Summary:

- Adobe reported Q2 earnings which beat expectations.

- The company is seeing significant demand for its latest AI powered capabilities as a game-changer in the digital media space.

- We are bullish on the stock with a price target of $625.

skynesher/E+ via Getty Images

Adobe Inc. (NASDAQ:ADBE) has quickly cemented itself a leader in generative AI tools geared toward visual media. Indeed, the company just reported its latest quarterly results which beat expectations with the press release and conference call dominated by AI updates.

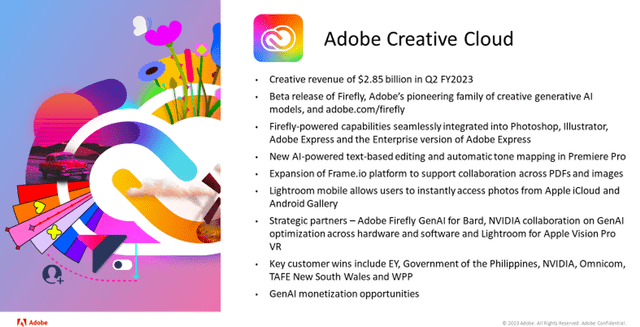

At the same time, the reality here is that the momentum from that side of the business is just getting started with the featured “Firefly” powered-capabilities only recently launching in beta. Management hiked full year guidance with an otherwise very positive outlook.

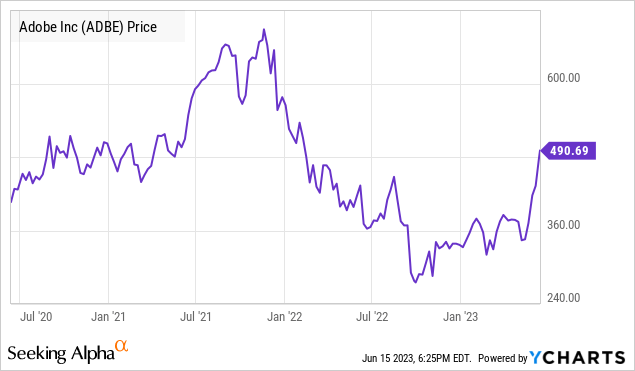

The stock has already been a big winner this year, but we see more upside going forward. The case we make is that the long-term growth and earnings outlook may be stronger today than when shares traded at $700 back in 2021 at the height of the pandemic boom. By this measure, we believe ADBE remains undervalued, with a potential return to the all-time high on the table.

ADBE Earnings Recap

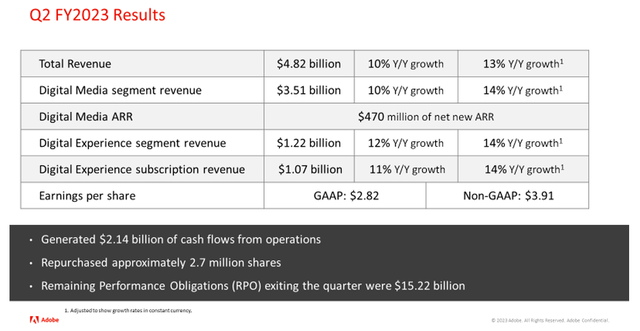

ADBE reported Q2 earnings with EPS of $3.91, up 17% year-over-year and also $0.12 ahead of estimates. Total revenue climbed by 13% y/y on an adjusted basis to $4.82 billion, beating the consensus by a solid $50 million.

Net new annual recurring revenue (ARR) in Digital Media reached $470 million, well above the target of $420 million announced at the end of Q1. Digital Experience subscription revenue crossed the $1 billion mark with the company citing large enterprise scale deals adding to the strength.

source: company IR

Again, the numbers here are good but have yet to really capture an expected wave of demand following the early rollout AI tools. The idea here is that the AI suite represents not only a new sales driver, but also able to capture higher margins and add to profitability through new monetization opportunities. The enthusiasm by management was evident during the conference call:

The introduction of the new Adobe Express and Firefly will go down as a seminal moment in our creative history. These innovative products and our generative AI co-pilot in our flagship applications will extend our leadership in core creative categories such as imaging, design, video, illustration, animation and 3D, as well as attract an increasingly expansive global audience.

source: company IR

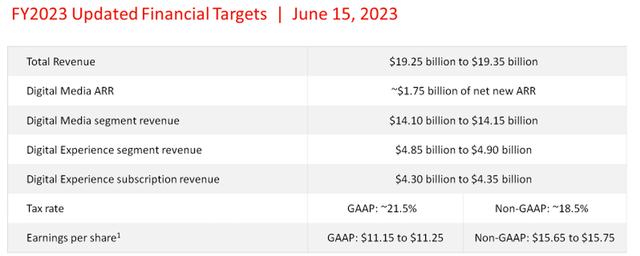

In terms of guidance, Adobe now sees full year non-GAAP earnings between $15.65 and $15.75, compared to a prior midpoint estimate closer to $15.45. A forecast for total revenue around $19.3 billion, represents an increase of 9% y/y, or 13% on a constant currency basis.

The expectation is for strength to be more pronounced towards the end of the year and into 2024 based on the timing of renewals and a traditional seasonal cycle. The company also see an expansion in the operating margin into 2024 highlighting the impact of new value-added products.

source: company IR

Why We Like ADBE

In our view, the attraction of Adobe is that its featured products across “Photoshop”, “Illustrator”, “Adobe Express”, and “Premier” represent turn-key platforms where an extensive global user base can begin to leverage the potential of AI immediately with very practical applications.

For both professional power users and hobbyist alike, it’s fair to say that tools like “generative fill“, where AI creates or reworks elements to existing visual media is a game changer in terms of productivity and value proposition.

Announced partnerships with companies like NVDIA Corp. (NVDA) to collaborate on hardware optimization, while powering text-to-image capabilities on Alphabet Inc’s (GOOGL) Google Bard chatbot highlight Adobe’s unique importance to the broader AI ecosystem.

Separately, Apple Inc. (AAPL) is implementing Adobe’s Lightroom with AI capabilities on the new “Vision Pro VR headset” which starts getting into metaverse opportunities as a future growth driver. Overall, there’s a lot to like about Adobe that is well positioned to consolidate its leadership in the years to come.

ADBE Stock Price Forecast

We rate ADBE as a buy with a price target for the year ahead at $625 representing a forward P/E of 40x on management’s 2023 EPS guidance. Keep in mind that shares are currently trading at around 32x on the same metric while the stock historically commanded a multiple closer to 50x over the past decade.

While the top-line growth is not quite at the peak levels when the company first moved to the subscription model years ago, the strong point here is the expected earnings momentum beyond next year as margins expand incremental to the new AI focus.

We believe the new AI focus coupled with already a solid company with high quality fundamentals warrants a higher premium. We can also point to the relative “stickiness” of the Adobe suite with users typically tied to the platform for the long-run. That dynamic typically translates into high quality cash flows and lower variability of quarterly results which is supportive to valuation.

With that, we’re eyeing an ongoing technical breakout in the ADBE with shares rallying above $500 and now at the highest level since early 2022. While it likely won’t be a straight line higher, updates on new product development and AI initiatives should work to keep the bullish trend going.

In terms of risks, these types of momentum tech stocks are prone to wide swings of volatility. The macro backdrop and financial market conditions remain key monitoring points. A deterioration of the economic outlook would also undermine the operating environment and force a reassessment of the earnings outlook.

Seeking Alpha

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADBE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click here for a two-week free trial.