Summary:

- Adobe has delivered double beat FQ2’24 earnings call while raising the FY2024 guidance, naturally warranting the tremendous rally post earnings call.

- It is apparent by now that the SaaS company continues to boast a robust moat while growing ARRs and monetizing AI across its multi-modal offerings, target audiences, and platforms.

- Despite so, the ADBE stock is still inherently discounted compared to its historical means and its peers, triggering an opportunistic long-term capital appreciation prospects.

- Combined with the excellent use of cash flow for shareholder returns, we believe that it continues to offer a compelling investment thesis here.

Gearstd/iStock via Getty Images

We previously covered Adobe (NASDAQ:ADBE) (NEOE:ADBE:CA) in April 2024, discussing why we believed that the market had over-reacted to the supposedly softer FQ2’24 earning guidance, since its core consumers remained highly sticky, as observed in the growing multi-year backlog and Annualized Recurring Revenues.

We had recommended opportunistic investors to buy the dip then, due to the SaaS company’s robust global market share of over 80% and untapped AI monetization prospects.

Since then, ADBE has already rallied by +19.1%, well outperforming the wider market at +9.7%.

Even so, we are maintaining our Buy rating, with FQ2’24 bringing forth double beat performances and raised FY2024 guidance, further underscoring its undisputed moat surrounding the well diversified SaaS offerings.

Moving forward, we believe that ADBE continues to offer a compelling investment thesis for those looking for capital appreciation opportunities. We shall discuss further.

ADBE’s AI Investment Thesis Is Here

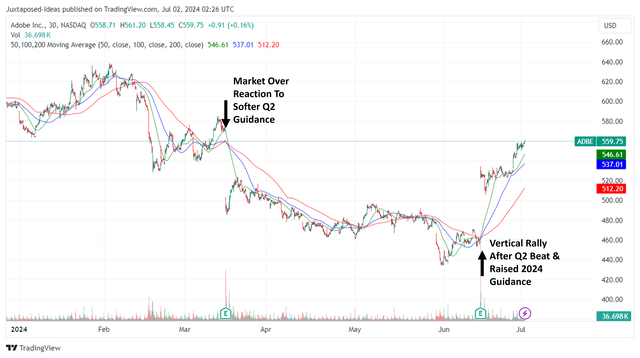

ADBE YTD Stock Price

ADBE has had a volatile first half of 2024 indeed, with the market over reacting to the management’s supposedly softer FQ2’24 guidance in March 2024 and sentiments rapidly recovering after the subsequent FQ2’24 double beat/ raised FY2024 guidance by June 2024.

For context, the management has reported FQ2’24 revenues of $5.31B (+2.5% QoQ/ +10.1% YoY) and adj EPS of $4.48 (inline QoQ/ +14.5% YoY), well exceeding the original midpoint guidance of $5.275B and $4.375, respectively.

Much of ADBE’s top-line tailwinds are attributed to its highly sticky SaaS offerings, as observed in the growing Digital Media Annualized Recurring Revenue [ARR] of $16.25B (+3.1% QoQ/ +14.9% YoY), Creative ARR of $13.11B (+2.5% QoQ/ +12.6% YoY), and Document Cloud ARR of $3.15B (+5.7% QoQ/ +26% YoY).

This is on top of its ability to cross-sell to existing and/ or new customers, based on the net new Digital Media ARR of $487M (+12.7% QoQ/ +3.6% YoY), with the accelerating QoQ growth well exceeding the management’s original guidance of $440M.

It is apparent from these developments, that the ADBE management has only been prudent in their guidance, since this strategy has allowed the SaaS company to sustain its consecutive top/ bottom-line beats over the past six quarters.

The same robust consumer demand may also be observed in the expanding gross profit margins of 88.7% (+0.1 points QoQ/ +0.6 YoY/ +3.8 from FY2019 levels of 84.9%) and efficient operations in the adj operating margins of 45.9% in FQ2’24 (-1.5 points QoQ/ +0.6 YoY/ +6 from FY2019 levels of 39.9%).

At the same time, part of the market’s exuberance may also be attributed to Adobe Firefly’s recent expansion from “ethical AI training” to “third-party text, image, and video” integration and strategic partnerships, which allows the SaaS company to accelerate the development of its multi-modal generative AI models.

Perhaps the increasingly rich AI capabilities have contributed to the company’s growing monthly active users and accelerated ARR growth on a QoQ basis. This is on top of the strategic launch of its new Adobe Express applications across the iOS and Android platforms in March 2024, allowing them to diversify their monetization efforts through other smart devices and target audiences.

As a result of these developments, we can understand why the market is increasingly buying into ADBE’s AI monetization prospects, directly contributing to the stock’s recent rally.

ADBE Is Still Inherently Discounted Here

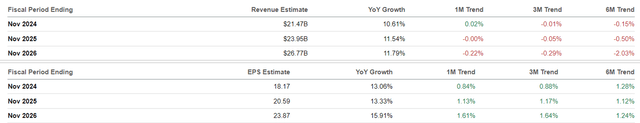

The Consensus Forward Estimates

ADBE has also raised their FY2024 revenue guidance to $21.45B (+10.5% YoY) and adj EPS guidance to $18.10 (+12.6% YoY) at the midpoint, up from the $21.4B (+10.2% YoY)/ $17.80 (+10.7% YoY) offered in the FQ4’23 earnings call.

This has naturally led to the consensus raised forward estimates, with the market expecting the SaaS company expected to generate an improved bottom-line expansion at a CAGR of +14.1% compared to the previous article at +13.5%.

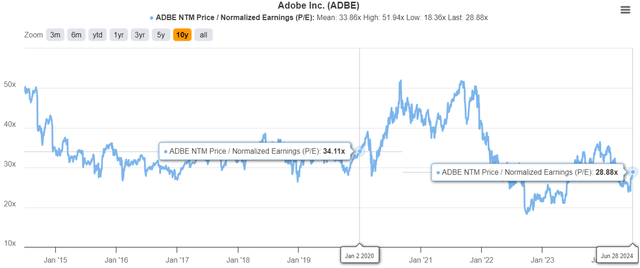

ADBE Valuations

This development has also led to the market’s moderate upgrade in ADBE’s FWD P/E valuations from the previous article at 26.09x to 28.88x, implying the improved conviction surrounding the company’s long-term prospects.

The optimism is not overly done as well, with the stock still inherently discounted compared to its 3Y pre-pandemic mean of 32.68x and 10Y mean of 33.86x.

This is especially since ADBE’s projected bottom-line growth through FY2026 does not pale in comparison to its other enterprise SaaS peers, such as Microsoft (MSFT) at FWD P/E of 37.77x and adj EPS CAGR of +16.9%, Oracle (ORCL) at 22.55x/ +14.4%, Autodesk (ADSK) at 30.47x/ +11.2%, respectively, implying that the former is still reasonably valued here.

This is especially aided by the growing multi-year remaining performance obligations of $17.86B (+1.5% QoQ/ +17.3% YoY/ +81.8% from FY2019 levels of $9.82B) in FQ2’24, with the highly sticky SaaS offerings lending strength to its long-term investment thesis.

So, Is ADBE Stock A Buy, Sell, or Hold?

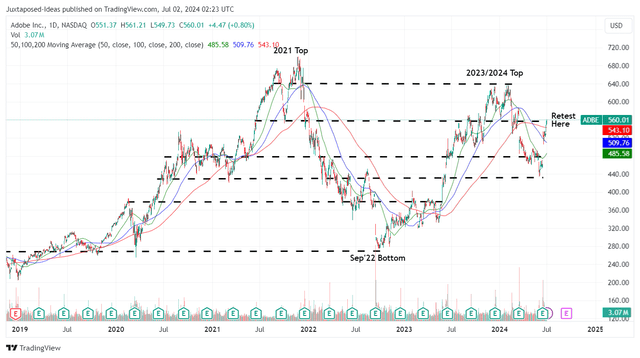

ADBE 5Y Stock Price

For now, ADBE has charted a nearly vertical rally since the recent FQ2’24 earnings call, while well exceeding its 50/ 100/ 200 day moving averages.

For context, we had offered a fair value estimate of $437.20 in our last article, based on the LTM adj EPS of $16.76 and the discounted FWD P/E valuations of 26.09x.

This is on top of the long-term price target of $612.50 in our last article, based on the FY2026 adj EPS estimates of $23.48 and the same discounted FWD P/E.

As discussed above, as the market grows increasingly certain about ADBE’s AI monetization prospects, it is unsurprising that the stock’s FWD P/E valuation has been upgraded to 28.88x, with it also nearing its 1Y mean of 30.52x.

This implies that the stock is still trading not too far from our upgraded fair value estimates of $522.70, based on the management’s raised FY2024 adj EPS guidance to $18.10 (+1.6% from previous estimates) and the FWD P/E of 28.88x.

Based on the consensus raised FY2026 adj EPS estimates of $23.87 (+1.6% from previous estimates) and potential upgrade in its FWD P/E nearer to its 10Y P/E mean of ~33x, we believe that there may be an expanded upside potential of +41.2% to our raised long-term price target of $787.70 as well.

The upgrade is not overly aggressive indeed, as discussed in our valuation section above, since ADBE remains inherently undervalued here. This is on top of the sustained share repurchases worth $7.17B (+24.6% sequentially), with 7.3M shares/ 1.5% of its float already retired over the LTM, building upon the 37.45M/ 7.6% retired since FY2019, demonstrating the robust shareholder returns thus far.

As a result of the still attractive risk/ reward ratio at current levels, we are reiterating our Buy rating here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.