Summary:

- Despite strong Q4 and FY24 results, ADBE’s stock dropped due to conservative FY25 guidance, creating a buying opportunity with a 29% upside potential.

- Monetizing Generative Credits and launching the Firefly Video Model are crucial for ADBE’s growth; delays could hinder the company’s AI-driven revenue potential.

- Document Cloud’s AI tools drove 17% y/y revenue growth, showcasing the importance of AI in ADBE’s product suite and future growth.

- ADBE trades at a lower P/E than peers, making it undervalued; maintaining a Buy rating, downgraded from Strong Buy due to short-term momentum concerns.

Cn0ra/iStock via Getty Images

Investment Thesis

The last time I wrote about Adobe Inc. (NASDAQ:ADBE) (NEOE:ADBE:CA), in September 2024, I analyzed the company’s third quarter results and argued how the company’s Generative Credits can be a whole new source of growth for the future. I had a STRONG BUY rating on the stock.

Since the article was published, the stock has tumbled 11.8%, primarily due to a nearly 16% drop following its Q4 report, underperforming the S&P 500, which gained 5.8% during the same period.

In this article, I dissect the company’s fourth quarter results and examine the progress made by the company with respect to monetization of its AI tools. I also analyze the company’s plans to launch the Firefly Video Model as well as explore whether there has been any progress made with respect to monetization of Generative Credits.

Fourth Quarter & FY24 Highlights

ADBE had yet another beat-and-raise quarter to end FY24. Q4 revenues came in at $5.61 billion, up 11.05% y/y and beating analyst estimates by $64.7 million. Non-GAAP diluted EPS came in at $4.81, up 12.6% y/y and beating analyst estimates by $0.14. The company’s remaining performance obligations (RPO) came in at $19.96 billion, which translates to a y/y growth of 16% in constant currency. Both the Creative and Document cloud segments once again registered a double-digit growth rate on a y/y basis.

For the full year, ADBE achieved record revenues of $21.51 billion, which translates to a y/y growth of 11% in constant currency. Non-GAAP EPS came in at $18.42, a y/y growth of 14.6%. Non-GAAP operating income came in at $10.02 billion and the company generated $8.06 billion in operating cash flows for FY24. Net new Digital Media ARR topped $2 billion, primarily driven by strong growth in the company’s Document Cloud segment.

Once again, despite a strong finish to the year, ADBE’s stock tanked after-hours, a repeat of the post-Q3 performance, with shares tumbling nearly 14% post the earnings. The selloff once again can be attributed to softer-than-expected guidance, the same reason as last time, with the only difference being that investors were disappointed with the full-year guidance as opposed to a quarterly guidance. More specifically, management now expects FY25 revenues to come in between $23.3 and $23.55 billion, below the $23.8 billion consensus estimate. Non-GAAP EPS is expected to come in between $20.2 and $20.50, with the midpoint of $20.35 falling once again below consensus estimate of $20.52.

Firefly Video Model Launch and Monetization of Generative Credits Needs to Be Done As Soon as Possible

As I mentioned earlier, ADBE’s stock once again fell victim to a softer-than-expected guidance. I find this reaction to be completely baffling because despite a conservative Q4 guidance in the previous quarter, the company comfortably exceeded the high-end guidance of both revenues and non-GAAP EPS. So, this is a company that is known to give conservative guidance. As such, investors should have taken the FY25 guidance with a pinch of salt rather than taking it at face value, which resulted in an approximately 16% drop in the two days following its earnings.

If one looks at ADBE’s fourth quarter, then there is very little to be disappointed. Both Document and Creative Cloud segments posted double-digit revenue growth. The 16% y/y growth seen in RPO was also impressive. And the company continues to make meaningful progress with respect to its AI initiatives. Firefly-powered generations across ADBE’s tools have now crossed 16 billion and the company launched its much-anticipated Firefly Video Model albeit in limited public beta mode. The company plans to make this model “more broadly available in early 2025.” Early signs are promising with the integration of Firefly Video Model in Premiere Pro driving a “70% increase in the number of Premiere Pro beta users.”

As I mentioned in my last article on ADBE, the Firefly Video Model is where users would consume a substantial amount of Generative Credits, which I consider to be ADBE’s key to unlock direct monetization of Firefly. Moreover, according to Verified Market Research, the text-to-video AI market is expected to grow at a CAGR of 36% from 2024 to 2031. Furthermore, the company’s primary competitor OpenAI’s Sora has failed to impress the market despite already being available. Therefore, it is vital that ADBE launches the Firefly Video Model as soon as possible.

Moreover, the net new Digital Media ARR growth has been stuck at 12% in the last three quarters. In Q1 of FY24, this growth was at 13%, which means that there has also been a drop-off in growth. The lack of acceleration in the ARR growth, in my opinion, can be attributed to the monetization of Firefly hitting a ceiling. This is why not only is it important for the company to start monetizing the generative credits but also ensure that they get the Firefly Video Model out of the beta version as soon as possible.

There was an analyst question, during the earnings call, which suggested that despite all the innovation and monetization avenues that the management was talking about, growth has been heading in the wrong direction. While ADBE CEO Shantanu Narayen did address the question to a reasonable extent, it was more of a qualitative response than a quantitative one. And what was disappointing was that there was no mention of either the Firefly Video Model or Generative Credits in his response. As an ADBE investor, I hope that the management unlocks the monetization potential of Generative Credits. Making Firefly Video Model mainstream would be the key to do that and FY25 must be the year when both of these become a reality. Else ADBE risks missing the opportunity to be a significant beneficiary of the AI revolution.

AI Tools Fuel Growth of Document Cloud

While the Creative Cloud is somewhat stuck in a growth limbo, the company has been using its AI tools to help fuel the growth of its Document Cloud business. In the fourth quarter, the Document Cloud saw its revenues surge 17% y/y and the company’s AI Assistant, which was introduced in Acrobat and Reader, has helped users complete their “document related tasks 4 times faster on average,” thereby driving productivity.

The company, during the fourth quarter, also introduced specialized AI for contracts and scanned documents, as well as AI tools to analyze larger documents. All of these tools not only led to a 23% y/y growth in Document Cloud ARR but also resulted in 25% y/y growth in monthly active users, with the number of paid and free users surpassing 650 million.

The way that AI tools have fueled the growth of Document Cloud is further proof for why the company needs to roll out Firefly Video Model from the beta version as well as monetize the use of Generative Credits.

Valuation

|

Forward P/E Approach |

|

|

Price Target |

$599.00 |

|

Projected Forward P/E Multiple |

28.95x |

|

Projected FY25 EPS |

$20.67 |

Source: Company’s Q4 Earnings Release, LSEG Data (formerly Refinitiv), and Author’s Calculations

As mentioned earlier, the company now expected FY25 non-GAAP EPS to come in between $20.30 and $20.50. The consensus estimate for FY25 is $20.52. In the last five years, the company has, on average, beat analyst estimates by 0.75%. Assuming the company exceeds the FY25 estimate by 0.75%, then the projected FY25 EPS would be $20.67, which is what I have estimated for my calculations. This is lower than my previous estimate of $21.30 because my current estimate translates to a y/y earnings growth of 12.21%, which is lower than my previous growth projection of 16.5% and was a more aggressive estimate.

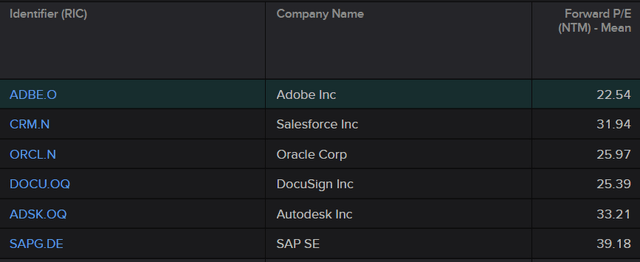

The company currently trades at a forward P/E of 22.54x, according to LSEG Data. This makes ADBE the cheapest stock among its peers, with the likes of CRM, ORCL, SAP and Autodesk all trading at much higher multiples. The median forward P/E multiple of the peer universe stands at 28.95x. Even relative to its historical multiples, the company is currently cheap, with its 2-year, 5-year, and 10-year median P/E multiples trading at 26.9x, 31.1x, and 30.8x, respectively. Given the surge in demand seen for its products, which has been driven by the addition of Firefly, and given that the company continues to convert free users to premium users consistently, I do believe that the stock should be trading at higher multiples. As such, I have assumed a forward P/E multiple of 28.95x, which is the industry median. This is slightly lower than my previous estimate of 31.3x. The choice of a lower multiple is reasonable in my opinion because not only is there still no timeline on when the company is going to monetize its generative credits, but also I have estimated a lower earnings growth rate compared to last time.

LSEG Data (formerly Refinitiv)

At a forward P/E of 28.95x and a projected FY25 EPS of $20.67, we would get a price target of $599 and while this updated PT is lower than my previous estimate of $667, it still represents an upside of about 29% from current levels. Given the considerable upside from current levels, I am maintaining a BUY rating on the stock, although this is a downgrade from my previous rating of STRONG BUY, which is a consequence of a lower PT and negative short-term momentum.

Risk Factors

My risk factors have largely remained the same from my last article. My bull case continues to rely on the Firefly Video Model, which has to be a success if ADBE needs to take its growth to the next level. Should the likes of Sora continue to gain popularity, then ADBE could fall behind. Furthermore, the USP of the Firefly Video Model is that it is expected to be commercially safe. Any glitches on that front could also be a setback to the company.

The timing of AI monetization continues to remain a mystery. There was only one mention of Generative Credits during the Q4 earnings call, that too towards the end. This is a cause for concern and unless there is a definite roadmap for the rollout of paid Generative Credits, there is not going to be any serious gain from Firefly. And the lower multiple relative to its software peers will be more than justified under such a scenario, making this uncertainty yet another risk factor to my bull case.

Concluding Thoughts

ADBE had a strong finish to the year, with both the revenues and EPS beating analyst estimates significantly. However, due to yet another conservative guidance, the stock tanked nearly 14% post the report. For a company that is known to provide a conservative guidance and comfortably beat it, such a reaction is unwarranted in my opinion.

Having said that, the company could have done more to convince investors that it’s plans to monetize Firefly are more concrete. For instance, it would have been better if, after spending a lot of the Q3 earnings call on plans to monetize the company’s Generative Credits, the company gave a proper timeline for when they would institute caps on these credits. The company also announced that it would launch the Firefly Video Model more broadly in 2025 and given that the Video Model is where a lot of Generative Credits would be consumed, it would have boosted investor sentiment had they announced concrete plans to monetize these Credits.

Nonetheless, overall, it was a great finish to the year for ADBE. The Document Cloud business continues to generate substantial growth thanks to the AI tools. And the company exiting the year with record RPOs does suggest that demand for its products continues to remain strong. From a valuation perspective, the post-earnings drop has led to a buying opportunity given the considerable upside from current levels. I continue to believe in the long-term potential of the company, and I plan to add to my existing position thanks to the post-earnings tumble. Having said that, I will continue to actively monitor the timeline of launch of both the Firefly Video Model and more importantly, the monetization of Generative Credits, as these are the catalysts for the company’s growth in 2025 and beyond.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADBE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.