Summary:

- I reiterate a “Strong Buy” rating for Adobe Inc. stock with a fair value of $600 per share, driven by their robust AI capabilities and future growth potential.

- Adobe’s Firefly Video Model, set to release later this year, will enable AI-powered video generation, enhancing their competitive edge in digital media.

- Despite weak Q4 guidance for net new digital media ARR, Adobe’s AI investments in tools like Firefly and Adobe Express will drive future growth.

- Adobe’s digital media and experience platforms are expected to grow by 12% and 9% respectively, supported by AI functionalities and robust subscription growth.

wwing

I published my ‘Strong Buy’ thesis on Adobe Inc. (NASDAQ:ADBE) in June 2024, highlighting their strong AI positions in Firefly. Adobe released a strong Q3 result on September 12th after the bell, while they guided a weak growth in net new digital media annual recurring revenue (ARR) for Q4. Adobe is set to release their Firefly Video Model later this year, enabling creators to generate video powered by AI. I continue to believe Adobe’s digital media and digital experience will remain relevant in the AI era. I reiterate a “Strong Buy” rating with a fair value of $600 per share.

Firefly Video Model Coming Soon

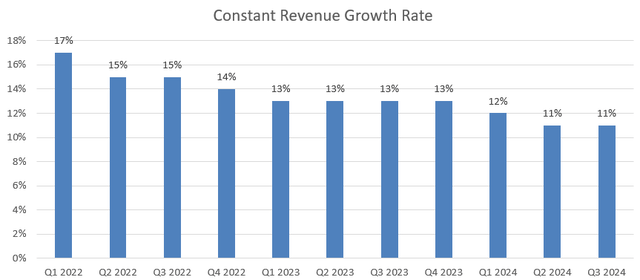

As depicted in the chart below, Adobe delivered 11% constant revenue growth, with 12% growth in Digital Media and 10% growth in the Digital Experience segment.

My biggest takeaway from the quarter is Adobe’s continuing investment in their Firefly and Adobe Express, which powers Adobe Photoshop, Illustrator, Lightroom, and Premiere Pro with AI functionalities. Adobe has surpassed 12 billion Firefly-powered generations across Adobe tools, as communicated over the earnings call. The AI-related investments are crucial to Adobe’s future growth, as AI-powered tools can create additional value for end customers and maintain Adobe’s competitive advantages in both digital media and digital experience markets.

On September 11th, Adobe announced their Firefly Video Model will be available later this year. With Adobe’s Firefly Video Model, editors can generate videos using generative AI tools. Adobe’s Firefly Video Model could potentially compete against OpenAI’s Sora and Runway’s Gen-3 Alpha model. More importantly, given Adobe’s extensive video/photo database, elements, and software tools, their Firefly Video Model can integrate more seamlessly with existing software platforms, enhancing the creation, editing, and publishing of digital content.

Weak Net New Digital Media ARR Growth

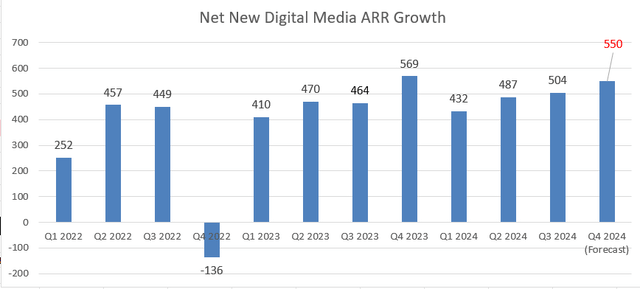

The issue for the quarter is their weak guidance for the digital media net new ARR growth in Q4, which indicates a 3.3% year-over-year decline. Adobe generated $569 million in net new digital media ARR in Q4 FY23, but guided $550 million in the coming quarter, as shown in the chart below.

I think the weak guidance is primarily caused by tough comparisons from last year. As illustrated in the chart above, Q4 FY23 was Adobe’s strongest quarter for digital media growth recently, delivering 14% constant revenue growth and 15.6% total ARR growth. As such, Adobe faces a strong comparable in Q4. Just considering the absolute amount of new ARR growth, the guidance is quite respectable, in my opinion.

Adobe continues to enhance its Digital Media platforms with AI functionalities, including the AI assistant and Firefly image generator. These AI-powered platforms are likely to contribute to ARR growth for FY25. As indicated over the earnings call, these AI-powered features in Photoshop have accelerated core creative workflows and streamlined repetitive tasks, saving editors/creators tremendous time when producing digital content. I believe these features could help Adobe engage more new customers and drive additional subscriptions from existing users, ultimately boosting ARR growth.

Outlook and Valuation

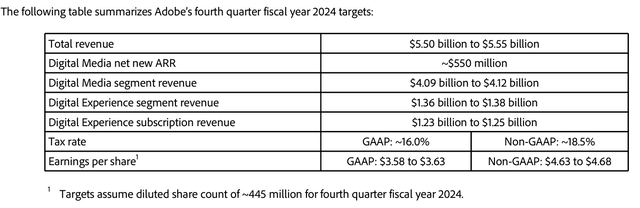

As shown in the table below, Adobe is guiding for $5.5 to $5.55 billion in revenue for Q4, and the midpoint implies 9.5% year-over-year growth in revenue.

I am considering the following factors for Adobe’s near-term growth:

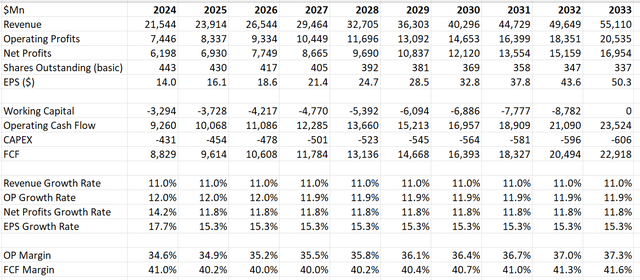

- Digital Media: As discussed previously, I believe AI-powered features can significantly enhance Adobe’s existing digital media platform and attract more new customers looking to leverage generative AI for creating and editing digital content. Based on their historical growth trajectory, I forecast the segment will grow by 12% in the future, comprising 10% growth from traditional platforms and 2% from AI-related features.

- Digital Experience: During the quarter, Adobe Experience Platform (AEP) and native applications demonstrated strong growth, growing by 50% year-over-year. AEP can support enterprise customers to perform Ads cloud workflow, data analytics, audience management, as well as campaign management. Thanks to the growth of direct-to-consumer digital marketing, Adobe’s digital experience platform has experienced robust subscription growth recently. I anticipate Digital Experience will grow by 9% annually.

Putting the two segments together, the overall revenue growth is projected to be 11% in my discounted cash flow (“DCF”) model. I forecast a 30 bps operating margin expansion driven by: 10bps gross margin expansion due to pricing increases; 10bps from SG&A operating leverage and 10bps from R&D optimization. With these parameters, the DCF can be summarized as follows:

The WACC is calculated to be 12.6% assuming: a risk-free rate of 3.6%; a beta of 1.8%; equity risk premium of 6%; cost of debt 6%; equity balance of $16.5 billion; debt of $3.6 billion; and a tax rate of 18.5%. The fair value is calculated to be $600 per share, as per my estimates.

Key Risks

For Adobe, the biggest headline risk is likely OpenAI’s Sora, an AI model capable of creating realistic and imaginative videos from text instructions. As discussed in my previous articles, Adobe is in the early stages of allowing third-party AI models to be embedded in their video/photo editing platforms. Adobe’s management also indicated that they are partnering with OpenAI to integrate Sora into Adobe’s platform.

As long as Adobe continues to invest in their AI-powered features, I don’t believe these third-party AI models significantly impact Adobe’s future growth. Instead, these AI models could potentially become part of Adobe’s ecosystem for digital media and digital experience. As such, the overall market will likely expand due to AI features, benefiting all the participants in the space.

Conclusion

I don’t believe there are any significant issues with Adobe’s Q4 guidance for net new Digital Media ARR growth. I continue to believe Adobe will grow their AI-powered digital media and experience platforms. Therefore, I reiterate a “Strong Buy” rating with a fair value of $600 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADBE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.