Summary:

- Adobe’s Experience Cloud is becoming increasingly relevant and important for the company, particularly in serving enterprise customers.

- I explain why Digital Experience might be growing slower than many expect.

- Third-party models like OpenAI’s were thought of as competitors but they will probably become partners.

- The company laid out its strategy to monetize AI. I summarize it in this article.

Vertigo3d

Introduction

Adobe (NASDAQ:ADBE) held one of its most important conferences last week, ‘Adobe Summit.’ At last year’s conference, the company announced several important updates, like the release of Firefly to compete with all the gen AI models that were popping up at the time. This year was no different, as it also brought relevant news to the company and, most importantly, helped me solidify my conviction in the investment thesis.

My conviction in Adobe has grown lately after fully understanding its strategy around AI. While there were no large swings for me during Summit, it was marginally positive conviction-wise. This article will bring two things:

-

All the important topics, both from the Keynote as well as the Investor Meeting the company held

-

The demos of the most relevant products for Adobe

I won’t add much in #2, but I will share what minute in the presentation you need to go to see these demos, which honestly blew my mind. It’s tough to build conviction here unless one considers what these end-to-end products are capable of.

Without further ado, let’s get on with all the relevant topics.

The growing relevance of the Experience Cloud

If there was one highlight for me during this year’s Summit, it was the growing relevance of Adobe’s Experience Cloud, not only as a standalone segment but also in the role it plays in the entire organization. Why did I come out with this feeling? First, because this year’s Summit was hosted by Anil Chakravarthy, President of Digital Experience. Second, this segment was given a lot of importance throughout the event.

But, why did Adobe do this? I feel that Adobe is trying to promote what makes them unique in order to tame disruption fears in Creative Cloud, and I think they did a great job at this during the Summit. Don’t forget that Adobe’s bread and butter are the enterprise customers, which was pretty evident in the company’s stats. 59% of its customers employ more than 5,000 people, and 64% of its customers generate more than $1 billion in revenue:

Adobe Investor Presentation

Enterprise customers are by far the most monetizable customers, and they also tend to be stickier. The reason they are stickier is because Adobe is a strategic partner, not any given solutions provider that they can easily switch out of.

These customers are also the ones who are more willing to pay for the value delivered, and value for them tends to be in being able to purchase an E2E solution that they can embed in their workflows. For this reason, Adobe’s management believes that generative AI models are not the differentiating factor, at least across these types of customers; what differentiates the company is everything that happens after the content has been created.

To show their conviction in this belief, management announced they would be supporting third-party models, like OpenAI’s, across their interfaces:

You can actually pick what model you want.

Adobe doesn’t really care if customers have access to third-party models because these third parties don’t have the interfaces and tools to edit this content (Creative Cloud) or to distribute it and measure its performance (Experience Cloud). It’s precisely in the next steps after ideation that generative AI adds the most value. We’ve already seen this play out in how the different models have gotten commoditized over time. This ultimately means that what many thought of as potential competitors (the models) might, in the end, become partners:

We’re really excited to bring some of these models into the interfaces that these customers use every day.

It’s also worth noting that this “partnership” might also be a game changer for such third-party models. Being embedded in Adobe’s tools will allow them to gain distribution. In many articles, I have discussed that despite many fears around AI disruptions, it was probable that those who would win would be those with the distribution, and this might be just another example of this dynamic at play.

Management believes that the independent models will have a tough time competing with their E2E solution as they get increasingly commoditized:

I actually think you’re going to see a lot of AI companies that have focused on fundamental models fall by the wayside because I think the capital allocation also associated with what they have to raise, it’s just not sustainable for them because they don’t have a business model.

This ultimately means that Adobe’s differentiation lies in the Experience Cloud in terms of enterprise customers. It’s normal to see management give this segment and the E2E value chain such importance after the arrival of AI because it’s ultimately its moat. I believe Shantanu did a pretty good job here explaining why Adobe will win:

A lot of people have solved the creation and production with asset management, but then activating that in real time and producing the delivery, that’s something only Adobe can do. It’s the combination of Express, Firefly, Creative Cloud, Acrobat and Experience Cloud that really gives us, I think, a very unique solution to address all of the content and data needs that anybody has.

But if Experience Cloud is so differentiated and critical for any company, why is it not growing faster? This is a fair question, so let’s go over it.

Why isn’t Experience Cloud growing faster?

Simply put, I believe Experience Cloud is not going faster due precisely to its mission criticality. When a customer purchases the Experience Cloud, the decision is strategic, and the product gets embedded in all aspects of the organization. The target customers for this offering are enterprise customers, so it’s normal that the first phases of installation are somewhat slow; turning a ship takes time.

Let me share a real-life example to help you quantify this. When I worked as a consultant, the client I worked for was implementing the Experience Cloud, and the project for the first phases was around 2 years long, and that was only the beginning.

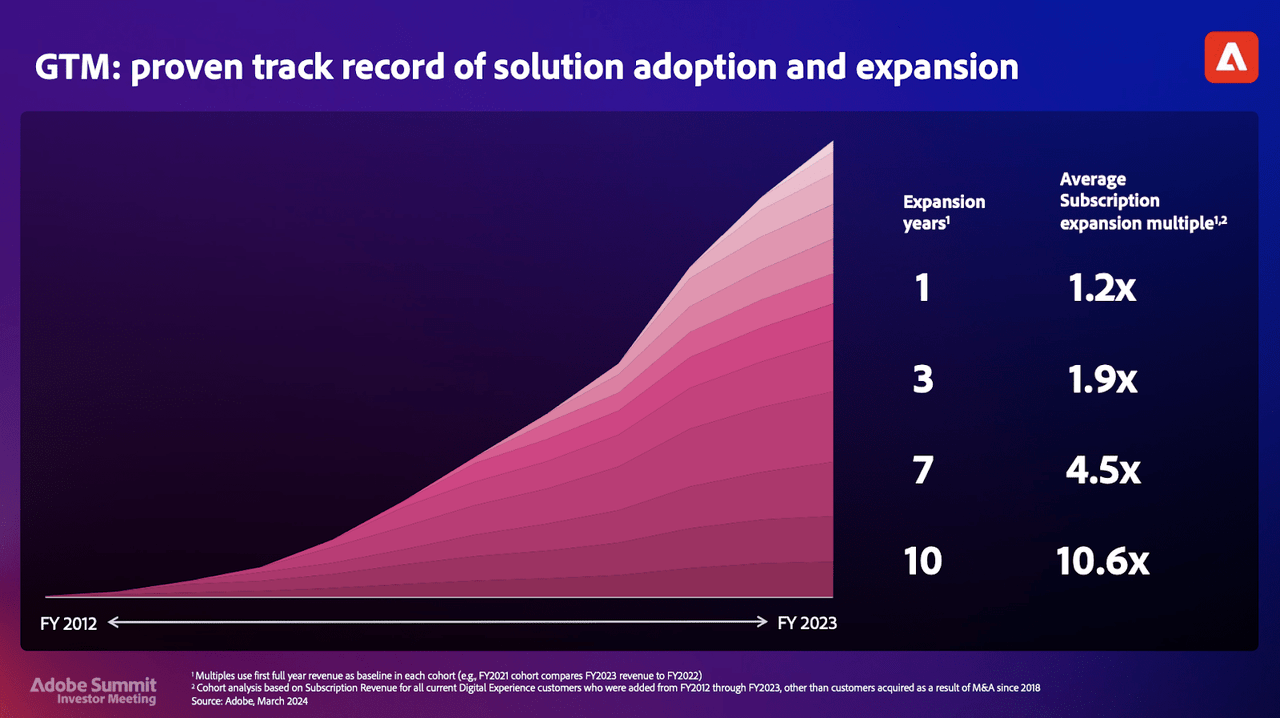

This initial slowness is evident from a slide management shared during their presentation. Expansion starts slow but then accelerates until almost reaching an exponential rhythm:

Adobe Investor Presentation

The reason for this exponential acceleration is two-fold. First, once you’ve done the first installation, you can consider that phase as a sunk cost. This means that adding new modules allows companies to get much more value without spending too much additional money. In short, the difficult part is over after the initial installation, so expansion becomes easier.

This is also the source of the second reason: switching costs. As the costs to implement this solution are so high, it’s improbable that a company would switch to a competitor, especially if the current solution is delivering value. This is why the decision to buy the Experience Cloud comes from the C-suite: it’s strategic.

The question here is…

Will AI accelerate this growth rate?

Well, lowering the barriers to entry in content creation certainly helps, as it allows the creation of much more content, but it’s still too soon to answer this question. This said, management believes it has the potential to accelerate the segment:

I think in the short term, to David’s point, we’ll probably monetize that (Artificial Intelligence) in the enterprise faster.

Probably the best thing about Experience Cloud, which stems from its high switching costs, is that growth seems inevitable. Management shared that they expect the TAM (Total Addressable Market) in 2027 to be around $155 billion, growing at a 3-year 12% CAGR. Of course, we should always be careful with TAMs as they are aspirational goals that are probably unachievable for management, but it’s a bit different for Experience Cloud:

A large portion of the TAM is represented by our existing installed base today.

This ultimately means that many enterprise customers are already in or beyond the installation phase and that it’s only a matter of working through the expansion phase. This expansion phase is highly likely to happen for the reasons discussed above.

In addition to this, I think it will be somewhat “easy” for Adobe to grow this offering if the largest consulting firms see value in the offering:

Anil and I met with the CEO of a really large consulting services company that wants to offer this as a premium offering to every company. And the fact that we called it GenStudio, for the next 15 minutes she was talking about how GenStudio is going to be a catalyst.

Management did not share the consulting firm’s name, but I am 99.9% sure it’s Accenture. Adobe and Accenture have worked closely for years. The latter was an integral partner in deploying the Experience Cloud, so it makes sense they are even more optimistic about GenStudio. The other reason I am inclined to believe that it is Accenture is that Shantanu refers to the CEO as “she,” and Accenture’s CEO is Julie Sweet.

All in all, Experience Cloud is what allows Adobe to differentiate in a generative AI world and will also be a critical growth driver going forward. The pace at which Adobe will realize this growth is unknown, but this might be one of those rare instances where the segment accelerates as it gets larger.

Will AI make the pie smaller?

The question most analysts had is the one they’ve been making for the past year:

Will AI make the pie smaller?

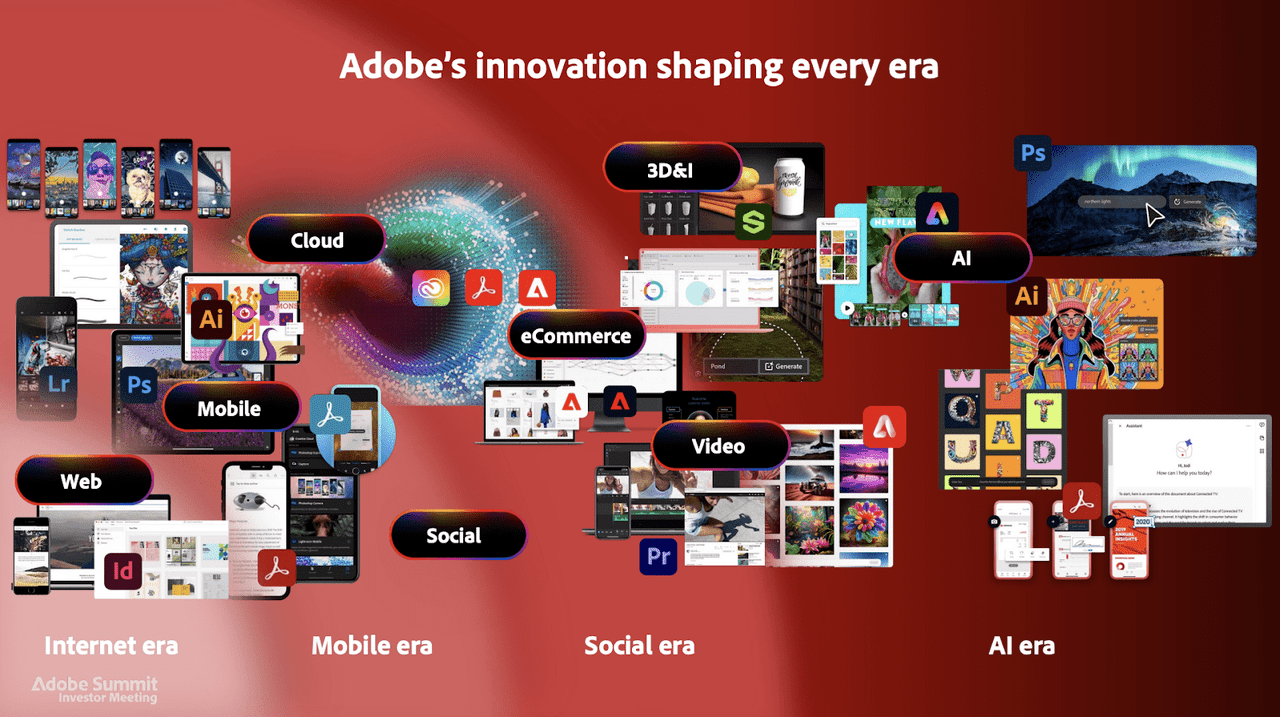

Their rationale is that AI brings plenty of productivity increases, which should, in theory, reduce the number of seats available to Adobe and, therefore, the number of subscriptions sold. Before digging deeper into this matter, let’s see what happened in previous tectonic shifts:

Adobe Investor Presentation

Every one of those tectonic shifts that has happened has increased our addressable market. Every one of them has allowed us to attract new customers. And frankly, each one of those shifts builds on each other.

But, why will this time be similar? Adobe’s management believes that AI will only benefit the company, and the reason for this is somewhat related to what I discussed above.

Generative AI has lowered the barriers to entry to the first step of the process: ideation. This means that a lot more content can initially be created, but remember that this is just the first step, and Adobe dominates what comes after: editing, delivery, and measurement. This means that AI has just made the top of the funnel larger, and Adobe believes the opportunity to monetize the remaining part of the funnel will be larger:

AI is going to further open the floodgates because now everybody’s imagination can be translated from their imagination into a piece of media or a piece of content that can be then further refined, edited, integrated, deployed, and delivered.

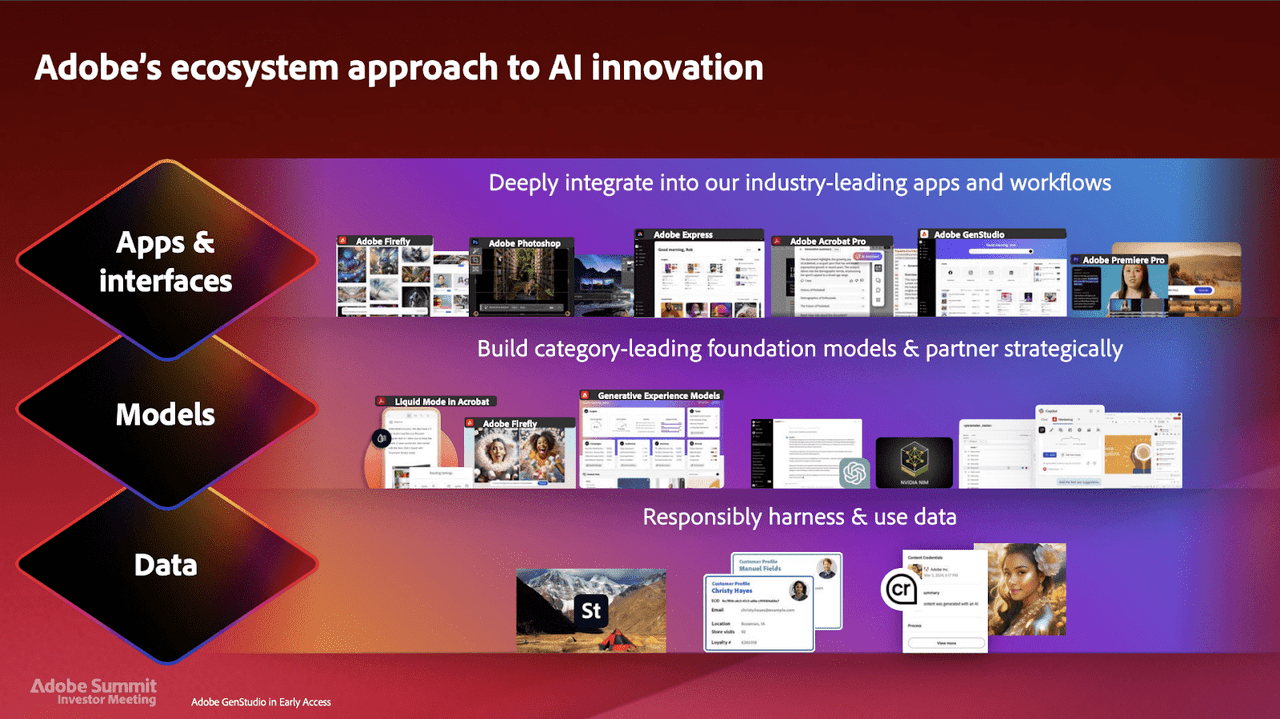

Management shared an excellent explanation by showing the three layers of the story: data, models, and apps and interfaces.

Adobe Investor Presentation

The company somewhat differentiates in Data and Models due to its safety-first approach and its vast professional-grade data, but where it really differentiates is in apps and interfaces. Large enterprise customers don’t simply want a model to generate an image for them; they want a way of integrating this generation into the editing and delivery process, and that’s where probably most of the tangible value will be created. In short, the output of a gen AI model is not actionable (in most cases):

The whole idea for us is how do our customers gain superpowers when gen AI is natively integrated into their workflows.

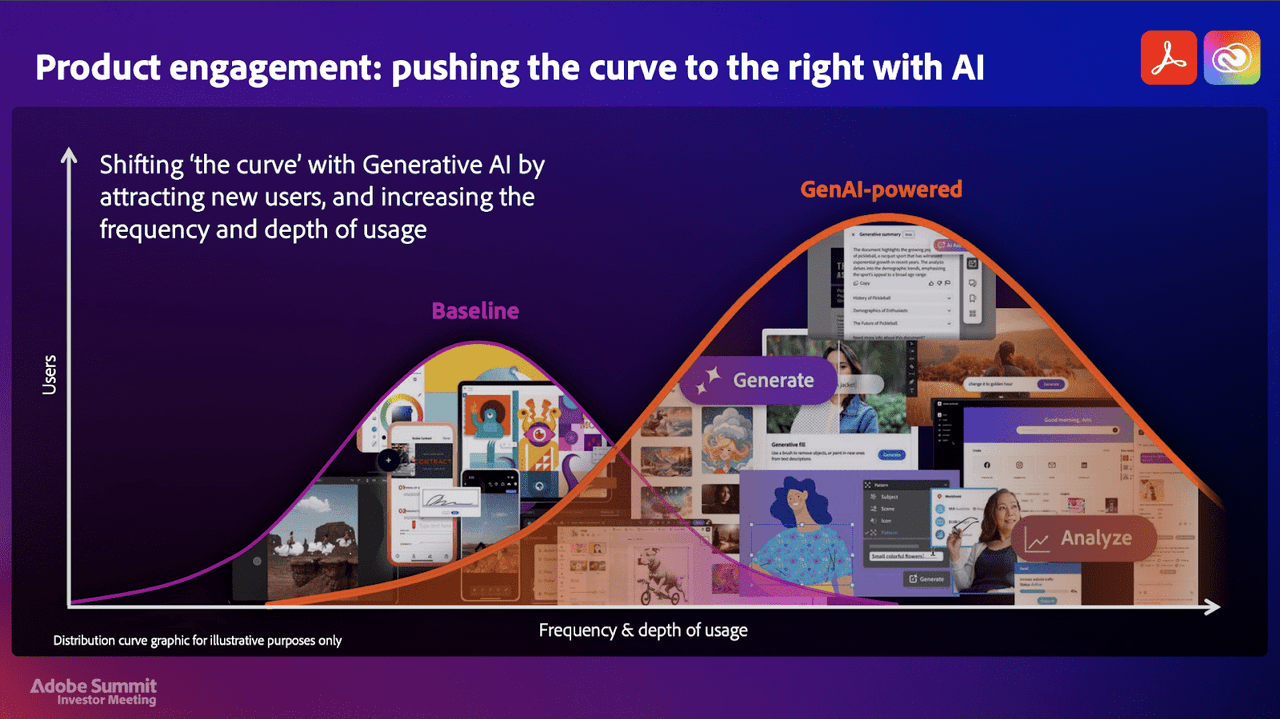

Management believes this explosion in content creation will lead to more seats sold, but it’s not only a matter of seats but also value and engagement. For example, Photoshop subscribers who use AI features have a higher Lifetime Value (‘LTV’):

Photoshop users who use Generative Fill, they utilize the product more, they renew at a higher rate.

Engagement and users going up ultimately means the “curve” moves to the right, which is better for Adobe as it technically leads to lower churn and more subscriptions sold:

Adobe Investor Presentation

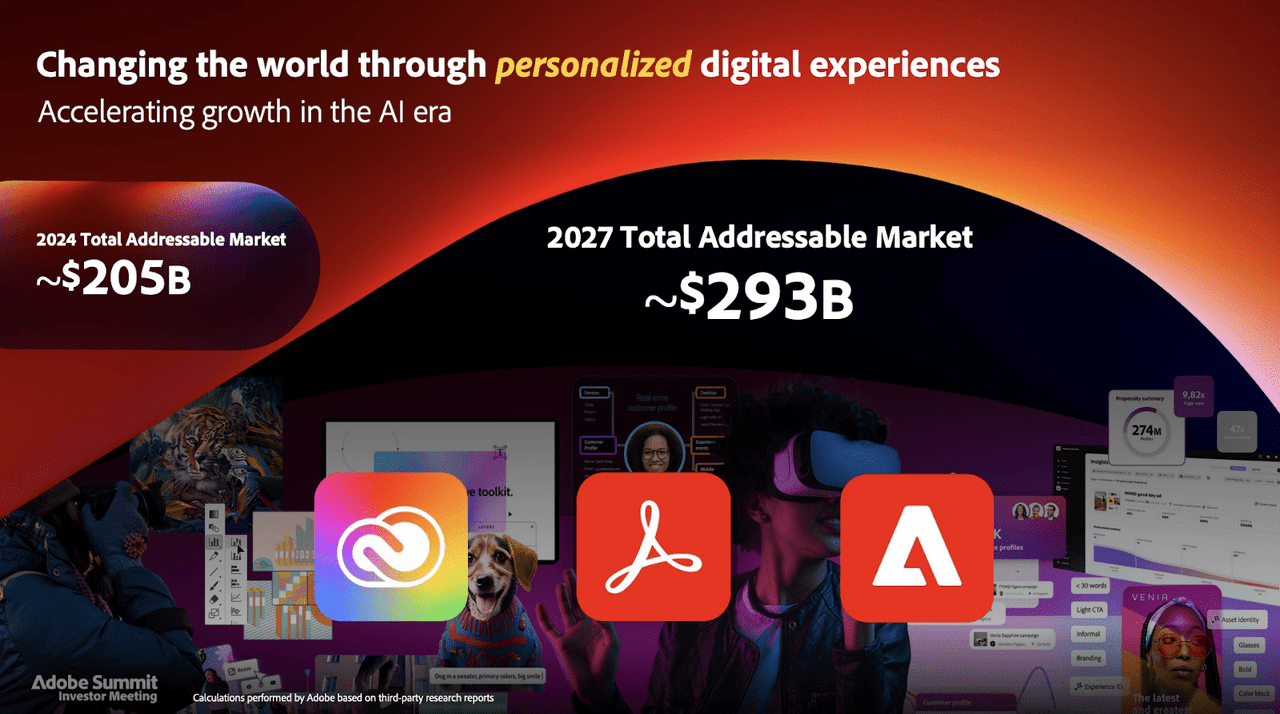

Management believes AI (among other things) will help its TAM grow from $205 billion today to $293 billion by 2027:

Adobe Investor Presentation

I obviously take this TAM with a grain of salt (as always), but I believe this number simply shows that Adobe will not be opportunity-constrained. If the company manages to defend its competitive position, it will probably grow nicely and profitably over the coming years. Will it be able to do this? I am getting increasingly comfortable with a “yes” answer to that question.

The monetization of AI

Another question that’s been on analysts’ minds for a long time is AI monetization. Adobe has experimented with Generative Credits but announced a somewhat change of strategy recently and now seems to have a much better-defined monetization strategy around AI:

The appropriateness of one monetization mechanism may not be across our entire set of products.

This is the summary that I have come up with…

-

Document Cloud: monthly subscription and an additional fee for the conversational interface with PDFs. Management expects monetization here to start this month, and it’s a pretty significant milestone…

It’s the first time that we can actually start to monetize PDF consumption and not just PDF creation or collaboration.

-

Creative Cloud: generative credits and a price-to-value model similar to Intuit’s. Adobe will be able to absorb price increases as AI becomes embedded in the different products.

-

Experience Cloud: price-to-value model tailored to large enterprises. You’ll understand the opportunity here after watching the videos I share below.

The only problem with the impact of AI right now is that it’s not measurable, but management told investors they’ll figure out a way to measure it:

We’re starting to track the contribution of gen AI to growth, and this is something that we have talked about how we start to break out externally.

Some people claim that Adobe is not seeing any impact whatsoever from AI, but this seems like a bad take. The fact that it’s not measurable doesn’t mean there’s no impact. Two examples:

-

“Greater than 30% year over year increase in Photoshop subscriptions” (since generative fill was embedded in the product.)

-

Acceleration in RPOs due to signing large contracts after releasing Firefly services and GenStudio.

We can’t quantify to what extent right now, but AI does seem to be accelerating Adobe’s growth.

Updates on the financial position

Dan Durn, Adobe’s CFO, also gave some updates on the company’s financial position. Here’s what he said:

We believe a net debt-neutral position gives us the right balance between financial flexibility and returning cash to shareholders. And over time, we’d expect to bring cash and debt into a closer balance, with both around approximately $6 billion.

So, what does this mean? In short, Adobe will probably issue some debt to repurchase shares as they believe their financial position is currently too strong. This means the financial position will deteriorate slightly going forward, but this should not be worrying for two reasons…

-

The company will have a net debt of 0

-

The business is very resilient

Where to watch the demos

At the beginning of the article, I promised to share where to watch three crucial videos to build one’s conviction in Adobe. The three videos are the demos that show Firefly Services, GenStudio, and AI Assistant. You can watch all these demos in the video below in the following minutes:

-

Firefly Services: starts in minute 40

-

GenStudio: starts in minute 56

-

AI Assistant: starts in 1h 33 minutes

(Video: Adobe Summit Opening Keynote 2024)

Conclusion

I wanted to end this article by talking briefly about disruption. Many believe AI would disrupt the incumbent, Adobe. While this made sense in essence, Shantanu believes this will not happen because the incumbents own the interfaces where AI will add value:

I do think this is one of those eras where incumbency is an advantage if you innovate at the right pace. I mean I think with every disruptive innovation, I mean there’s an opportunity for the disruptors and there’s an opportunity for the incumbents. I think this one, given the data that we have, given the interfaces that we have, to your point and maybe even Saket’s, I mean there’s a lot of conversation around the models. But where the value really accrues to people is in the interfaces and what you can do with it, which is your first.

But actually like the incumbents in the space because the incumbents have the interfaces.

Something that I had not realized before this Summit is that it’s tough for AI to disrupt Adobe because AI impacts phases where Adobe has never been present:

It’s about generating the video instead of shooting it with the camera. That’s not typically been a business that Adobe has been at. Every time that there’s something that comes out in the AI space that improves the model, that increases the amount of content that’s going to get created, we’re all cheering, whether it comes from Adobe or whether it comes from a third-party model.

Food for thought.

In the meantime, keep growing!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADBE, INTU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Best Anchor Stocks helps you find the best quality stocks to outperform the market with the lowest volatility/growth ratio. We look for top-notch quality compounders, with solid growth and lower volatility than you would expect.

Best Anchor Stocks picks have a track record of revenue growth combined with below-average volatility. Since the inception in January 2022, our portfolio has generated a MWR (Money Weighted Return) of 48%, or what’s the same: a 21,7% MWR CAGR. This compares against a MWR of around 7% for the S&P 500.

There’s a 2-week free trial, so don’t hesitate to join Best Anchor Stocks now!