Summary:

- Adobe Inc.’s Digital Media segment, including Creative Cloud and Document Cloud, has industry leadership featuring a rich software portfolio and dominance in the PDF reader market.

- The impact of AI on the creative software market is significant, with generative AI creating new revenue streams and cutting out traditional subindustries.

- Adobe continues to build its strengths that include a broad product portfolio, ample resources, and AI development, preserving the company’s lead in the creative software market.

hapabapa

In our previous analysis of Adobe Inc. (NASDAQ:ADBE), we assessed Adobe’s Digital Media segment, encompassing Creative Cloud and Document Cloud. We highlighted Creative Cloud’s industry leadership, feature-rich software portfolio, and PDF reader market dominance fueled by a substantial user base (41% of global devices) that drives premium subscriptions. Additionally, we recognized Adobe’s scalability, stemming from its robust branding and industry standing.

In this analysis, our focus shifts to assessing Adobe’s position in the creative software market. To begin, we examined the creative software landscape, identifying key competitors and breaking down market share. We also examined the growing impact of AI on creative software and its influence on the industry’s value chain. Adobe itself highlighted its AI developments in its latest earnings briefing where AI was mentioned a total of 41 times. We evaluated Adobe’s strengths as well as its AI developments, comparing them to those of its rivals to gauge its competitiveness. Finally, we projected the company’s market share and growth trajectory in the creative software market factoring in our comparison of the company’s AI capabilities.

Impact of AI on the Creative Software Market

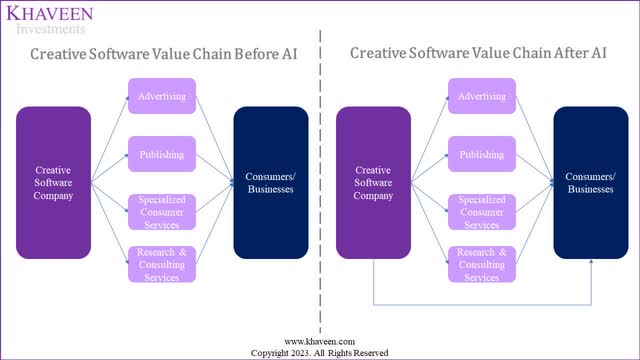

According to Noble Desktop, Adobe’s creative software products are used by advertising professionals “responsible for creating marketing materials, such as brochures, advertisements, infographics, videos, and social media content, among much more,” classified under the Advertising subindustry in GICS. Also, the company caters to the Research & Consulting Services subindustry which includes marketing services and marketing professionals using Adobe’s products. Furthermore, the Publishing subindustry also uses the company’s products “that makes digital or printed information such as literature, music, or software available for public consumption.” Adobe products are also used for interior design under the Specialized Consumer Services subindustry.

Company Data, Statista, SignHouse, Petapixel, MLYearning, Photutorial, Khaveen Investments

|

Adobe Market Share ($ mln) |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

|

Adobe |

4,174 |

5,343 |

6,482 |

7,736 |

9,550 |

10,459 |

|

Adobe Share |

28.5% |

34.2% |

40.0% |

47.4% |

54.5% |

57.0% |

Source: Company Data, Statista, Khaveen Investments.

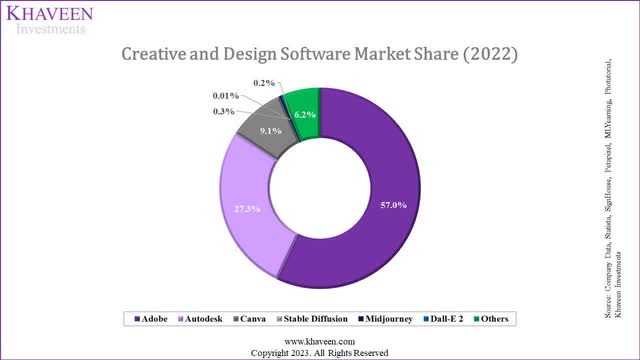

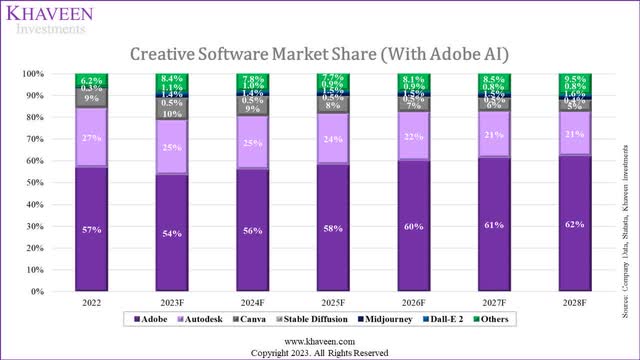

We derived our market share chart of the creative and design software market above. In 2022, the creative software market was dominated by Adobe, holding a commanding 57% market share. Furthermore, Adobe’s market share surged from 28.5% in 2017 to 57% in 2022. Autodesk (ADSK) followed as a notable competitor with a 27.3% market share. Canva also had a significant presence with a 9.1% share. However, smaller AI players such as Stable Diffusion, Midjourney, and Dall-E 2 held relatively low market shares at 0.01%, 0.3%, and 0.2% respectively. The remaining 6.2% of the market was distributed among various other creative software companies.

According to Razorfish, generative AI will have a significant influence on the field of digital advertising. For example, generative AI can be used to create compelling and attractive advertisements, including video ads and product demonstrations. Furthermore, generative AI in marketing enables businesses to produce lifelike product images for “online stores, social media, and marketing materials.” Moreover, companies can also develop “visual branding of materials like logos.” Authors can also use generative AI to make book covers instead of having publishers design the covers for them. Furthermore, generative AI can be used in interior design, as it “can help homeowners save money on design costs by quickly generating a wide range of design options.” Therefore, in our value chain, we believe creative software with generative AI enables companies to directly target consumers and businesses and cut out the middlemen which are traditional advertising, publishing, marketing and interior design services, thereby creating a new revenue stream for creative software companies at the expense of the traditional subindustries.

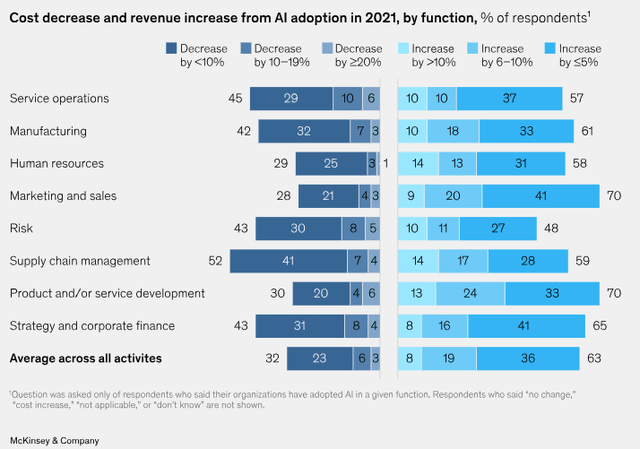

Based on the chart above by McKinsey of the breakdown of the cost savings and revenue increase due to AI adoption for each business function, AI adoption has contributed to cost savings and revenue increase for businesses across various functions. Specifically, we believe the marketing function benefits directly from design generative AI tools as discussed in our value chain above. According to McKinsey, 28% of businesses surveyed reported a decrease in costs for marketing and sales functions. Based on the chart, we derived weighted average cost adjusted for range and skewness translating to a decrease of 12% which would represent the net cost savings for companies due to the adoption of AI.

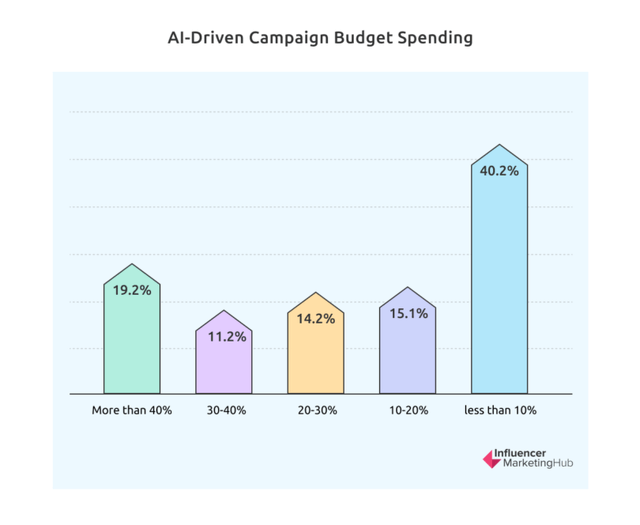

For the amount of spending on AI by companies, according to Influencer Marketing Hub, 19.2% of respondents allocated more than 40% of their marketing budget to AI-driven campaigns, while 11.2% dedicated 30 to 40%, 14.2% allocated 20 to 30%, and 15.1% spent 10 to 20%, while the remaining 40.2% of respondents allocated less than 10% of their marketing budget in AI-related initiatives. Based on this data, we derived a weighted average spending on AI for marketing adjusted for range and skewness of 23.7%.

According to Statista, the creative and design software market is projected to grow to $21.95 bln by 2028 from $18.35 bln in 2023, representing an average forward growth rate of 3%. However, we believe this does not reflect the positive growth outlook of the creative software market with AI creating new revenue streams for companies such as Adobe.

Statista, IMF, Forbes, HBR, Gartner, Khaveen Investments

To forecast the market growth of the creative software market with AI, we first projected the total estimated revenue of companies globally of $103.73 tln and its growth based on the GDP growth rate forecast of 2.7%. Moreover, we applied an average marketing spending % of total revenue of 12.1% assumption based on HBR to calculate the total marketing spending of all companies. As discussed above, we calculated the total marketing spending factoring in cost savings from AI of a weighted average of 12% as mentioned above.

Additionally, we estimated the total marketing spending on creative software by multiplying the total marketing spending factoring cost savings with the % of creative of total productivity software excluding administration software (31.4%) from Statista, the software spending % of total IT spending (68.2%) and the average share of IT spending of companies of total revenue (8.2%). Based on this, we calculated a total market opportunity of $24.43 bln by 2028 which we added to the creative software market forecast and derived a new average forward growth rate of 16.7%, which is higher by 13.7%.

We curated a value chain of creative software companies such as Adobe in the chart above. We believe that the advent of generative AI for creative software could create new revenue stream opportunities for companies such as Adobe by catering to consumers and businesses directly instead of targeting their traditional customers in sub-industries such as Advertising, Publishing, Specialized Consumer Services and Research & Consulting Services.

Company Data, Statista, Khaveen Investments

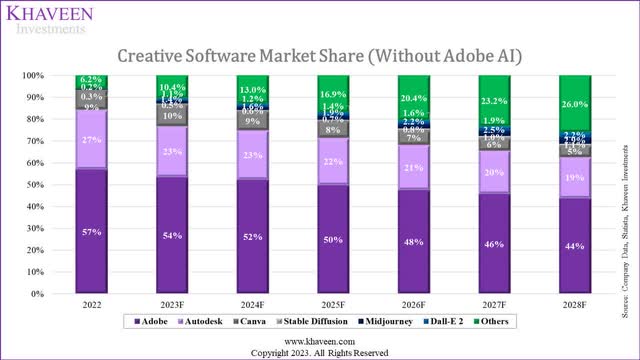

Furthermore, we projected the market share of the creative software market in the chart above without factoring in Adobe’s AI. For Adobe and Autodesk, we based its growth on the company’s rolling 3-year average past growth rate. Additionally for the AI companies, we estimated their 2023 revenues based on their user base in 2023 from various sources online and projected their growth beyond 2023 on the AI art generator market forecast CAGR of 35% by Infinity Business Insights. Thus, we estimated Adobe’s market share to decrease from 57% to 44% through 2028 based on its historical growth rate. On the other hand, we see AI companies such as Stable Diffusion, Midjouney, and Dall E-2 as well as companies in the Others category increasing their market share.

Can Adobe Maintain Its Lead in Creative Software?

In the first point, we highlighted the growth outlook of the creative software market supported by AI and that we see Adobe losing market share against AI creative software companies. At this point, we examined whether Adobe could maintain its market leadership in the creative software market.

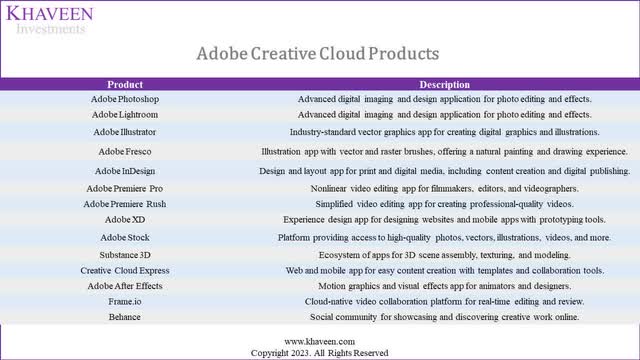

Broad Product Portfolio

One of the strengths of Adobe is its broad portfolio of creative software suite. Based on its annual report, we compiled the company’s 14 creative software products in the following chart below.

Company Data, Khaveen Investments

More Resources

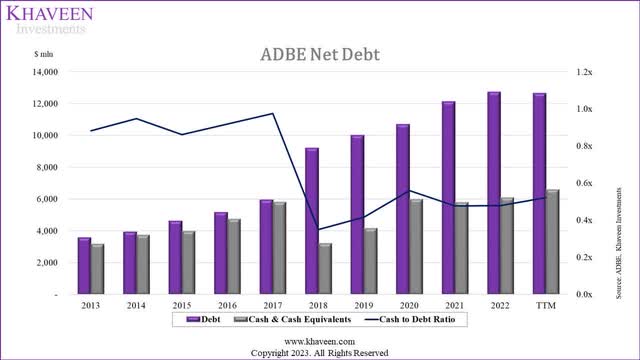

In comparison to other AI companies, Adobe is the largest creative software company with a significantly large market share of 57% with $10.5 bln in revenues in the market which is 209x larger compared to Midjouney’s $50 mln revenue in 2022.

Company Data, Khaveen Investments

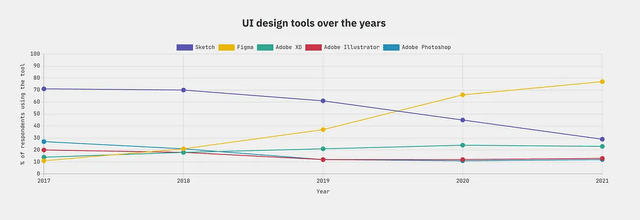

Based on the chart above of the company’s cash and debt, the company maintains a substantial cash balance of $6.6 bln in the TTM, thus we believe demonstrates its large resources to support its growth. For example, in 2022, the company announced its plans to acquire Figma for about $20 bln in a cash and stock combination, aiming to expand its market presence.

Furthermore, according to UX Design in the UI design tools market, Figma has surpassed Sketch as the leader in terms of usage, with Figma rising from 45% in 2020 to 77% in 2021. Figma also has revenues of over $400 mln by the end of 2022.

Adobe AI Developments

Furthermore, from the company’s latest earnings briefing, the term “AI” was mentioned a total of 41 times, highlighting the significance the company’s management is placing on it. We highlighted the company’s AI developments in creative software below which include:

- Adobe Firefly: A family of generative AI models integrated into Adobe products, using open-licensed images to transform text descriptions into AI-generated visuals and effects, with applications ranging from design to video editing.

- Generative Fill in Photoshop: Incorporates Firefly’s AI capabilities, allowing users to manipulate images non-destructively using text prompts, with plans for wider integration across Adobe’s Creative Cloud ecosystem.

- Adobe Sensei: An AI technology that improves content comprehension and efficiency in tasks such as image recognition, tagging, subject extraction, text summarization and document analysis.

Overall, we believe Adobe’s strengths include the company’s broad portfolio of creative software products as highlighted above as well as its superior scale and resources compared to the emerging AI software companies as reflected by its dominating market share and huge cash balances which enabled the company to acquire Figma. Moreover, the company has launched several AI developments that enable the company to compete against the new AI companies that we examined below.

Adobe Creative Software AI Comparison with Competitors

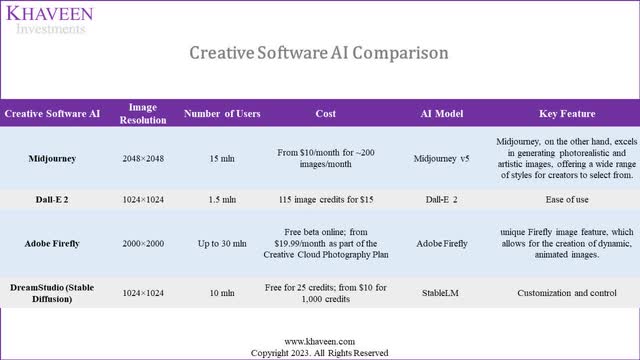

Furthermore, we compared Adobe’s AI with the top AI companies including Midjourney, Dall-E 2, Adobe Firefly and DreamStudio below in terms of image quality (resolution), popularity and reach (user base), pricing and AI models to determine which creative software AI stands out among competitors.

Based on the table above, Midjourney offers an impressive image resolution of 2048×2048 and has a substantial user base of 15 mln. Its pricing starts from $10 per month for approximately 200 images. According to PC Guide, Midjourney has a strong capability in producing lifelike and artistic images.

On the other hand, Dall-E 2 provides a slightly lower image resolution of 1024×1024 but is known for its ease of use according to Zappier. With 1.5 mln users, it is priced based on image credits of 115 image credits for $15.

Adobe Firefly offers an impressive image resolution, only lagging behind Midjourney, of 2000×2000 and is integrated with its Creative Cloud which has a large user base of up to 30 mln users. It stands out with its “unique Firefly image feature,” allowing users to create dynamic and animated images. The tool offers a free beta online version and a paid option starting at $19.99 per month as part of the Creative Cloud Photography Plan which sets it apart from competitors despite its high monthly subscription but offers unlimited image generation and also access to Adobe’s broad product suite.

DreamStudio (Stable Diffusion) may have a lower image resolution at 1024×1024, but it caters to a substantial user base of 10 mln. It offers a free option with 25 credits and a paid option starting at $10 for 1,000 credits. DreamStudio is known for its customization and control features.

In conclusion, Midjouney stands out with high-resolution images and a range of artistic styles. Dall-E 2 offers simplicity while Adobe Firefly stands out with its dynamic image creation feature and integration with its Creative Cloud suite of software products which offers superior value compared to competitors despite its higher monthly subscription cost.

|

Ranking |

Image Resolution |

Number of Users |

Cost |

AI Model |

Average |

Factor Score |

|

Midjourney |

1 |

2 |

3 |

1 |

1.8 |

1.14 |

|

Dall-E 2 |

3 |

4 |

4 |

3 |

3.5 |

0.57 |

|

Adobe Firefly |

2 |

1 |

1 |

2 |

1.5 |

1.33 |

|

DreamStudio (Stable Diffusion) |

3 |

3 |

2 |

3 |

2.8 |

0.73 |

*Factor Score = 1/(Average/2)

Source: Khaveen Investments.

We ranked these companies based on our comparison table above. For image resolution, we ranked Midjourney as the first due to its superior image resolution with Adobe Firefly trailing behind and Dall-E 2 and DreamStudio tied. Furthermore, we ranked Adobe at the top in terms of the number of users as the company already has an installed base of 10 mln users on its creative cloud product suite and Adobe Firefly is integrated with it. This is followed by Midjourney, DreamStudio and Dall-E 2 with the next greatest number of users.

Furthermore, in terms of cost, we ranked Adobe Firely as the top despite its higher monthly subscription cost as it is the only plan that provides unlimited image generation compared to competitors who use a credit system, thus we believe Adobe offers superior value in addition to access to its broad suite of creative software. This is followed by DreamStudio with the highest image credit per dollar as well as Midjourney and Dall-E 2. Finally, we ranked Midjourney’s AI model as the best compared to competitors due to its superior image quality followed by Adobe Firefly which trails behind with slightly lower image quality and animation features. Finally, we ranked Dall-E 2 and DreamStudio tied with similar image quality.

Overall, we ranked Adobe Firefly as the top creative AI software followed by Midjouney, DreamStudio and Dall-E 2. Additionally, we projected the company’s revenue growth in the creative software market by deriving a growth factor based on our comparison ranking of these companies on our derived market forecasts as discussed above. Based on the table, we derived a growth factor of 1.33x for Adobe as it has the highest average ranking among competitors.

Company Data, Statista, Khaveen Investments

All in all, we projected Adobe’s creative cloud revenue growth based on our creative software market growth forecast beyond 2023 multiplied by a growth factor of 1.33x but tapered down by 1% per year, for an average forward growth rate of 20.3% and in line with the company’s past 5-year average growth. Additionally, we see the market share of the other companies rising through 2028 with the entry of new creative AI software at the expense of traditional players such as Autodesk and Canva.

|

Adobe Market Share Forecast |

2023F |

2024F |

2025F |

2026F |

2027F |

2028F |

|

Without AI |

53.5% |

52.3% |

49.8% |

47.6% |

45.8% |

43.9% |

|

With AI |

53.5% |

56.1% |

58.3% |

60.0% |

61.4% |

62.2% |

|

Difference |

0.0% |

3.7% |

8.4% |

12.4% |

15.5% |

18.3% |

Source: Khaveen Investments.

In comparison with our market share forecast before factoring in Adobe’s AI developments and competitiveness in our first point, we projected the company’s market share to increase as much by 18.3% by 2028 due to its AI capabilities and its market share leadership to remain firm unlike in the market share projection without AI where we forecasted its share to decrease in that scenario.

Risk: Rise of AI Competitors

While we expect the company’s competitiveness to remain supported by its competitive strengths, we believe the rise of greater AI competitors could pose a threat to the company. These AI tools only launched recently in the past years such as Midjourney in 2022 and Dall-E in 2021. Given the low capital requirements and barriers to entry into the software industry, we believe more emerging competitors could enter the market. This is reflected in our market share projection where we expect the share of companies in the others category to increase from 6.2% to 9.5% by 2028. Besides that, larger competitors have also launched AI art tools integrated with other software applications. In our recent analysis of Microsoft (MSFT), we highlighted that Microsoft’s AI tool, Microsoft Designer, which launched in 2023, incorporates OpenAI’s DALL-E2 model, competing with Adobe Express and its Adobe Firefly AI engine.

Valuation

|

Revenue Segments ($ mln) |

2022 |

2023F |

2024F |

2025F |

2026F |

|

Digital Media |

12,842 |

14,176 |

16,973 |

20,212 |

23,938 |

|

Growth (%) |

11.48% |

10.38% |

19.73% |

19.08% |

18.44% |

|

Digital Experience |

4,422 |

4,957 |

5,557 |

6,229 |

6,983 |

|

Growth (%) |

14.26% |

12.1% |

12.1% |

12.1% |

12.1% |

|

Publishing and Advertising |

342 |

296 |

256 |

221 |

192 |

|

Growth (%) |

-13.5% |

-13.5% |

-13.5% |

-13.5% |

-13.5% |

|

Total |

17,606 |

19,429 |

22,786 |

26,663 |

31,113 |

|

Total Growth % |

11.5% |

10.4% |

17.3% |

17.0% |

16.7% |

Source: Company Data, Khaveen Investments.

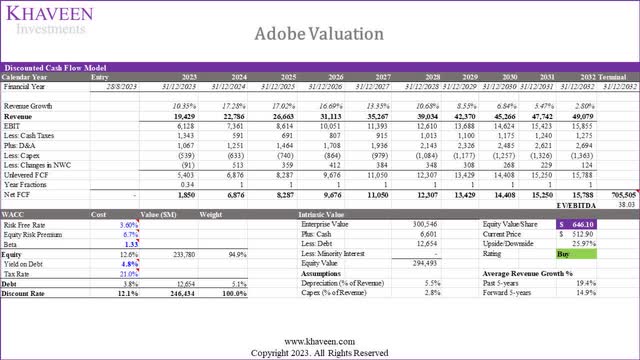

We updated our projection of the company’s revenue based on its segments. For the Digital Media segment which is broken into its Creative Cloud and Document Cloud, we projected its Creative Cloud segment based on our software market projections as discussed above. Moreover, we forecasted its document cloud based on its historical average growth and its Digital Experience based on the CRM market forecast CAGR of 12.1%. In total, we derived a forward average growth of 14.9% for its total revenue.

Based on a discount rate of 12.1% (company’s WACC) and terminal value based on its 5-year average EV/EBITDA of 38.03x, we obtained an upside of 26%.

Verdict

In summary, we anticipate that the emergence of generative AI in creative software could open up new revenue opportunities for companies like Adobe catering directly to consumers and businesses instead of solely targeting traditional professional customers. We estimated a total market opportunity of $24.43 bln by 2028, which we integrated into the creative software market forecast. This results in a new average forward growth rate of 16.7%, surpassing the base market forecast growth rate by 13.7%.

Regarding Adobe, we believe the company boasts several strengths. These include a wide-ranging portfolio of creative software products, significant scale, abundant resources, dominant market share, substantial cash reserves, and strategic acquisitions like Figma. Furthermore, Adobe has introduced several AI advancements that position it as a formidable competitor against emerging AI software companies. Our comparison with competitors leads us to conclude that Adobe stands out as the superior company overall, given its commendable image quality and a massive user base, which we believe it can leverage with its product diversity. Consequently, we’ve projected a 5-year forward average growth rate of 20.3% for Adobe’s creative software revenues, solidifying its position as the market leader through 2028.

Based on our updated discounted cash flow, or DCF, analysis, we obtained an upside of 26% with a price target of $646.10, which is lower compared to our previous analysis of $692.17 due to a lower EV/EBITDA of 38.03x based on the company’s 5-year average compared to 54.61x previously, thus we rate the company as a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADBE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No information in this publication is intended as investment, tax, accounting, or legal advice, or as an offer/solicitation to sell or buy. Material provided in this publication is for educational purposes only, and was prepared from sources and data believed to be reliable, but we do not guarantee its accuracy or completeness.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.