgment as of the date of publication and are subject to change without notice.

Looking for better positioned high quality businesses in the technology space?

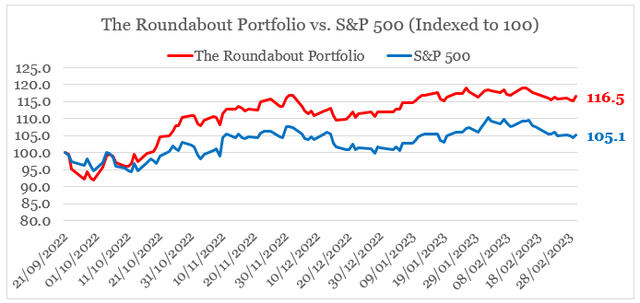

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.