Summary:

- Adobe’s stock, priced at 27x forward free cash flow, is fairly valued but lacks compelling growth, making it a less attractive investment.

- Despite strong AI tool adoption, Adobe faces slowing growth and stiff competition from Canva, Microsoft, Salesforce, and others.

- Heavy reliance on stock buybacks for shareholder returns raises concerns about capital allocation and future performance.

- Adobe’s dominance in digital creativity feels outdated, with better investment opportunities available elsewhere.

hapabapa

Investment Thesis

Adobe (NASDAQ:ADBE) delivered fiscal Q4 2024 results that were largely in line with my expectations. Even though I have been neutral on this name for a long while and remain neutral on this stock, I’m somewhat surprised that the stock dropped 10%. After all, what did investors expect?

Well, given that the stock was climbing higher alongside many names in the post-election rally, investors probably wanted to be blown away.

Basically, what we have here is a mature business priced at 27x forward free cash flow. It’s not an expensive stock by any stretch. But at the same time, I know that investors can do a lot better elsewhere, why bother to get involved here? I know I won’t.

Rapid Recap

Back in September, I said,

Even though its outlook wasn’t too far off analysts’ own expectations, this has been a battleground stock for a long time.

Bulls call Adobe a value stock, while bears question whether this business is flying high on narrative and low on growth rates.

For my part, I’m very much on the fence with Adobe, and believe that there are amply better opportunities elsewhere.

Author’s work on ADBE

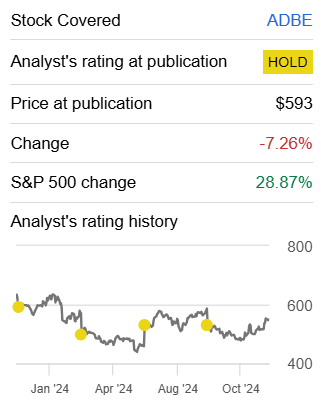

In the past year, I’ve been neutral on ADBE. And in the past year, this stock has decidedly underperformed the S&P 500. Looking ahead, I maintain that this stock is dead money.

Adobe’s Near-Term Prospects

Adobe is a leader in digital creativity and productivity tools, enabling individuals, students, and businesses to create, edit, and share content across multiple platforms.

Its offerings span Creative Cloud, which includes household names like Photoshop; Document Cloud, which includes the ubiquitous Acrobat family of products; and Experience Cloud, which powers marketing technology.

The company’s value proposition lies in its innovative use of technology to provide users with creative control, productivity products, and marketing tools.

During the very upbeat earnings call, management discussed how they are seeing strong customer adoption of its AI-powered tools. For example, how Adobe has new premium offerings, such as Firefly video models, which are expected to enhance its Creative Cloud suite.

Also, how combining Creative and Experience Clouds through GenStudio, positions Adobe to address the growing demand for personalized and scalable content production.

Given this balanced background, let’s now discuss its fundamentals.

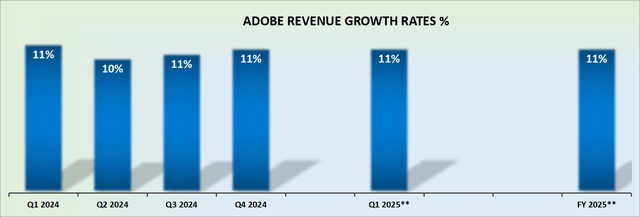

Revenue Growth Rates Moderate

In my previous analysis, back in September, I stated:

Author’s work on ADBE

This is a case that what you see is all there is. A business that is still able to deliver some growth, but at barely double-digit growth rates, this stock is not going to entice a lot of growth-minded investors.

Hence, investors are forced to look beyond its topline, to see what else there’s on offer here.

ADBE Stock Valuation — 27x Forward Free Cash Flow

Adobe holds about $2 billion of net cash, once we factor in its debt profile. That’s a fairly strong balance sheet, but nothing that is going to provide a suitable catalyst to the bull thesis.

One could make the case that there’s room for Adobe to further leverage its balance sheet and start paying out a dividend. But I’m not sure that its current shareholder base is holding on to Adobe for the sake of a potential dividend.

On the other hand, there are a lot of ETFs that would be forced to buy ADBE if the tech business did start to pay out a dividend. Nonetheless, my point is that Adobe could do something with its balance sheet, but I’m not sure there’s enough that could be done.

To further support my argument, keep in mind that in fiscal 2024, Adobe used more than 100% of its free cash flow to repurchase its stock and yet, the share price right now, including the after-hours slump, is back to around $500.

Accordingly, Adobe’s free cash flow in fiscal Q4 2024 was about $7.9 billion, and they repurchased $9.5 billion of stock.

Was that a good use of capital? It’s OK, but generally speaking, unless the company is buying back stock that is clearly undervalued, it ends up being a poor capital allocation. I suppose that management wants to be seen to be doing something, but doing something isn’t always the best decision.

On top of that, Adobe’s non-GAAP operating margin for the fiscal year just ended was 46.6%, while its guidance for the year ahead points to around 46%.

Even if management is guiding to be somewhat conservative with its guidance to allow for an easier beat later, the fact remains that squeezing higher profit margins from the business at this stage is going to be a challenge. After all, Adobe already has one of the highest profit margins in the S&P500.

How many more levers are left to optimize in the coming couple of years?

The way I see it, Adobe will probably deliver roughly the same amount of free cash flow in fiscal 2025 as in fiscal 2024. Give or take about $8 billion of free cash flow.

The main difference now is that Adobe won’t be able to as aggressively lean on its balance sheet to repurchase its stock in fiscal 2025, since the balance sheet has some flexibility, but not as much.

This leaves that stock priced at about 27x forward free cash flow. A stock that is fairly valued.

Further Risk Factors

Once interest rates start to come down further, investors will probably be more than willing to pay 27x forward free cash flow for a business that is barely delivering double-digit growth. Even if right now, the stock appears to be fairly valued.

After all, the appeal of backing Adobe is the knowledge that this is a very steady, predictable, recurring story.

On the other hand, Adobe faces near-term challenges, including fierce competition from rivals like Canva (PRIVATE) which is gaining traction with intuitive and affordable design tools, while Microsoft’s (MSFT) integration of AI features in Office products poses a threat to Adobe’s Document Cloud dominance.

Further, Salesforce (CRM) and Zeta (ZETA) also challenge Adobe in the customer experience and marketing technology space, but there are many more players out there.

Basically, the days when Adobe was the only player in the space have long gone and when we add together the challenging question of whether AI could make it a lot cheaper and easier for other companies to innovate their offering, suddenly this business gets a big question market over its continued value proposition.

The Bottom Line

I’ve decided to steer clear of Adobe’s stock. While it’s undeniably a leader in digital creativity and productivity tools, its slowing growth, stiff competition, and heavy reliance on buybacks for shareholder returns don’t inspire confidence in future performance.

At 27x forward free cash flow, it’s neither a bargain nor a compelling growth story.

Adobe’s dominance feels more like a relic of the past than a promise for the future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.