Summary:

- Adobe is one of the few tech names to sustain revenue growth throughout 2023 – thank generative AI.

- Unlike many tech peers, Adobe stock has recovered so strongly that it is trading near all-time highs.

- Consensus estimates call for an acceleration in revenue growth next year.

- I discuss my evaluation of ADBE stock given long-term forecasts and the valuation.

gorodenkoff

Adobe (NASDAQ:ADBE) is a mature and highly profitable tech company, but its stock has recently traded with the same volatility as smaller-cap names. The company has been an early beneficiary of generative AI given that it quickly integrated the functionality into its product suites. Generative AI has likely helped ADBE to sustain resilient top-line growth rates while many peers have seen growth slow down amidst a tough macro environment. Tech stocks on the whole have been levitating higher over the past few weeks, even after experiencing a dramatic recovery year to date. A case can be made that tech stocks have earned a higher deserved valuation, but it is admittedly uncomfortable to base any investment thesis on multiple expansion from already-high levels. ADBE trades at among its highest valuations over the past few decades in spite of its large revenue base and the associated likelihood of decelerating growth rates. I reiterate my neutral rating heading into the company’s earnings report next week.

ADBE Stock Price

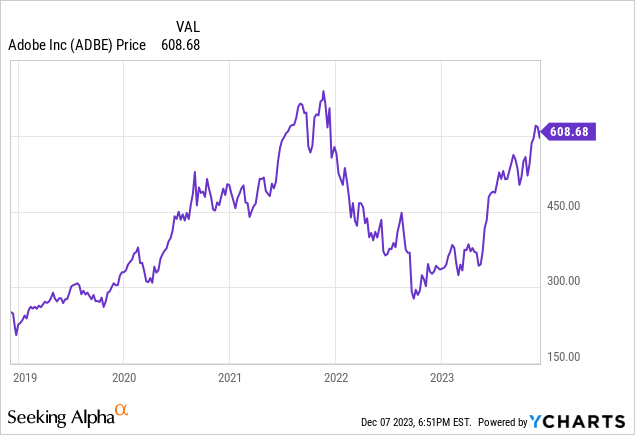

Like many tech stocks, ADBE saw its stock crater during the 2022 tech crash as it experienced multiple compression. It is however interesting to note that ADBE is one of the few tech names that have recovered so much that it trades within striking distance of all-time highs.

I last covered ADBE in October, where I explained why generative AI may pose long-term headwinds given the high valuations. The stock appears to have no limits, soaring 20% since then.

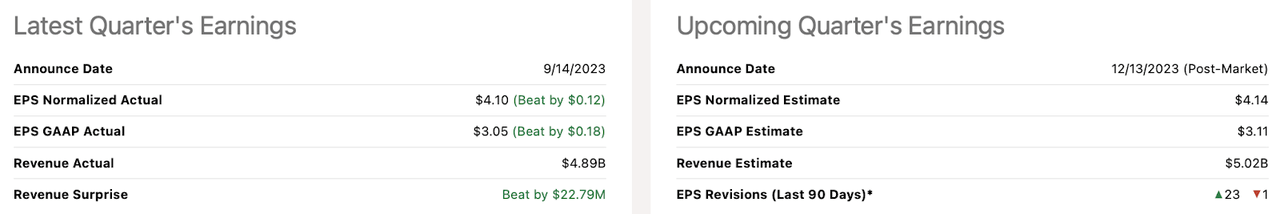

Adobe Stock Q4 Earnings Preview

In its latest quarter, ADBE delivered strong results, surpassing consensus estimates on both the top and bottom lines. ADBE delivered 13% YoY (constant currency) revenue growth to $4.89 billion, beating estimates by $22.79 million, and non-GAAP earnings of $4.10 per share, beating estimates by $0.12 per share. Management has guided for the fourth quarter to see revenues between $4.975 billion and $5.025 billion, alongside non-GAAP earnings of $4.10 to $4.15 per share. Consensus estimates have ADBE achieving the high end of that guidance.

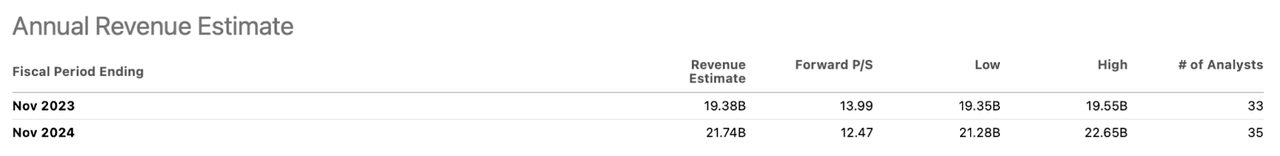

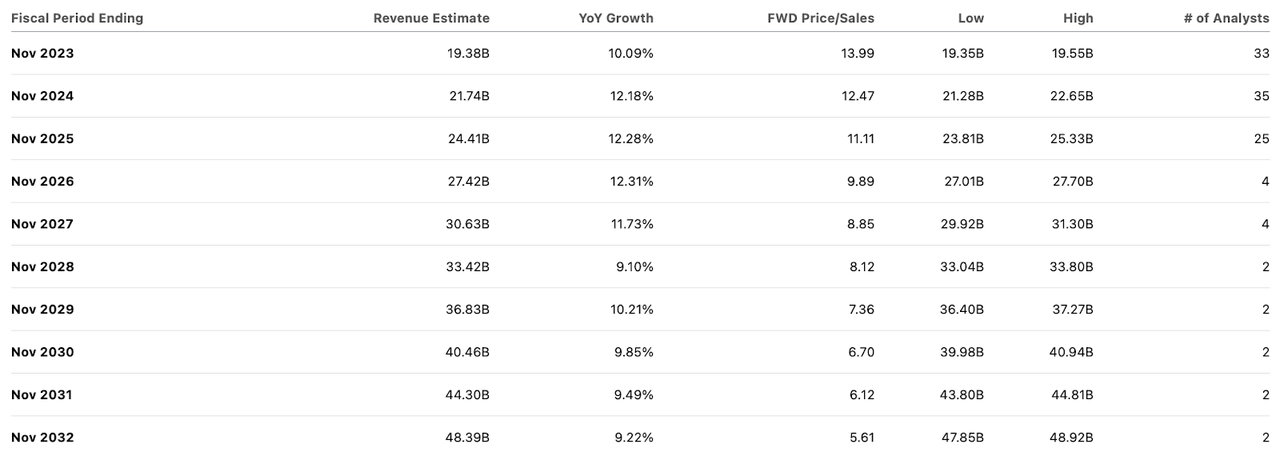

Beyond the fourth quarter, consensus estimates expect ADBE to generate $21.74 billion in revenues next year, representing 12.2% YoY growth and some acceleration from the 10% projected growth this year (I note that consensus estimates are not on a constant currency basis).

Many tech names saw revenue growth rates decelerate in 2023 due to the tough macro conditions resulting from the rising interest rate environment. The common thinking may be that 2024 may see some acceleration in growth rates due to 2023 being an “easy comparable.”

Is ADBE Stock A Buy, Sell, Or Hold?

Amidst peak generative AI hype, ADBE has been a real winner. The company was quick to integrate generative AI into its product suites, highlighted by Adobe Firefly, which (among other things) allows users to generate beautiful images from the typical text instructions.

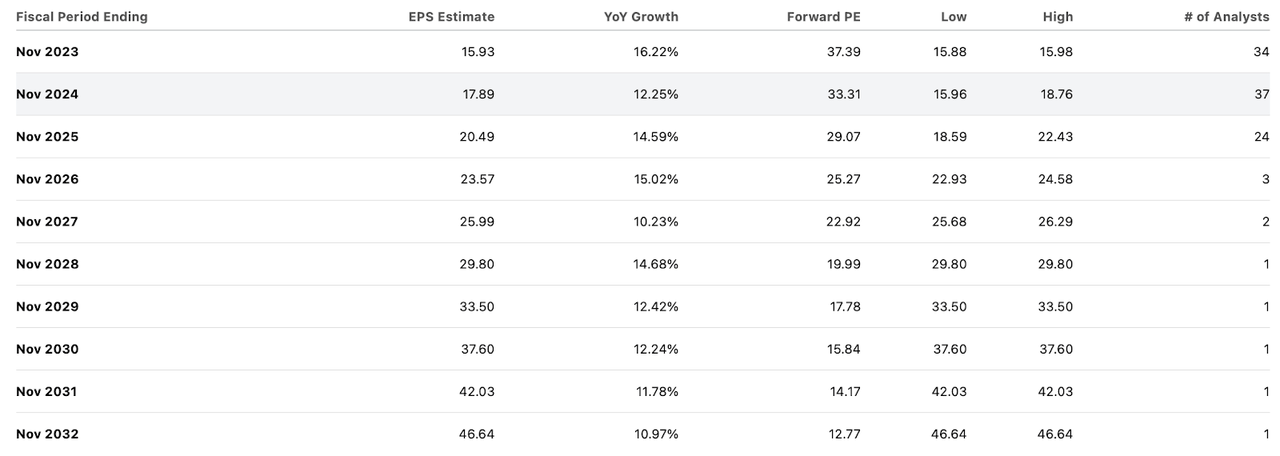

Given that generative AI appears to have helped drive stronger top-line results at ADBE than the company would have otherwise generated given the tough macro environment, it is clear that ADBE is a real generative AI beneficiary. However, are the benefits already priced in? I obviously have that opinion – the stock recently traded hands at 37x earnings and based on consensus estimates would not trade at 20x earnings until 2028.

I note that consensus estimates look rather aggressive given that they are assuming that the company can sustain double-digit top-line growth for many years (implying minimal deceleration in growth rates) while also assuming that net margins rise from 37% this year to 44% in 2032.

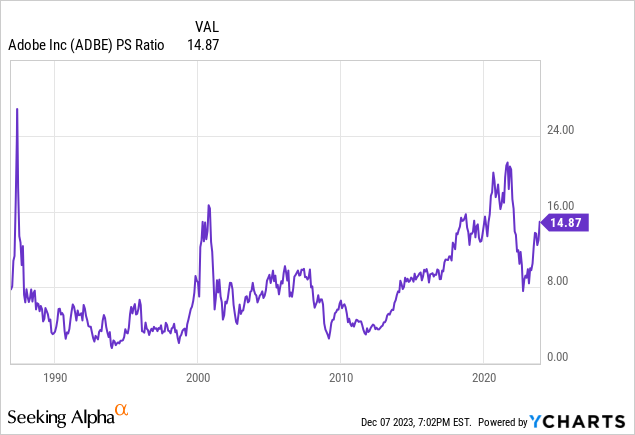

I must note that on a price-to-sales basis, ADBE trades at among its highest valuations over the last several decades – it only traded higher during the 2000 tech bubble and 2021-2022 pandemic boom. Conventional logic might expect the stock to instead trade at some historical discount due to the likelihood of decelerating growth moving forward.

At the same time, one can make an argument that tech stocks have earned a long-term re-rating higher due to the strong overall performances in the tough macro environment (resilient revenue growth and ability to expand operating margins). I typically use a 1.5x price-to-earnings growth ratio (‘PEG ratio’) as a barometer for fair value, but perhaps tech stocks now deserve 2x to 2.5x PEG ratios? ADBE happens to already be trading at the high end of that range.

Assuming that ADBE trades at a 2.5x PEG ratio in 2032, the stock might trade at around $1,280 per share. That represents an 8.6% potential annual return over the next 9 years (or perhaps around 11% to 12% inclusive of the earnings yield). I note that this would equate to a 27.5x PE ratio and 12x P/S ratio in 2032 after 9 more years of maturity. Sure, anything is possible, but such an outcome feels highly unlikely – even Microsoft (MSFT) is trading at around 11x sales right now (and that stock also looks expensive). Some readers might wonder if it is appropriate to be looking at 9-year consensus estimates. I must clarify that the point of this exercise isn’t to show that based on a precise 9-year forecast, ADBE looks expensive, but rather, to show that based on a rough 9-year projection that looks aggressive already, ADBE looks expensive. I find it unlikely that ADBE meets the aggressive consensus estimates and equally unlikely for the stock to trade at the above valuation multiples, making the potential return look unsatisfactory.

If the stock instead trades at a 1.5x-2.0x PEG ratio in 2032, equating to a PE ratio between 16.5x and 22x, that would imply a potential annual upside of around 2.9% and 6.2% (or around 6% to 9% inclusive of earnings yield). In this case, we are still facing uncertainty from consensus estimates, but the prospective returns appear likely to underperform the broader market.

This is one of those cases where it might “feel” good to buy the stock, as the company is posting strong growth and profitability numbers while creating wonderful generative AI-powered products. The current valuation is pricing in too many years of growth to justify owning this stock over the broader market index. I reiterate my neutral rating as the company may need to deliver supernatural results (over the next 9 years) to justify buying at current prices.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!