Summary:

- Upgraded Adobe Inc. to “Strong Buy” in March 2024, highlighting AI as an ally, not an enemy.

- Adobe’s Q2 FY24 results showed 11% revenue growth, strong AI capabilities in Firefly, and robust capital allocation.

- Forecasting 11% revenue growth for FY24 and 12% growth beyond FY25, reiterating a ‘Strong Buy’ rating with the fair value of $620 per share.

- Adobe is working on some new AI features for its Premiere Pro, including integration with third-party services like OpenAI’s Sora.

David Tran

I upgraded Adobe Inc. (NASDAQ:ADBE) to “Strong Buy” in my previous article published in March 2024. I argued that AI is not an enemy, but an ally. The company released its Q2 result on June 13th after the bell, delivering 11% revenue growth and 15% EPS growth.

Adobe has been investing in AI training for its Firefly platform, and applying it to its flagship solutions including Photoshop, Illustrator, Lightroom and Premiere. I continue to trust Adobe is well positioned to capture the growth in the AI era. I reiterate a “Strong Buy” rating with a fair value of $620 per share.

AI Positioning in Firefly

As indicated over the earnings call, Firefly has been used to generate more than 9 billion images since it was launched in March 2023. My biggest takeaway for the quarter is Adobe’s strong AI capabilities in its Firefly and major platforms. I think Firefly can help Adobe sustain its technology advantages in both creativity and data cloud market. Key reasons are as follows:

- Firefly is utilizing Adobe’s tremendous data sets and media library for AI training and inference. Adobe launched its Firefly Image 3 model for higher quality images and more accurate text in images. With the Image 3 model, users can improve the productivity of their creative design works. Additionally, AI-based text to image can make creativity more accessible than ever before.

- With Firefly’s AI capability, Adobe can potentially attract more subscribers. While not everyone can use Photoshop to design images, generative AI allows almost anyone to become an artist.

- Lastly, Adobe offers multiple creative platforms, including Photoshop, Illustrator, Lightroom and Premiere. Adobe has been integrating Firefly into these platforms, enabling both existing and new users to easily leverage the additional AI assistance.

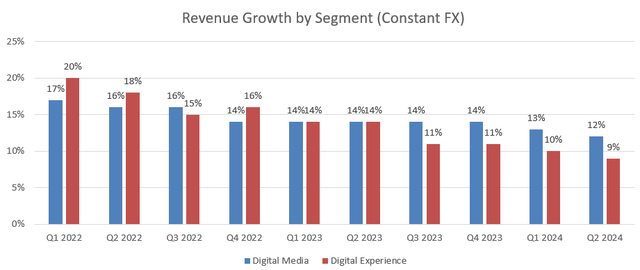

In Q2 FY24, Adobe’s revenue grew by 12% in digital media and 9% in digital experience. Notably, the annual recurring revenue (ARR) for digital media increased by 14.9% year-over-year, indicating strong growth momentum in both Creative and Document Cloud businesses.

Regarding the capital allocation, Adobe repurchased $2.5 billion of own shares in the quarter, with $22.7 billion remaining in authorization. As discussed in my previous coverage, Adobe has a strong balance sheet, excellent cash flow conversion and robust capital allocation policy.

FY24 Outlook and Valuation Update

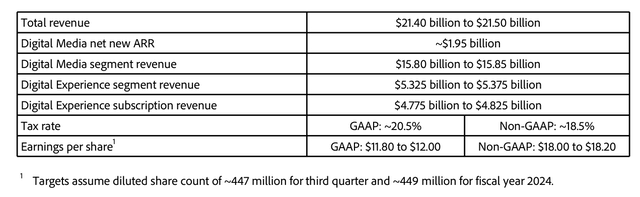

As detailed in the table below, Adobe guides approximately 10.8% revenue growth for FY24.

I am considering the following factors for FY25’s growth:

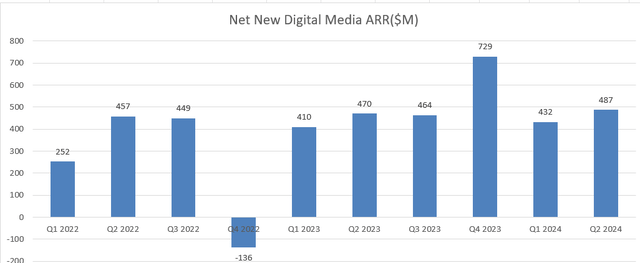

- Digital Media Business: the annual recurring revenue is a good leading indicator for the future growth of Digital Media. The chart below shows the net new digital media ARR growth in dollar amount for each quarter. In Q2 FY24, Adobe grew its net new digital media ARR by 3.6%, followed by 5.4% growth in Q1 FY24. Using the past two quarters’ new ARR growth as a reference, it is quite reasonable to assume Adobe’s Digital Media business will grow by 12%+ in FY25.

- Digital Experience: The business represents around 25% of total revenue, and the growth is tied to the overall digital marketing budget growth. MarkNtel predicts that the global digital marketing market will grow at a CAGR of 11.1% from 2024 to 2030. Amid the current challenging macro environment, it is likely that enterprises will temporarily reduce their marketing spending. In other words, the digital marketing growth in FY24 might be lower than the historical average. To be conservative, I assume Adobe’s Digital Experience business will grow by 9% in FY24.

Therefore, the combined revenue growth for FY24 is estimated to be 11%, based on my calculations.

For the growth beyond FY25, I am considering the followings:

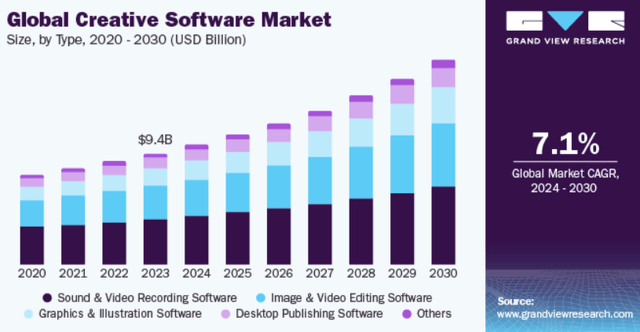

- The global creative software market is expected to grow at a CAGR of 7.1% from 2024-2030, according to Grand View Research. As Adobe holds a leading position in the creative software market, it is highly likely to outgrow the market growth. Considering its historical growth trajectory, I assume Adobe can increase its Digital Media business by 12% in the long term.

- The growth of the global digital advertising market is primarily driven by increasing advertising budgets, as well as the structural shift from traditional media to digital advertising. As the market is more likely to grow at a low-teens rate, I assume Adobe can grow its digital experience business by 14%.

Thus, the combined revenue is forecasted to grow by 12% beyond FY24, based on my estimates.

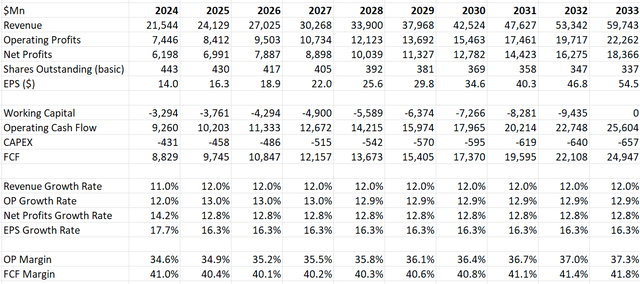

In the discounted cash flow (“DCF”) model, I anticipate Adobe will generate operating leverage through gross profits and sales/marketing costs. I assume 10bps margin leverage from COGS and 20bps leverage from sales and marketing, leading to 30bps annual margin expansion. The summary of my DCF is:

Adobe’s DCF Model – Author’s Calculations

The WACC is calculated to be 14.8% assuming: risk-free rate 4.2% ((US 10Y treasury yield)); beta 1.8 ((Seeking Alpha)); equity risk premium 7%; cost of debt 7%; debt balance $3.6 billion; equity balance $16.5 billion; tax rate 18.5%.

Discounting all the future free cash flow, the fair value of Adobe’s stock price is calculated to be $620 per share.

Risks

In my last report, I mentioned the risk of OpenAI’s Sora, an AI model capable of creating video from text. As reported by the media, Adobe is working on some new AI features for its Premiere Pro, including integration with third-party services like OpenAI’s Sora. I think the partnership makes sense for both companies.

Adobe owns a vast stock of images, video content within its creative platforms. Adobe’s data inputs could be highly valuable for AI training. In addition, since Adobe has already established its leadership in the design software market, OpenAI can potentially launch its Sora AI model under Adobe’s software platform.

As analyzed in my last report, I see Adobe benefiting from the evolution of generative AI.

Verdict

Adobe Inc. has made solid progress integrating AI technology into its renowned platforms. I estimate the company can sustain its double-digit revenue growth in the near future. The stock price is undervalued, based on my model; therefore, I reiterate a “Strong Buy” rating with a fair value of $620 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADBE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.