Summary:

- The market once feared that Adobe would be a victim of generative AI, but no more.

- Adobe was one of the few software companies to post a “beat and raise” quarter, as generative AI has proven to be a resilient tailwind.

- I see the company posting market-beating growth from annual top-line growth and the earnings yield.

Frazao Studio Latino/E+ via Getty Images

Adobe (NASDAQ:ADBE) appears to be reclaiming its position as a generative AI beneficiary, after Wall Street appeared to briefly view it as a potential generative AI victim. The company was one of the few software names to post a “beat and raise” quarter, indicating that it might not be seeing the same pressure as peers – many customers had otherwise been showing increased IT scrutiny. ADBE remains a highly profitable cash cow and maintains a strong net cash balance sheet. With the growth outlook looking as strong as ever, the valuation is looking quite compelling here. I reiterate my buy rating for the stock.

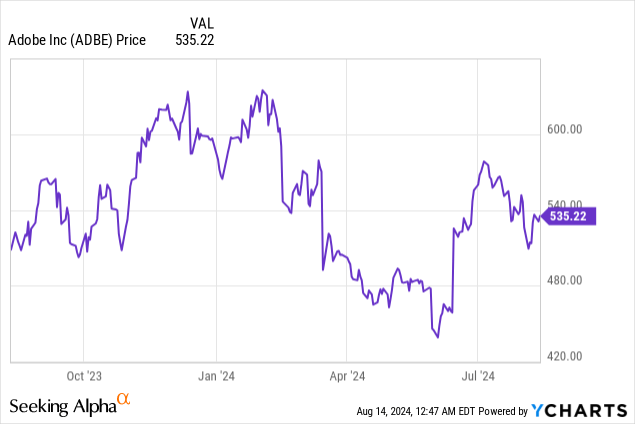

ADBE Stock Price

I last covered ADBE in May, where I explained why I was upgrading the stock on valuation.

The stock has performed strongly after posting solid earnings results, as well as showing that valuation is not the only thing going for this bullish thesis.

ADBE Stock Key Metrics

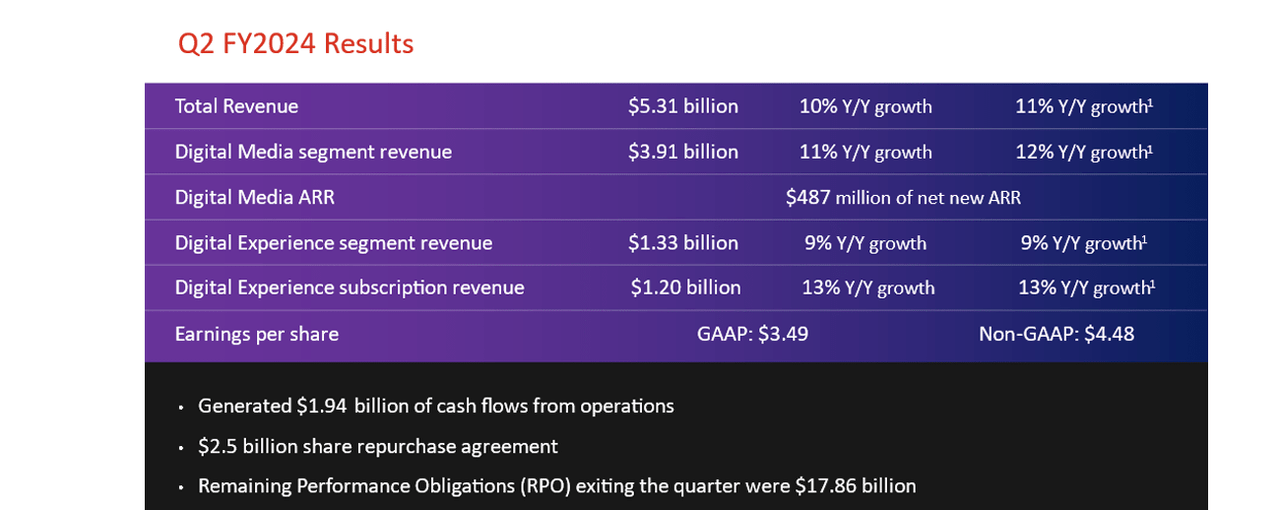

In the most recent quarter, ADBE posted 10% YoY revenue growth to $5.31 billion, surpassing guidance for between $5.25 billion to $5.3 billion. The company generated $487 million of digital media net new ARR, surpassing guidance for $440 million – Wall Street had previously been concerned about slowing ARR growth. On the profitability front, ADBE posted $4.48 in non-GAAP EPS, surpassing guidance for between $4.35 to $4.40.

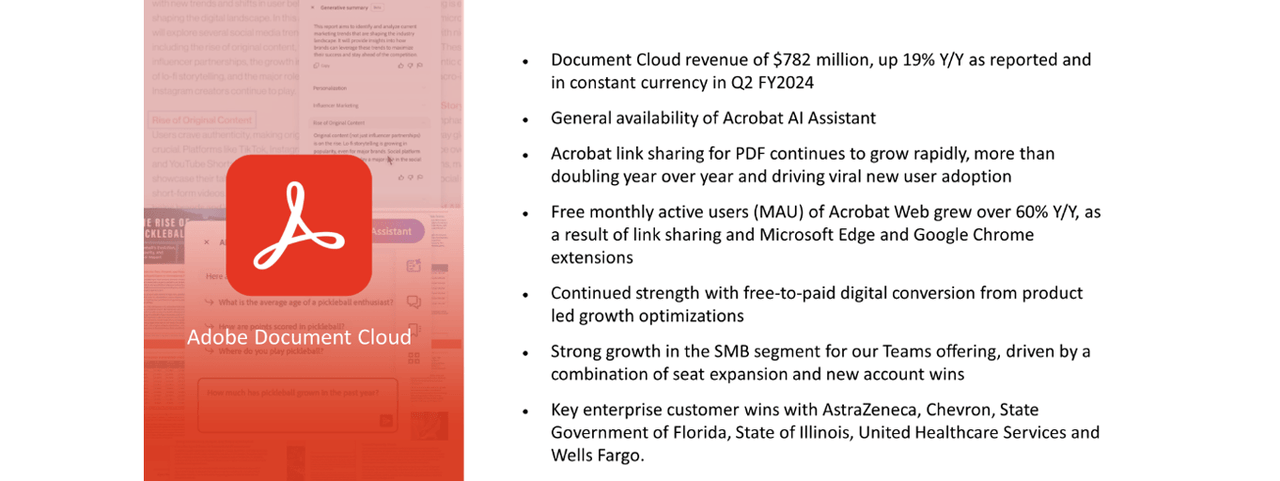

The company is known for having a wide portfolio, and it posted solid growth across all of its core businesses, though its smallest segment in Document Cloud remains the fastest grower, with revenues growing 19% YoY to $782 million. Some readers might point out that there are many tech peers that are posting faster top-line growth rates, but with a company like ADBE, one should instead focus on the company’s uncanny ability to sustain double-digit growth in spite of such a large revenue base all while generating enviable profit margins.

ADBE ended the quarter with $8.07 billion of cash versus $5.6 billion of debt, representing a bulletproof net cash balance sheet. Given the company’s high profitability, I would not be surprised to see it eventually take on net leverage in the future (helping to fund an accelerated share repurchase program).

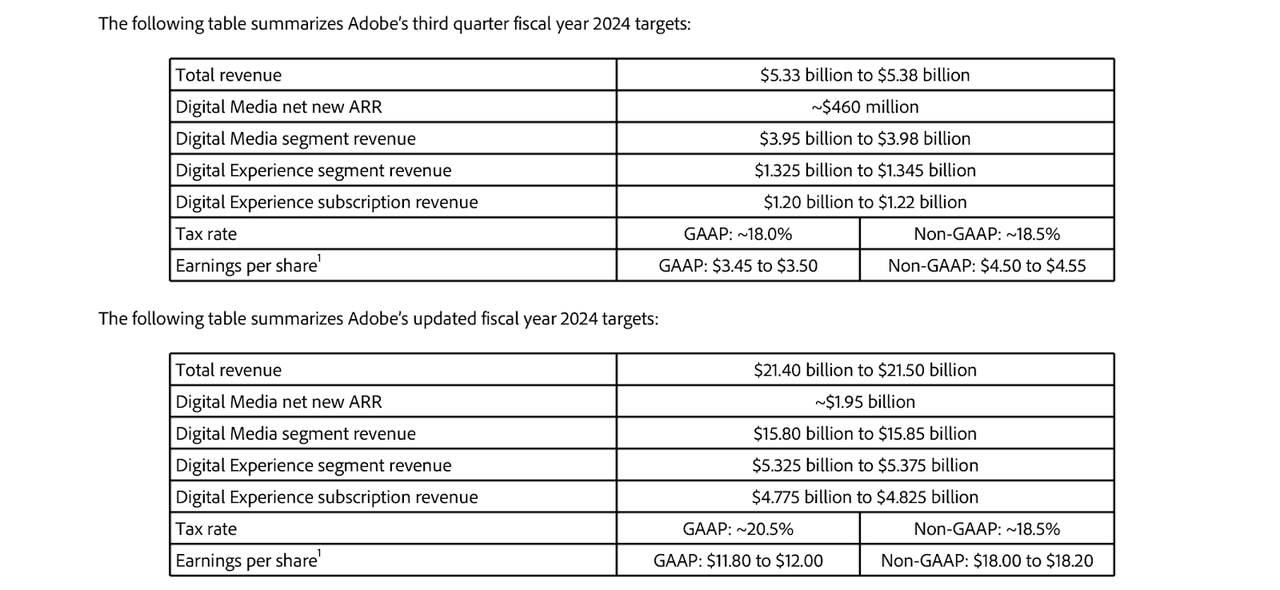

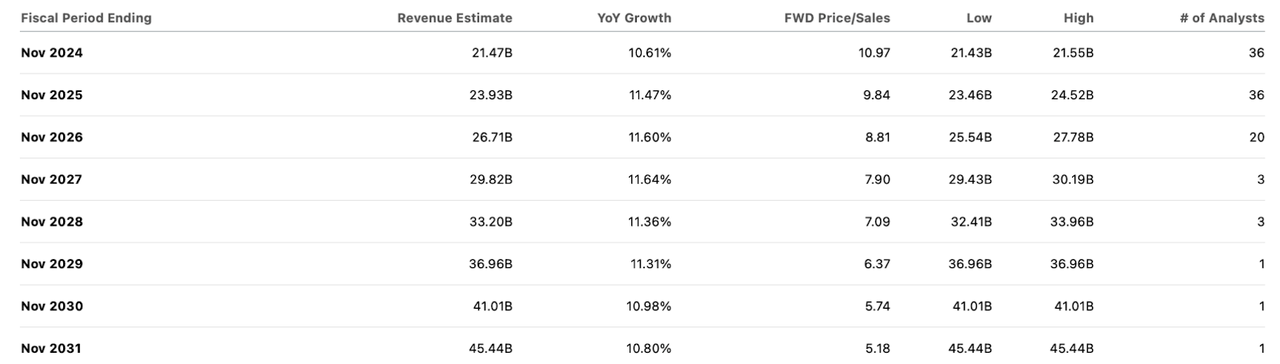

Looking ahead, management has guided for up to $5.38 billion in revenue in the third quarter, representing 12.1% YoY growth (and crucially, some sequential acceleration). Management also slightly increased the lower end of the full-year revenue guidance from $21.3 billion to $21.4 billion. While that represents just a slight increase to full-year guidance, it should be noted that Wall Street had previously appeared of the view that the guidance was too aggressive (these fears seem to have been dispelled).

On the conference call, management noted that remaining performance obligations grew 17% YoY to $17.86 billion, with current RPO growing 12%. These are strong results which may imply that the company can sustain double-digit growth rates at least over the next year. Management credited their strength as being due in part to their successful rollout of generative AI products like Firefly. I (and likely many other investors) had previously been of the view that generative AI may help competitors by narrowing the competition. Instead, management cites Firefly as helping to both win new users as well as increasing retention rates. I am reminded of the business reality that there’s more to successful sales than just the functionality or product itself – just because the competition might be able to use generative AI to narrow their functional gap does not mean that they would have addressed the other factors like name brand, customer documentation, etc. After more than a year since the rise of generative AI, it is looking like a story told many times over: the strong just keep getting stronger. As one analyst succinctly put it on the call, Adobe embraced its prior pivot to the cloud to become a tech leader and appears to be doing it once again with generative AI.

Is ADBE Stock A Buy, Sell, or Hold?

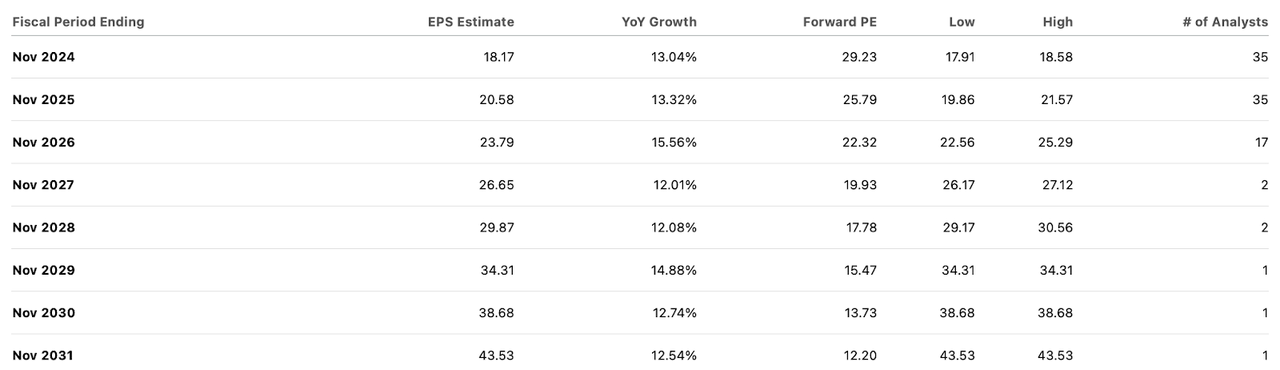

Given the company’s resilient fundamentals, some might find it fortunate to see the stock trading at attractive valuations. ADBE was recently trading hands at just under 30x earnings.

The stock commands some premium to tech peers at a 11x sales multiple, but that premium looks easily justifiable due to the mature profitability profile.

The way I see it, ADBE is a world-class business with a highly recurring revenue stream. The company’s ability to sustain elevated top-line growth year-after-year as well as its net cash balance sheet should at least justify a 30x to 35x earnings multiple. I based that view on the fact that there are a plethora of blue-chip companies in the S&P 500 that trade in the 20x to 27x earnings range in spite of slower growth rates and highly leveraged balance sheets – Waste Management (WM) and Coca-Cola (KO) come to mind. That means that between the 10% forward revenue growth rate and 3% earnings yield, the stock looks primed to deliver at least 13% annual returns moving forward, even assuming no multiple expansion or operating leverage. I view this to be a highly satisfactory value proposition given the company’s dominant market positioning and strong financial profile.

ADBE Stock Risks

While the stock looks poised to deliver solid double-digit returns from here, it is admittedly difficult to make a case for substantial multiple expansion. That may mean that the stock may see some volatility in the event of a market downturn, especially if we see a repeat of the 2022 crash in tech stocks. While I am of the view that the just-mentioned tech crash had a sort of “educational” value to investors by showing the resilience of the revenue generation and operating leverage of the tech sector, it is possible that such a view might fade over time. It is also possible that my initial fear about disruption from generative AI may end up resurfacing in the future. I think the biggest near term risk is that consensus estimates look aggressive – I am doubtful that the company can sustain double-digit revenue growth indefinitely without consistent deceleration from the law of large numbers. I am of the view that the stock price is still justified even accounting for this anticipated deceleration, but it is possible that the stock still trades with volatility due to some initial disappointment.

ADBE Stock Conclusion

In some sense, ADBE is not doing anything it hasn’t done in the past. Executing on strong results is certainly not new to this company, but perhaps it is more than enough in the current environment. The company remains a cash generating machine and is somehow still sustaining double-digit revenue growth. I can see the stock delivering double-digit returns from here, given the high quality of its business model. I reiterate my buy rating for the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADBE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!