Summary:

- Adobe’s stock price dropped after OpenAI released Sora, a new AI that creates high-quality videos from text and after a disappointment revenue guidance for Q2.

- I am bullish on the company’s future due to its generative AI strategy that will transform the industry.

- Adobe’s strategy of integrating AI models into its existing products will help it maintain its leadership position in the creative software market.

Justin Sullivan/Getty Images News

Overview

Adobe’s (NASDAQ:ADBE) price dropped by 18% while the S&P 500 went up by 7.4% (Figure 1) after OpenAI released Sora, a new AI capable of producing high-quality videos directly from text descriptions, and Adobe issued revenue guidance for the second quarter of 2024 that fell short of expectations.

Figure 1: Seeking Alpha

Adobe reported revenue of $5.18 billion for 1Q, up 11%, beating the expected $5.14 billion. Adjusted profits were $4.48 per share, exceeding Wall Street’s forecast of $4.38 per share. However, the guidance for Q2 2024 anticipated revenues between $5.25 billion and $5.3 billion, slightly below the consensus estimate of $5.31 billion. Of particular concern is the Digital Media segment’s projected revenue of $3.87 billion to $3.9 billion, which falls short of the expected $3.9 billion. Moreover, the segment’s anticipated new revenue is estimated at $440 million, significantly below the consensus forecast of $469.8 million.

Lower guidance has made investors anxious, and uncertainty over whether AI is benefiting or harming Adobe has led to a sharp 14% drop in its stock price on March 14th.

However, Adobe could be a clear winner in the AI space. Adobe will likely be able to defend its leadership position in the creative software industry. Today, it is hard to see the impact of AI technology in its financials, but in the future, I foresee a bright future for Adobe, thanks to generative AI. This drop in stock price presents a great opportunity to invest in the company.

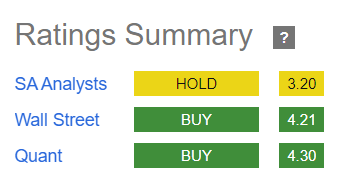

Figure 2: Seeking Alpha

It is hard to beat Adobe in its market.

It will be difficult for competitors like OpenAI (Dall-E or Sora), Midjourney, Microsoft (MSFT), or Google (GOOGL) to beat Adobe and gain market share from it. First of all, Adobe’s culture and technical capabilities to create solid products will ensure a quality product that meets the expectations of the professional creative. Second, Adobe provides a complete catalog of products (from idea generation, editing tools, and content distribution) that has a clear competitive advantage over a single generative AI tool that focuses on the upper funnel: content generation.

Adobe’s customer is a professional committed to maintaining high standards in the quality of his work. They can’t afford errors as their reputation could be damaged. We all have witnessed some flaws in the outcomes delivered by these AI tools. Working with Adobe minimizes these kinds of errors.

Adobe is integrating its AI models into its existing products. For example, Adobe has incorporated Firefly Image, Firefly Vector, and Firefly Design models as features within the Creative Suite. AI tools for Premiere Pro have been developed within Frame.io, and Liquid Mode is included in Document Cloud. Adobe is utilizing AI tools within its software, capitalizing on its competitive advantage, as competitors like OpenAI and Midjourney do not currently replicate this capability.

How generative AI tools affect Adobe’s financial performance

It’s challenging to discern the impact of generative AI tools on Adobe’s financials after nearly a year in production. Microsoft hasn’t yet shown an impact. The only data we have is about GitHub Copilot, which 1.5 million coders use with a $10 monthly subscription fee, and they automate the production of half the code they generate.

ChatGPT has over 180 million users and 1.6 billion visits to its website compared to 2.57 billion to Amazon.com website but further away from Google.com with 85 billion.

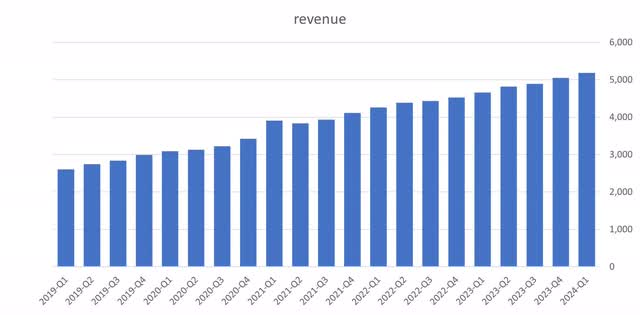

Since March 2023, Adobe has produced 6.5 billion assets generated by AI. For me, it is a clear sign of interest from users and clients. Photoshop Generative Fill and Generative Expand are the most used features in Adobe’s suite. Despite this high interest, there hasn’t been a significant increase in revenue, as indicated in Figure 3. For Adobe, the impact of generative AI tools will be reflected in increased customers in paid plans.

Figure 3: financialmodelingprep

So, Adobe’s strategy with Generative AI is to integrate its models into existing products. This approach tries to expand its paid customer base and enable Adobe to raise prices consistently, which is justified by the added value of this innovative functionality.

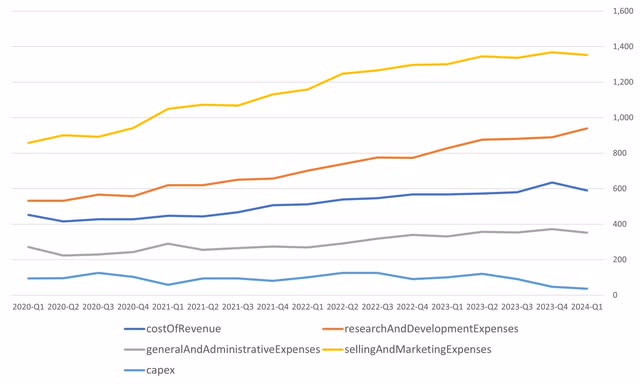

When reviewing costs (Figure 4), I notice a rise in research and development expenses by $112 million year over year, while capital expenditures have decreased by $64 million. Both cost of revenues and sales and marketing costs appear to remain constant. From this, I interpret that Adobe’s primary focus lies in enhancing AI technical capabilities in the short term. The quarter-over-quarter decrease of $44 million in cost of revenues suggests that Adobe may have overspent in previous quarters and is now reassessing. Managing AI infrastructure costs presents particular challenges.

Figure 4: Adobe’s costs. financialmodelingprep

The Future Impact of Generative AI on Adobe

Generative AI tools will enhance workers’ productivity, but I believe this increased productivity won’t lead to a reduction in the number of creators at publishing companies and, as a result, lower revenues for Adobe from reduced licenses. Similar to what occurred with Excel and Office tools in general, increased productivity resulted in a higher volume of work being created, rather than less. Therefore, I believe that Generative AI tools will increase workload and justify premium pricing because publishers will find these functionalities indispensable, ensuring their adoption.

Only 25% of tasks in Arts, Design, Entertainment, and Media can be automated by Generative AI. However, 26% of tasks in the industry will have their job capabilities augmented by AI. According to a Stack Overflow survey in May 2023, where coders ask and answer questions about coding, 70% of respondents reported using or planning to use AI tools primarily to enhance productivity. However, more general studies do not provide a clear consensus on the extent to which AI tools can enhance productivity.

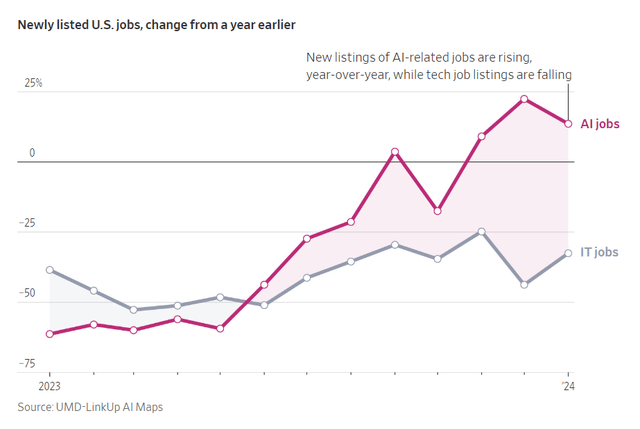

In the short term, I don’t observe job substitution; instead, AI jobs are being created alongside IT jobs, supporting my thesis regarding productivity and job destruction (Figure 5).

Figure 5: UMD

Risks

Generative AI tools, particularly Dall-E/Sora and Midjourney, have the potential to disrupt Adobe by appealing to non-consumers or amateurs. If these companies develop new business models and introduce more convenient and useful products, they could attract amateur users and individuals who currently don’t use design tools. Subsequently, they could acquire high-end clients and expand their market share, posing a challenge to Adobe.

Productivity gains can be bigger than I expect, and this will lead to a significant reduction in the number of digital creative professionals. A decline in users could translate to fewer license purchases and lower revenues for Adobe, which might not be offset by increased premium prices.

Actual generative AI tools are prone to errors or ethical matters that are not feasible in a professional context. AI tools can create unethical images that can influence public opinion. The reputation of the AI tool provider could be harmed if such images are created using its software.

The investment thesis hasn’t focused on the failed acquisition of Figma. One of the emerging trends in creative design software is collaborative workflows. Without this acquisition, Adobe risks losing market share by not having a good product compared to Figma’s current offering.

Valuation

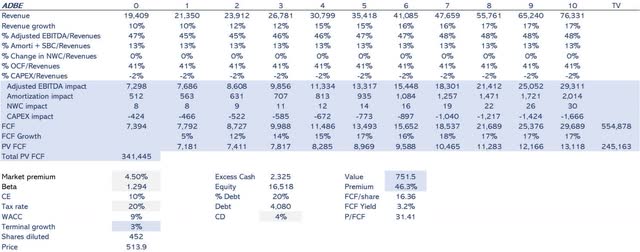

I have talked about revenue generation: it will grow incrementally and through more paid customers and more premiums over the years. The revenue growth rate in 2023 has been 10%. I estimate that the revenue growth rate will keep rising until reaching 17% in 10 years.

The costs to train a model can range from $1.4M, as with the GPT-3 model, to $11.2M for models like PaLM. For a company like Adobe, these costs are reasonable, even as Adobe is creating several models for various purposes. For instance, with Firefly, Adobe utilizes the Firefly Image model, Firefly Vector model, and Firefly Design model. It’s worth noting that these costs are expected to decrease in the coming years.

Inference costs are harder to manage. AI systems lack the economies of scale seen in standard software. As more users make queries, costs will increase because additional GPU resources will be required for calculations. As user queries increase, costs rise because additional GPU resources are needed for calculations. The more customers use the models, the more infrastructure costs escalate. This can pose a problem if you charge a flat fee.

In the example we previously talked about, Github Copilot, individuals pay $10 a month for the AI assistant, while the actual cost is $20 a month flat rate (even some intense users could cost $80). Microsoft and Google charge $30 for their services, stating that at this price, their customers will be profitable. Adobe uses a system of credits to ensure profitability in its Generative AI services. The mechanism ensures that when customers exceed the assigned credits, the speed will decrease to prevent excessive use of the AI infrastructure.

I expect a negative impact on Adobe’s margins, from 48% EBITDA over Revenue to 45%. However, over time, I anticipate to recover margins of 48% due to a reduction in model creation and operational costs.

The rest of the key variables in the model are a terminal growth rate of 3% after ten years, a 9% WACC, and a market premium of 4.5%

My valuation of Adobe is $751 per share, a 46% premium from its actual price, as shown in Figure 6. I see Adobe as undervalued, and I recommend buying the stock if it fits with the overall portfolio strategy

Figure 6: Author

Conclusion

The creative design software market is going through a big transformation due to Generative AI, where users can create images and videos from text prompts. Adobe is reacting to this transformation through a strategy based on integrating AI tools into its products, developing its own models, and ensuring the quality necessary for creative professionals.

I believe Generative AI will allow Adobe to increase its revenue growth rate to 17% in ten years. Margins would decline from 48% to 45% due to the huge investment in hardware infrastructure and coding. But I expected them to rebound to the current 48%.

Adobe’s stock price can have an upside of 46% from its actual price to get a value of $751 per share. I recommend buying the stock, as the decrease in the price from the last earning call presents a clear opportunity.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADBE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.