Summary:

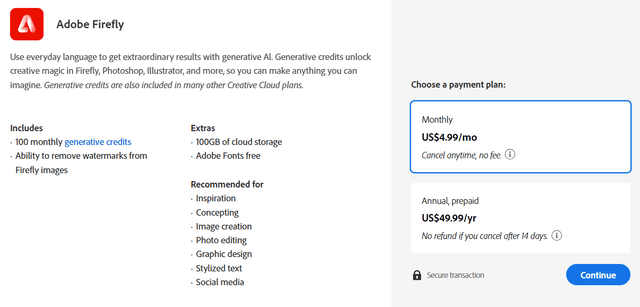

- Adobe reported an 11% constant revenue growth and 13% adj. EPS growth in Q4 FY24, with a lower-than-expected guidance for FY25.

- I believe the broad availability of Firefly Video Model in early 2025, and the upcoming higher-priced Firefly subscription, could potentially accelerate its revenue growth.

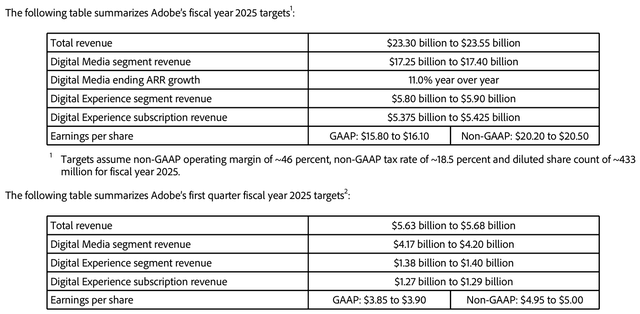

- Adobe is guiding for around 8.8% revenue growth and around 10.2% adjusted EPS growth for FY25, slightly lower than the market expectations.

- I anticipate Adobe will deliver 10% organic revenue growth, comprising 7% market growth and 3% growth from newly launched AI solutions.

andresr/E+ via Getty Images

In my previous “Strong Buy” thesis on Adobe (NASDAQ:ADBE) in September 2024, I discussed their Firefly Video Model. Adobe reported an 11% constant revenue growth and 13% adj. EPS growth in Q4 FY24, with a lower-than-expected guidance for FY25. I believe their broad availability of the Firefly Video Model in early 2025, and the upcoming higher-priced Firefly subscription, could potentially accelerate revenue growth. I reiterate a “Strong Buy” rating with a fair value of $605 per share.

Launching Firefly Video Model

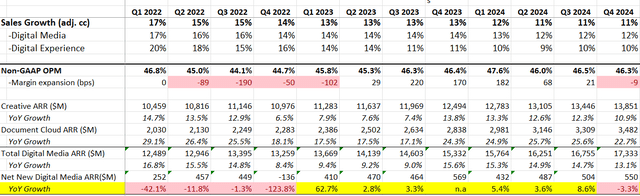

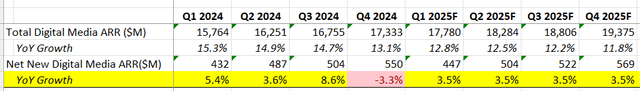

Adobe released its Q4 FY24 result on December 11th after the market close, reporting 11% constant revenue growth and 13% adj. EPS growth. As shown in the table below, Adobe’s Creative annualized recurring revenue (ARR) grew by 10.9% year-over-year. However, the company’s net new digital median ARR declined by 3.3% year-over-year.

I think the biggest highlight during the quarter was their launch of the Firefly video model on October 14th, 2024. The Firefly video model is a new breakthrough in image, vector and design models. Currently in limited public beta, the video model will be broadly available in early 2025. As noted during the earnings, Firefly video model is uniquely integrated into Premiere Pro, driving a 70% increase in Premiere Pro beta users since its introduction.

I believe the broad launch of Firefly video model could significantly enhance Adobe’s AI offerings. As a leader in video and image editing platforms, the AI-powered video model could simplify content creation and potentially attract more subscribers.

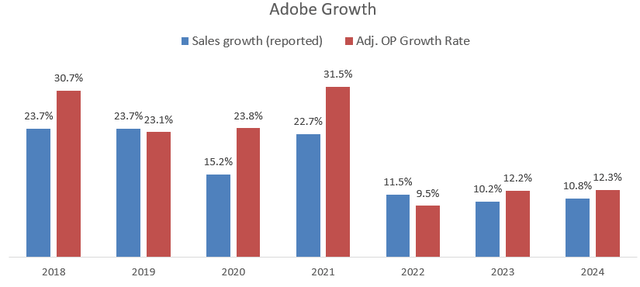

In addition, Adobe will soon introduce a higher-priced Firefly subscription service that includes their latest video models, and AI solutions for creative professionals, as noted during the earnings call. The new offering could potentially increase its ARPU and better monetize existing users.

Outlook and Valuation

Adobe is guiding for around 8.8% revenue growth and around 10.2% adjusted EPS growth for FY25, slightly lower than the market expectations.

To estimate Adobe’s topline growth, I am considering the following aspects.

Grand View Research predicts that the creative software will grow at a CAGR of 7.1% from 2024 to 2030, driven by increasing demand for digital contents. Adobe has consistently grown its topline by more than 10% in the past three years, as depicted in the chart below. I think the overall creative software market growth lays the foundation for Adobe’s growth from both its existing customers and offerings.

In addition, I’ve estimated Adobe’s digital media ARR growth, as detailed in the table below. Assuming a 3.5% year-over-year growth in net new Digital Media ARR, aligned with the recent quarterly average, I calculate that the total digital media ARR will grow by around 12% in FY25.

Adobe Digital Medial ARR Calculation

Assuming a 10% annual growth for Digital Experience, aligned with recent trends, the overall organic revenue growth is estimated to be 10%, as per my calculations.

Currently, Adobe Firefly is offered at $4.99 per month as a stand-along basis, and is also bundled with core products like Photoshop and Premiere Pro. Assuming the newly Firefly Video Model priced at $2/month as an add-on, and a 30% adoption rate for this advanced model, I calculate these AI solutions could contribute an additional 3% growth to the overall topline.

As such, I anticipate Adobe will deliver 10% revenue growth, comprising 7% market growth and 3% growth from newly launched AI solutions. Therefore, I think Adobe’s FY25 guidance is a bit conservative.

In addition, I anticipate Adobe will allocate 5% of revenue toward M&A, aligned with their historical average. Assuming they will pay a 4x EV/Sales multiple for targets (a reasonable multiple for small software companies, in my view), I calculate these deals could contribute an additional 130bsp to the topline growth.

Adobe repurchased around 17.5 million of own shares in FY24, and I anticipate the share repurchases will continue in FY25, reducing the total share count by 2% annually.

As Adobe offers subscription services and has already built its cloud infrastructure, the incremental costs of new subscription services are negligible. As such, their margin expansion will primarily be driven by price increase and operating leverage. Assuming 2% annual price increase, I calculate a 20 basis point annual expansion in gross margin. I calculate the total operating expenses will grow by 10.7% annually, leading to a total of 30bps in annual operating margin expansion.

The WACC is estimated to be 12.5% assuming: risk free rate 3.6%; beta 1.8; equity risk premium 6%; cost of debt 5%; equity $16.5 billion; debt $3.6 billion; tax rate 18.5%.

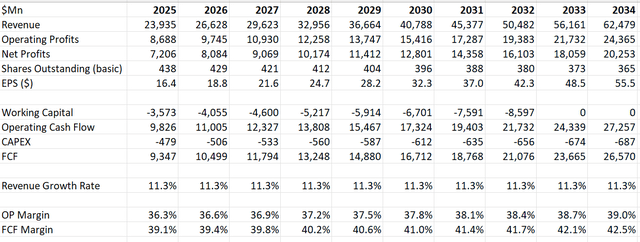

The DCF can be summarized as follows:

Discounting all the future FCF at a rate of 12.5%, the fair value is calculated to be $605 per share, as per my estimate.

Key Risks

In December 2024, OpenAI released Sora, a powerful text-to-video model, after the completion of its testing phase. Sora will be available to users at different price points in early 2025, with a capability of generating 1080p videos up to 20 seconds long in various aspect ratios.

Sora could potentially pose a significant threat to Adobe’s Premiere platform. On the positive side, Adobe has invested in its AI Video model, which could help Adobe maintain its relevance to creative professionals.

It is hard to compare the price between Sora and Adobe’s AI Model at this moment as neither has been officially priced. However, I expect both companies will have a similar subscription model. Earlier this year, Adobe indicated that they planned to cooperate with third-party AI models, such as Runway or OpenAI Sora video generation models, in Document Cloud and Digital Experience products. As such, in the future, I anticipate Adobe’s core platforms incorporating both its own AI model as well as third-party models. As OpenAI doesn’t have video and photo editing software, I believe it is natural to partner with Adobe and position themselves as a pure third-party model provider.

Conclusion

The broad availability of Firefly Video Model and the potential launch of a higher-priced Firefly subscription could significantly enhance Adobe’s value proposition in the AI-powered creative software market, in my view. I reiterate a “Strong Buy” rating with a fair value of $605 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADBE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.