Summary:

- In light of reporting a double beat for Q2 FY2024, Adobe’s stock came back to life late last week, reversing most of its year-to-date losses in one fell swoop.

- While its post-ER bounce has left Adobe stock trading at a sizeable premium, ADBE’s long-term risk/reward is attractive enough to justify fresh capital.

- In this note, we shall review Adobe’s Q2 report and go over its valuation. Learn more now.

David Tran

Breaking Down Adobe’s Q2 FY2024 Report

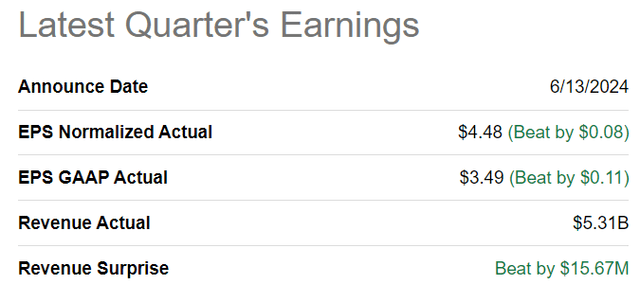

Considering Adobe’s (NASDAQ:ADBE) (NEOE:ADBE:CA) post-ER pop of ~14.5% to ~$525 per share, it is natural to assume that the software giant just delivered a blowout quarter. Now, while Adobe beat consensus street estimates and raised guidance for FY2024 [with Narayen & Co. highlighting their GenAI opportunity], Adobe’s revenue beat was wafer-thin, and updated guidance came more or less in line with consensus estimates heading into the Q2 print.

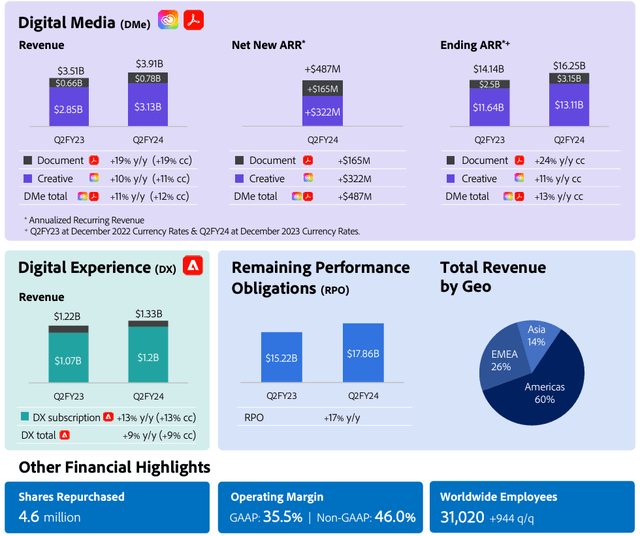

Seeking Alpha Adobe Investor Relations

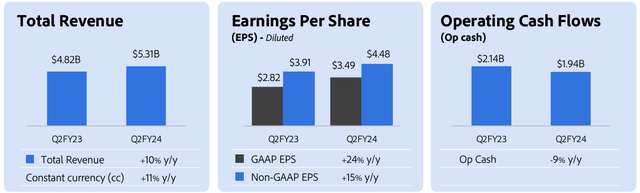

In Q2 FY2024, Adobe’s revenue grew +10% y/y to $5.31B, beating consensus estimates of $5.29B. While the top-line beat looks de minimus, investor expectations were quite low, with the stock trading -20% year-to-date heading into the Q2 report last Thursday.

According to Adobe’s CEO, Shantanu Narayen, this better-than-expected financial performance was driven by broad strength across the business:

Adobe achieved record revenue of $5.31 billion driven by strong growth across Creative Cloud, Document Cloud and Experience Cloud. Our highly differentiated approach to AI and innovative product delivery are attracting an expanding universe of customers and providing more value to existing users.

Over the last few quarters, Adobe has been infusing GenAI across its software suites. While that work is far from over, Adobe is already starting to reap benefits from these efforts, as evidenced by the Digital Media segment’s net new ARR of $487M and Adobe’s RPO growth of +17% y/y.

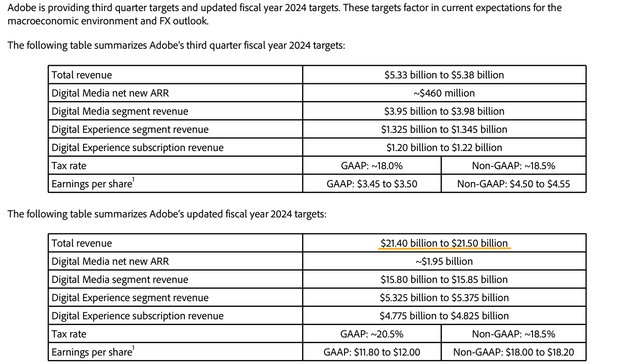

Both Creative Cloud and Document Cloud are showing healthy growth, with existing customers upgrading tiers to utilize Adobe’s AI innovations (like Firefly (image generation LLM), Acrobat AI assistant, etc.) and strong growth in new customers. For FY2024, Adobe is now guiding for revenues to be in the range of $21.4-21.5B. While the updated guidance is an improvement on management’s previous guidance range of $21.3-21.5B, consensus estimates for FY2024 revenues stood at $21.46B ahead of the Q2 report.

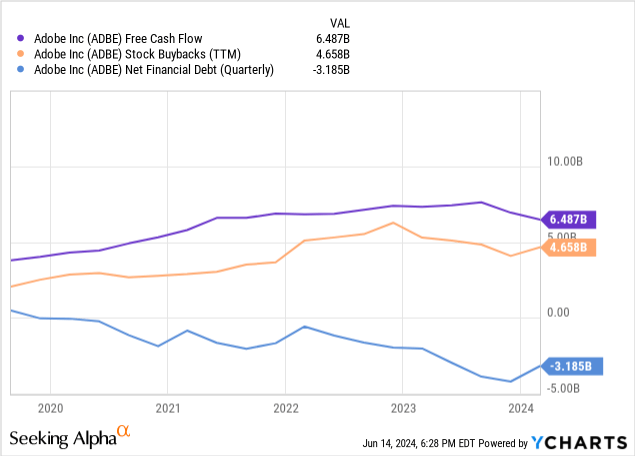

On the margin front, Adobe’s gross and operating margins rose to 88.7% and 35.5%, respectively. Despite rising margins, Adobe’s quarterly operating cash flow was down -9% y/y to $1.94B due to changes in deferred revenues. While Adobe’s cash flow generation has been a little wonky in the past year or so (primarily due to a $1B acquisition termination fee payout to Figma), the software giant is still producing tons of free cash flow and returning billions of dollars back to shareholders – $2.5B in Q2 alone!

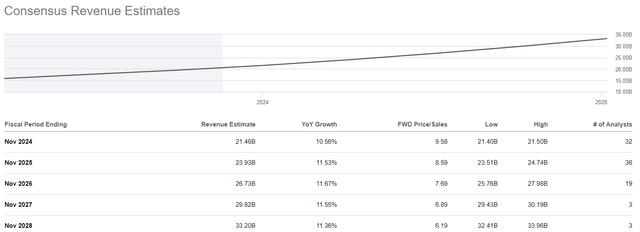

While fears of disruption in the software industry have taken a toll on valuations in the sector, Adobe is still trading at a premium valuation multiple of ~37x P/FCF (or ~31x P/adj. FCF [adjusted for $1B Figma deal termination fee]) with consensus street estimates calling for double-digit CAGR sales growth for the next five years:

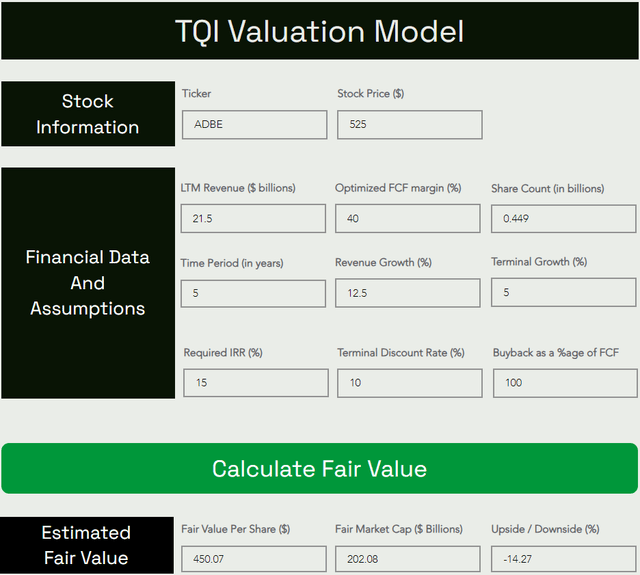

Given this information, let us evaluate Adobe’s long-term risk/reward using TQI’s Valuation Model.

Adobe’s Fair Value And Expected Return

Based on conservative assumptions for future revenue growth and steady-stage FCF margins, Adobe is worth ~$450 per share (or $202B in market capitalization), which is ~15% lower than ADBE’s current stock price.

TQI Valuation Model (Free to use at TQIG.org) TQI Valuation Model (Free to use at TQIG.org)

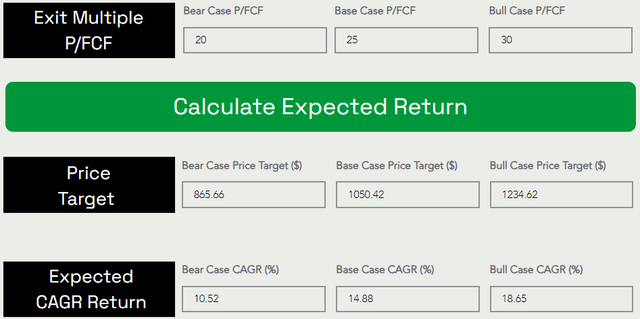

Assuming a base case exit multiple of 25x P/FCF for 2029, I see ADBE stock rising from $525 to $1050 per share over the next five years. This price target implies an expected 5-year CAGR return of 14.9% for ADBE stock, which is more or less in line with our investment hurdle rate of 15%. Hence, I think Adobe is a decent long-term purchase in the low-$500s.

Final Thoughts: Is ADBE Stock A Buy, Sell, or Hold Right Now?

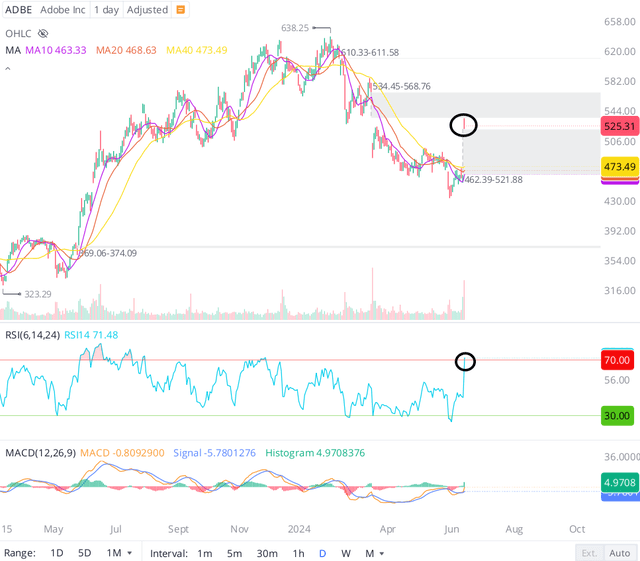

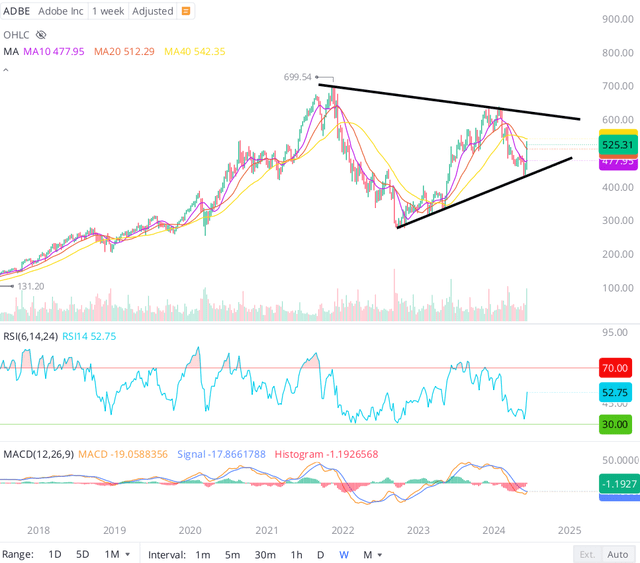

On the back of its post-ER gap up, Adobe’s short-term technical trend has flipped from bearish to bullish, with the stock re-capturing key moving averages. However, with ADBE stock going from oversold to overbought territory on the daily chart, investors and traders must remain open to the possibility of this bounce being a gap and trap setup.

Zooming out to the weekly chart, I see the formation of a triangle pattern, and as we know, triangles can break in either direction. Hence, the medium-term technical setup for ADBE stock is finely balanced.

From a fundamental standpoint, I think Adobe is a fantastic company and a very reliable growth compounder. While Adobe is trading at a ~15% premium to our fair value estimate, the long-term risk/reward is attractive enough to justify buying ADBE stock right here, right now. That said, considering Adobe’s technical setup, I like the idea of staggered accumulation via a 6-12-month DCA plan over a lump-sum purchase.

Key Takeaway: I rate Adobe a modest “Buy” at $525 per share, with strong preference for staggered accumulation.

Thank you for reading, and happy investing! Please share any questions, thoughts, and/or concerns in the comments section below or DM me.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking to upgrade your investing operations?

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our investing group – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

At TQI, we are pursuing bold, active investing with proactive risk management to navigate this highly uncertain macroeconomic environment. Join our investing community and take control of your financial future today.