Summary:

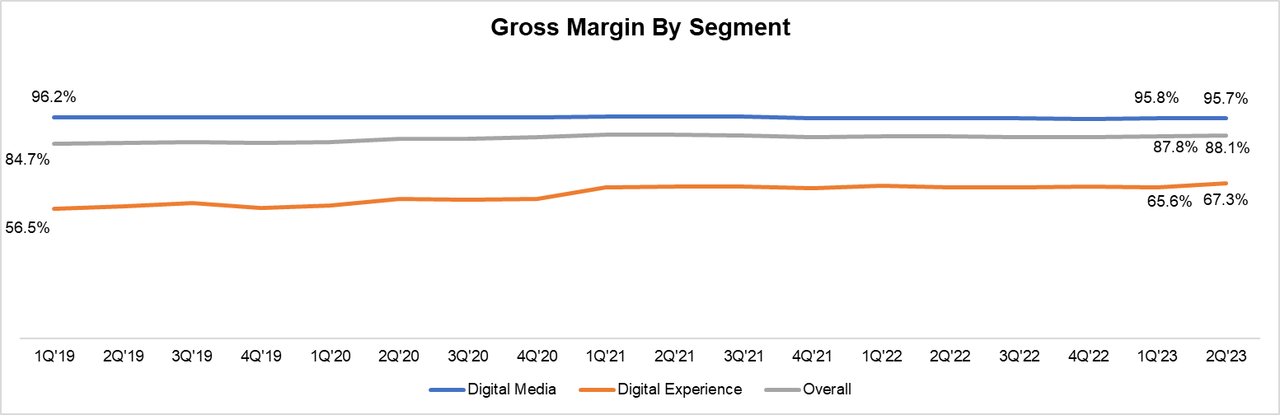

- Digital Media gross margin remains steady at ~96%, but Digital Experience posted its highest ever gross margin of 67.3% in 2Q’23.

- 2Q’23 GAAP operating margin was 33.7%, down from 34.9% in 2Q’22. SBC as % of revenue increased from 8.0% in 2Q’22 to 9.0% in 2Q’23.

- While as of this writing I do own Adobe shares, I have gradually trimmed half of my Adobe holdings for the last couple of weeks.

hapabapa

First things first, while as of this writing I do own Adobe (NASDAQ:ADBE) shares, I have gradually trimmed half of my Adobe holdings for the last couple of weeks. By the time I will publish my Deep Dive next week, it is likely that I may not own any Adobe shares. Before I explain my thought process on selling Adobe, let me quickly recap Adobe’s latest earnings.

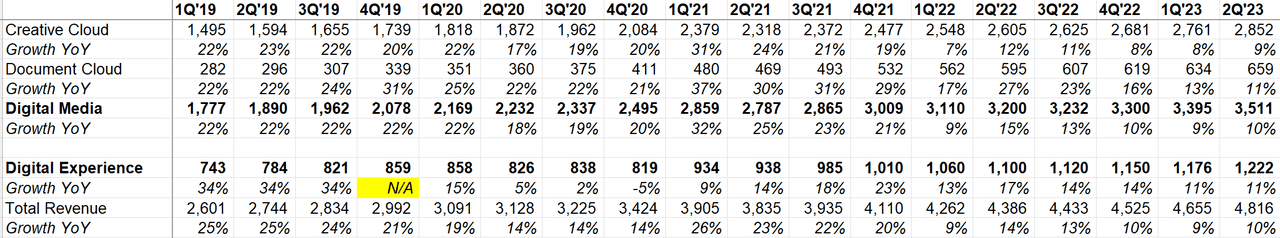

Revenue

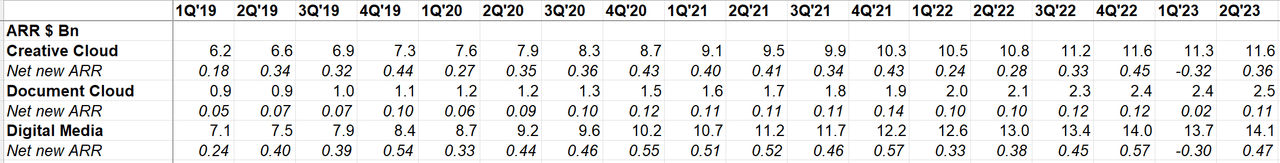

Digital Media net new ARR $470 Mn ($50 mn higher than guided)

Digital Media segment revenue $3.5 Bn (guide $3.45-3.47 Bn)

Digital Experience $1.22 Bn (guide $1.21-1.23 Bn)

Total revenue $4.8 Bn (guide $4.75-4.78 Bn)

Source: MBI Deep Dives, Daloopa

Gross Margin

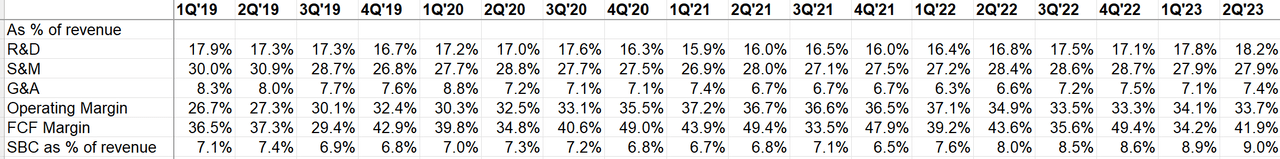

Digital Media gross margin remains steady at ~96%, but Digital Experience posted its highest ever gross margin of 67.3% in 2Q’23. Overall gross margin expanded by 41 bps YoY to 88.1% last quarter.

Source: MBI Deep Dives, Daloopa

Cost Structure

2Q’23 GAAP operating margin was 33.7%, down from 34.9% in 2Q’22. SBC as % of revenue increased from 8.0% in 2Q’22 to 9.0% in 2Q’23. Working capital benefits and SBC make FCF look better than it is.

Capital Allocation

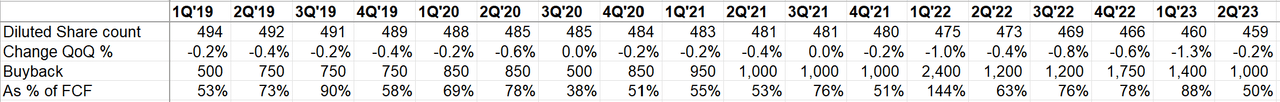

Buyback pace has slowed down as Adobe only utilized 50% of their FCF to buy back shares, which is noticeably lower compared to the last three quarters. Share count went down by only 0.2% QoQ.

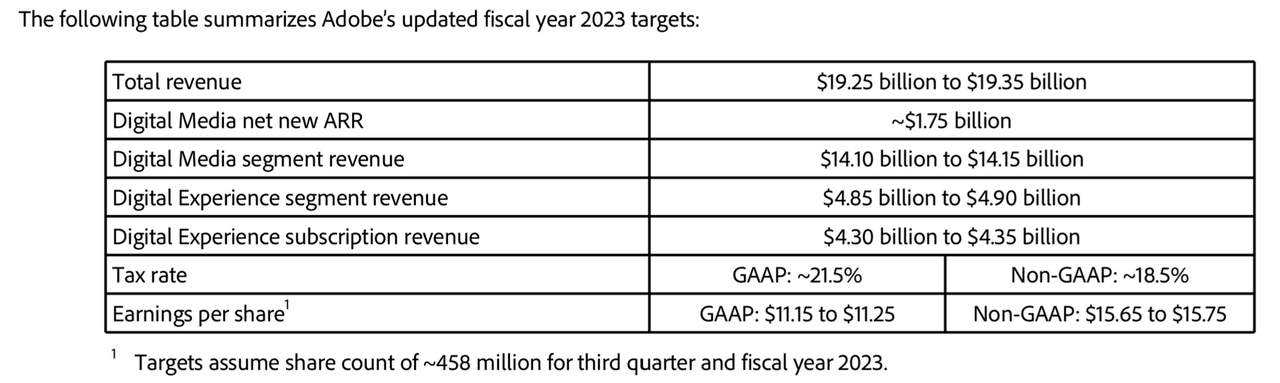

Guidance

Digital Media net new ARR increased from $1.7 Bn to $1.75 Bn in 2023.

GAAP EPS range was increased from $10.85-11.15 to $11.15-11.25 for 2023.

Why I am selling Adobe

When I published my Deep Dive on Adobe in August 2022, I was cautious about their ongoing and likely intensifying competitive onslaught from Figma and Canva.

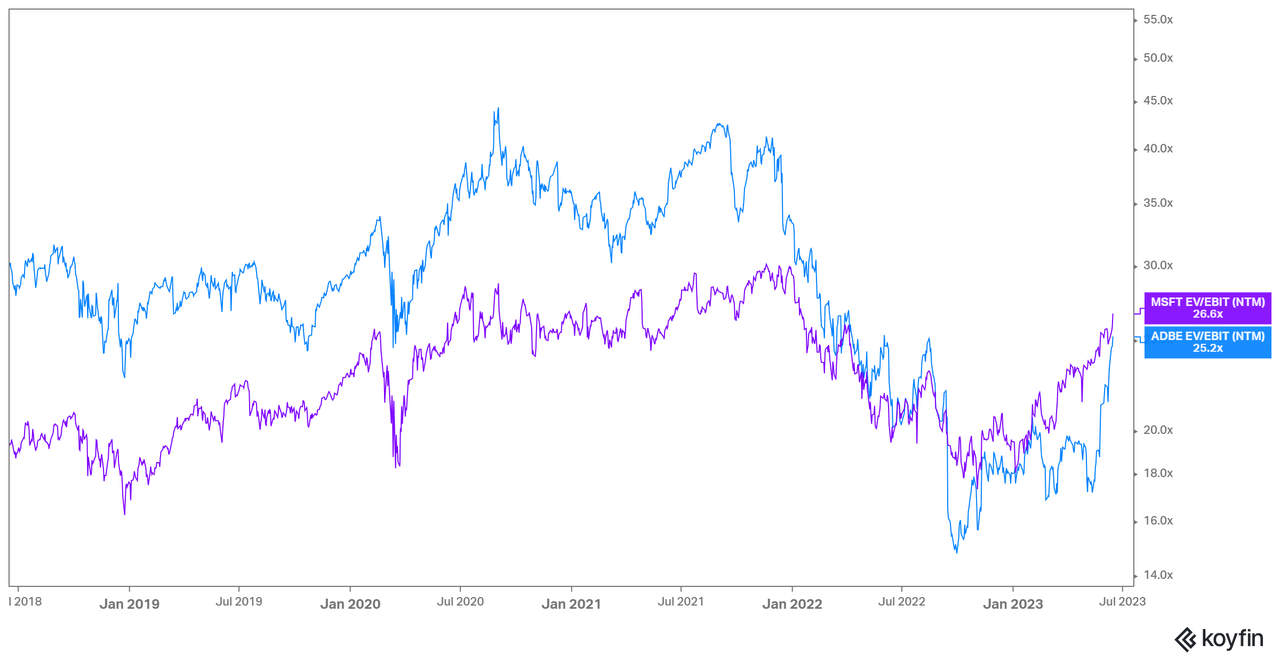

Moreover, I mentioned I was reluctant to pay premium multiples for Adobe vs. Microsoft (MSFT) which is likely the greatest software business in the world today.

While Adobe may offer potentially higher growth, I considered the moat and durability unlikely to be as strong as Microsoft to deserve the premium multiples.

Adobe was trading at $450/share or in the low 20s NTM EV/EBIT multiple (not really, but more on this later). For context, 10-year treasury was trading at ~2.8% yield back then.

Just one month after publishing my Deep Dive, Adobe announced to acquire Figma for an eye-popping valuation, which the market absolutely hated and the stock tanked by 40%.

While I agreed the price paid for Figma is likely to be excessive, I inferred such an acquisition would lead to more pricing power for Adobe over time and given the massive drawdown, the valuation concerns were more than taken care of.

To me, it seemed the market almost forgot Adobe still remains an excellent business and despite the valuation concerns, the fact remains they were about to take a likely potent long-term competitor under their own umbrella.

Moreover, the more Adobe stock was falling, the lower Figma’s price tag would be since the deal was priced as $10 Bn cash+26.5 mn shares+6 mn RSUs. With Adobe stock at $275, Figma would cost ~$19 Bn to Adobe. The odds seemed good to me. I changed my mind and took a decent sized position in the stock at an average cost of $315/share.

Okay, so where do we stand today? For starters, 10-year is now yielding 3.7%. But that’s hardly my only concern.

Let’s take a look at Microsoft and Adobe valuation multiples again. At first glance, it may seem they are both trading at similar multiples, but there is an important nuance that’s missed in this graph.

Not sure how many investors miss this nuance, but I certainly did. While reporting consensus EBIT estimates, analysts consider SBC in their EBIT calculation for Microsoft whereas for Adobe, consensus EBIT deducts SBC.

Basically, Microsoft’s number is GAAP whereas Adobe’s number is non-GAAP which make this whole graph an apple-to-oranges comparison (unfortunately, every data provider does this; I’m not taking a dig at KoyFin. You may wonder why such discrepancy exists. For some reason, big tech’s NTM EBIT estimates includes SBC impact but except for those handful of tech companies, everyone else just deducts SBC from NTM EBIT estimates. I guess SBC only matters for Big Tech shareholders).

Analysts estimate Adobe’s NTM EBIT (non-GAAP) to be $8.7 Bn. Adobe’s 1H’23 SBC was $849 Mn (vs. $674 Mn in 1H’22). Let’s double the 1H’23 number to assume NTM SBC to be $1.7 Bn which would make NTM GAAP EBIT to be $7 Bn.

After making the numbers more apples-to-apples, Adobe actually currently trades at ~31x NTM EV/EBIT multiple (ignoring AH rally), almost ~5 turn higher than Microsoft. Even if these estimates are revised upwards a little, the multiple isn’t going to change much.

How about the rest of the concerns?

With Adobe stock at $510/share, Figma deal is currently priced at ~$26 Bn. If you thought $20 Bn was expensive, well the price may end up being a lot higher thanks to +50% rally over the last month.

Perhaps more importantly, will the deal even close? If the Microsoft and Activision (ATVI) saga are any indication, the regulatory bodies across the Atlantic will likely fight tooth and nail to stop this deal and I would argue the probability that the deal will go through is likely declining.

Adobe bulls think failure to consummate this deal may even be a boon for Adobe as they will be stopped from paying ZIRP-like valuation multiples amidst a mid single-digit Fed rate world. I am not sure I see it this way.

So far, Figma raised $333 Mn over seven funding rounds. If the deal with Adobe doesn’t go through, Figma will receive $1 Bn breakup fee. So, effectively, Adobe shareholders will pay ~3x money that Figma raised over its entire life to receive exactly 0% ownership of Figma.

To put it differently, Adobe shareholders will be giving $1 Bn charity to Figma to potentially compete much more directly with Adobe in the medium term.

So, in a sense, today, when I am looking at Adobe, all my concerns deteriorated over time. 10-year yield increased by ~100 bps, the stock trades at a more expensive multiple, and the competitive concerns from Canva and Figma are very much alive.

But what about AI? Isn’t this potentially a big boon for Adobe?

I suspect if I am wrong about selling Adobe today (I will consider my decision to be wrong if Adobe generates >10% IRR over the next 5 to 7-year period), it may be because I am underestimating AI’s potential for strengthening Adobe’s moat.

Adobe seems to be taking a bit of a conservative approach in mitigating some of the legal concerns that may end up affecting much of the leading AI companies today, and they also have a much clearer path to monetize their AI capabilities.

I mostly agree with bulls that Adobe will likely beat earnings estimates in the next few quarters, and I am certainly not expecting any quick doom for Adobe. But I am not as confident as Mr. Market that AI is an unalloyed positive for Adobe in the long term.

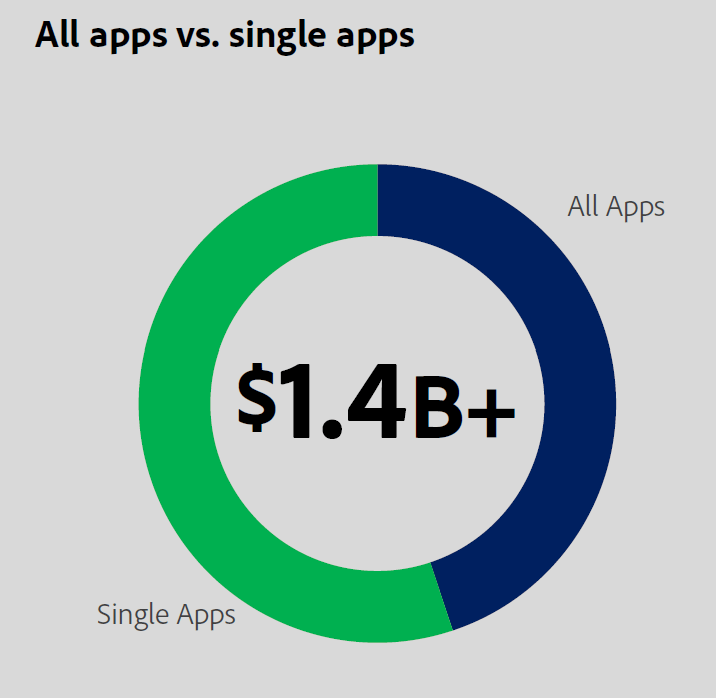

Take the below graph for example, which Adobe shared on their last Analyst Day. The majority of their net new ARR in Creative Cloud comes from single apps, a likely material percentage of which I assume come from consumer+ SMB segment.

If AI is truly as revolutionary tech as the consensus thinks it to be, I wonder if Google (GOOG) (GOOGL) and Meta (META) will make Adobe’s life difficult in the consumer+ SMB segment.

Given the pace at which Meta, Google, or Microsoft (thanks to OpenAI) are moving in AI, it would not shock me if they completely end up disrupting the consumer creativity software industry. Kevin Kwok wrote in his piece titled “How to Eat an Elephant, One Atomic Concept at a Time“:

Even more striking, many of the dominant video platforms – like Youtube – are purely distribution focused. They don’t even have any editing capabilities. Instead, companies like Adobe end up being large beneficiaries of this need.

Color me surprised if YouTube and Meta’s family of apps business don’t end up incorporating significantly better editing tools leveraging their state-of-the-art AI research centers in five years.

One counterargument could be thanks to AI tools, if the number of people interested in editing tools or art increase substantially, the market may be large enough to accommodate both big tech and Adobe.

That may not be a bad argument, but the fact that Adobe today is $220 Bn EV perhaps doesn’t provide much margin of safety if Adobe becomes a consistent market share donor to accommodate other players over time.

Moreover, Adobe’s AI-related capabilities are very unlikely to insulate itself from competitive pressure of Canva and potentially Figma. On top of that, I am not sure I have the skill set to assess where Midjourney or RunwayML end up in 5 years both of which are more born and operated in “native” AI environment. Adobe’s distribution will continue to be a massive moat, but it may not be an unassailable moat.

As I often mention in my valuation-related discussions, I think of valuation in terms of questions the stock price asks me, and my job is to assess my confidence or comfort level in answering the questions.

At the current valuation, I consider the questions posed by Adobe’s stock price are increasingly discomforting. While the market seems to have labeled Adobe an “AI” stock, the long-term returns will ultimately be decided not by today’s labels, but the company’s ability to maintain its competitive moats and profits/FCF in the long run.

Disclosure: I am long shares of Adobe

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.