Summary:

- Despite Adobe’s vast software suite and successful SaaS model, its growth has stagnated, leading me to downgrade the stock to neutral.

- Adobe’s AI launch, Firefly, has not accelerated growth as expected, raising concerns about its ability to compete in the AI-driven market.

- Macroeconomic pressures and potential AI competition threaten Adobe’s market share, particularly among individual and small business customers.

- Q3 earnings showed modest growth, but Adobe’s guidance for Q4 ARR is underwhelming, and its margins have remained flat despite industry-wide cost-cutting trends.

- The stock remains expensive at a ~28x forward P/E ratio and is susceptible to a correction.

gorodenkoff

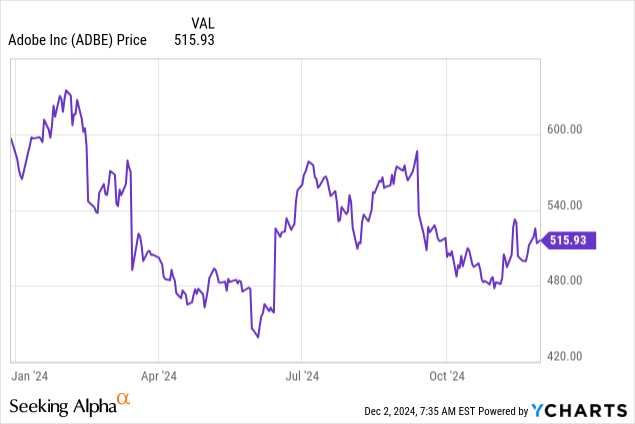

Though the risk-on attitude that has emerged in the back half of 2024 has lifted the stock market to new all-time highs, not every major growth stock has been a beneficiary. Investors still seem to be chasing companies with true AI tailwinds, and distinguishing from those that have purported to release AI features but are mostly just paying lip service to the buzzword.

Against this backdrop, Adobe (NASDAQ:ADBE) has been punished this year. The software portfolio company, maker of ubiquitous tools like PDFs and Photoshop, has seen its share price slide by more than 10% this year, underperforming the S&P 500 by more than 30 points. The core question for investors now is: is Adobe due for a rebound, or will losses continue?

I last wrote a bullish note on Adobe in January, when the company was trading closer to $600 per share. Since then, I’ve lost on my position while the rest of the market has gained. At the time, I had believed that the company would be able to materially outperform its own guidance for FY24; but in reality, in spite of the company’s major AI launch in Firefly, growth has continued to decelerate while margin progress has stagnated. I am losing patience with Adobe and am downgrading the stock to neutral. In my view, Adobe will be stuck in a range-bound pattern for the near term, and no longer has a wide opportunity to outperform the S&P 500.

At current share prices, I see a more balanced bull-and-bear thesis for Adobe. On the one hand, I still see the following positives for the company:

- Vast suite of software products to cater to all creative needs. From flagship core products like Photoshop and Acrobat to newer tools like Firefly, Adobe’s far-ranging suite of software products suits both individual and enterprise needs.

- Successful shift to a subscription-based model that extracts higher lifetime value from loyal customers. Adobe made the switch to a SaaS model several years ago, and the company now generates over $15 billion in ARR – or roughly three-quarters of its annual revenue.

At the same time, however, I’m concerned about the following measures:

- Will AI do away with much of Adobe’s clientele? Adobe’s fiercest customer base is creatives that use Adobe’s tools to produce documents and edit their work. AI models from competing companies, meanwhile, have already started to latch on to image-generating and image-editing features. If Adobe Firefly is perceived to be lagging in this space, Adobe could lose considerable market share entirely.

- Macroeconomic pressures – Adobe also counts a large number of individuals and small businesses as customers, as well as those who use Adobe products for leisure. Amid a continued macroeconomic crunch in an inflation-weary environment, more and more people could be on the lookout to cut unneeded spending.

All in all, I think it’s best to move to the sidelines here and invest elsewhere.

Q3 Download

The big concern with Adobe is the fact that its growth rates have stubbornly clung to the ~10% range. While it’s true that we can’t expect Adobe to continue growing at a +20% pace as it did in the earlier wake of the pandemic, we also have to wonder: if Adobe’s growth is slowing, does it deserve the same valuation premium as it has always had?

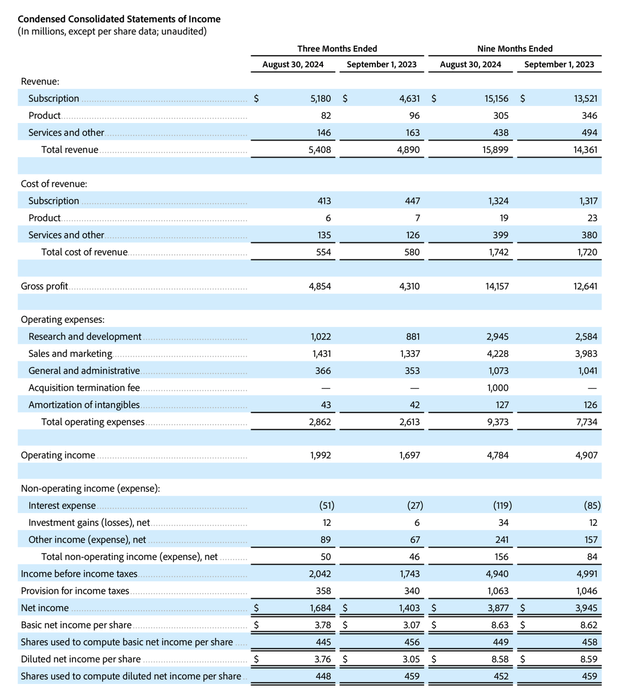

The Q3 earnings summary is shown below:

Adobe Q3 results (Adobe Q3 earnings release)

Adobe’s revenue grew 11% y/y to $5.41 billion, which did slightly beat Wall Street’s expectations of $5.37 billion (+10% y/y) by a one-point margin. However, we note that Adobe grew at a ~10% clip in 2023 as well, and the company had been positioning AI and Firefly as a major driver for acceleration: which hasn’t happened yet.

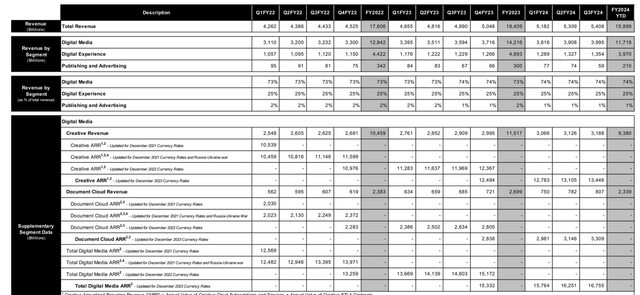

Further concerns follow in the company’s ARR buildup – and more specifically, how it’s guiding to ARR for the next quarter. In Q3, as shown in the chart below, the company added $504 million of net new Digital Media (all in) ARR. This compares favorably with adding $464 million in ARR in the year-ago Q3.

There are still some bright spots here. Document Cloud, though a small chunk of Adobe’s ARR, is growing at an 18% y/y clip, and added $25 million of net new ARR in Q3. We note that Adobe has been able to continue taking market share from struggling Docusign (DOCU), whose growth has fallen to the high single digits this year.

Adobe ARR trends (Adobe Q3 earnings release)

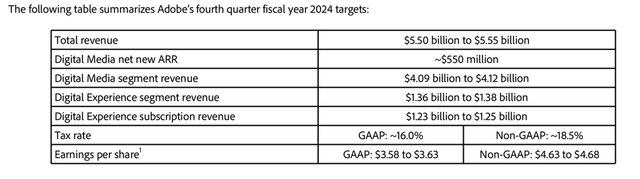

We are concerned, however, about the fact that the company is only signaling $550 million of net new ARR in the fourth quarter, as shown in the chart below:

Adobe outlook (Adobe Q3 earnings release)

This would be 3% lower than the $569 million of net new ARR that the company added in the preceding Q4 (and at its larger scale, Adobe has to keep adding more net new ARR to keep up its growth rates). Again, we have to pose the question: when will Adobe be able to show a growth advantage from its AI release?

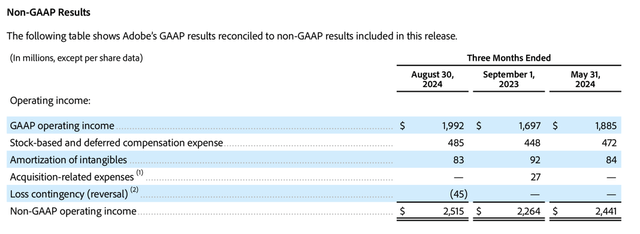

We note as well that in a year in which many companies have aggressively focused on cost-cutting and raising margins, particularly even tech companies that were stalwart on “growth at all costs” like Salesforce.com (CRM), Adobe’s margins haven’t budged much. The company generated $2.52 billion in pro forma operating income in Q3 – at a high 46.5% margin, but basically unchanged from 46.3% in the year-ago quarter.

Adobe operating income (Adobe Q3 earnings release)

Valuation And Key Takeaways

To me, it seems that not only has Adobe’s growth engine sputtered with minimal incremental growth from AI, but its capacity to expand its profitability has also slowed. This begs the question: does Adobe still deserve to be valued above the S&P 500?

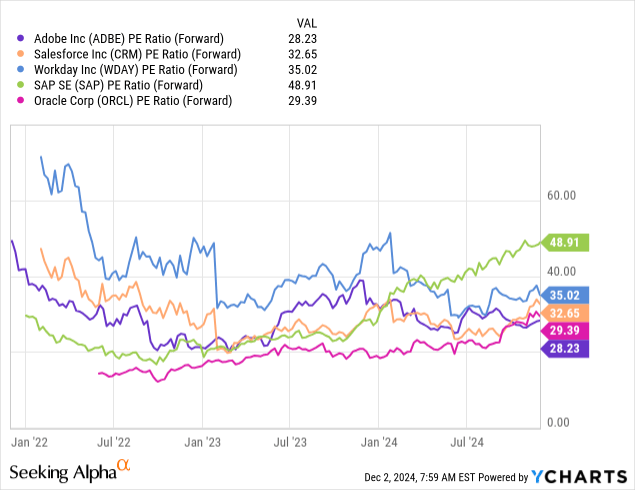

Now, the comforting news is that Adobe’s 28x forward P/E multiple is in line or lower than many of its large-cap software peers, that have also seen their growth rates tip to the low/mid-teens.

But in my view, the whole group is relatively overvalued, and my macro view is that we’re likely to see a correction in January/February of 2025 (many people may be holding on to big winners until the end of 2024 to defer their tax bills by another year), and I believe Adobe is susceptible.

The bottom line here: don’t rush to buy the dip in Adobe, and it’s wise to start trimming your position here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.