Adobe: AI Is Not An Enemy, But An Ally – Buy The Weakness (Rating Upgrade)

Summary:

- Adobe shares dropped by over 13% after their earnings announcement, but I remain optimistic about their AI growth potential.

- Adobe delivered strong Q1 growth with a 12% revenue increase, but their Q2 outlook disappointed with a decline in net new ARR.

- I believe that the threat from OpenAI’s Sora to Adobe’s Creative Cloud business is limited, and view AI-powered video tools as complementary to Adobe’s offerings.

Justin Sullivan

Adobe (NASDAQ:ADBE) shares dropped by more than 13% when they announced their Q1 FY24 earnings on March 15th. I discussed my bullish view on Adobe in my article published in December 2023, indicating their growth from AI and pricing increase. Despite their Q2 outlook being lower than the market expected, I am quite optimistic about their AI growth potential. Considering the price drop, I am upgrading Adobe stock to ‘Strong Buy’ with a fair value of $600 per share.

Strong Q1 Growth and Disappointed Net ARR Guidance for Q2

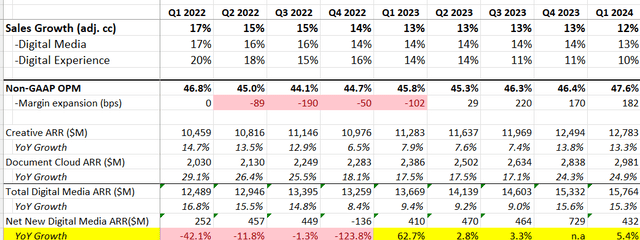

In Q1 FY24, they delivered 12% revenue growth on a constant currency basis, and their margin expanded by 182bps YoY, as summarized in the table below. Annualized Recurring Revenue (ARR) is the key leading indicator for Adobe, and their creative ARR was up 13.3% YoY and document cloud ARR increased by 24.9%. A quite robust result in Q1 indeed!

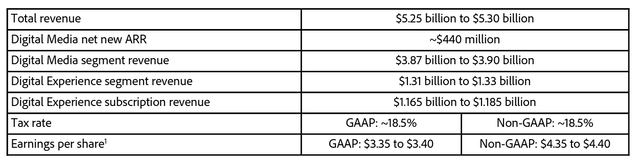

As illustrated in the Q2 guidance table below, Adobe guides around 9% revenue growth, and $440 million digital medial net new ARR for Q2 FY24. The market is quite disappointed with the net new ARR guidance, which indicates 6.4% decline year-over-year.

The key reason for such weak ARR growth is due to the normalization of their pricing growth.

Adobe started to raise their product price from FY22, and some pricing actions have been rolled out in FY23. These pricing increases have contributed additional growth to their topline over the past two years. As discussed in my previous article, Adobe raised their Creative Cloud subscription price in FY23. Without further pricing adjustments, Adobe is expected to normalize their pricing growth in FY24, which would create some growth headwinds due to high comparables. Their weak ARR guidance is more likely to be a math issue, not caused by any fundamental issues.

AI Monetization Is on the Early Stage

As mentioned in my previous article, Adobe has been heavily investing in AI related projects. Adobe has integrated their Firefly into both Creative Cloud and Adobe Express, and Firefly has been used to generate 6.5 billion pieces of media as disclosed over the earnings call. Additionally, Adobe expressed that they experienced the highest adoption rate of Firefly powered by Photoshop in Q1 since its launch in May 2023. It is quite impressive to see the strong adoption of Firefly, a power tool to utilize AI to generate photos. Adobe plans to expand Firefly into all of their main products over time, and the strong adoption rate paves the way for their future monetization.

Adobe also launched AI Assistant in Acrobat, aimed at assisting users to simplify tasks such as search and share documents. The management is quite confident that Adobe has tremendous opportunities for monetization among their core base of Acrobat users.

All these AI-related projects are still in the early stage, and presently, I don’t anticipate these features/products generating notable growth for the company. However, I acknowledge these AI-powered features would make it easier for users to create digital contents. Adobe should be able to monetize these subscription-based products in the future as it can add value for people who want to create digital contents.

Is Sora a Big Threat?

Sora, OpenAI’s text-to-video model, has attracted lots of attentions recently. The advancement of AI technology makes it possible to create digital contents much easier than before. There are some concerns that Sora could potentially disrupt Adobe’s Creative Cloud business. Is that a real threat?

Sora is still in the private beta, and it would be too early to assess its functionality. But essentially, users can generate a video based on the inputs such as scenery, actions or subjects.

Sora is not the first to apply AI to video contents. Runway was founded in 2018, and the company focuses on AI models for generating video and images. Their video editing tools have been used in some movies, such as “Everything Everywhere All at Once”. Runway has also launched AI tools for public users, offering image-to-video and text-to-video models.

I think the overall threat to Adobe’s Creative Cloud business is quite limited.

Adobe has been heavily investing in AI technology, leveraging notable competitive advantages such as data and massive digital content repositories. These assets could be potentially utilized for AI machine learnings. During the earnings call, Adobe’s management indicated that the company is collaborating with OpenAI regarding Sora, and both Adobe and OpenAI are developing their own models.

Even in the future when users can create contents from texts or some simple inputs, they would still require Adobe’s Creative tools to edit these videos. The AI-powered video tools should be viewed as complementary to Adobe’s Creative Cloud solutions, in my view.

$25B Shares Repurchase and Outlook

Adobe announced a new $25 billion shares repurchase plan, representing around 11% of total market cap. Assuming they complete the shares repurchase over the next four years, the total count of shares outstanding could be reduced by 3% annually, as per my calculation. A quite impressive capital allocation!

Another takeaway from Q1 FY24 is their strong FCF growth. Excluding the $1 billion break-up fee with Figma, their operating cash flow was up 28% year-over-year. Their management indicated that the strong deferred revenue and unbilled backlog contributed to their strong cash flow growth for the quarter.

For the FY24, I forecast they can deliver 10% organic revenue growth, which represents a deceleration from 13% growth achieved in FY23. The deceleration reflects their pricing increase benefits in FY23, and the comparables headwinds in FY24. Adobe is going to ramp up their Express Mobile and AI Assistant in the second half of FY24, expecting these AI-related features to contribute to their ARR growth from the second half of the year. I don’t assume any material changes in macro environment or enterprise digital marketing spending in FY24. As such, if excluding 3% pricing growth in FY23, Adobe should be able to deliver 10% organic revenue growth even without any contribution from AI features.

Valuation Update

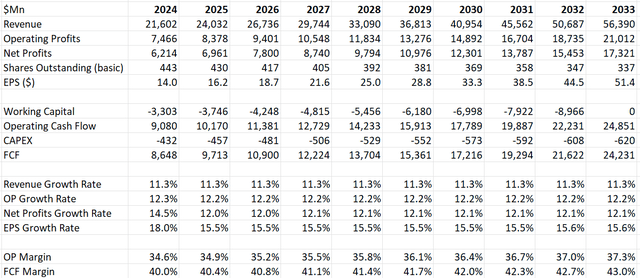

As discussed previously, I forecast Adobe to achieve 10% organic revenue growth in FY24. Assuming Adobe allocating 5% of group revenue towards acquisitions, tuck-in deals could attribute 1.3% to the topline growth.

As Adobe plans to repurchase $25 billion of own shares over the next few years, the shares outstanding could be reduced by 3% annually according to my calculation.

I estimate their operating expenses will grow by 10.7% year-over-year, resulting in 30bps margin expansion.

After discounting all the free cash flow, the total equity value of Adobe is calculated to be $266 billion, as per my estimate. Thus, the fair value is estimated to be $600 per share in my model. The current stock price is only trading at 22 times FY25’s FCF, a quite cheap multiple for a double-digit growth company in my opinion. It appears to me that the current stock price has factored in many concerns regarding AI disruptions in the future.

Adobe DCF – Author’s Calculation

Other Issues

Figma Break-up Fee: Adobe paid $1 billion for the break-up fee after they abandoned the acquisition plan. I always think it was not a good idea for Adobe to pay a hefty price to acquire Figma, and lucky (or unlucky for Adobe) the regulator didn’t approve this deal.

Stock Options: Adobe spent 8.9% of total revenue on SBC in FY23, an increase from 8.2% in FY22. My margin assumption in the DCF model does require their SBC as a percentage of revenue to decline to 6% by FY33. If Adobe continues their high SBC payout in the future, the fair value in my DCF model would be overestimated.

Conclusion

Adobe’s AI technology is still in the early stage, and they have the potential to monetize their current AI investments in the near future, in my opinion. I continue to view Adobe as a high-quality growth company, and I upgrade Adobe to ‘Strong Buy’ with a fair value of $600 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADBE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.