Summary:

- Adobe Inc. reported its earnings last week, and the company beat on the top and bottom lines. We examine the results a bit closer.

- AI has made the stock price increase significantly over the last month, but what is the impact on the company’s fundamentals?

- At the same time, investors are worried about AI negatively weighing on the company’s growth. We look at this concern.

- Stock-based compensation remains high, but we show how cash-generative Adobe is even after taking this metric into account.

- Management raised guidance across the board, although there was one lowlight.

da-kuk

Introduction

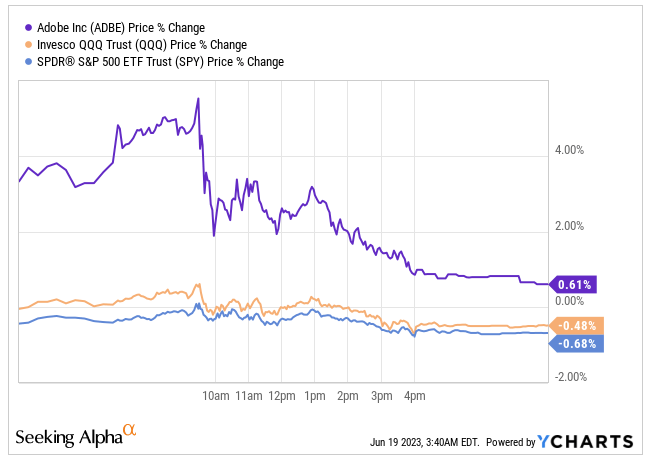

Adobe Inc. (NASDAQ:ADBE) reported great quarterly earnings for fiscal Q2 2023 again. The company beat on the top and bottom lines and raised its guidance for the year. The market liked the results and sent the stock price up 4% after hours. It corrected the following day due to the broad market weakness:

YCharts

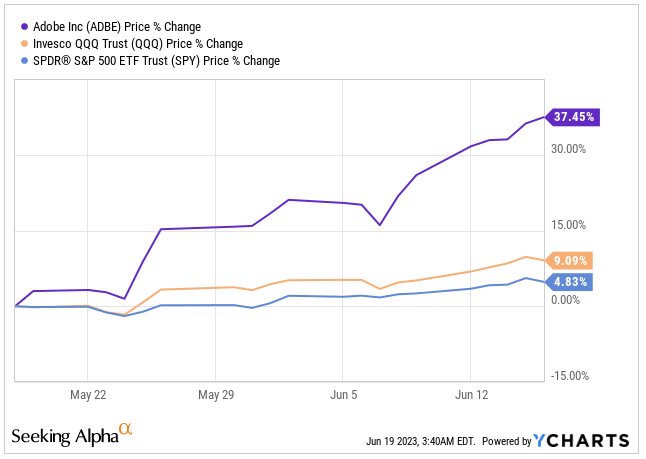

We must not forget that Adobe has had a big run coming into earnings. The company’s stock is up almost 40% in the last month alone!

YCharts

The reason behind this run is probably AI, as investors have realized that Adobe might be a winner in the space, especially when it comes to enterprise customers. For this reason, all eyes were on AI during the call. Management had already given us information about how they plan to monetize its AI offerings, but they were even more explicit this time. They also told investors when we could expect these revenues.

Without further ado, let’s take a look at Adobe’s quarter.

The numbers

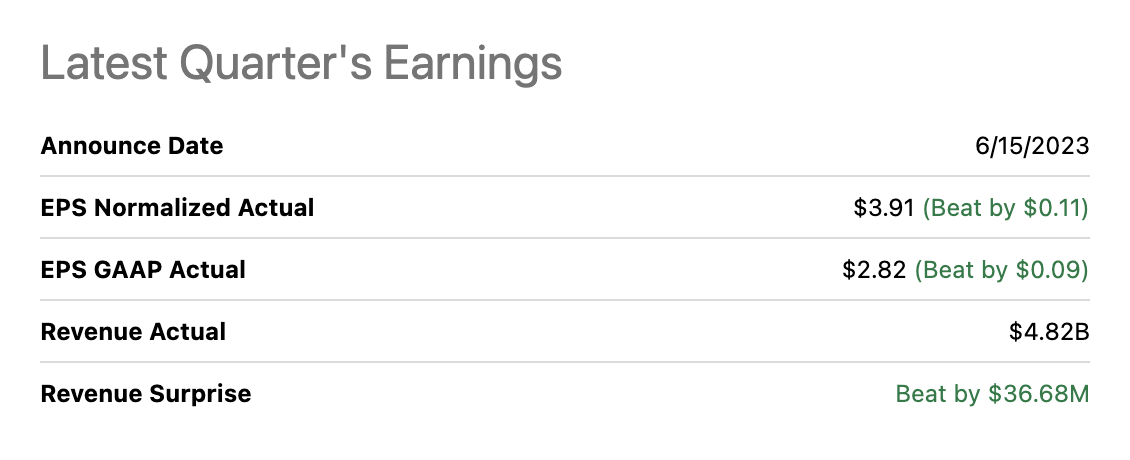

Adobe beat analysts’ top and bottom line estimates again:

Seeking Alpha

At first glance, it might seem the beat was driven by AI, but this is only partially true. Even though the company is moving fast with its AI offerings, we are still not seeing their direct impact on the top line and, most importantly, the bottom line. We’ll discuss this in more detail later.

The top line – AI driving indirect revenue?

Adobe’s growth was the same as last quarter in constant currency, although currency headwinds subsided slightly. The company grew revenue by 13% in Constant Currency, with a 3% revenue headwind. This means that reported revenue grew 10% year-over-year.

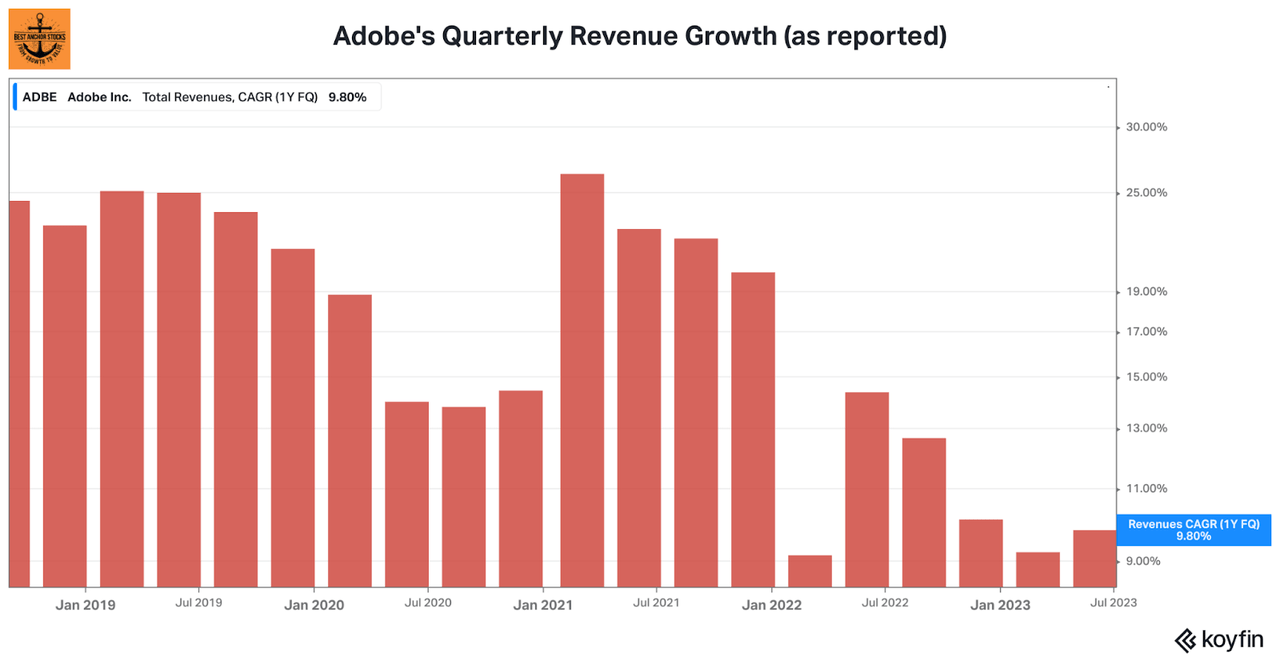

Quarterly revenue growth had been decelerating for some quarters, so it’s great to see it accelerated for the first time in a while:

Koyfin

This acceleration might have been partially caused by pandemic comps fading away. This is why we should always try to look forward and focus on the compounded annual growth rate in revenue, not any quarterly revenue growth individually. Growth goes up and down, especially after such a volatile period as the pandemic. If we zoom out and look at Adobe’s Q2, we can see the company has compounded its revenue by 15% over the last 4 years.

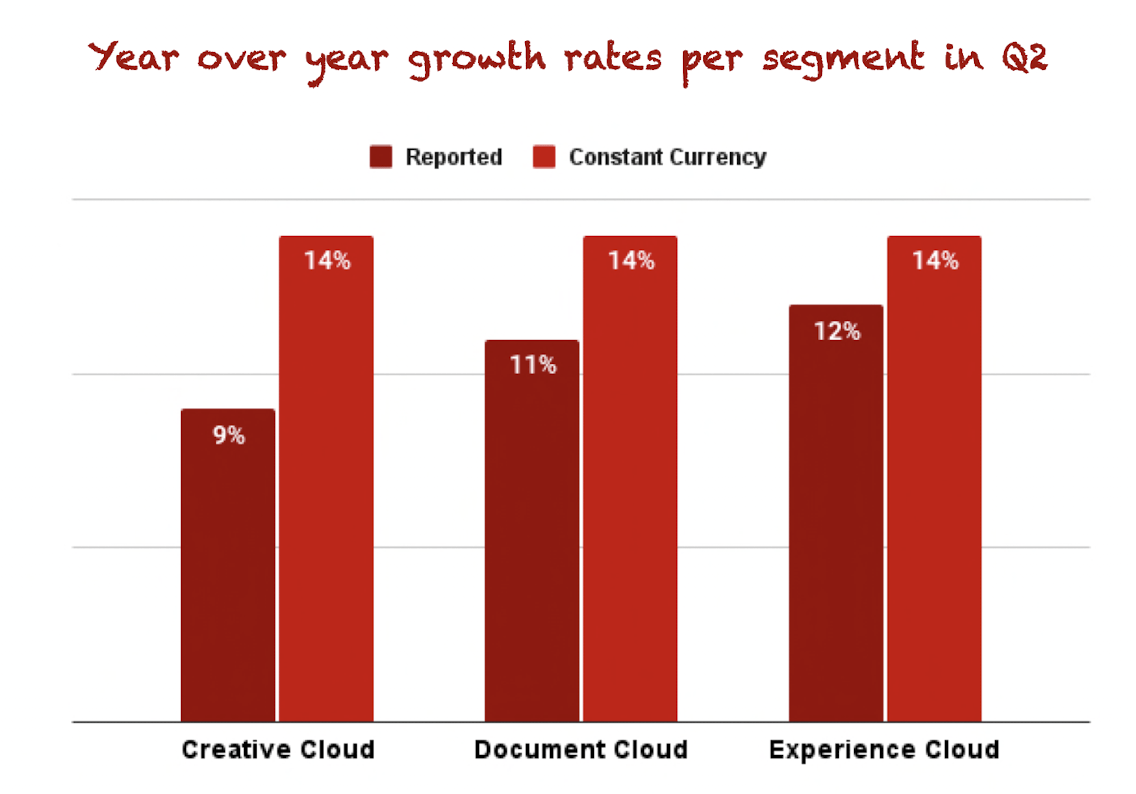

All of the company’s segments grew at the same pace this quarter in constant currency. The surprise was probably Creative Cloud which accelerated from last quarter. Document Cloud slightly decelerated, and Experience Cloud remained resilient:

Made by Best Anchor Stocks

Let’s look at each individually.

Digital Media Highlights – What about AI?

Adobe exited the quarter with $14.14 billion in Digital Media ARR (Annual Recurring Revenue). This means the company added around $470 million in annualized net new ARR quarter-over-quarter. This marked an acceleration compared to last quarter, where it added around $370 million.

Management cited several revenue drivers for Creative Cloud. Direct AI revenue was not among these, but we think we might be seeing AI weigh in indirectly. Adobe’s AI innovations have gathered a lot of attention in the designer community, which might have led to additional signups or upselling.

The direct monetization of AI might still not be here, but the funnel opportunities it creates might be starting to surface. Management believes that one of the strong points of AI is that it will help Adobe reach more people, not less like many people think. We’ll discuss this in more detail later. This AI interest can already be seen in some of the company’s betas:

Users have now generated over 0.5 billion assets on the Firefly website and in Photoshop, making these 2 of our most successful beta releases in company history.

Source: David Wadhwani, President of Digital Media, during the Q2 2023 earnings call (emphasis added).

Adobe also released a much-needed update to Express. We had tried the prior version of Express, and it was not great. We still have to try this one, but a fundamental change comes from the integration of Firefly. Adobe Express now has generative AI capabilities, which are probably more important here than in any other product, as this one is oriented toward non-professional designers. Adobe Express is also important for the content supply chain, which refers to the link between Creative and Experience Cloud:

The enterprise version of Adobe Express and Firefly will empower every employee in an organization to participate in the creation of content, campaigns and websites in conjunction with Experience Cloud.

Source: David Wadhwani, President of Digital Media, during the Q2 2023 earnings call (emphasis added).

This content supply chain is at the front and center of Adobe’s strategy, so the company has unified its enterprise salesforce:

And so we have one enterprise sales force calling on them across Express, Creative Cloud as well as Experience Cloud solutions.

Source: Shantanu Narayen, Adobe’s CEO, during the Q2 2023 earnings call (emphasis added).

At first, many people (ourselves included) believed that AI was advancing faster than Adobe, but we are pretty impressed with the company’s quick response to the “threat.” After some additional research, we believe management has transformed AI from a threat to a differentiator and an opportunity.

It’s not only AI that’s blowing in Adobe’s favor. The company made some investments in collaboration products and other formats like 3D design, and these are playing out well:

Another strong quarter for Adobe Stock and other emerging businesses, with exiting ARR for both Frame.io; and Substance growing greater than 50% year-over-year in constant currency.

Source: Dan Durn, Adobe’s CFO, during the Q2 2023 earnings call (emphasis added).

Document cloud ending ARR grew faster than revenue for another quarter. Revenue grew 14% year-over-year, but ending ARR grew 22% year-over-year. This is a good indicator that growth in this segment is far from over. There’s not much to comment on here except the fact the company is seeing a strong uptake in its collaborative and mobile offerings.

Digital Experience highlights – Differentiated but suffering some headwinds

Digital Experience was a slight lowlight. The segment continues to grow at a good pace but far from what one would expect for such a differentiated offering that is so much in demand. There’s no denying that Experience Cloud is becoming ubiquitous in large corporations:

Experience Cloud is now used by 87% of Fortune 100 companies.

Source: Anil Chakravarthy, Digital Experience President, during the Q2 2023 earnings call (emphasis added).

But if it’s so ubiquitous, why isn’t it growing faster? One explanation might be that many of these corporations are still early in the upsell. These companies might use one or two products today, which will inevitably lead to upselling in the future. Upselling should happen in other Experience Cloud products and across clouds.

Key to this upselling is making the Experience Cloud easier to use. According to management, AI will play an important role in this:

Conversation in natural language interfaces powered by Sensei gen AI will make it significantly easier for any marketer to derive insights from customer journey analytics and apply these insights in real-time to optimize their campaigns.

Source: Anil Chakravarthy, Digital Experience President, during the Q2 2023 earnings call (emphasis added).

We believe this upselling will eventually happen, but knowing when and at what pace is challenging. We don’t think we’ll see it in the short term, as management said that some projects are being pushed out:

While overall demand is strong and win rates remain healthy, as we enter the second half, we are seeing some projects being pushed out in the current enterprise spend environment.

Source: Anil Chakravarthy, Digital Experience President, during the Q2 2023 earnings call.

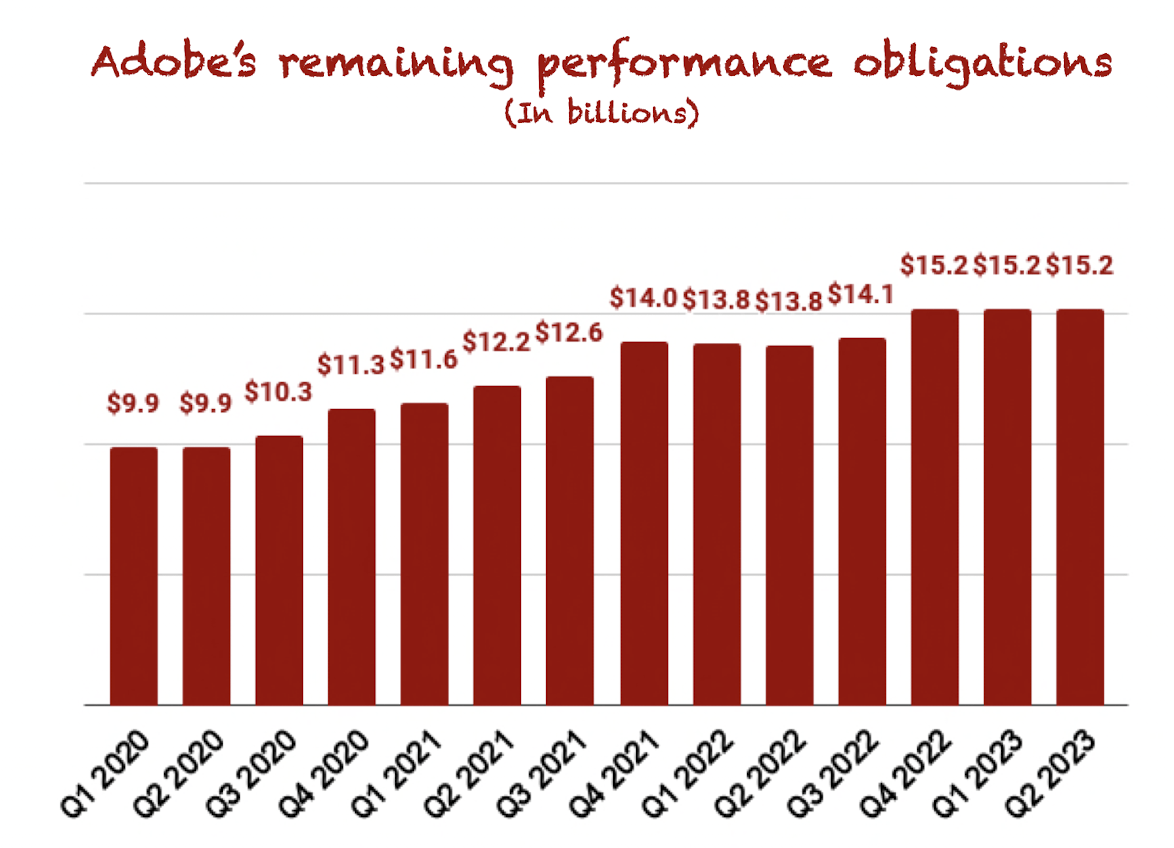

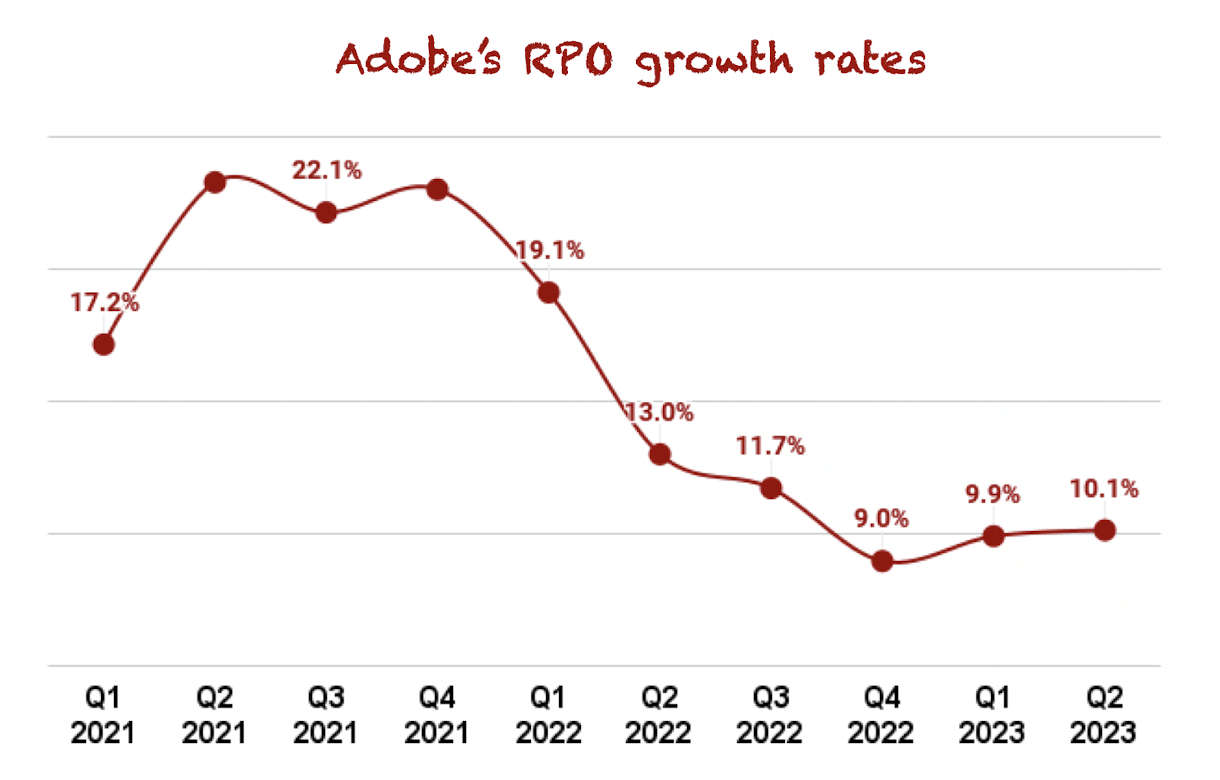

Remaining performance obligations (RPO), the leading indicator

Adobe also reports remaining performance obligations, which includes all contracts, both invoiced and not. Therefore, RPO is a leading indicator of sales.

RPO was $15.22 billion exiting the quarter, a 10% year-over-year increase or 13% in constant currency:

Made by Best Anchor Stocks

Adobe RPOs remained more or less flat sequentially for another quarter:

Made by Best Anchor Stocks

We don’t think there’s much to worry about here. The company’s generative AI offerings are still not in this number.

Profitability – Investors’ focus

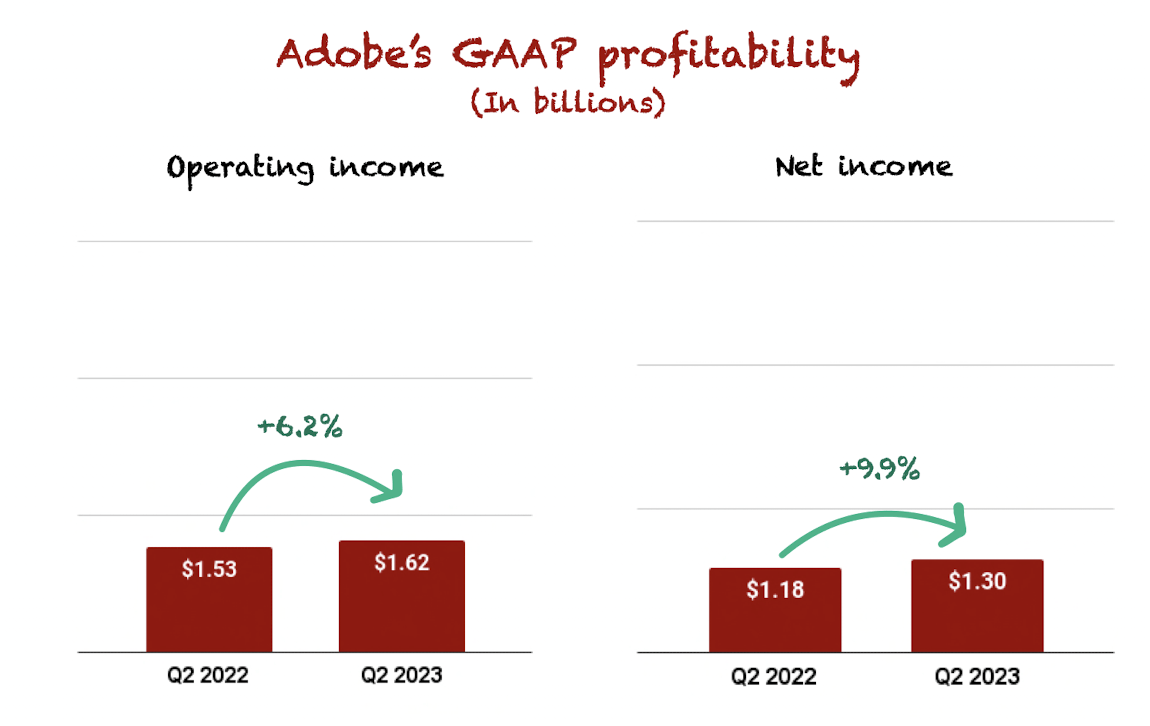

Adobe reported GAAP operating income of $1.6 billion and GAAP net income of $1.3 billion:

Made by Best Anchor Stocks

We are still seeing margin contraction at the operating level, but the pace of the contraction is decelerating.

Despite this margin contraction, the company posted a very healthy 34% and 27% GAAP operating and net income margins, respectively. We must consider that some “AI costs” here are not being matched by revenue. These are the costs associated with generative AI:

When we think about the cost drivers, we think about training, we think about inference, we think about storage costs.

Source: Dan Durn, Adobe’s CFO, during the Q2 2023 earnings call (emphasis added).

Management also said they are working on some initiatives to be efficient with these costs:

The first is the model training itself. There are a number of things the team has been doing to optimize our ability to train larger models more efficiently.

The second is post-training inference optimization. There’s a lot of, I think, cutting-edge work coming out here, both in terms of research and the work we’re doing around things like pruning and distillation and quantization that make the inference execution much more efficient.

Third is, as we’ve talked about in the past, we’re working with folks like NVIDIA to make sure that the hardware and software advances go hand in glove, and we’re leveraging more and more compute pathways that are on the chip itself.

Four is user experience, making sure that as we expose these things to users, we do it in a way that drives more efficiency in the back end.

Source: David Wadhwani, Digital Media President, during the Q2 2023 earnings call (emphasis added).

There are many doubts about where we will see margins after AI comes into play, but we think it’s a good sign to see margins remaining resilient as these costs come in with no revenue yet to match them. Management got the question about AI and margins, and Shantanu answered the following (emphasis added):

I just wanted to add, in addition to all of that great work that we’re doing on saving costs, I’m more excited about the top line growth that this is going to cause for us.

This makes us believe that we’ll see margins contract even after revenue from AI offerings comes in, but a higher growth rate in the top line will compensate for this. Having a good AI offering is not cheap, but that’s also a reason why not many companies can really compete with Adobe in the space.

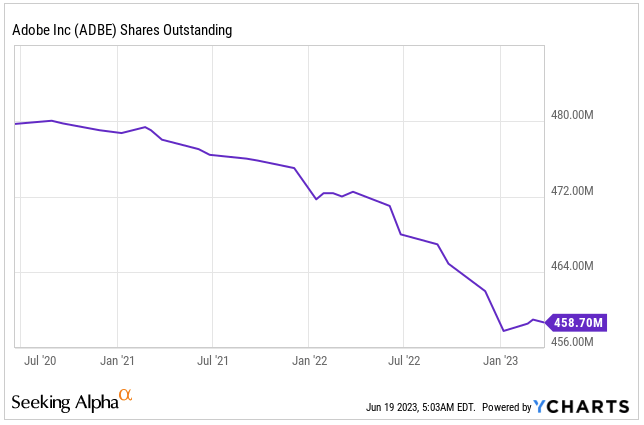

SBC (Share-Based Compensation) was once again high, growing 23% year-over-year to $433 million. The company spent $1 billion in repurchases during the quarter to offset dilution, slightly decreasing shares outstanding:

YCharts

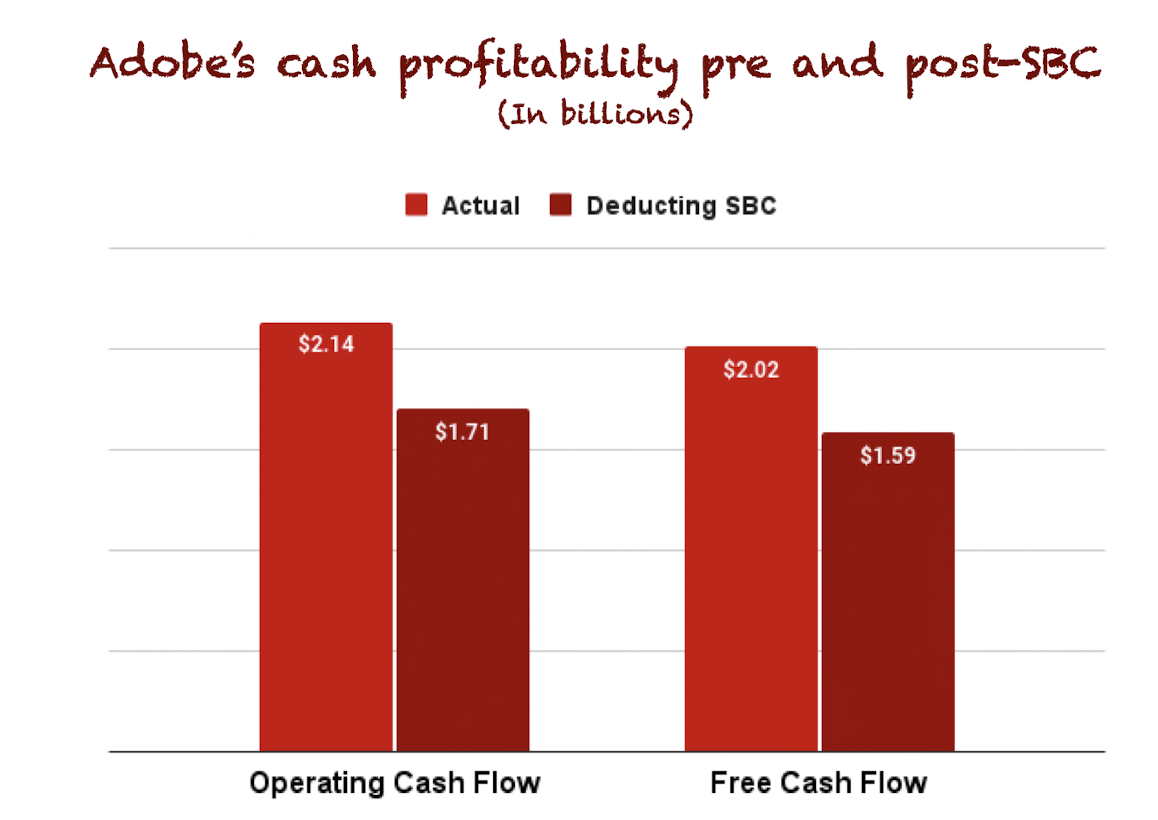

As we always say, we have nothing against SBC as long as we treat it as an expense. Technology companies in the U.S. use this compensation method to attract the best talent, and there’s little a tech company can do to avoid it if they want to remain competitive in the labor market. If we deduct SBC from Cash Flows, we come to the following numbers:

Made by Best Anchor Stocks

We think these adjusted numbers are a fairer representation of the company’s true cash generation capacity, as it systematically spends some of this cash in stock repurchases to offset SBC dilution. Even after deducting SBC, we can see that Adobe is a cash-generative company, posting 35% and 33% operating and free cash flow margins, respectively.

This cash generation capacity allows the company to enjoy a strong financial position and even strengthen it.

Balance sheet is getting stronger

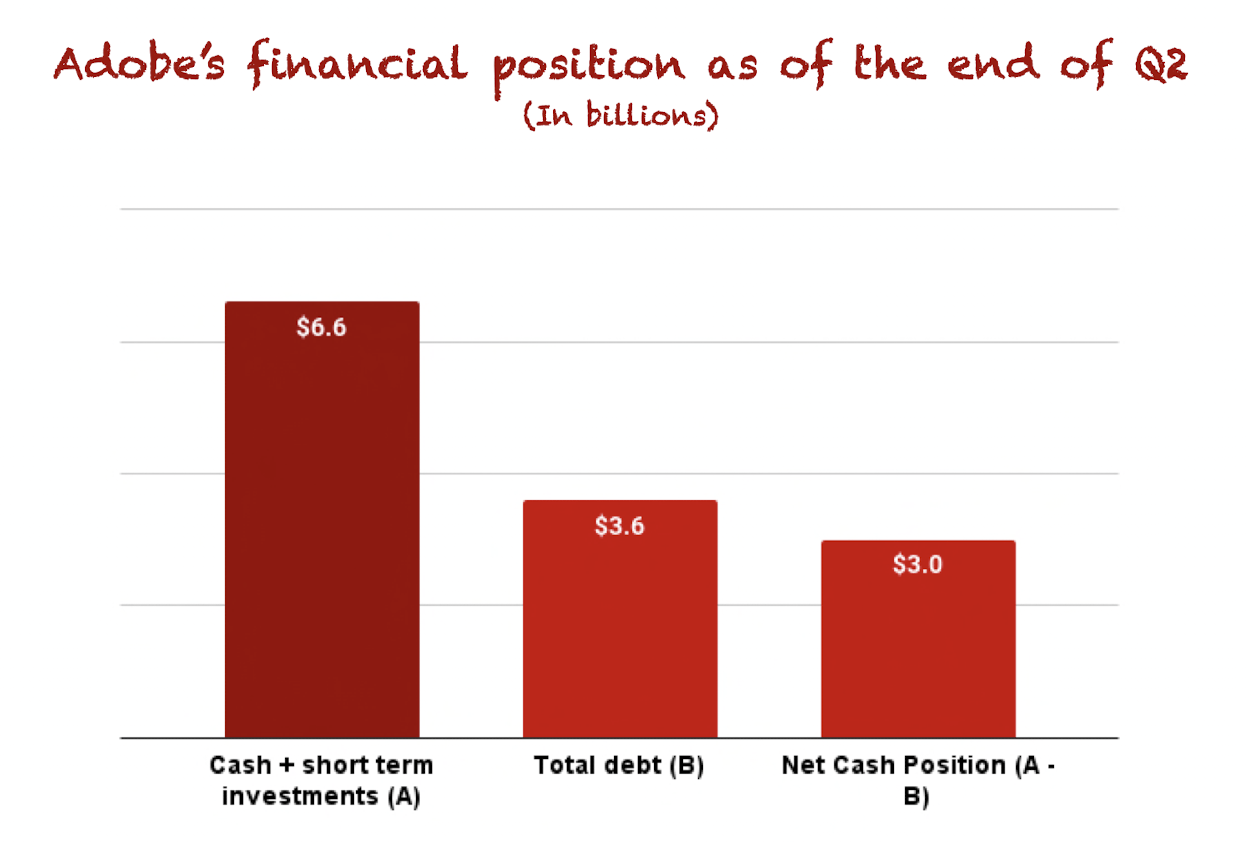

Adobe’s balance sheet strengthened this quarter. The company ended the quarter with $6.6 billion in cash and short-term investments and $3.6 billion in debt. This results in a net cash position of $3 billion, improving remarkably versus the previous quarter ($1.9 billion):

Made by Best Anchor Stocks

We should take this financial position with a grain of salt, though. If the Figma acquisition goes through, we’ll see two things:

-

The company’s financial position weakening, although we don’t think the weaker financial position would be worrying.

-

SBC jump considerably: part of the deal will be paid in stock, so we’ll see quite a bit of money going into repurchases to offset dilution.

Qualitative highlights

Comments on Figma and our thoughts

Management did not make many comments on Figma. They simply said the following (emphasis added):

We continue to engage in conversations with the Competition and Markets Authority in the U.K., the European Commission and the U.S. Department of Justice as they conduct their regulatory reviews and given the merits of the case, we believe the transaction should close by the end of 2023.

We don’t think we should expect management to say anything different. We believe that Adobe’s AI leadership might make this acquisition less necessary today than when it was announced. We are less worried today about the deal not going through than we were before Adobe Firefly, but we are still making up our minds on this topic.

How and when will Adobe monetize AI?

It’s becoming obvious that Adobe will become a generative AI leader thanks to its several competitive advantages (some of which we discussed here), but the question is if this new landscape will be accretive for the company’s financials.

To answer this question, we must first look at how the company plans to monetize AI, which management clearly explained during the earnings call:

First, Firefly will be available both as a standalone freemium offering for consumers as well as an enterprise offering announced last week.

Second, copilot generative AI functionality within our flagship applications will drive higher ARPUs and retention.

Third, subscription credit packs will be made available for customers who need to generate greater amounts of content. Fourth, we will offer developer communities access to Firefly APIs and allow enterprises the ability to create exclusive custom models with their proprietary content. And finally, the industry partnerships as well as Firefly represent exciting new top-of-funnel acquisition opportunities for Express, Creative Cloud and Document Cloud.

Our priority for now is to get Firefly broadly adopted, and we will introduce specific pricing later this year.

Source: David Wadhwani, President of Digital Media, during the Q2 2023 earnings call (emphasis added).

The company is still not monetizing AI, but the monetization strategy is clear. We should see “AI revenue” flow into the income statement around Q4. This is where we will start to see if the higher revenue growth will compensate for the supposedly lower margins coming from this new paradigm.

Won’t AI reduce the number of seats?

Another concern from investors is the number of seats. Many people believe that if AI makes designers much more productive, companies can do the same work with fewer people, and the number of seats available for Adobe will decrease. It’s a fair concern and one that management addressed during the earnings call:

So Brent, if you take a look at Adobe’s history, this is what we do, right? If you look at desktop publishing, if you look at creative imaging, if you look at video editing, the result of Adobe’s focus here is always about increasing productivity, increasing the importance of these new workflows, and that has always led to an increase in jobs.

Let’s take video editing as an example, right? We lowered the cost of production in video significantly with our work with Premier and After Effects in Audition. And what that did was it increased the ability for people to create more content. So they didn’t create the same amount of content with fewer people. What they did was they found new business opportunities.

Source: David Wadhwani, President of Digital Media, during the Q2 2023 earnings call (emphasis added).

This explanation makes sense for several reasons. First, content creation is growing fast. The need for more content creation might grow faster than productivity, thereby increasing the number of seats:

And we’re sitting at a moment where companies are telling us that there’s a 5x increase in content production coming out in the next couple of years. And you see a host of new media types coming out. And we see the opportunity here for both seat expansion as a result of this.

Source: David Wadhwani, President of Digital Media, during the Q2 2023 earnings call (emphasis added).

This might happen, but understanding if it will be a net positive or negative for Adobe is tough. What seems more evident is that Adobe will make money out of this increased productivity even if seats decrease:

And also because of the value we’re adding into our products themselves, increase in ARPU as well.

Source: David Wadhwani, President of Digital Media, during the Q2 2023 earnings call (emphasis added).

There’s another angle to this too. As Adobe’s products become more differentiated, the company expects to retain customers for longer, thereby increasing the lifetime value (“LTV”).

How the number of seats will evolve is an unknown at this point, but we think management’s explanation makes sense. It has happened before. For example, app developers are now more productive than 5 years ago, but their demand has grown faster than productivity, thereby growing the number of developers. As for ARPU and retention, we think there’s more visibility to guess that they will both increase thanks to AI.

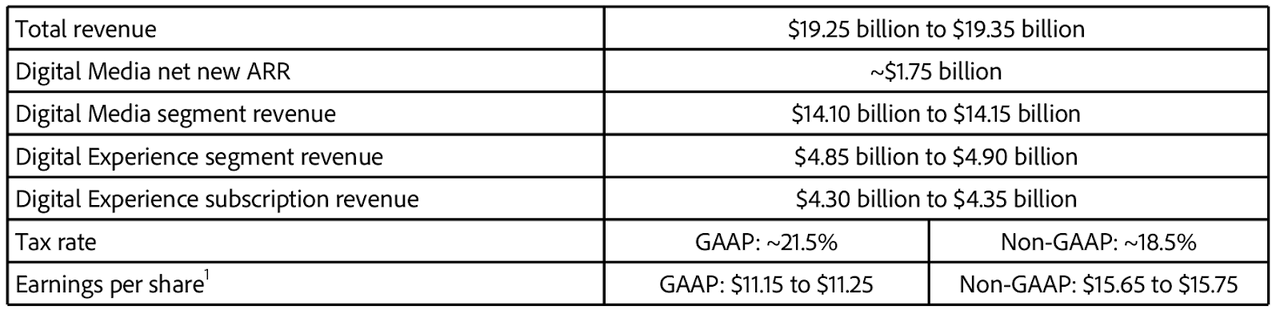

Guidance – The highlight again

Guidance was once again the highlight. The company raised the expectations for pretty much every metric, with a special mention to EPS, in which the prior high of the range now became the low of the new range:

Adobe’s Press Release

The only lowlight was the one we discussed above: Digital Experience is now expected to come below prior expectations due to customers pushing projects forward.

Conclusion

Adobe posted excellent earnings once again. Despite great numbers, the focus was on the company’s AI offerings, which should help the company grow faster once pricing is implemented. Knowing if these will help the company grow seats is not possible yet, although there are reasons to believe management’s claim. What seems pretty clear is that Adobe Inc. will get paid for the value it provides, which should translate into a higher average revenue per user and a higher lifetime value.

In the meantime, keep growing!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADBE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Best Anchor Stocks helps you find the best quality stocks to outperform the market with the lowest volatility/growth ratio. We look for top-notch quality compounders, with solid growth and lower volatility than you would expect.

Best Anchor Stocks picks have a track record of revenue growth combined with below-average volatility. Since the inception in January 2022, our portfolio has outperformed the S&P 500 by almost 12% (on 05-16-2023).

At Best Anchor Stocks, we follow up our quality compounders meticulously, so you don’t have to worry about your portfolio.

There’s a 2-week free trial, so don’t hesitate to join Best Anchor Stocks now!