Summary:

- Adobe stock has been quite volatile over the last few months: first falling sharply on a weak Q1 FY2024 report, only to recover the entire decline three months later.

- Today, I decided to initiate coverage of ADBE stock in the form of a valuation analysis to give ADBE investors (followers) an unbiased picture.

- The results of the calculations show that ADBE is fully priced even under the core assumption that there are no cardinal shocks from competition in the Gen AI space shortly.

- In addition, Adobe faces significant risks from a recent lawsuit filed by the FTC accusing the company of “concealing early termination penalties in its most popular subscription plan, which made it difficult for customers to cancel.”

- Therefore, I think ADBE deserves a “Hold” rather than a “Buy”.

JHVEPhoto

Intro & Thesis

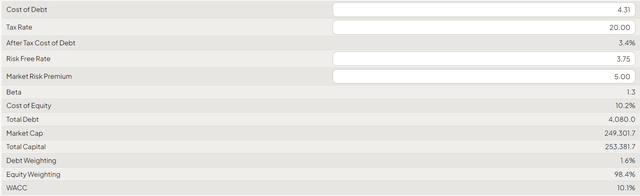

Adobe Inc. (NASDAQ:ADBE) stock has been quite volatile over the last few months: first falling sharply on a weak Q1 FY2024 report, only to recover the entire decline three months later on a strong Q2 FY2024 report and guidance that was well above Wall Street’s initial expectations.

TrendSpider Software, ADBE, the author’s notes

Today, I decided to initiate coverage of ADBE stock in the form of a valuation analysis to give ADBE investors (followers) an unbiased picture (I don’t hold the stock and haven’t covered it here on Seeking Alpha or elsewhere). The results of the calculations show that ADBE is fully priced even under the core assumption that there are no cardinal shocks from competition in the Gen AI space shortly.

Why Do I Think So?

The last time Adobe reported was in mid-June 2024 (Q2 FY2024), beating the high end of management’s guidance regarding sales (it was up 10% YoY), while non-GAAP EPS of $4.48 (+15% YoY) topped the high end of the guidance range by $0.08 (and the consensus estimate by also $0.08). What helped to ignite the rally was the fact that Adobe raised FY2025 revenue guidance by $50 million and the non-GAAP EPS by nearly 200 basis points – you could see the stock price reaction in the chart above.

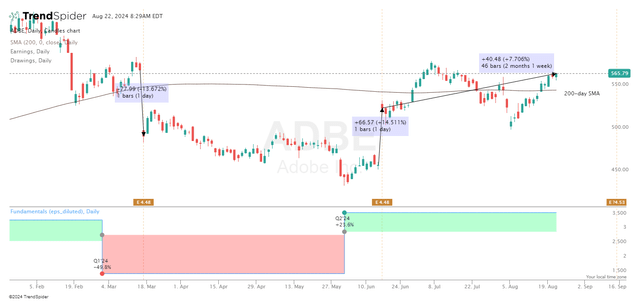

Basically, the positive market reaction was fair: Adobe not only managed to prevent its operating margin from falling amid previous market concerns that new AI solutions in the design sphere would take away significant market share, but it also improved this metric. The non-GAAP operating margin increased by 70 basis points from the prior year to 46% (below, you can see the GAAP metric).

Adobe’s headcount increased by 3% in Q2 FY2024, compared to double-digit increases in FY2021 and FY2022, but it has slowed the pace of new hiring and headcount, unlike many tech industry peers out there. So as a result, the operating leverage helped the firm sustain relatively high-growth rates during the last quarter.

The whole growth was primarily driven by its Digital Media segment (~74% of total revenue), which exceeded expectations by generating ~$487 million in net new ARR and saw a ~11% YoY increase to $3.91 billion. Also, regarding the sales structure by offering, the standout performer was the Document Cloud, with a 19% revenue surge to $782 million, bolstered by the innovative Acrobat AI Assistant that enhances document productivity, according to the 10-Q’s MD&A section. Creative Cloud also thrived, integrating AI tools like Firefly, which has generated >9 billion images, contributing to an 11% revenue increase to $3.13 billion. From what I see, Adobe’s focus on AI extends to its Experience Cloud, which reported $1.33 billion in revenue, with innovations like the AEP AI Assistant driving a 13% rise in subscription revenue, enabling enterprises to deliver personalized experiences at scale.

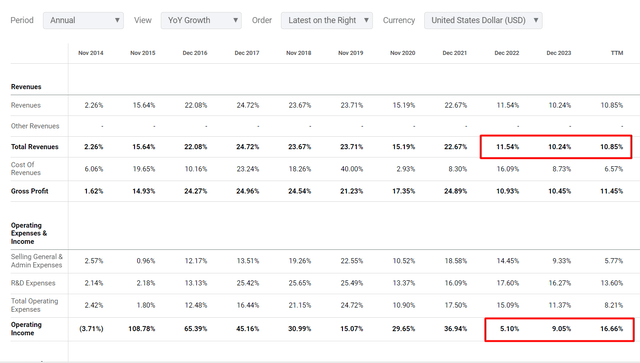

The new offerings that the company is presenting today are not yet fully “developed” by the market, so it may be that Wall Street doesn’t fully appreciate the future growth prospects of Adobe’s business. A look at the past shows that the company’s revenue has grown by ~17.3% annually over the last 10 years (“CAGR”), while the EBIT margin has increased from 10.4% in FY2014 to 35.4% on a TTM basis. However, growth has obviously slowed in recent years and I don’t think we have the right to simply extrapolate these growth rates to the next five to 10 years. Furthermore, we have seen a significant slowdown in both top-line and bottom-line growth rates over the last three years – only TTM margin expansion is saving the day.

Seeking Alpha, ADBE’s income statement, the author’s notes

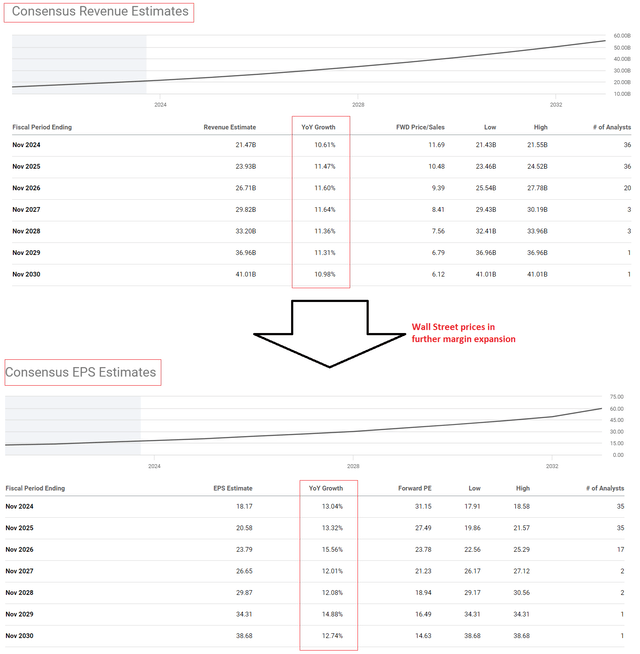

On the other hand, I see that the market is already assuming that the margin expansion that didn’t take place in 2022-2023 but occurred in 2024 will continue in the coming years, albeit not at the same pace as before. The market is therefore pricing in that the long-term trend towards expanding margins and perhaps even ADBE’s market share will continue.

Seeking Alpha, the author’s notes

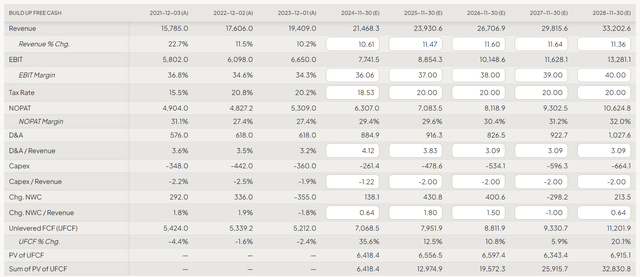

I suggest we agree with the market on this issue and not think about how the daily growing competition in the Gen AI market can undermine Adobe’s position in the foreseeable few years. I’ll take as basic assumptions that the market is right today, so I take the forecast revenue growth rates (consensus), assume a smooth increase in GAAP EBIT margin (by 1% annually), and approximately similar dynamics for D&A-as-of-sales and other driving metrics for my DCF model. Here’s what I get as intermediate results:

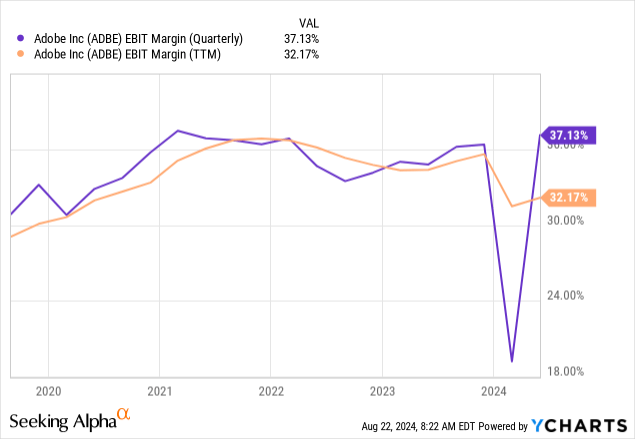

Adobe’s long-dated bonds are now trading at a yield of 4.31%, which is the rate I use as the cost of debt. With a risk-free rate of 3.75% and an MRP of 5%, the WACC of my model is 10.1%, which, I think, is close to the truth.

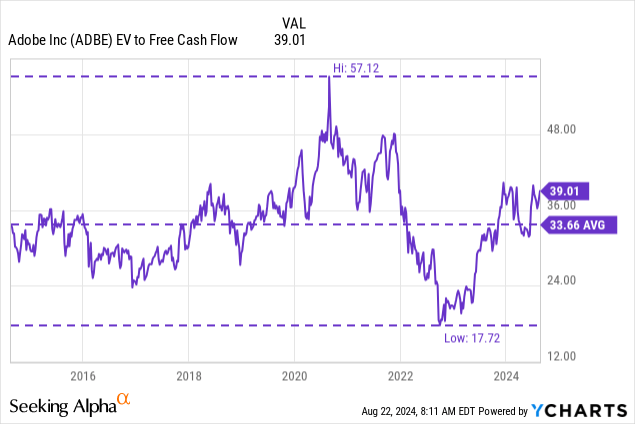

I calculate the terminal value of the company using the EV/FCF, which has been quite volatile for Adobe stock over the last decade (the max-min spread looks large indeed).

I assume that the company’s shares will trade at 33x EV/FCF by the end of FY2028, which is not far from the average of the last 10 years. The company’s stock therefore appears to be fully priced in today, and there’s little or no scope for future increases in value.

Since growth from here without obvious fundamental reasons would mean a premium on the valuation according to my model, I am forced to rate Adobe as a “Hold” today.

The Verdict

It is hard to deny that the Q2 results were really strong – the company was able to prove to the market that it is too early to write it off. However, this fact does not cancel out the risk to the company’s leading position posed by the rapid development and emergence of new competitors on the market thanks to the mass availability of Gen AI.

In addition, Adobe faces significant risks from a recent lawsuit filed by the FTC accusing the company of “concealing early termination penalties in its most popular subscription plan, which made it difficult for customers to cancel.” The FTC wants to impose penalties and prevent future violations. While Adobe plans to contest the lawsuit, the legal battle could drag on for years – so even if Adobe wins, the case could damage its reputation and portray it as deceptive and unfriendly to customers.

In my opinion, the market may be underestimating the company’s growth prospects today due to various uncertainties. But the Wall Street consensus is already painting a very rosy picture by factoring in 2024 and ignoring what was two or three years ago. Even if we take the current favorable ADBE consensus forecasts at face value, DCF modeling will tell us that the stock may already be fully priced in. Therefore, it deserves a “Hold” rather than a “Buy”.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!