Summary:

- Adobe’s share price is experiencing significant momentum, which is likely to be sustained for the time being.

- Better than expected quarterly results could easily prompt a new wave of rating upgrades by the sell-side analysts.

- Having said that, however, investors interested in holding Adobe for a longer period of time should not ignore some important red flags.

SeanShot

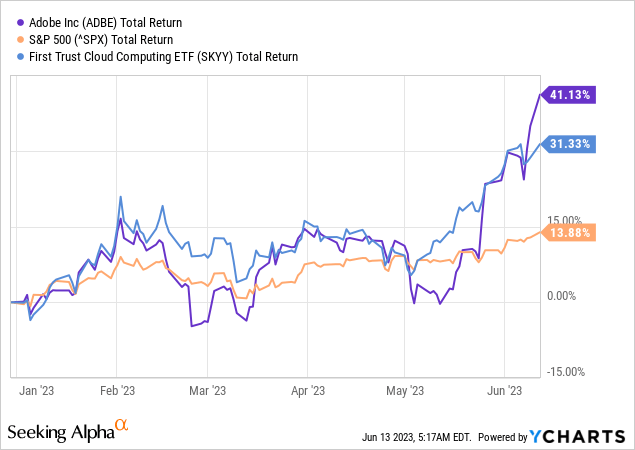

Adobe Inc. (NASDAQ:ADBE) stock has seen renewed optimism among investors as opportunities around generative AI continue to make the headlines.

Although the company certainly has a significant opportunity ahead with such tools, investors should not assume that this would be the silver bullet that would solve Adobe’s problems associated with its capital allocation. In the meantime, however, ADBE has significantly outperformed the broader equity market since the beginning of the year and has been delivering returns that are largely in-line with the cloud computing and software sector.

Most of that return for ADBE has occurred since mid-May, when the narrative around opportunities in generative AI accelerated.

Seeking Alpha

The impact on Adobe’s top and bottom line is not yet entirely clear, even though the company is at the forefront of the field with Firefly and the upcoming offerings by Adobe Sensei GenAI.

Seeking Alpha

In addition, Adobe is also introducing a number of other features across its service portfolio which would further differentiate the company’s offerings.

(…) we’re going to be launching soon a feature in Photoshop called Generative Fill. And it actually literally just anything you select, you can fill it with anything you can imagine.

Source: MoffettNathanson’s Inaugural TMT Conference

Tools like Firefly could also prompt more cross-selling opportunities across Adobe’s ecosystem which is essential for some of the most recent acquisitions.

And of course, around half of Figma users are developers, which are not currently in our ecosystem, and we hope they are soon.

Source: MoffettNathanson’s Inaugural TMT Conference

Short-Term Tailwinds

As I said earlier, the market has suddenly realized the generative AI opportunity and even though it is still hard to quantify, Adobe’s share price has reacted positively.

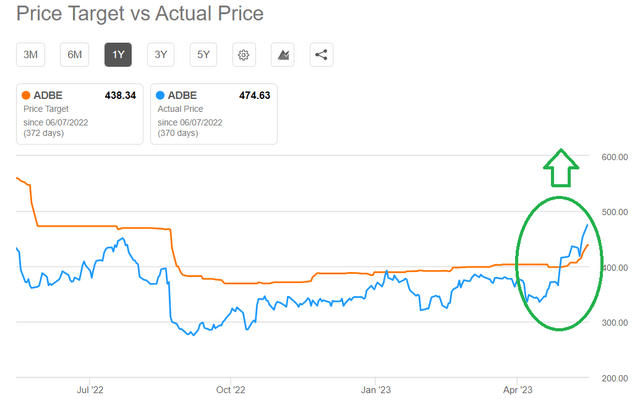

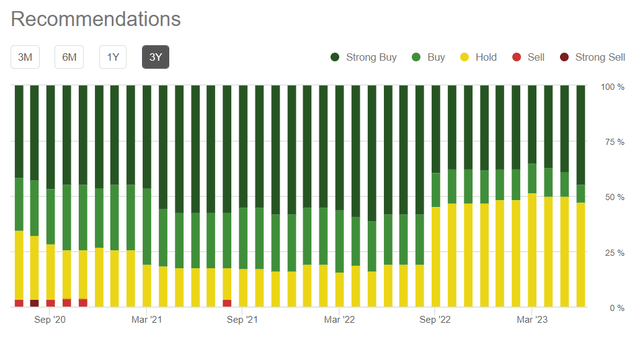

As we see in the graph below, however, sell-side analysts are just beginning to catch-up and could provide yet another leg up for Adobe’s share price.

Seeking Alpha

There’s definitely further scope for ratings upgrades in the coming months, but the lack of ‘sell’ ratings is indicating that sentiment around Adobe is still heavily one-sided.

Seeking Alpha

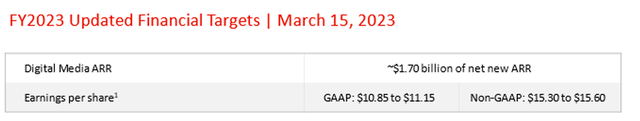

The recently reported strong quarterly results have further strengthened the case for a sustained business momentum at least in the short-run. During the most recent quarter, management has increased its EPS target for FY 2023 by $0.10, from a range of $10.75-$11.05 in Q4 2022 to a new range of $10.85-$11.15 in Q1 2023.

Adobe Earnings Release

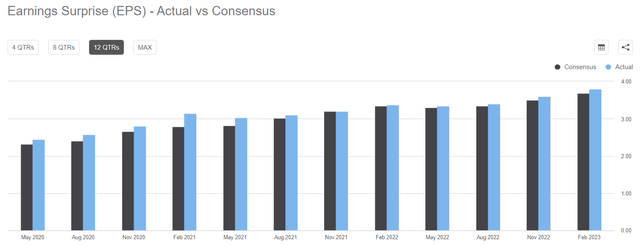

Given Adobe’s recent history of positive quarterly surprises against the consensus estimates, it wouldn’t come as a surprise if the company once again exceeds expectations, which in combination with the strong narrative around AI could produce a meaningful response in the company’s share price.

Seeking Alpha

Considerations For Long-Term Holders

Looking beyond the next few weeks and even months, investors should be mindful of all the risks overshadowing Adobe’s future returns. As a starting point, the company’s capital allocation issues have not gone away.

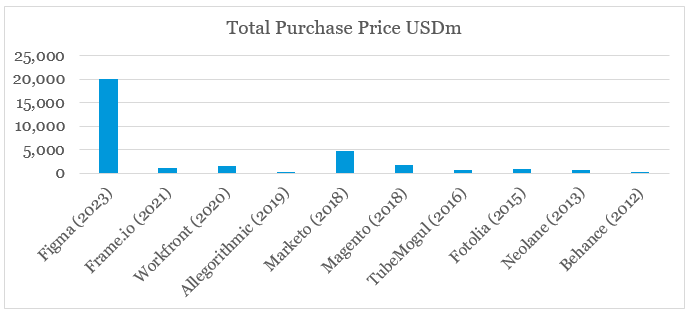

What I mean by that is that management has been too aggressive in its M&A strategy, while at the same time the amount of stock-based compensation has skyrocketed. The recent deal for Figma also raised some red flags for Adobe’s long-term growth potential (more on that here).

prepared by the author, using data from SEC Filings

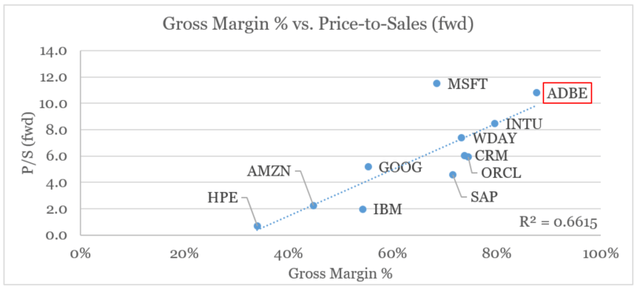

Moreover, Adobe’s share price is also priced at a premium to its current margins on a cross-sectional basis (against peers). As we see in the graph below, the broader peer group in the cloud space exhibits a strong relationship between gross profitability and sales multiples.

prepared by the author, using data from Seeking Alpha

This shows that the market is already pricing-in an improvement in Adobe’s gross margins as the company steps-up its efforts to expand its generative AI enabled offerings.

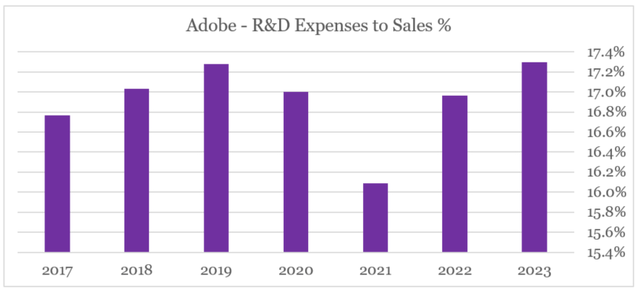

As we move down on the income statement, however, the company is now spending significantly more on research and development relative to sales than it was during the 2021/22 period.

prepared by the author, using data from SEC Filings

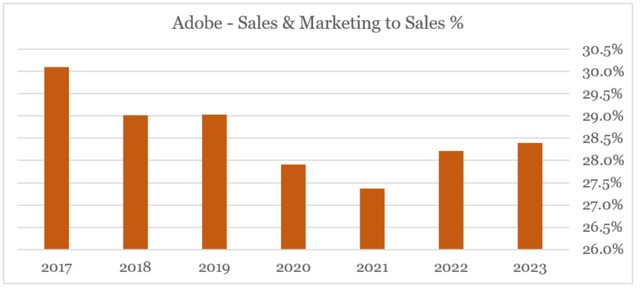

The same holds true for sales and marketing expenses and given the need to fully capitalize on recent trends in generative AI tools, these expenses are unlikely to cool-off anytime soon.

prepared by the author, using data from SEC Filings

What that means is that Adobe’s management might need to sacrifice operating margins to an extent, in order to take advantage of the growth opportunity described in the first section of this article.

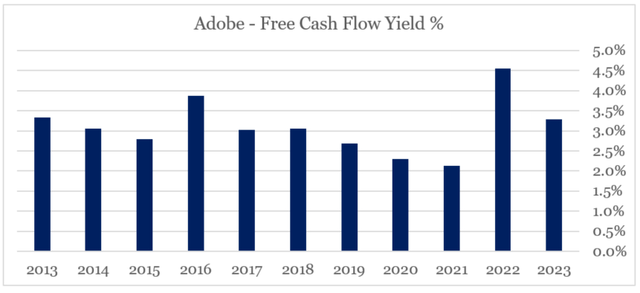

This would put more pressure on Adobe’s free cash flow yield, which is now largely in-line with its historical average.

prepared by the author, using data from Seeking Alpha

Conclusion

The set-up for Adobe’s share price remains favourable at least in the short-run. With the narrative around generative AI gaining momentum and sell-side analysts still catching-up, ADBE could continue to outperform the broader market in the coming weeks and even months. Beyond that, however, the risks for shareholders are significant. On one hand, capital allocation remains an issue and on the other the market is already pricing-in a very favourable scenario for the company going forward.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ORCL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for better positioned high quality businesses in the cloud space?

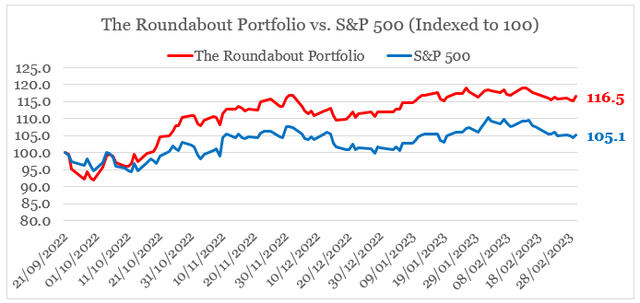

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.