Summary:

- Adobe expects robust total revenue for Q4 2023, solid performance, and capitalization on market trends.

- The company’s financial strength is evident in its Q3 2023 revenue increase and profitability.

- Technical analysis suggests that Adobe’s stock price is on an upward trajectory and may reach new highs.

bennymarty

Adobe Inc. (NASDAQ:ADBE) emerges as a significant player, showcasing resilience and innovation in the financial outlook in the ever-evolving world of digital technology. As the company prepares for Q4 2023, it anticipates robust total revenue, aligning with its strong performance in fluctuating economic conditions and capitalizing on seasonal market trends. This article extends the conversation from the previous discussion, delving deeper into Adobe’s financial status and conducting a technical analysis of its stock price to uncover potential investment opportunities. The stock price has reached the lowest point at the support level defined in the previous articles and has rallied, aligning with expectations. This upward momentum is expected to persist and propel the stock price even higher.

Adobe’s Financial Landscape and Growth Prospects

Adobe expects a robust total revenue for Q4 2023, estimating a range between $4.975 billion to $5.025 billion. This projection accounts for current macroeconomic conditions and typical year-end seasonal strength. The Digital Media segment is expected to contribute significantly with a new Annualized Recurring Revenue (ARR) of around $520 million, while the segment’s total revenue is forecasted to be between $3.67 billion and $3.70 billion. Additionally, the Digital Experience segment revenue is projected to be between $1.25 billion and $1.27 billion, with subscription revenue expected to be $1.11 billion to $1.13 billion.

From a profitability standpoint, Adobe’s expectations for the tax rate vary depending on the accounting principles applied. The GAAP tax rate is projected to be approximately 18.0%, whereas the non-GAAP tax rate is expected at around 18.5%. Earnings per share (EPS) for Q4 2023 are anticipated to range from $3.10 to $3.15 under GAAP, while non-GAAP EPS is expected to be higher, ranging from $4.10 to $4.15. These targets reflect Adobe’s financial goals and indicate the company’s confidence in its performance for the upcoming quarter.

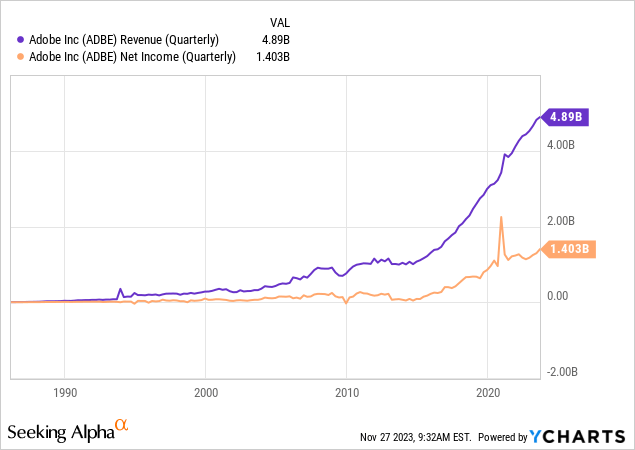

These robust profitability projections for Adobe are grounded in the company’s latest financial earnings. In Q3 2023, Adobe showcased a vigorous growth pattern underpinned by its commitment to innovation and operational excellence. The company recorded a remarkable revenue of $4.89 billion during this period, indicating a 10% increase compared to Q3 2022, or 13% when adjusted for constant currency. This performance reflects Adobe’s strategic focus and the growing market demand for its broad range of products. The chart below illustrates the robust profitability of the company, as evidenced by the substantial increase in quarterly revenue and net income.

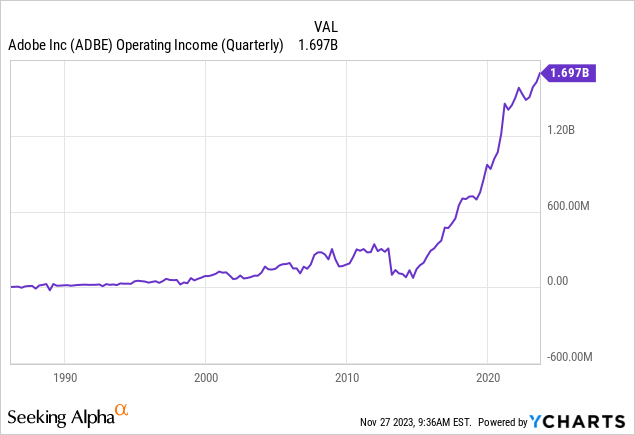

Examining the earnings details, Adobe’s financial strength and profitability become evident. The company’s GAAP diluted earnings per share stood at $3.05, with a higher figure of $4.09 on a non-GAAP basis, highlighting Adobe’s strategic financial management and profitability. The company reported a GAAP operating income of $1.697 billion and a non-GAAP operating income of $2.26 billion. Similarly, the GAAP net income stood at $1.403 billion, while the non-GAAP net income climbed to $1.88 billion, highlighting the firm’s successful cost management and robust revenue generation.

Moreover, Adobe’s operational cash flow was robust, amounting to $1.87 billion, which speaks to its solid cash-generating capability. The company’s financial health is further reinforced by its Remaining Performance Obligations (RPO), which stood at a formidable $15.72 billion at the quarter’s end. Moreover, Adobe demonstrated its commitment to shareholder value by repurchasing around 2.1 million shares.

A closer look at Adobe’s business segments reveals more about its growth dynamics. The revenue in the Digital Media segment was a substantial $3.59 billion, representing an 11% growth year-over-year, or 14% in constant currency. Creative revenue increased to $2.91 billion within this segment, and Document Cloud revenue to $685 million, indicating robust market demand.

The growth in ARR is also noteworthy. The Digital Media segment’s net new ARR was $464 million, pushing the segment’s total ARR to $14.60 billion. The growth in Creative ARR to $11.97 billion and Document Cloud ARR to $2.63 billion reflects a solid and expanding customer base and commitment to Adobe’s offerings. Moreover, the Digital Experience segment also reported positive results, with revenues of $1.23 billion, marking a 10% year-over-year increase, or 11% in constant currency. The subscription revenue in this segment, which is crucial for future revenue projections, grew by 12% year-over-year to $1.10 billion.

As Adobe gears up to announce its Q4 2023 earnings, its robust financial standing, and strong projections set the stage for a potentially outstanding quarter. The anticipated growth in ARR and subscription revenues, coupled with Adobe’s consistent track record of profitability, positions the company favorably in the eyes of investors and market analysts. This solid financial performance, if realized, may positively influence Adobe’s stock price, reflecting the market’s confidence in the company’s strategic direction and its ability to sustain growth in a competitive digital landscape.

Consistent Growth in a Bullish Market Environment

Recap

A previous article presented a bullish outlook based on the emergence of a reverse triangle at the 61.8% Fibonacci retracement level of $271.71. It was noted that any price correction would present a valuable buying opportunity for long-term investors. Subsequently, the stock price declined, creating an attractive entry point, then rebounded sharply upwards. This rebound, initiated by long-term support, presented another opportunity to increase holdings, as further discussed in a different article. Additionally, the article delved into a strong bullish price movement in the context of an inverted head and shoulders pattern. Since the bullish outlook was first introduced, the stock has risen over 65%, and this upward momentum appears set to continue.

Adobe’s Next Move

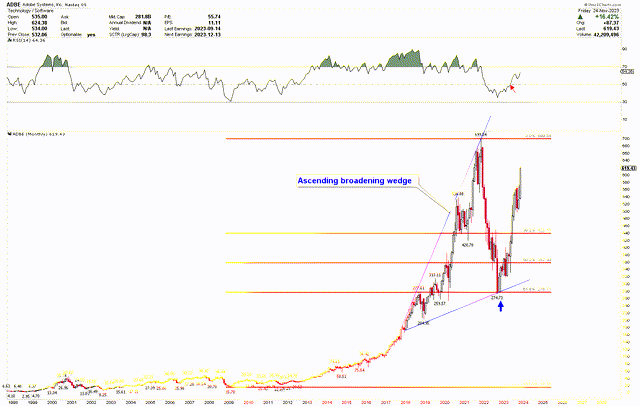

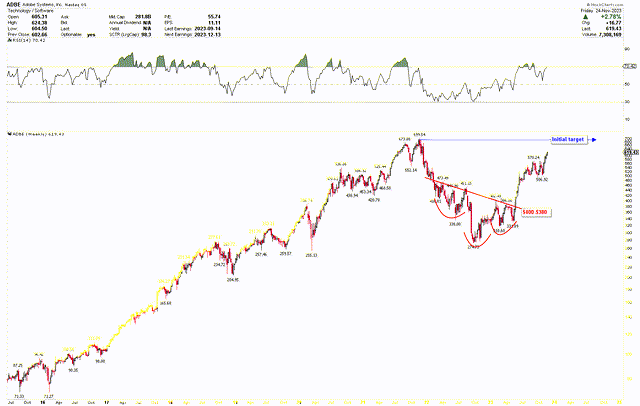

The revised monthly chart illustrates a robust rally from the 61.8% Fibonacci retracement level, aligning with expectations. The stock has demonstrated significant bullish momentum from these levels and has surpassed the critical RSI midpoint of 50. The rebound from the 61.8% Fibonacci retracement level to higher values has resulted in an ascending broadening wedge pattern, signaling high market volatility. Given the upward trend, the stock’s price is poised to climb further. The November 2023 monthly candlestick is bullish, underlining the momentum and suggesting an impending resistance near $700.

Adobe Monthly Chart (stockcharts.com)

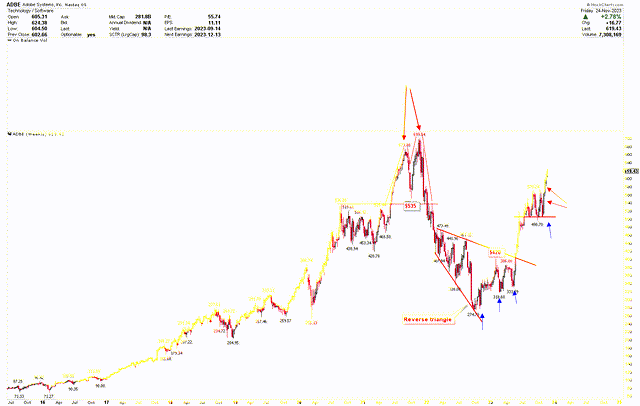

This bullish trend is similarly evident in the weekly chart, highlighting the break of the reverse triangle pattern and substantial movement, underscored by considerable volatility. However, price fluctuations in September and October led to a new low of around $500 before the commencement of this robust rally. Recent strong weekly candlesticks suggest the stock is on track to reach new all-time highs, potentially fueled by the upcoming Q4 2023 earnings announcement.

Adobe Weekly Chart (stockcharts.com)

Another previously discussed weekly chart features an inverted head and shoulders pattern, which was breached around $400. This pattern sets an initial price target of $700, with a likely surge past this point, triggering another significant rally to even higher levels. Despite approaching overbought territory, similar past scenarios, such as in 2013 when the RSI indicated overbought conditions at around $40, suggest these signals might be overlooked. Even in past overbought states, the stock continued its ascent to an all-time high of $699.54. Thus, current overbought conditions may be disregarded, potentially leading to a significant price rally. Given the stock’s strength, investors may consider increasing holdings during corrections towards the $400-$500 range.

Adobe Weekly Chart (stockcharts.com)

Market Risk

External economic factors, such as shifts in consumer spending, market volatility, or changes in fiscal policy, could impact Adobe’s revenue projections, especially in its critical segments like Digital Media and Digital Experience. Additionally, while the Digital Media segment’s expected significant contribution to the new ARR is promising, any unforeseen changes in market demand or competitive dynamics could affect this outcome.

From a profitability perspective, Adobe’s tax rate projections and anticipated EPS for GAAP and non-GAAP calculations reflect internal targets and confidence. However, these figures could be subject to change due to external factors such as tax law amendments, regulatory changes, or unexpected financial challenges. While the company’s profitability metrics seem substantial, they are not immune to market risks, including fluctuations in foreign exchange rates, changes in the global economic environment, or increased operational costs, which could impact the final financial outcomes.

Investors should consider potential risks such as technological disruptions, intensifying competition, and changes in consumer preferences, which could affect Adobe’s market share and revenue growth. Additionally, Adobe’s reliance on continued innovation and adapting to changing market needs means there’s always a risk of misjudging future trends or failing to meet evolving customer demands.

Bottom Line

Adobe Inc.’s financial outlook for Q4 2023 reflects a company in a state of vigorous growth and innovation, even amid challenging economic conditions. With projections of robust total revenue and substantial contributions from Digital Media and Digital Experience segments, Adobe demonstrates its resilience and adaptability in the digital technology landscape. The company’s expected profitability, underscored by its EPS projections and firm performance in Q3 2023, further reinforces its financial health and strategic effectiveness.

The technical analysis of Adobe’s stock price aligns with this optimistic financial scenario. The stock has shown a remarkable recovery from its support level and is currently on an upward trajectory, as evidenced by its movement in monthly and weekly charts. The ascending broadening wedge and the inverted head and shoulders suggest that the stock price may continue to rise, potentially reaching new highs. The positive momentum in Adobe’s stock will likely accelerate with Q4 2023 earnings announcement. Investors may consider increasing holdings if the stock price adjusts to the $400-$500 range.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.