Summary:

- Adobe’s Q4 2023 results were mixed, with regulatory scrutiny being a major concern.

- The company’s near-term prospects are driven by technological innovation and strategic partnerships.

- In the best case, this stock is priced at 31x forward EPS, which is probably fairly priced.

bennymarty

Investment Thesis

Adobe (NASDAQ:ADBE) delivered investors with a very mixed set of Q4 2023 results. The headline grabber was that Adobe was at the receiving end of regulatory scrutiny. This was further accentuated by the fact that aside from Adobe, there were no other large caps reporting earnings yesterday.

But once the dust has settled, I believe that investors will be less on edge and look forward to appraising Adobe on its ongoing prospects.

On this front, I find that paying 31x forward non-GAAP EPS is a fair valuation. Even as I can see that right now there are a lot better investments in the market, the fact remains Adobe is not unreasonably priced.

Rapid Recap,

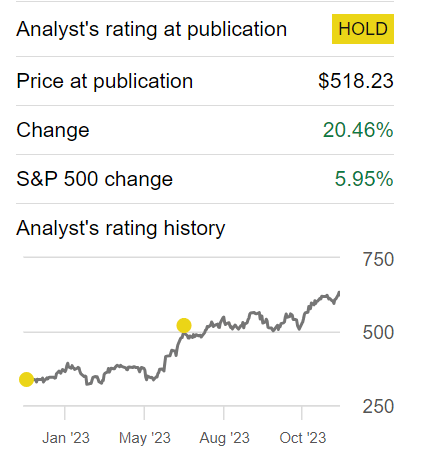

Back in June, in my previous neutral analysis, I concluded by saying,

[…ADBE’s valuation] may not be shockingly high, in the present AI hype, sometimes, it’s difficult to get much sense of what’s actually happening.

Since I made those comments, Adobe has been on a tear, see below.

Author’s work on ADBE

And yet, I stand by those comments. ADBE isn’t irrationally expensive. But it’s difficult to argue that the stock is particularly cheap too. Therefore, I rate this stock a hold.

Adobe’s Near-Term Prospects

In the near term, Adobe’s prospects are buoyed by its robust commitment to technological innovation and strategic partnerships. The company’s relentless focus on advancing generative AI, exemplified by groundbreaking products like Firefly models, positions it at the forefront of transformative technologies. Adobe’s strategic collaboration with Figma underscores its dedication to shaping the future of creativity and productivity on the web.

The emphasis on personalized digital experiences remains a key driver, as Adobe continues to leverage its foundational technology across Creative Cloud, Document Cloud, and Experience Cloud. The integration of AI services, such as real-time Customer Data Platform and advancements in Express, empowers a diverse user base, from creative professionals to beginners.

Furthermore, Adobe’s global engagement with millions of users through events like Adobe MAX showcases a vibrant community that contributes to brand strength and organic growth.

However, amid these positive prospects, Adobe faces near-term challenges, notably in regulatory scrutiny. One of the primary hurdles revolves around regulatory scrutiny, with ongoing engagements with the European Commission, the UK Competition and Markets Authority, and the US Department of Justice. The regulatory bodies have expressed concerns about potential antitrust issues. Navigating these regulatory reviews requires meticulous attention, and any adverse outcomes could lead to operational adjustments or legal ramifications.

Furthermore, within Adobe’s Digital Media business, achieving sustained net new ARR growth poses a challenge, particularly in the Creative Cloud segment.

Despite innovations like Firefly models, the year-on-year decline in Q4 2023 net new ARR for Creative Cloud indicates the difficulties of the competitive landscape and market dynamics. The pricing adjustments implemented may have contributed to the challenge, emphasizing the need for a delicate balance between providing value to customers and ensuring sustainable revenue growth.

Adobe must navigate these market complexities, address competitive pressures, and refine its strategies to reignite growth in Creative Cloud, a pivotal segment that historically has been a major driver of the company’s success.

Given this background, let’s delve into its financials.

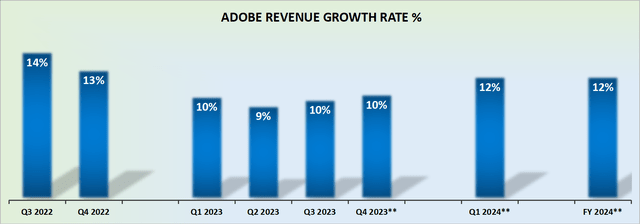

Revenue Growth Rates Are Still in the Double-Digits

Adobe’s guidance for Q1 2024 didn’t let off fireworks and came in ever-so-slightly light of what analysts were forecasting.

Given that management is in the business of being conservative with its guidance, I’ve now adjusted my fiscal 2024 CAGR for this consideration. This implies that approximately 12% is what investors should expect from Adobe this year.

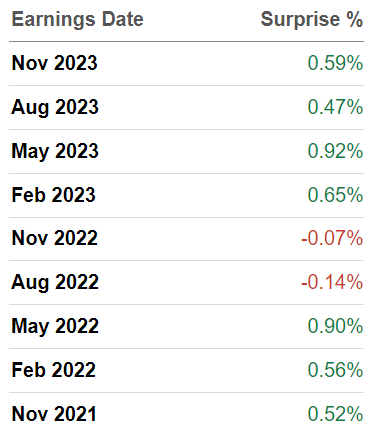

Furthermore, consider the following table.

SA Premium

What you see here is that in the past 2 years, Adobe has not beaten analysts’ revenue estimates by more than 1%. This means, that what we see in my revenue growth rates graphic, is pretty much what investors are likely to see delivered.

Is that so bad? Well, this depends on investors’ risk-seeking attitude in calendar 2024. I believe that the ”trade towards mega-cap” tech may have already largely played out.

There may still be some legs left in this general trade of putting capital to work in mega-cap stocks, such as Adobe, but for the most part, I struggle to see a lot more upside in this name, particularly considering its valuation.

ADBE Stock Valuation — 31x Forward Non-GAAP EPS

Here are my assumptions. Let’s say, that at the very high end of the scale, Adobe grows its bottom line EPS by 20% y/y. Hopefully, you’ll take a step back when you read this and immediately question, how will Adobe manage to grow its bottom line EPS by 20%, when its topline is only expected to grow by around 12%?

For that, I’ve assumed that the business gets some measure of positive operating leverage off of its fixed cost basis. Admittedly, this is a very rosy outlook on its bottom line.

This would see Adobe’s EPS reaching $19.29. For Adobe to deliver my estimated figure for full-year 2024 non-GAAP EPS, Adobe would have to out-deliver the high end of its EPS guidance by 7%.

If that took place, the stock would be priced at 31x forward non-GAAP EPS. That’s not an irrational valuation by any measure. But it’s far from enticing when there are plenty of small-cap tech companies that are growing meaningfully faster than Adobe and priced at very similar valuations.

On the other side of the scale within medium-caps, there are mature businesses, for example, Dropbox (DBX), that are not delivering a lot of growth much like Adobe, but are priced at 10x free cash flow.

The Bottom Line

In conclusion, despite Adobe’s consistent double-digit revenue growth rates, the Q1 2024 guidance slightly below analyst forecasts raises caution.

The overarching concern lies in Adobe’s valuation at 31x forward non-GAAP EPS, which, considering the modest growth and evolving tech landscape, prompts a reevaluation against potentially more appealing investment opportunities, particularly in small and medium-sized tech companies with far superior valuations.

While Adobe’s innovation and community engagement are commendable, its current valuation somewhat tempers the attractiveness of this stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.