Summary:

- ADBE is a demonstrated compounder that has already fallen over 50% from all-time highs. Worrying about another pullback when there is a buying opportunity now may be foolish.

- Chatter about AI destroying Adobe is a laughable fear, as the company is spending billions on R&D to maintain its competitive edge with the technology.

- Using conservative metrics, we estimate ADBE to be worth approximately $400/share, indicating current market prices offer a great company at a fair price.

- Though there is some doubt about overpaying for Figma, I believe a $20 billion price tag is justified and could easily be accretive to shareholder value.

Jaap2

Executive Thesis

Adobe (NASDAQ:ADBE) may be one of the best demonstrated compounders on the market right now, with free cash flow/share growing over 20% CAGR from 2013-2022, consistently having above 80% gross margins and consistently high returns on capital. Of course, the question always becomes if this trend can continue, and there has been a lot of public attention on AI possibly destroying companies with the rise of ChatGPT. I believe the recent pullback and the cloud of uncertainty surrounding the company over the Figma deal and AI provides a good entry point for long term investors. Adobe’s demonstrated network effects and their suite of products will likely continue to provide the company with a competitive advantage for years to come.

Company Overview

Adobe invented the PDF digital format in 1991 and has since expanded its offerings to a full suite of creative and operational software tools, with over 25 different software products described on the 2022 10K. The main segments involve cloud-based solutions for media editing and design, document management, data analytics and customer optimization solutions. The company believes its brand leadership, wide arrays of offerings and network effects help provide a competitive edge in a highly competitive industry.

The AI Scare

Only now that AI has been brought into the limelight with ChatGPT has the market become spooked on several companies, including ADBE. AI has been part of our daily lives for a while now from robot vacuums and Alexa to Adobe Photoshop and Sensei. Adobe has been investing in AI for over 10 years and has the R&D budget to stay on top of the field, with 17% of revenue or almost $3 billion shoveled into R&D in 2022. The technology enhances the capability of Adobe’s products, which is easily demonstrated with their smart video and photo editing capabilities. Here and here are links to how the company is already using the technology.

Network Effects

A network effect is when the value of a product increases when more people use it. Adobe has created this network effect for itself, the first example being with PDFs and Acrobat Pro. The more people who have Acrobat Pro, the more valuable it becomes as it makes it easier to share, edit, sign and secure pdf documents. This provides a moat along with Adobe’s trusted brand value, despite there being competitors who may offer lower cost options.

Adobe is also trying to create these network effects with its entire suite of products, with another prime example being Adobe Creative Cloud. If you are a graphic designer using the product, it would be beneficial for your colleagues and clients to also have the same service to easily collaborate, make edits and provide feedback on your work.

The Figma Deal

Figma is a browser based collaborative design application, which may synergize well with Adobe’s Creative Cloud solutions. The idea of this $20 billion half stock half cash acquisition brings up many questions, most of them with negative connotations. Why did ADBE aggressively buyback shares when their stock was at all-time highs and make an offer for a company at multiyear lows? Is Adobe overpaying for a company? If the deal doesn’t go through, does this mean ADBE’s compounded growth is finished? Time will tell, but Adobe has a long history of acquisitions, and the company’s track record speaks itself. Figma’s operating strength and growth prospects can be summarized by the Adobe press release on the matter:

Figma has a total addressable market of $16.5 billion by 2025. The company is expected to add approximately $200 million in net new ARR this year, surpassing $400 million in total ARR exiting 2022, with best-in-class net dollar retention of greater than 150 percent. With gross margins of approximately 90 percent and positive operating cash flows, Figma has built an efficient, high-growth business.

Let’s try to see why Adobe thinks this acquisition is a good idea. First let’s tackle net dollar retention or NDR:

NDR = ((ARR+expansion-downgrades-churn) / ARR)*100

NDR gives you a greater understanding of how much revenue is increasing or decreasing from your existing customer base. In plain terms, this calculation begins with recurring revenue from existing customers, adds any increases in revenue from existing customers (ex. existing customer going from a basic to a more expensive pro package), and subtracts out any losses in revenue from customers leaving the platform and downgrading their packages. This is divided by the original annual recurring revenue ARR, to get a proportion, and is often multiplied by 100 to get a percent expression.

Figma’s greater than 150% NDR is considered very good for the industry. If we extrapolate from the press release’s numbers, we can assume Figma earned a little over $400 million in ARR in 2022, and about $200 million in 2021. 150% NDR would indicate that Figma earned $100 million more in 2022 than 2021, just from existing customers net of subscriber losses and downgrades. Adobe is likely seeing this as both a growth opportunity within itself, and a chance to synergize and further increase NDR with Adobe Creative Cloud.

Figma is thought to have about a 30% market share in its space. If this is correct, we assume the company can maintain its market share, and that total addressable market TAM is $16.5 billion in 2025 like in the press release, this could equate to $5 billion in revenue by 2025. This immense growth could also be aided by Adobe’s aggressive sales and marketing budget ($5 billion in 2022) and any increases in NDR from purchase of additional Adobe products. Assuming margins of the segment will be similar to that of Adobe, Figma could be netting over $1 billion by 2025. Using these assumptions, we see how $20 billion could be considered a bargain for the company.

Valuation

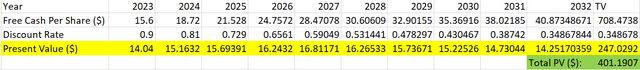

I decided to extrapolate my valuation model from free cash flow per share, as this accounts for heavy stock-based compensation as well as stock buybacks. I assumed that growth will be minimal this year, due to the assumed Figma deal dilution, and economic headwinds likely weighing on results. In my model the company would then be able to grow fcf/share first by 20% as the economy recovers in 2024, down to 15% for 3 years and to 7.5% for the next 5 years. After this, the period of explosive growth ends, and I assumed the company would be able to maintain its competitive advantages and grow with the global economy at a 4% terminal growth rate.

I used a 10% discount rate, as the company only has $3.6 billion in long term debt with a $175 billion market cap at time of writing, and 10% is likely the minimal return investors would expect. This gives us an estimated fair value of $400/share. I believe this is a conservative estimate, given the company’s high growth track record of over 20% CAGR, their aforementioned competitive advantages, and the potential for Figma growth and synergies. These assumptions are demonstrated as follows:

Risks

Front Loading of Cash Flow

Since ADBE is a subscription model, a slowdown in the economy might have a delayed effect on free cash flow. One reason cash flow is higher than earnings in this kind of business is because GAAP income requires cash received for services not yet performed to be recorded as deferred revenue. Indeed, there is $5.5 billion in deferred revenue on the balance sheet. Are we yet to see the economic slowdown in Adobe’s cash flow?

Stock Based Compensation

This needs to be watched carefully. In the most recent quarter, y/y there has been a reduction in operating cash flow, but nearly a $100 million increase in stock-based compensation. This puts my calculation of adjusted free cash flow at $1.18 billion, compared to $1.34 billion a year ago. This is a 12% decrease y/y, and if this trend continues investors may call into question whether Adobe is still a compounder.

Artificial Intelligence

ADBE is spending R&D dollars integrating AI into its services and has demonstrated its staying competitive within the field. Theoretically, if AI continues to make tasks exponentially easier, the amount of Adobe subscriptions required could decrease. I am skeptical though, that a shrewd business such as ADBE could research itself out of its own market.

Competition

There are numerous less expensive and even free products that compete with many of ADBE’s offerings, and if the company is unable to maintain its stature with network effects shareholder value could be greatly diminished.

Figma Uncertainty

The Figma deal could fail to complete as the DOJ indicated it would sue to block the deal. Additionally, even if the deal is completed there is no guarantee that Figma will maintain its competitive advantage or continue its immense growth to justify a $20 billion price tag.

Conclusion

In the end, I believe ADBE to be a great company selling at a fair price given its track record, demonstrated moat and our conservative estimate of a $400/share fair value. The Figma deal creates uncertainty, but extrapolating from press release data indicates the company could net over $1 billion by 2025, easily justifying a $20 billion price tag. As there is also uncertainty surrounding the most recent quarter stagnation in free cash flow growth, conservative investors may desire a higher margin of safety. The flipside is if it becomes clear ADBE is returning to growth mode, the stock will likely be well on its way to or even past all-time highs. Adobe has a 40-year history of successfully adapting its software and creating shareholder value despite changes in technology, and I believe the rise of AI will only enhance the value this company can create.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADBE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.