Summary:

- Adobe’s Q1 earnings report is approaching, and I lean towards a cautious approach in terms of their outlook.

- I discuss the potential pros and cons of labeling AI-generated images and the challenges Adobe may face in navigating the scrutiny of AI-generated content.

- Lastly, I highlight the expectations and key things to focus on for Adobe’s Q1 earnings, indicating an uncertain stock trajectory, especially in light of their overvaluation.

Robert Giroux

Investment Thesis

This article will dive into Adobe Inc.’s (NASDAQ:ADBE) market positioning and future outlook, particularly as we approach their Q4 earnings report. I definitely balance the scale between optimism and caution, but in the end lean towards a cautious approach. I will illustrate how Adobe’s strides in AI and multimedia creation play against the backdrop of a market in major fluctuation. I reflect on the company’s innovation and how they will endure this volatile market. We have noticed major industry shifts and economic uncertainty recently. So, expect me to explore Adobe’s potential from different angles regarding AI-driven content creation along with the potential hurdles they could face.

Adobe Rating: Hold

Introduction

Adobe Inc. is a prominent software company widely recognized for its array of creative and multimedia products. They have a stronghold in the market for digital content creation. Its flagship products include: Adobe Creative Cloud, Document Cloud, and Experience Cloud. These tools offer assistance with graphic design, video editing, web development, photography, and services for both document management and digital marketing. The company has a diverse customer base- from individual creatives to large enterprises. For these specified customer bases, Adobe hones in on delivering innovative solutions that facilitate creation, management, and deployment within the content space.

Labeling AI Generation

I’m very turned by this recent media release from Meta (META) and the impact it will have on Adobe, which is playing a role in my ‘hold’ thesis. Meta Platforms’ decision to label AI-generated images is multifaceted, so let’s break down the potential pros and cons. On one hand, it exemplifies the growing prominence of AI-generated content. And we know this is a field Adobe is investing and innovating in. A part of me thinks this move could increase the visibility of Adobe’s AI capabilities, since their content will now be explicitly recognized on such social platforms.

However, I also see the flip side. This labeling could contribute to heightened scrutiny of AI-generated content. We are in a societal debate around the ethics and transparency of synthetic media (especially in light of it being an election year). So, Adobe may need to navigate the potential challenges around user trust and the application of its AI technology as it is produced in masses.

One thing is that an opportunity is presenting itself for Adobe to be a leader in responsible AI creation and detection. That could be interesting: taking the high road. Curious if they’d buy into that?

Q1 Preview: Analyst Expectations

Adobe is gearing up for its Q4 earnings release, which is estimated to drop on March 14th. The analyst community has set the bar with specific expectations. The consensus for the company’s earnings will be $4.38 per share, suggesting a notable year-over-year uptick of over 15%. Revenue forecasts are equally optimistic with projections hovering around $5.08 billion. That would mark an increase of just over 9% from the same quarter last year. These figures will be indicators of Adobe’s market trajectory and operational efficiency. All in all, they will provide investors with a gauge on whether the company is maintaining growth amidst wary market conditions.

What Am I Looking For?

In my perspective, I hope for a few specific things to be discussed in the upcoming Q1 earnings call. But first, let’s understand prior performances. Last call, Adobe reported a record-breaking $5 billion quarter to cap off the fiscal year and a 13% growth in annual revenue, the spotlight is on Adobe’s sustained momentum. They reported YoY growth in both GAAP and non-GAAP earnings per share- 17% each. This was very solid, but I am really interested in their forward-looking statements around AI and generative AI’s integration across their product suite. This type of discussion will spur catalysts to either send the stock lower or higher.

We know that Adobe has experienced usage of their groundbreaking innovations, such as their Firefly models in Creative Cloud and AI services in Experience Cloud. What I would want to be listening to, is how these integrations are translating into customer engagement and financial performance. If we can receive good numbers and intel on that, the stock will likely push higher, but I’m not optimistic. Adobe’s commitment to product differentiation through AI could be a potential catalyst for future growth, but in this hyped environment, I believe we are due for a setback.

Lastly, I’ll pay close attention to the new Digital Media ARR, which at $569 million (from last quarter) indicated robust adoption. We all should be glancing at their progress in this division. They seem to be focused on product-led growth, which is great as a fundamental business attribute. And based on the previous report, Adobe’s growth levers are well-calibrated- that is a good sign. However, the company’s investment in AI, particularly in the Document Cloud through innovations like the AI assistant in Acrobat, must be consistent and deeply progressing. I’m unsure if they will be enhancing user experience and driving growth at the same speed, which is why my money will be on the sideline for a little.

In summary, my expectation is that Adobe will continue leveraging AI to solidify its market position for the long-term, but I see some struggles with the overall market, including Adobe, for the next couple months. I think they will continue to drive growth across its product segments, but not bullish on their near-term potential. The forthcoming earnings report will be a great update that discusses these important components, where I believe my ‘hold’ rating will follow through.

Risks

What are the risks you ask? Well, let’s chew over the potential negative aspects of the company. To me, the reliance on AI and generative AI introduces execution risk. There is a significant need to live up to the AI frenzy, and falling short is not ideal in this current market. Adobe’s investment may not yield the expected return if these technologies fail to capture market interest or run into ethical/governance hurdles.

Another risk casting a shadow over Adobe is the macroeconomic environment. I see this potentially leading to decreased consumer and enterprise spending. As businesses tighten their belts, Adobe’s high-ticket subscriptions might be seen as expendable. Therefore, this would illustrate a slowdown in new ARR growth. This is particularly relevant given the economic uncertainty where Adobe’s products (though essential to digital content creation) could face scrutiny over costs versus benefits.

And speaking of risks, the value of the company doesn’t look great…

Valuation

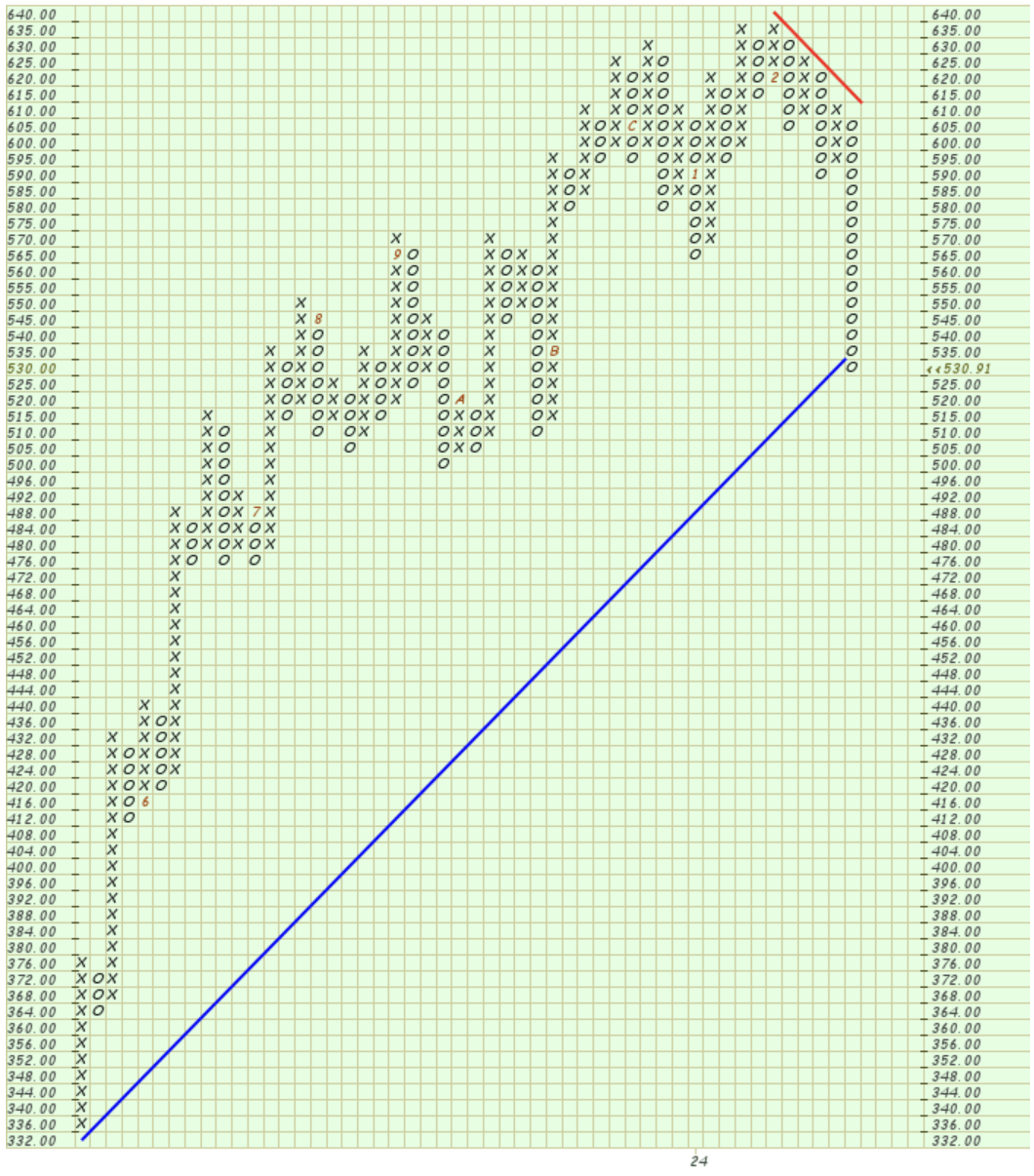

Adobe has had solid growth as we take a glance at the 1-year time-frame being up +53.12%. We will analyze the point and figure chart, which I have added below. This is the traditional three box reversal method to understand support and resistance levels and trend lines. This chart is not promising. Although you may be catching Adobe at a discount, the stock doesn’t show signs of stopping. The momentum is most definitely downward. Further, on February 16th, the stock chart illustrated a descending triple bottom breakdown. In other words, Adobe broke through its support line, which is concerning to me. Based on this graphical perspective, I see the stock traveling to approximately 505.00, give or take 5 bucks. This concept and strategy reinforces my hold rating.

ADBE Point & Figure (Stock Charts)

Now let’s move to the metrics. The stock’s Forward Price to Earnings (FWD P/E) ratio at 39.21 significantly overshoots the sector’s median of 27.24. To me, it suggests an expectation of potentially being overvalued. The Forward Price to Sales (FWD P/S) ratio of 11.39 really soars above the sector median of 2.99. This signals that the market is pricing a significant top-line growth; I think this is exaggerated. Lastly, the Forward Price to Book (FWD P/B) at 12.47 is standing much higher than the sector median of 4.15. This also indicates that investors are willing to pay a premium for what they believe to be a superior asset base; I sit on the contrary. Together I believe my conviction to hold the stock is fundamentally and technically strong.

Conclusion

My analysis of Adobe ahead of its Q4 earnings circles back to a cautious stance. I presented a balanced argument with potential positive and negative catalysts going forward, with emphasis on this earnings report being pivotal for the company. As investors and observers, we are currently navigating through a market where AI’s role in content creation is blossoming. However, it’s also prevalent that questions are arising concerning the longer-term ethical implications. Adobe’s push into AI with its Creative and Document Cloud services is ambitious; this innovation illustrates their growing opportunity. But as I digest the various analyst expectations and the potential industry shifts, my scale tips to caution, hence a hold. Adobe’s next steps released in this report will define its trajectory, so I am most definitely awaiting their numbers and outlook. It’s one of the most competitive and ever-evolving digital landscapes. But I do further stand on a hold as I’ll watch how Adobe handle’s the high tide of change in the tech space from the comfortable sideline.

Please share your insights and questions in the comment section. I will respond promptly!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Thomas Potter is an independent investor as this publication has been produced for informational purposes only. This is not investment advice. Please do your own due diligence and invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.