Summary:

- ADBE’s double beat performance and robust FY2024 guidance have been met with skepticism, with the stock plunging afterwards.

- Part of the headwinds may be attributed to its deteriorating balance sheet, thanks to the aggressive share repurchases and higher interest expenses.

- Even so, ADBE’s high growth trend can not be denied, as observed in the growing ARR/ multi-year backlog with increasingly richer gross profit margins.

- With adoption of its AI tools already accelerating on a QoQ/ YoY basis, we believe that these remain early days in the SaaS company’s AI monetization cadence.

- It goes without saying that the market remains somewhat pessimistic about ADBE’s prospects, with the stock likely to underperform in the near-term.

Klaus Vedfelt

ADBE’s Investment Thesis Is Even More Attractive After The Correction

We previously covered Adobe (NASDAQ:ADBE) (NEOE:ADBE:CA) in July 2024, discussing why we had maintained our Buy rating then, attributed to the double beat FQ2’24 performance and raised FY2024 guidance, with it underscoring the undisputed moat surrounding the well diversified SaaS offerings.

Combined with the growing ARRs and improved AI monetization across its multi-modal offerings, target audiences, and platforms, we had believed that it continued to offer a compelling investment thesis for those looking for capital appreciation opportunities.

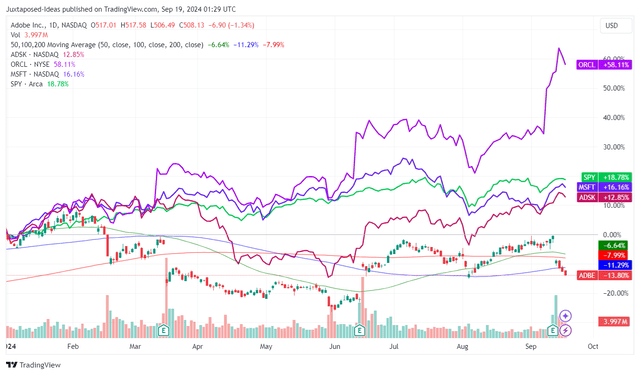

ADBE YTD Stock Price

Since then, ADBE has had seven consecutive double beat performances with FQ3’24 bringing forth a similar outperformance – one that has been unappreciated as observed in the underwhelming YTD stock price performance compared to its diversified SaaS peers and the wider market.

For reference, ADBE reported FQ3’24 revenues of $5.4B (+1.8% QoQ/ +10.4% YoY) and adj EPS of $4.65 (+3.7% QoQ/ +13.6% YoY).

Much of its tailwinds are attributed to the accelerating subscription revenue growth to $5.18B (+2.3% QoQ/ +11.8% YoY) and increasingly rich subscription gross margins of 92% (+1.1 points QoQ/ +1.7 YoY) – with it underscoring why the management’s strategic decision to shift from one-time perpetual license business model to the subscription business model have worked out profitably.

It is apparent from these developments, that ADBE has been able to command a robust pricing power, with it triggering expanding adj operating margins of 46.5% (+0.6 points QoQ/ +0.3 YoY).

The excellent SaaS demand has also been observed in the growing Annualized Recurring Revenue [ARR] of $16.76B (+3.1% QoQ/ +14.7% YoY) and multi-year Remaining Performance Obligations [RPO] of $18.14B (+1.5% QoQ/ +15.3% YoY), with it naturally offering investors with an extremely healthy outlook into its intermediate-term top/ bottom-line performance.

While the market has previously lamented ADBE’s supposedly slower AI monetization, we believe that the results above have already demonstrated its ability to natively integrate AI capabilities into its existing SaaS offerings, including Adobe GenStudio and Firefly Services.

If anything, AI adoption has been accelerating on a QoQ/ YoY basis, with the management reporting over 12B Firefly-powered generations (+33.3% QoQ/ +500% YoY) and +70% QoQ growth in AI Assistance usage by FQ3’24 – with it delivering the extra layer of generative AI creative power that is “commercially safe.”

On the one hand, market sentiments have naturally been marred by ADBE’s supposedly softer FQ4’24 outlook, with the revenue guidance of $5.525B at the midpoint (+2.3% QoQ/ +9.6% YoY) and adj EPS guidance of $4.655 (inline QoQ/ +9% YoY) met with a drastic stock pullback of -13.3% by the time of writing.

For now, we can understand why the market has decided to discount its prospects, since these numbers pale in comparison to its 10Y top/ bottom-line growth CAGR at +16.9%/ +28.2%, respectively, significantly worsened by the cooling market sentiments surrounding generative AI stocks.

On the other hand, we believe that the correction has already been overly done, since ADBE’s overall FY2024 guidance of $21.42B (+10.3% YoY) and $18.26 (+13.6% YoY) remains way higher than the original guidance of $21.4B (+10.2% YoY) and $17.80 (+10.7% YoY) offered in the FQ4’23 earnings call, respectively.

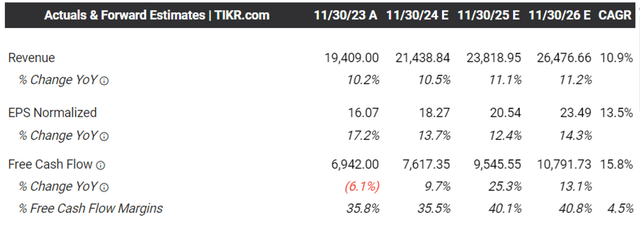

The Consensus Forward Estimates

If anything, the consensus forward estimates remain optimistic, with ADBE still expected to generate double digit top/ bottom-line growth through FY2026, with accelerating Free Cash Flow generation.

The latter has already allowed the SaaS company to accelerate their shareholder returns, with $8.55B (+52.6% sequentially) or the equivalent 2.3% of its float retired over the last twelve months, and 8.3% since FY2019.

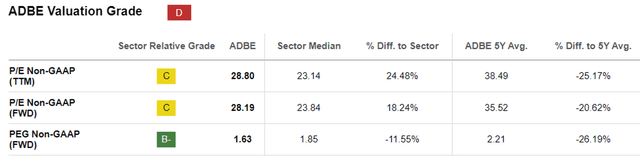

ADBE Valuations

Lastly, we believe that ADBE remains cheap at FWD P/E non-GAAP valuations of 28.19x, compared to its 5Y mean of 35.52x while elevated compared to the sector median of 23.84x.

This is attributed to its relatively reasonable FWD PEG non-GAAP ratio of 1.63x compared to its 5Y mean of 2.21x and the sector median of 1.83x.

Even when comparing ADBE to its enterprise SaaS peers, such as Microsoft (MSFT) at 2.48x, Oracle (ORCL) at 2.28x, and Autodesk (ADSK) at 1.95x, it is undeniable that the former is highly attractive here, offering interested investors with an improved margin of safety.

So, Is ADBE Stock A Buy, Sell, or Hold?

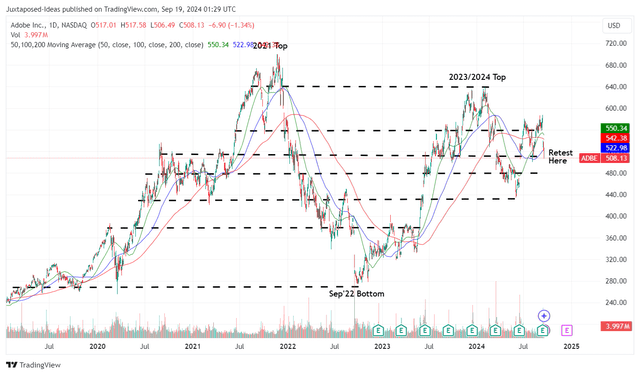

ADBE 5Y Stock Price

For now, ADBE’s recovery from June 2024 has been mostly moderated, attributed to the July 2024 market rotation, with the stock now retesting its previous support levels of $508s while trading below its 50/ 100/ 200 day moving averages.

Even so, we believe that the recent pullback has been well deserved indeed, since it is finally trading near to our updated fair value estimates of $514.70, based on the management’s raised FY2024 adj EPS guidance of $18.26 and the FWD P/E of 28.19x.

There remains an excellent upside potential of +52.5% to our bull-case price target of $775.10 as well, based on the consensus FY2026 adj EPS estimates of $23.49 and the eventual upgrade in its FWD P/E nearer to its 10Y P/E mean of ~33x.

As a result of the attractive risk/ reward ratio and robust capital appreciation prospects, we are reiterating our Buy rating for the ADBE stock here.

Risk Warning

It goes without saying that the market remains somewhat pessimistic about ADBE’s prospects, as observed in the stock’s volatility since early 2024 – with it implying a lack of bullish support. This development suggests that the stock may continue to underperform in the near-term, prior to the restart of its new growth opportunities.

As a result, readers may want to pay attention to the management’s FY2025 guidance in the December 2024 earnings call, since it will be highly indicative of the SaaS company’s near-term prospects along with the potential impact on its stock valuations and prices.

At the same time, while the Fed has started to pivot in the September 2024 FOMC meeting, ADBE has also reported a deteriorating balance sheet with a net cash position of $1.9B (-22.4% QoQ/ -51% YoY) partly attributed to the aggressive share repurchases thus far.

The higher debt levels have already triggered a drastic increase in its annualized interest expenses to $204M (+24.3% QoQ/ +88% YoY), attributed to the debts issued in April 2024 at a relatively higher weighted average interest rate of 4.99%, compared to the prior debts at 2.48%.

Therefore, while the consensus has priced in higher Free Cash Flow generation from FY2025 onwards, readers may want to monitor ADBE’s balance sheet health moving forward, since any further debt reliance may trigger an impact on its bottom-line performance.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.